Deflation, Falling Velocity of Money Ensures Printing Presses Will Keep Running

Economics / Deflation Sep 13, 2009 - 01:26 AM GMTBy: John_Mauldin

Elements of Deflation, Part 2

Elements of Deflation, Part 2

The Velocity Factor

Y=MV

Sir, I Have Not Yet Begun to Print

There Are No Good Choices

Just as water is formed by the basic elements hydrogen and oxygen, deflation has its own fundamental components. Last week we started exploring those elements, and this week we continue. I feel that the most fundamental of decisions we face in building investment portfolios is correctly deciding whether we are faced with inflation or deflation in our future. (And I tell you later on when to worry about inflation.) Most investments behave quite differently depending on whether we are in a deflationary or inflationary environment. Get this answer wrong and it could rise up to bite you.

The problem is that there is not an easy answer. In fact, the answer is that it could be both. Today I got another letter from Peter Schiff, who seems to be ubiquitous. He says the rise in gold is because of rising inflation expectations among investors. Gold is predicting inflation. Maybe, but the correlation between gold and inflation for the last 25-plus years has been zero. I rather think that gold is rising in terms of value against most major fiat (paper) currencies because it is seen as a neutral currency. The Fed and the Obama administration seem to be pursuing policies that are dollar-negative, and they give no hint of letting up. The rise in gold above $1,000 does not really tell us anything about the future of inflation.

In fact, it is my belief that if the Fed were to withdraw from the scene of economic battle, the forces of deflation would be felt in short order. The answer to the question "Will we have inflation in our future?" is "You better hope so!"

I wrote in 2003, when Greenspan was holding down rates too long in order to spur the economy, that the best outcome or endgame over the course of the full cycle would be stagflation. I still think that is the most likely scenario. The Fed will fight deflation and knows how to do that. They also know what to do when inflation becomes too high. But there is a cost.

It is not a matter of pain or no pain; it is a matter of choosing which pain we will face and for how long, and perhaps in what order. As I wrote a few weeks ago, like teenagers, we as an economic polity have made some very bad choices. We are now in a scenario where there are no good choices, just less-bad ones.

In a normal world, the amount of monetary and fiscal stimulus we are witnessing would produce inflation in very short order. That is what has the gold bugs of the world excited. It is their moment. They keep repeating that Milton Friedman taught us that inflation was always and everywhere a matter of too much money being printed. The answer to that is that the statement is mostly true, but not always and not everywhere (think Japan). The reality is somewhat more nuanced. Let's review something I wrote last year about the velocity of money, and this time we are going to go into the concept a little more deeply. This is critical to your understanding of what is facing us.

The Velocity Factor

When most of us think of the velocity of money, we think of how fast it goes through our hands. I know at the Mauldin household, with seven kids, it seems like something is always coming up. And what about my business? Travel costs are way, way up; and as aggressive as we are on the budget, expenses always seem to rise. Compliance, legal, and accounting costs are through the roof. I wonder how those costs are accounted for in the Consumer Price Index? About the only way to deal with it, as my old partner from the 1970s Don Moore used to say, is to make up the rise in costs with "excess profits," whatever those are.

Is the Money Supply Growing or Not?

But we are not talking about our personal budgetary woes, gentle reader. Today we tackle an economic concept called the velocity of money, and how it affects the growth of the economy. Let's start with a few charts showing the recent high growth in the money supply that many are alarmed about. The money supply is growing very slowly, alarmingly fast, or just about right, depending upon which monetary measure you use.

