Stock Market Crash 2010, History Repeating?

Stock-Markets / Financial Markets 2010 Jan 16, 2010 - 08:30 AM GMT Consumers aren’t that confident. - Confidence among U.S. consumers rose less than forecast in January, signaling a lack of hiring will restrain spending. The Reuters/University of Michigan preliminary index of consumer sentiment increased to 72.8 from 72.5 in December. The gauge averaged 66.3 last year after reaching a record 28-year low of 55.3 in November 2008. Unemployment, close to a 26-year high and projected to average 10 percent this year, remains a hurdle for the recovery. Gains in confidence and spending, which makes up 70 percent of the economy, will depend on sustained job growth that hasn’t happened since the recession started two years ago.

Consumers aren’t that confident. - Confidence among U.S. consumers rose less than forecast in January, signaling a lack of hiring will restrain spending. The Reuters/University of Michigan preliminary index of consumer sentiment increased to 72.8 from 72.5 in December. The gauge averaged 66.3 last year after reaching a record 28-year low of 55.3 in November 2008. Unemployment, close to a 26-year high and projected to average 10 percent this year, remains a hurdle for the recovery. Gains in confidence and spending, which makes up 70 percent of the economy, will depend on sustained job growth that hasn’t happened since the recession started two years ago.

Finding the truth about derivatives.

At yesterday’s Financial Crisis Inquiry Commission hearings, Brooksley Born, one of the 10 commissioners on the Congressional panel, didn’t use her time taking cheap shots. Born, who ran the Commodity Futures Trading Commission (CFTC) under President Clinton, asked modest questions of Goldman Sachs chief Lloyd Blankfein. The details that she tried to uncover are the financial crisis, distilled. Born confined her questioning to inadequately regulated, or “over the counter,” derivatives. It’s easy to see derivatives as peripheral to the “mortgage crisis,” but they were actually central to it.

Timothy Geithner remains uncontrite.

Tim Geithner, who will be testifying before congress over his role in the AIG disclosure coverup, confirms that nothing has changed in the administration, and that if he had to bail out AIG's counterparties at par all over again, he would.

Is history repeating?

-- Today was the 312th day from the March low. The significance of this is that the duration of this rally is now more than twice as long as the bear market rally separating the Crash of 1929 with the 26 month decline from May 1930 to July 1932. Yet both rallies only retraced 54% of the original losses in both declines. Mark Twain said, “History doesn’t repeat, but it often rhymes.” How will it rhyme

-- Today was the 312th day from the March low. The significance of this is that the duration of this rally is now more than twice as long as the bear market rally separating the Crash of 1929 with the 26 month decline from May 1930 to July 1932. Yet both rallies only retraced 54% of the original losses in both declines. Mark Twain said, “History doesn’t repeat, but it often rhymes.” How will it rhyme

Treasury bonds recover from a near-death experience.

-- Treasuries rose, with 10-year notes headed for their biggest weekly gain since November, after a government report showed the cost of living rose less than forecast in December. Treasury long bonds have been written off by the investor public as a “loser.” The concern about the U.S. Treasury issuing too much debt is a real one. However, a failure in equities may drive investors into the eager arms of our treasury for a while, since the risk of default is still uncertain, while the risk of loss in stocks may be more immediate.

-- Treasuries rose, with 10-year notes headed for their biggest weekly gain since November, after a government report showed the cost of living rose less than forecast in December. Treasury long bonds have been written off by the investor public as a “loser.” The concern about the U.S. Treasury issuing too much debt is a real one. However, a failure in equities may drive investors into the eager arms of our treasury for a while, since the risk of default is still uncertain, while the risk of loss in stocks may be more immediate.

Gold may be losing favor.

-- Gold prices fell as the dollar’s rally sapped investor demand for the metal as an alternative asset.The greenback rose as much as 0.7 percent against a basket of six major currencies, halting a six-session slide. Demand for the dollar as a haven increased amid speculation that China’s economy will cool following interest-rate increases. Gold gained 41 percent in 2009 as the dollar declined 9.1 percent. Is it possible that they will change places in 2010?

-- Gold prices fell as the dollar’s rally sapped investor demand for the metal as an alternative asset.The greenback rose as much as 0.7 percent against a basket of six major currencies, halting a six-session slide. Demand for the dollar as a haven increased amid speculation that China’s economy will cool following interest-rate increases. Gold gained 41 percent in 2009 as the dollar declined 9.1 percent. Is it possible that they will change places in 2010?

Has the Nikkei gone too far, too fast?

-- Japanese stocks rose, capping a second week of gains, as banks advanced on speculation their shares will recover and efforts to boost capital are ending. The Nikkei’s 20% rally in six weeks has been an eye opener. It currently trades at 38 times earnings, which is a bit of a nosebleed for stock valuations. Foreign investors have been eager to buy shares, but they may have come late in the game.

-- Japanese stocks rose, capping a second week of gains, as banks advanced on speculation their shares will recover and efforts to boost capital are ending. The Nikkei’s 20% rally in six weeks has been an eye opener. It currently trades at 38 times earnings, which is a bit of a nosebleed for stock valuations. Foreign investors have been eager to buy shares, but they may have come late in the game.

Shanghai world ranking rises.

-- Shanghai overtook Tokyo as Asia’s biggest stock market by trading value last year, as an 80 percent jump in China’s benchmark index boosted equities demand. Shares worth $5.01 trillion changed hands on the Shanghai Stock Exchange in 2009, compared with $4.07 trillion on the Tokyo Stock Exchange, according to data compiled by Bloomberg. The Shanghai and Tokyo exchanges were ranked third and fourth globally, the Nikkei newspaper reported, citing the World Federation of Exchanges. Only the Nasdaq stock market and the New York Stock Exchange had higher trading volumes than Shanghai.

