Buying the Market Dip? - Let the Buyer Beware

Stock-Markets / Financial Markets Jul 27, 2007 - 05:00 PM GMTBy: Doug_Wakefield

Doug Wakefield and Ben Hill write: “Cheap money policies have allowed us to continue to borrow. We have taken this money and maintained or increased our rate of consumption and purchased assets. The swell in dollars has created a swell in demand. While consumption prices have stayed low because of globalization, asset prices have inflated greatly. The primary effect of asset inflation can be seen most clearly in real estate prices, yet the stock and commodity markets reveal this as well.

Doug Wakefield and Ben Hill write: “Cheap money policies have allowed us to continue to borrow. We have taken this money and maintained or increased our rate of consumption and purchased assets. The swell in dollars has created a swell in demand. While consumption prices have stayed low because of globalization, asset prices have inflated greatly. The primary effect of asset inflation can be seen most clearly in real estate prices, yet the stock and commodity markets reveal this as well.

As our borrowing capacity begins to tap out, who will keep inflating these asset prices? If we are forced to pay down debt and thus have less money to buy assets and consume, is the next major obstacle inflation or deflation? Every investor will witness the answer to these questions. Our history, and that of Japan 's, teaches that asset classes and investment strategies work very differently in long-term deflationary cycles. The real question is whether we, as individuals, will prepare now or be caught off guard at some point in the future.” – The Great Inflation Illusion: A Historic Perspective , Doug Wakefield

When I produced this article in May of 2005, the Dow had moved down almost 1,000 points in six weeks. The retracement fit a nice ABC pattern, and everything looked as though we'd seen the final top . With two years passing since, this obviously wasn't the U.S. equity market's top, but it was the top for the housing sector of U.S. equity markets. This was the first warning that a long-term, deflationary trend was beginning to set in. [The housing chart can be found on page 6 of our July 2005 newsletter.]

In the last several weeks the reason that equity markets have floated higher has started to surface. The parabolic rises that we've been seen in most of our major markets the world over has come from maniacal growth in the money supplies of the same. The price of which has been a deflating U.S. dollar and Japanese Yen. Though the BIS 77 th Annual Report, which was released on June 24 th of this year, does not pinpoint the reason, they do note the effect this has had on many of the world's stock markets:

“It could be suggested that the market reaction to good news might have become irrationally exuberant. There seems to be a natural tendency in markets for past successes to lead to more risk-taking, more leverage, more funding, higher prices, more collateral, and in turn, more risk-taking.”

The recent reaction of various equity markets should have come as no surprise. Yet, since the major equity indices have been disconnected from reality for sometime, many were likely caught off guard. Still, those who took note of the weakening trend in the brokerage or banking sectors over the last few months would have known that when this is the case and the headlines read, “ Dow at All Time High ,” something is indeed wrong.

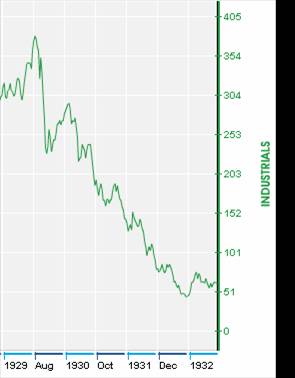

Undoubtedly, many buy-and-hold investors and advisors have been struggling to explain this recent “dip.” And as they sit, waiting for the next rally which is surely just around the corner, we remind the reader that “buying on the dip” this go ‘ round could prove to be as costly as it was for the two and a half years that the Dow fell from 11,750 to 7,197.

If after watching the Dow drop more than 500 points in 5 trading days, after hitting its all time high, you are beginning to think critically about what the markets may do next, consider these comments from previous issues of The Investor's Mind .

Dr. Benoit Mandelbrot , known as “the father of fractal geometry, authored a book called The (Mis) Behavior of Markets , which we used as a resource in our September 2006 issue , Too Costly to Bear .

“‘The size of the price changes clearly cluster together. Big changes often come together in rapid succession, like a fusillade of cannon fire; then come long stretches of minor changes, like the pop of toy guns.'

Those receiving conventional buy-and-hold advice from their brokers and advisors should be leery. We referenced Barton Biggs' , former Chief Global Strategist with Morgan Stanley, book Hedgehogging in our April 2006 issue , Losers: Why We Invest with Them .

