US Employment Numbers Don't Look Good

Economics / Financial Markets Aug 03, 2007 - 07:53 PM GMTNonfarm payroll employment continued to trend up (+92,000) in July, and the unemployment rate (4.6 percent) was essentially unchanged, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment grew in several service-providing industries. Average hourly earnings rose by 6 cents, or 0.3 percent.

The payroll numbers are disappointing; no matter how you spin it. Already low expectations (133,000 new jobs) were not met and Wall Street is not happy. ( Read MarketWatch's analysis ) Interestingly enough, the Federal Government laid off 28,000 employees. The CES Birth/Death Model shows 26,000 Hypothetical jobs were included in that number. We can take faint solace in the fact that the report was still positive after taking out the “spin.”

Show me the money!

The Bureau of Economic Analysis issued its latest report on personal income and outlays. One of my sharp-eyed gnomes (http://www.urbansurvival.com) pointed out some revisions that were quite startling. Can you believe it? We actually saved money in the past year! Here are the revisions:

| Personal Savings as a Percentage of Disposable Income | ||

| From Table 13 | ||

| Month | "REVISED" | First Published |

| May 06 | 0.1 |

-1.6 |

| Jun 06 | 0.5 |

-1.5 |

| Jul 06 | -0.3 |

-1.7 |

| "Aug 06 | -0.1 |

-1.5 |

| Sep 06 | 0.4 |

-1 |

| Oct 06 | 0.4 |

-0.8 |

| Nov 06 | 0.5 |

-0.9 |

| Dec 06 | 0.3 |

-1.1 |

| Jan 07 | 0.8 |

-0.8 |

| Feb 07 | 0.9 |

-0.8 |

| Mar 07 | 1.5 |

-0.4 |

| Apr 07 | 0.6 |

-1.2 |

| May 07 | 0.4 |

-1.4 |

| Average | 0.46 |

-1.13 |

That means the “average family” saved $202.40 last year instead of borrowing, begging and robbing Peter to pay Paul $497.20 they don't have. As they say, the check is in the mail.

A lot can happen in just two weeks!

Two weeks ago I suggested that the Nikkei might get pushed over the edge on the following Monday. That is exactly what happened. Since then, the selling has almost incessant, with only three up days out of ten. Two days ago it crossed below 17000. More importantly, if it crosses 16500, the long-term trend turns down.

I just talked with Mr. Wong Wey and he said…

…oh, never mind. Both the analysis and my conclusions from two weeks ago were wrong. Meanwhile, the news media are chortling, “ Shanghai index sets another record .” The question stil stands, “Will the Chinese markets be able to stand alone against the falling tides of the world markets? Check back with me next week.

…oh, never mind. Both the analysis and my conclusions from two weeks ago were wrong. Meanwhile, the news media are chortling, “ Shanghai index sets another record .” The question stil stands, “Will the Chinese markets be able to stand alone against the falling tides of the world markets? Check back with me next week.

The S&P 500 took another nosedive today.

The question is, “Are we there yet?” It has been very interesting to get phone calls from clients and other advisors to ask whether I was buying yet. The answer is, “Nyet!” That could be construed as a Russian word for “No.” Or that I had skipped typing some keys for “Not yet!” The cyclical pattern suggests another two weeks (that's right!) of decline are ahead of us. Cycles may expand or contract, so I'll be on my toes to catch the low. But I won't be around to catch falling knives, which appear to be next on the agenda.

The question is, “Are we there yet?” It has been very interesting to get phone calls from clients and other advisors to ask whether I was buying yet. The answer is, “Nyet!” That could be construed as a Russian word for “No.” Or that I had skipped typing some keys for “Not yet!” The cyclical pattern suggests another two weeks (that's right!) of decline are ahead of us. Cycles may expand or contract, so I'll be on my toes to catch the low. But I won't be around to catch falling knives, which appear to be next on the agenda.

Bonds put in a magnificent rally.

And we were there to catch most of it over the past two months. Today's news is that investors are seeking a safe haven from the rather poor news. I've had a few people question why I only show the U.S. Treasury bond index. Why not use a broader bond index? The answer lies in today's report from Standard & Poors . According to the latest survey, more than 50% of corporate bonds are rated BB (speculative) or below.