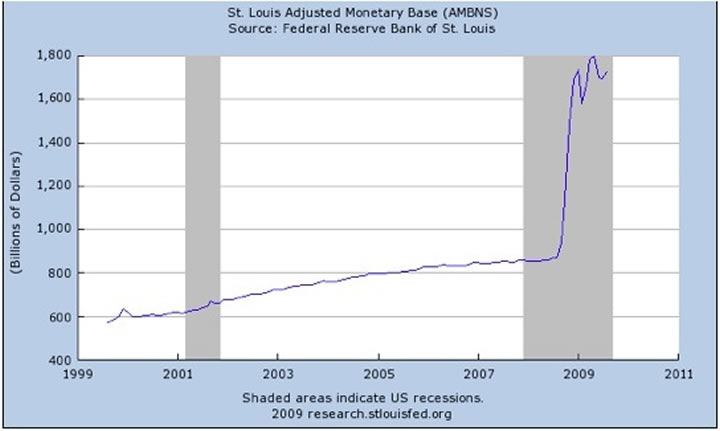

First, let's look at the adjusted monetary base, or plain old cash plus bank reserves (remember that fact) held at the Federal Reserve. That is the only part of the money supply the Fed has any real direct control of. Until very recently, there was very little year-over-year growth. The monetary base grew along a rather predictable long-term trend line, with some variance from time to time, but always coming back to the mean.

But in the last few months the monetary base has grown by a staggering amount. And when you see the "J-curve" in the monetary base (which is likely to rise even more!) it does demand an explanation. There are those who suggest this is an indication of a Federal Reserve gone wild and that 2,000-dollar gold and a plummeting dollar are just around the corner. They are looking at that graph and leaping to conclusions. But it is what you don't see that is important.

Now, let's introduce the concept of the velocity of money. Basically, this is the average frequency with which a unit of money is spent. Let's assume a very small economy of just you and me, which has a money supply of $100. I have the $100 and spend it to buy $100 worth of flowers from you. You in turn spend the $100 to buy books from me. We have created $200 of our "gross domestic product" from a money supply of just $100. If we do that transaction every month, in a year we would have $2400 of "GDP" from our $100 monetary base.

So, what that means is that gross domestic product is a function not just of the money supply but how fast the money supply moves through the economy. Stated as an equation, it is Y=MV, where Y is the nominal gross domestic product (not inflation-adjusted here), M is the money supply, and V is the velocity of money. You can solve for V by dividing Y by M.

Now let's dig a little deeper. Y, or nominal GDP, can actually written as Y=PQ, that is, GDP is the Price paid times the total Quantity of goods sold. Therefore, since Y=MV, the equation can be written as MV=PQ. But the point is that Price (P) is tied to the velocity (V) of money. You can increase the supply of money, and if velocity drops you can still see a drop in the "P," or inflation.

Now, let's complicate our illustration just a bit, but not too much at first. This is very basic, and for those of you who will complain that I am being too simple, wait a few paragraphs, please. Let's assume an island economy with 10 businesses and a money supply of $1,000,000. If each business does approximately $100,000 of business a quarter, then the gross domestic product for the island would be $4,000,000 (4 times the $1,000,000 quarterly production). The velocity of money in that economy is 4.

But what if our businesses got more productive? We introduce all sorts of interesting financial instruments, banking, new production capacity, computers, etc.; and now everyone is doing $100,000 per month. Now our GDP is $12,000,000 and the velocity of money is 12. But we have not increased the money supply. Again, we assume that all businesses are static. They buy and sell the same amount every month. There are no winners and losers as of yet.

Now let's complicate matters. Two of the kids of the owners of the businesses decide to go into business for themselves. Having learned from their parents, they immediately become successful and start doing $100,000 a month themselves. GDP potentially goes to $14,000,000. But, in order for everyone to stay at the same level of gross income, the velocity of money must increase to 14.

Now, this is important. If the velocity of money does NOT increase, that means (in our simple island world) that on average each business is now going to buy and sell less each month. Remember, nominal GDP is money supply times velocity. If velocity does not increase and money supply stays the same, GDP must stay the same, and the average business (there are now 12) goes from doing $1,200,000 a year down to $1,000,000.

Each business now is doing around $80,000 per month. Overall production on our island is the same, but is divided up among more businesses. For each of the businesses, it feels like a recession. They have fewer dollars, so they buy less and prices fall. They fall into actual deflation (very simplistically speaking). So, in that world, the local central bank recognizes that the money supply needs to grow at some rate in order to make the demand for money "neutral."

It is basic supply and demand. If the demand for corn increases, the price will go up. If Congress decides to remove the ethanol subsidy, the demand for corn will go down, as will the price.

