Precious Metal Analysts Bullish in 2010; Asia Favours Gold as Inflation Hedge

Commodities / Gold and Silver 2010 Jan 28, 2010 - 06:09 AM GMTBy: GoldCore

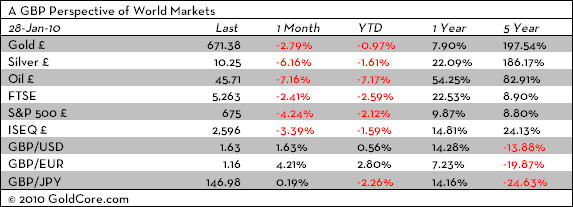

Gold slipped some 1% to $1,085.40/oz in US trading but then recovered to range trade from $1,085/oz to $1,091/oz in Asian trading. Gold is currently trading at $1,089.00/oz and in euro and GBP terms, gold is trading at €779/oz and £672/oz respectively.

Gold slipped some 1% to $1,085.40/oz in US trading but then recovered to range trade from $1,085/oz to $1,091/oz in Asian trading. Gold is currently trading at $1,089.00/oz and in euro and GBP terms, gold is trading at €779/oz and £672/oz respectively.

Obama's Populist Rhetoric Soothes Markets but Uncertainty Growing

Obama's Populist Rhetoric Soothes Markets but Uncertainty Growing

Risk appetite has returned after Obama's populist State of the Union address which has seen equity markets and gold rise tentatively in unison. Gold is up some 1% since Obama's speech but this may be due to gold bouncing from a somewhat oversold position rather than Obama's soothing words about the economy. The dollar also strengthened on Obama's speech and these gains have been maintained and appear to be capping gold below the $1,100/oz level.

.png)

The FOMC left rates unchanged but their statement was interpreted as being slightly more upbeat than before, despite the emergence of Kansas City Fed President Thomas Hoenig as a dissenting voice, concerned about developing inflation. Another note of caution ignored by many was that a housing improvement was no longer seen by the FOMC. Concerns about further declines in property markets, particularly the vulnerable commercial property market, should see continuing safe haven demand for gold.

Record low interest rates set to remain near 0% for the foreseeable future remain bullish for gold. There is still no opportunity cost in owning the non yielding yellow metal versus the dollar and other currencies that have interest rates remaining near 0%.

A risk that may not have been fully factored into markets is growing uncertainty regarding the position of Treasury Secretary Geithner who yesterday was subject to a bipartisan attack over the secretive AIG deal. The populist mood sweeping America clearly affecting politicians (Geithner was accused of incompetence and negligence) is leading to increasing uncertainty – regulatory, political, economic and monetary: gold benefits from such uncertainty.

Silver

Silver dipped as low as $16.47/oz overnight but we have seen support and recovery this morning. Silver is currently trading at $16.69/oz, €11.88/oz and £10.26/oz.

Platinum Group Metals

Platinum is trading at $1,520/oz and palladium is currently trading at $419/oz. Rhodium is at $2,450/oz.

.png)

News:

- The Reuters Precious Metals Poll found that leading analysts of the precious metals markets remain bullish on the precious metals. Precious metals are expected to make further gains this year, with platinum group metals (PGMs) and silver forecast to outperform gold on hope that an upturn in the economic cycle will boost demand for industrial usage. 60 leading precious metals analysts, traders and fund managers (including GoldCore) took part in the survey on the outlook for precious metals in 2010 and 2011, collected in January.

- Gold could increasingly be investors' top hedge against mounting inflationary pressures in Asia, a regional survey showed on Wednesday. With economic growth in Asia expected to lead the world again in 2010, 45 percent of investors in the region's markets outside of Japan picked the precious metal as their most favoured tool to protect their returns from inflation, while 42 percent chose equities, according to a quarterly survey from ING.

- At the World Economic Forum in Davos, Newmont Mining Corp (NEM.N) CEO Richard O'Brien forecast that the price would in the longer term rise to $1,250 to $1,500 an ounce. O'Brien said that the gold price could range between $1,025 and $1,250 an ounce this year.

China looks set to overtake India as the world's largest gold consumer while also being the world's largest gold producer. China's gold output jumped 11.34 percent to a record of 313.98 tonnes in 2009, securing the country's position as the world's largest producer of the yellow metal. China has dramatically opened bullion markets to active trade in the past decade, including allowing gold to be traded freely on the Shanghai Gold Exchange. Citizens owning gold was outlawed in 1949 when the communists took power and was only allowed again in 2003.

To read these and other important news and commentary, see our News and Commentary pages: http://www.goldcore.com/news and http://www.goldcore.com/commentary.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.