Footprints of a Stock Market Crash

Stock-Markets / Financial Crash Nov 23, 2009 - 02:20 AM GMTBy: Magnus_Ekervik

Asset markets around the world have been propelled higher from fiscal stimulus packages, record low interest rates and money printing. This type of government action can push markets higher in the short term, but to create long term growth bank lending has to increase along with rising consumption and job creation, none of which has happened. Actually bank lending is still contracting, unemployment is rising and consumption is in decline.

Asset markets around the world have been propelled higher from fiscal stimulus packages, record low interest rates and money printing. This type of government action can push markets higher in the short term, but to create long term growth bank lending has to increase along with rising consumption and job creation, none of which has happened. Actually bank lending is still contracting, unemployment is rising and consumption is in decline.

If the recovery is as strong as many investors believe why haven't we seen rising revenues together with the rising profits? It´s because profit increases are mostly the result of cost cutting and layoffs none of which creates long term growth. For the recovery to gain traction we need to see sales boosted from higher consumption. The problem is that consumption is still falling why I believe this recovery will fail when the stimulus fades.

In my July essay I made a call for a stock market crash during the summer or early fall. That call was a bit premature, now however there are crash footprints in stock indexes, bond markets, commodities and precious metals. Everywhere I look I can see bubbles forming from this global cheap money policy.

All major asset markets seem to be topping in synchronized fashion. We have a major 20 months non confirmation between gold and silver and a two month non confirmation between the Dow Jones Industrial Average and the Dow Jones Transportation Average, there is also a non confirmation between the primary indexes and the secondary indexes like the Small Cap 600 Index, Russel 2000 Index and the KBW Bank Index. These are all signs of distribution and topping behavior.

Market breadth has contracted for several months and transaction volumes have decreased as the rally has pushed higher, both are signs that the market rally is losing steam.

In addition to this, market sentiment is bullish on stocks, commodities, precious metals and bearish on the US dollar and bonds.

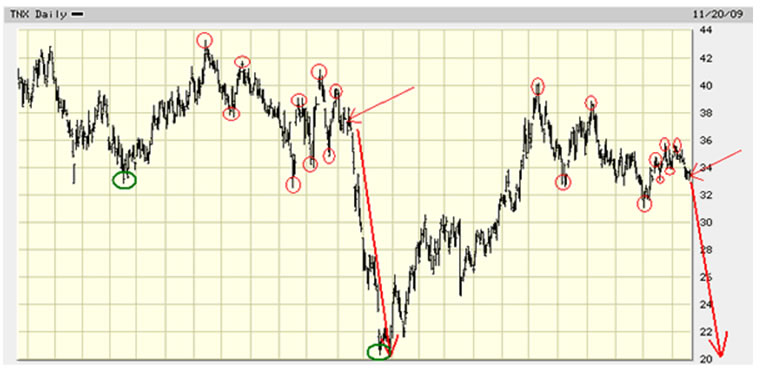

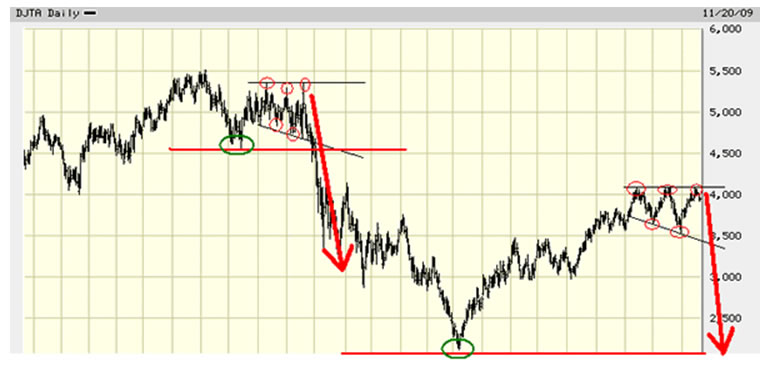

I have found two charts that I find very interesting, the first chart is the 10-year bond (TNX) and the second is Dow Jones Transportation Average (DJTA).

The 10-year bond has formed an almost perfect fractal of the price pattern that appeared before the 2008 crash in bond yields. The market is in the same position now as before the 2008 crash and if the pattern continues to play out bond yields will be cut in half in less than two months. Considering the bearish sentiment on bonds not many investors are prepared for sky rocketing bond prices and crashing yields at the moment, that's why I believe the pattern could be important. If the crash in bond yields materializes the US dollar will go up in a big way. Not many investors are expecting this either.

The second chart that deserves attention is the Dow Jones Transportation Average. This index is also forming a replica of the 2008 price structure. The expanding wedge is a very rare pattern. It was seen in many individual stocks just before the 1929 market crash and it was seen in 2008 in Dow Jones Transportation Average moments before prices went into a waterfall decline. It is interesting to see the same pattern forming again at the end of 2009 together with high bullish sentiment on stocks. The pattern is clearer in 2009 probably because this turn is of higher degree than the turn of 2008.

If the pattern of 2009 plays out in similar fashion as in 2008 the Dow Jones Transportation Average (and probably most other stock indexes) will fall more than 50% in less than one month, starting now.

Sounds impossible? Maybe it is, time will tell.

Conclusion:

If the above crash patterns play out investors should sell stocks, precious metals and commodities. Investors should consider buying long maturity bonds or play it safe and stay liquid and wait for the buying opportunity of the century.

By Magnus Ekervik

Magnus Ekervik offers independent research and analysis of macroeconomics to financial corporations and financial newspapers. For more information please contact: ekervik@gmail.com

© 2009 Copyright Magnus Ekervik - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.