If the central bank increased the money supply too much, you would have too much money chasing too few goods, and inflation would rear its ugly head. (Remember, this is a very simplistic example. We assume static production from each business, running at full capacity.)

Let's say the central bank doubles the money supply to $2,000,000. If the velocity of money is still 12, then the GDP would grow to $24,000,000. That would be a good thing, wouldn't it?

No, because only 20% more goods is produced from the two new businesses. There is a relationship between production and price. Each business would now sell $200,000 per month or double their previous sales, which they would spend on goods and services, which only grew by 20%. They would start to bid up the price of the goods they want, and inflation would set in. Think of the 1970s.

So, our mythical bank decides to boost the money supply by only 20%, which allows the economy to grow and prices to stay the same. Smart. And if only it were that simple.

Let's assume 10 million businesses, from the size of Exxon down to the local dry cleaners, and a population which grows by 1% a year. Hundreds of thousands of new businesses are being started every month, and another hundred thousand fail. Productivity over time increases, so that we are producing more "stuff" with fewer costly resources.

Now, there is no exact way to determine the right size of the money supply. It definitely needs to grow each year by at least the growth in the size of the economy, plus some more for new population, and you have to factor in productivity. If you don't then deflation will appear. But if the money supply grows too much, then you've got inflation.

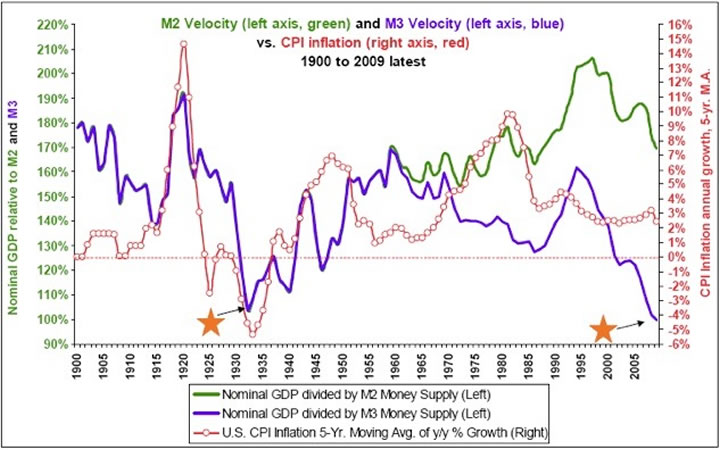

And what about the velocity of money? Friedman assumed the velocity of money was constant. And it was from about 1950 until 1978 when he was doing his seminal work. But then things changed. Let's look at two charts, the first from Stifel Nicolaus Capital Markets.

Here we see the velocity of money for the last 109 years. The left side of the chart shows the velocity of money using both M2 and M3 (measures of the money supply.)

Notice that the velocity of money fell during the Great Depression. And from 1953 to 1980 the velocity of money was almost exactly the average for the last 100 years. Lacy Hunt, in a conversation that helped me immensely in writing this letter, explained that the velocity of money is mean reverting over long periods of time. That means one would expect the velocity of money to fall over time back to the mean or average. Some would make the argument that we should use the mean from more modern times since World War II, but even then mean reversion would mean a slowing of the velocity of money (V), and mean reversion implies that V would go below (overcorrect) the mean. However you look at it, the clear implication is that V is going to drop. In a few paragraphs, we will see why that is the case from a practical standpoint. But let's look at the first chart.