-- Shanghai overtook Tokyo as Asia’s biggest stock market by trading value last year, as an 80 percent jump in China’s benchmark index boosted equities demand. Shares worth $5.01 trillion changed hands on the Shanghai Stock Exchange in 2009, compared with $4.07 trillion on the Tokyo Stock Exchange, according to data compiled by Bloomberg. The Shanghai and Tokyo exchanges were ranked third and fourth globally, the Nikkei newspaper reported, citing the World Federation of Exchanges. Only the Nasdaq stock market and the New York Stock Exchange had higher trading volumes than Shanghai.

The dollar retraces 50% of its recent gains.

The dollar spent the first two weeks on a “breather” from its first meaningful rally in nine months. This retracement is common after a financial asset becomes “overbought.” This is when price gets pushed too far in one direction and profits are taken. A 50% retracement is common, although some pullbacks are more severe. A pullback allows for “price discovery” where the market allows for buyers who believe that the asset may go higher to come in as “half price.” Folks, the dollar may be having a blue light special this week!

The dollar spent the first two weeks on a “breather” from its first meaningful rally in nine months. This retracement is common after a financial asset becomes “overbought.” This is when price gets pushed too far in one direction and profits are taken. A 50% retracement is common, although some pullbacks are more severe. A pullback allows for “price discovery” where the market allows for buyers who believe that the asset may go higher to come in as “half price.” Folks, the dollar may be having a blue light special this week!

Is the real estate market ready for a fall?

-- After four months of gains, home prices flattened in October. Worse yet, industry insiders think that they'll soon start to fall. Prices have risen more than 3% since May, according to S&P/Case-Shiller. But most forecasts predict price declines in 2010, with possible losses ranging from anywhere from 3% on up. Fiserv Lending Solutions, a financial analytics firm, forecasts that prices will fall in all but 39 of the 381 markets it covers, with an average drop of 11.3%.

-- After four months of gains, home prices flattened in October. Worse yet, industry insiders think that they'll soon start to fall. Prices have risen more than 3% since May, according to S&P/Case-Shiller. But most forecasts predict price declines in 2010, with possible losses ranging from anywhere from 3% on up. Fiserv Lending Solutions, a financial analytics firm, forecasts that prices will fall in all but 39 of the 381 markets it covers, with an average drop of 11.3%.

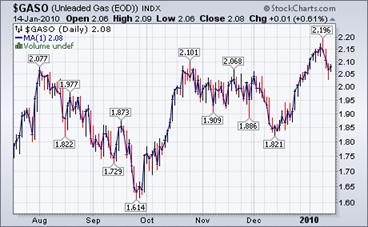

Average Gasoline prices still higher than a year ago.

The Energy Information Agency weekly report suggests, “The U.S. average price for regular gasoline rose for the third week in a row, advancing nearly nine cents to settle at $2.75 per gallon, $0.97 higher than the average a year ago. Despite an increase of more than 16 cents over the past three weeks, the average remains $1.36 per gallon less than the all-time high price set on July 7, 2008.”

The Energy Information Agency weekly report suggests, “The U.S. average price for regular gasoline rose for the third week in a row, advancing nearly nine cents to settle at $2.75 per gallon, $0.97 higher than the average a year ago. Despite an increase of more than 16 cents over the past three weeks, the average remains $1.36 per gallon less than the all-time high price set on July 7, 2008.”

Frigid weather keeps NatGas prices high.

The Energy Information Agency’s Natural Gas Weekly Update reports, “A major arctic air mass enveloped most of the country through Monday, January 11, bringing the lowest temperatures of the season to date as far as the southern tip of Florida. The cold weather resulted in spot price increases across the lower 48 States in the first few days of the report week, most of which peaked on Thursday, January 7. The associated increase in space-heating demand resulted in double-digit prices in Florida and the Northeast, while the rest of the spot price locations traded between $6 and $9 per MMBtu.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “A major arctic air mass enveloped most of the country through Monday, January 11, bringing the lowest temperatures of the season to date as far as the southern tip of Florida. The cold weather resulted in spot price increases across the lower 48 States in the first few days of the report week, most of which peaked on Thursday, January 7. The associated increase in space-heating demand resulted in double-digit prices in Florida and the Northeast, while the rest of the spot price locations traded between $6 and $9 per MMBtu.”

David Rosenberg says “This is not a time to chase the market.”

The vagaries of an overvalued market is that good news may no longer be good enough — and viewed as an opportunity to take profits. When this strategy occurs en masse — well, look out. And in extremely overvalued markets, it doesn’t take much. Food for thought — think of the risk involved before chasing the performance of the past year.

Are the regulators really watching?

-----Original Message-----

From: CME Globex Control Center

Sent: Wednesday, January 13, 2010 4:54 PM

Subject: ESH0 Event

Importance: High

Between 11:03 and 11:04 CT today, there were a series of transactions in

ESH0 in which a market participant appears to have inadvertently traded

approximately 200,000 contracts as both buyer and seller. CME maintains

trade practice and risk management rules and procedures respecting such

matters. In keeping with standard practices and CME's self-regulatory

responsibilities, CME is reviewing the circumstances of this event.

If they aren’t watching, maybe someone else should be. This trade is presumably worth as much as $13 billion in notional value and benefitted the trading firm involved by as much as $22 million. The problem was, it was all smoke and mirrors. This has been identified as a cross-trade between two computers owned by the same firm. So far they have not been busted.

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.