“Secular cycles, both in markets and sectors of the market, make a big investment management firm a very conflicting enterprise to manage if you are a businessperson, because the rational things to do to maximize short-term profitability are exactly the wrong things from both an investment and a long-term profitability point of view . For example, during 2000, even as the bubble was bursting, Morgan Stanley Investment Management, which has a business-dominated management, acted like businessmen: they heavily promoted the underwriting of technology and aggressive growth stock funds because those were the funds the salespeople could sell and that the public would buy . Management was not evil; they were doing what they thought was right. Large amounts of public money were being raised and very quickly lost. Short-term sales profits were collected at the expense of, not only the public, but the firm's long-term credibility and profitability.”

Those who are looking for warnings from our “trusted” government officials should consider their track record. On July 12 th of this year, U.S. Treasury Secretary Paulson declared, “This is far and away the strongest business economy that I have seen in my lifetime.” Several days prior, on July 2 nd , he stated, “In terms of housing, most of us believe that we are at or near the bottom.”

If the truth is not already obvious to us, history can be instructive. With the help of Dr. Mark Thornton, of the Ludwig Von Mises Institute , one needn't look far to find examples of misleading statements at major market and economic turning points. Paul Warburg , an early advocate of the Federal Reserve, was on the Federal Reserve Board when he made this statement in January of 1930.

“Happily, we have now turned our backs upon the events of this unfortunate event.”

“Happily, we have now turned our backs upon the events of this unfortunate event.”

Even more incredulously, on November 22 nd of 1929, William Green, President of the American Federation of Labor, stated:

“All the factors which make for a quick and speedy industrial and economic recovery are present and evident. The Federal Reserve System is operating, serving as a barrier against financial demoralization. Within a few months industrial conditions will become normal, confidence and stabilization in industry and finance will be restored.”

As a final word of warning, we leave you with the words of Dr. Carroll Quigley , a noted historian, former professor of history at Georgetown University , and consultant to the U.S. Defense Department, the Smithsonian Institute, and NASA. His tome, Tragedy and Hope: A History of the World in Our Time was used as a resource in our December 2006 issue : Mind Games .

“ All past history shows that espionage has been generally successful and intelligence has been generally a failure. By this I mean that no country had much success in keeping secrets, in the twentieth as in all earlier centuries, but neither has any other country had much success in evaluating or in interpreting the secrets it obtained. The so-called ‘surprises' of history have emerged not because other countries did not have the information, but because they refused to believe it. The date of Hitler's attack on the West in May 1940 had been given to the Netherlands by the German Counterintelligence Office as soon as it was decided; the Western countries refused to believe it. The same was true of every one of Hitler's surprises. Stalin was given the date of the German attack on the Soviet Union by a number of informants, including the United States Department of State, but he refused to believe. Both the Germans and Russians had the date of D-Day, but ignored it. The United States had available all the Japanese coded messages, knew that war was about to begin, and that a Japanese fleet with at least four large carriers was loose (and lost) in the Pacific, yet Pearl Harbor was a total surprise.”

While the evidence of trouble has just begun to surface in U.S. equity prices, the love affair with credit, as demonstrated by record profits in the banking and brokerage industries, has only made investors, especially large institutional investors, more attached to this bullish run than ever. But, with the continuing contraction in the housing sector, and its impact on borrowing, the early warning signals are blowing.

The following is an excerpt from the email we sent our subscribers last Thursday, July 19 th, regarding our latest issue of The Investor's Mind :

“We are releasing this month's Investor's Mind early because a variety of technical indicators are pointing to an end to the bull market run that began in the fall of 2002. I thought it important to release this piece on three high-level financial meetings that have taken place over the last few months, which I believe make it clear that those at the top of the money game have known for some time that the end of this period will bring massive shifts to the global capital markets.”

If you're interested in an overview of the newsletters we've produced since January of 2006, click here . We continue to gain recognition for our industry paper on short selling, Riders on the Storm: Short Selling in Contrary Winds , can be obtained with a subscription to The Investor's Mind . To learn more about our mission, as well as our educational and advisory services, visit our website .

By Doug Wakefield with Ben Hill

Doug Wakefield,

President

Best Minds Inc. , A Registered Investment Advisor

Copyright © 2005-2007 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.