Y=MV

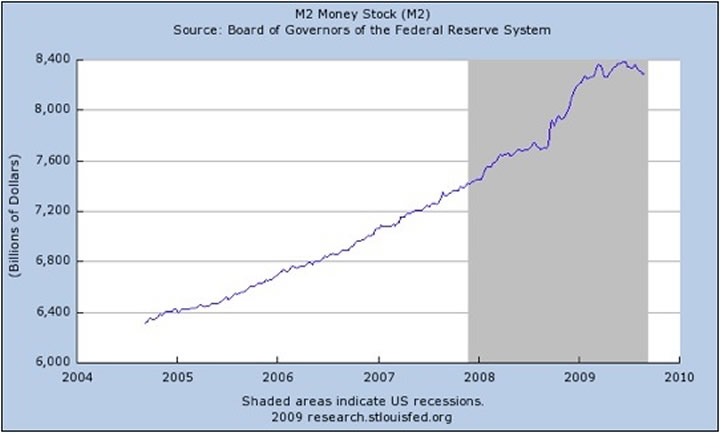

And then let's go back to our equation, Y=MV. If velocity slows by 30% (which it well has in terms of M3 - and it is down more than 15% in terms of M2) then money supply (M) would have to rise by that percentage just to maintain a static economy. But that assumes you do not have 1% population growth, 2% (or thereabouts) productivity growth, and a target inflation of 2%, which mean M (money supply) would need to grow about 5% a year, even if V were constant. And that is not particularly stimulative, given that we are in recession. And notice in the chart below that M2 has not been growing that much lately, after shooting up in late 2008 as the Fed flooded the market with liquidity.

Bottom line? Expect money-supply growth well north of what the economy could normally tolerate for the next few years. Is that enough? Too much? About right? We won't know for a long time. This will allow armchair economists (and that is most of us) to sit back and Monday morning quarterback for many years.

But this is important. The Fed is going to continue to print money as long as they are not confident deflation is no longer a problem. They can't tell us what that number is because they don't know. My guess is if they did tell us the markets would simply throw up, especially the bond market, which would of course make the situation from a deflation-fighting point of view even worse.

Sir, I Have Not Yet Begun to Print

Remember the story of John Paul Jones? An American naval officer during the American Revolution (the French gave him a medal, although the British referred to him as a pirate), he engaged a larger British ship off the coast Yorkshire. He literally tied his boat to the larger ship and they shot cannons and guns at point blank range. Legend has it that he was asked to surrender, as his ship was sinking. He is supposed to have replied, "Sir, I have not yet begun to fight!"

When faced with the possibility of deflation, I can almost hear Bernanke saying, "Sir, I have not yet begun to print!"

When will they know when enough is enough? When the velocity of money stops falling. When we see two quarters in a row where the velocity of money is rising, then it is time to start investing in inflation hedges.

Now, why is the velocity of money slowing down? Notice the significant real rise in velocity from 1990 through about 1997. Growth in M2 was falling during most of that period, yet the economy was growing. That means that velocity had to have been rising faster than normal. Why? It is financial innovation that spurs above-trend growth in velocity. Primarily because of the financial innovations introduced in the early '90s, like securitizations, CDOs, etc., we saw a significant rise in velocity.

And now we are watching the Great Unwind of financial innovations, as they went to excess and caused a credit crisis. In principle, a CDO or subprime asset-backed security should be a good thing. And in the beginning they were. But then standards got loose, greed kicked in, and Wall Street began to game the system. End of game.

What drove velocity to new highs is no longer part of the equation. The absence of new innovation and the removal of old innovations (even if they were bad innovations, they did help speed things up) are slowing things down. If the money supply had not risen significantly to offset that slowdown in velocity, the economy would already be in a much deeper recession.

The Fed has more room to print money than most of us realize. How much more? My bet is that we'll find out. Will they print too much at some point? Probably.

There Are No Good Choices

What we are looking at in our near future is not inflation. We are in a period where the Fed is in the process of reflating, or at least attempting to do so. They will eventually be successful (though at what cost to the value of the dollar one can only guess). One can have a theoretical argument about whether that is the right thing to do, or whether the Fed should just leave things alone, let the banks fail, etc. I find that a boring and almost pointless argument.

The people in control don't buy Austrian economics. It makes for nice polemics but is never going to be policy. My friend Ron Paul is not going to be allowed to make monetary policy, although he might get a bill through that actually audits the Fed. I am much more interested in learning what the Fed and Congress will actually do and then shaping my portfolio accordingly.

A mentor of mine once told me that the market would do whatever it could to cause the most pain to the most people. One way to do that would be to allow deflation to develop over the next few quarters, thereby probably really hurting gold and other investments, before inflation and then stagflation become (hopefully) the end of our perilous journey. Which of course would be good for gold. If you can hold on in the meantime.