And we were there to catch most of it over the past two months. Today's news is that investors are seeking a safe haven from the rather poor news. I've had a few people question why I only show the U.S. Treasury bond index. Why not use a broader bond index? The answer lies in today's report from Standard & Poors . According to the latest survey, more than 50% of corporate bonds are rated BB (speculative) or below.

Foreclosed? Just look for brown grass in the front…

…and green water in the swimming pool . Even lower interest rates are not helping those already caught in the subprime mess. The housing index (of home builders) took almost a 15% hit in the last month. Even Wall Street is affected, since the subprime ills are hitting banks, brokerage houses and homebuilders and suppliers. The personal effect that it has on all of us is the lessening of equity in our own homes.

…and green water in the swimming pool . Even lower interest rates are not helping those already caught in the subprime mess. The housing index (of home builders) took almost a 15% hit in the last month. Even Wall Street is affected, since the subprime ills are hitting banks, brokerage houses and homebuilders and suppliers. The personal effect that it has on all of us is the lessening of equity in our own homes.

The dollar stopped its slide. What next?

Some are saying that this small rally is just a pause that refreshes from the long downtrend. The news today wasn't particularly helpful for the dollar, either. The worry, it seems, is that the poor employment report today could affect the dollar, due to mortgage woes spreading. U.S. Treasury secretary Henry Paulsen has been trying to talk up the dollar recently, but the bully pulpit doesn't seem to be working, yet.

Some are saying that this small rally is just a pause that refreshes from the long downtrend. The news today wasn't particularly helpful for the dollar, either. The worry, it seems, is that the poor employment report today could affect the dollar, due to mortgage woes spreading. U.S. Treasury secretary Henry Paulsen has been trying to talk up the dollar recently, but the bully pulpit doesn't seem to be working, yet.

Gold investors are seeing high volatility.

This could lead to an eventual shakeout, but for now, the bad news on the dollar is contributing to another surge in gold prices. The question is, will it last? There may be a potential ceiling on gold that has existed for more than a year. If gold can break through the July high, there may be hope for even higher prices. However, each subsequent high has been lower than the last, so the jury is out until it overcomes that potential barrier.

This could lead to an eventual shakeout, but for now, the bad news on the dollar is contributing to another surge in gold prices. The question is, will it last? There may be a potential ceiling on gold that has existed for more than a year. If gold can break through the July high, there may be hope for even higher prices. However, each subsequent high has been lower than the last, so the jury is out until it overcomes that potential barrier.

Finally! Relief at the pump.

Finally! Relief at the pump.

The EIA's report on Wednesday that the product cycles in petroleum may be shifting. Crude oil has been rising, while refined products, such as gasoline and heating oil have been falling. The good news is that most refinery capacity has been brought back online, which should send prices for gasoline even lower. At the same time, crude prices are falling . This is good news for consumers.

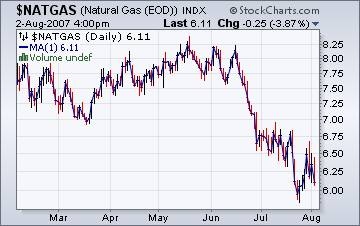

Natural gas is also in a volatile season.

U.S. natural gas supplies are up , contributing to lower prices. The Energy Information Agency reports that seasonal (hot) temperatures and increased storm activity are putting pressure on natural gas prices, however. This may lead to a boost in prices over the next month or so. Hurricane season also may last until the end of October, so there are reasons to see potential spikes in natural gas prices, but not the type of activity seen in past years.

U.S. natural gas supplies are up , contributing to lower prices. The Energy Information Agency reports that seasonal (hot) temperatures and increased storm activity are putting pressure on natural gas prices, however. This may lead to a boost in prices over the next month or so. Hurricane season also may last until the end of October, so there are reasons to see potential spikes in natural gas prices, but not the type of activity seen in past years.

Back on the air again.

Tom Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again last week. You may listen to our comments by clicking here .

Employment on Pluto also rises.

The need to put a happy face on the state of the economy is beginning to cause embarrassment to those familiar with how things are being reported. My friend, Michael Shedlock has some comments about this in today's blog . Things just don't add up at foggy bottom. Maybe they never have.

The Practical Investor is finally moved! Please note the phone number that follows.

Please make an appointment to discuss our investment strategies by calling me or Claire at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.