Is it possible that we can find some Goldilocks end to this crisis? That the Fed can find the right mix, and Congress wakes up and puts some fiscal adults in control? All things are possible, but that is not the way I would bet.

While there are some who are very sure of our near future, I for one am not. There are just too damn many variables. Let me give you one scenario that worries me. Congress shows no discipline and lets the budget run through a few more trillion in the next two years. The Fed has been successful in reflating the economy. The bond markets get very nervous, and longer-term rates start to rise. What little recovery we are seeing (this is after the double-dip recession I think we face) is threatened by higher rates in a period of high unemployment.

Does the Fed monetize the debt and bring on real inflation and further destruction of the dollar? Or allow interest rates to rise and once again push us into recession? (A triple dip?) There will be no good choice. The Fed is faced with a dual mandate, unlike other central banks. They are supposed to maintain price equilibrium and also set policy that will encourage full employment. At that point, they will have to choose one over the other. There are no good choices. I can construct a number of scenarios. All end with the same line: there are no good choices.

Washington DC, San Diego, and New Orleans, etc.

It is time to hit the send button. I have struggled through this letter with a very upset stomach. I rarely eat pizza, but my son and his friends ordered and I ate half of a very good pizza with everything, which I very rarely do. It really kicked my gut. Maybe that is why I am a little more bearish than normal tonight.

I fly to Washington, DC on Sunday and will have dinner with good friend Neil Howe (of Fourth Turning fame). I am really looking forward to that. Neil is a very interesting dinner partner. I do some consulting on Monday and then catch a long night flight to San Diego. I will be at the Schwab conference on Tuesday, September 15. If you are going to be there, look me up. I will be at the Altegris booth at the first break and then the Gemini booth with my partners from CMG, where we will be talking about the new mutual fund. (You can learn more about it by reading a report I have prepared, entitled "How to Deal with Volatility in Extraordinary Markets - Introducing the CMG Absolute Return Strategies Fund." Simply click here.) And there will be books there!

That is my only trip in September. But then it gets interesting. I celebrate my 60th birthday the first weekend of October, then fly to New Orleans to be at the annual New Orleans Conference, October 8-11. The speaker line-up is better than ever. I find this to be one of the best conferences I go to very year. I have been attending on and off for over 25 years. You should think about this one. http://www.neworleansconference.com/speaker-eblast-JohnMauldin/

Then I will spend the next weekend in Detroit, then probably go to New York, then Philadelphia for a CMG conference October 20, then down to Houston, over to Orlando, stop to change clothes and pack at home, and then fly off on a whirlwind trip to Argentina, Brazil, and Uruguay, speaking at a series of CFA conferences. Denver and Orlando in mid-November, and nothing else so far. Switzerland and London in January.

Trey came home tonight a little discouraged, with four of his friends. He had been at his first school dance (8th grade). "Dad, I got a Bohac." This is bad. Mr. Bohac is a very reasonable, pleasant enough fellow. However, he is also the vice-principal, and as such is the nemesis of 8th-grade boys. When you get called down for whatever reason, you get what they call a Bohac, which means you have to go to his office. I grimaced. What had he done? A fight? Girls? My mind went through a dozen bad scenarios in about 3 seconds. My stomach, already roiled, immediately got worse.

As it turns out, he simply wore the wrong kind of shorts to the dance. Seems he didn't know the dress code for the dance here in Highland Park. He evidently was not the only one. When he changed and all the kids left the house, I must confess I did not see any difference. Oh well. With any luck, this will be his only Bohac this year. And Dad can live with that.

I'll leave you with this thought I gleaned from a newsletter from Australia called The Privateer (www.the-privateer.com).

"In 1909, the US federal government had an annual budget of $US 0.8 Billion. With this it governed a population of just over 90 million people. The cost of government was about $9 per capita. In 2009, the US federal government has an annual budget of $US 3,550 Billion. With this it governs a population of just over 300 million people. That's a cost of about $11,675 per capita."

Are we 1200 times better off?

Have a great week. With all my flying, I might make it through a few books on my desk this week. I will let you know if anything should be on your radar screen.

Your trying to Muddle Through analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.