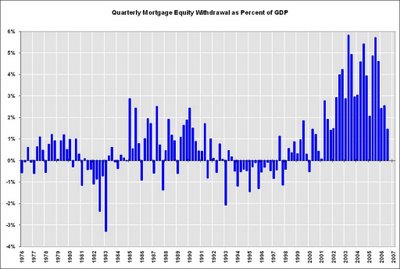

Mortgage Equity Withdrawal Syndrome. The Third Rail of the Housing Led Boom

Housing-Market / UK Housing Aug 11, 2007 - 08:23 AM GMT  Unless you've been living under a rock, it is apparent that there will be no summer bounce in housing. This comes as a grave shock to those that are entwined like a ball of yarn with the housing industry. We've created an entirely new generation of folks that think housing equity equals housing wealth. All of us have anecdotal stories of friends, family members, or ourselves tapping into home equity for vacations, consumption purchases, or using the HELOC to pay off other credit cards. The simplicity of getting money out of your home is so easy it is frightening.

Unless you've been living under a rock, it is apparent that there will be no summer bounce in housing. This comes as a grave shock to those that are entwined like a ball of yarn with the housing industry. We've created an entirely new generation of folks that think housing equity equals housing wealth. All of us have anecdotal stories of friends, family members, or ourselves tapping into home equity for vacations, consumption purchases, or using the HELOC to pay off other credit cards. The simplicity of getting money out of your home is so easy it is frightening.

Step one , you call the bank.

Step two, you decide between a home loan or home equity line of credit.

Step three , you get a 2 nd on the home after an inflated bubble market appraisal.Step four , your off to the spending races.

Sounds rather poetic doesn't it? But aside from the personal stories, how much money was taken out of homes at inflated prices and pumped back into this economy? The answer may surprise you.

Making Your Home a Bank

During the 1990s, in terms of tapping out equity, mortgage equity withdrawals (MEW for short) were roughly flat for a decade. It was flat for a couple of reasons. The collateralized debt obligations market wasn't as streamlined as it currently is. This made it more difficult and a longer drawn out process to extract money from your home. The next major point is home prices were stagnant throughout this decade. How are you going to extract money out of a dry well? And finally we have declining returns and world wide investors chasing stronger yields. Keep in mind it was very normal to see 35% year-over-year gains in the technology sectors. Why in the world would you want to invest in housing where over a century of gains have trended with inflation? This all changed after 9/11.

After 9/11, we suddenly saw a progressive campaign of rate slashing to keep the economy afloat. Of course, when you decrease the fed funds rate, you increase the money flowing through the economy. Take a look at the below chart:

After 9/11, we suddenly saw a progressive campaign of rate slashing to keep the economy afloat. Of course, when you decrease the fed funds rate, you increase the money flowing through the economy. Take a look at the below chart:

s you notice, through the 90s MEW stayed flat. Then we see a sudden quarterly jump in 2001. The tipping point started in the late 90s and early part of the decade because many people started jumping ship from technology investments when most seasoned investors realized that annualized gains of 35 to 40 percent were not going to last. They did what any smart gambler would do, they took their winnings off the table. But here come the stragglers, Joe and Susie public, and go tech crazy. No need to dive into that $7 trillion debacle, but suffice it to say that bubbles do pop. As you will notice from the chart, MEW jumped at a whopping 2 to 1 ratio over the following years. Keep in mind that the bull argument was that money that was extracted from the home was being used to pay off debt and not splurge on consumption.

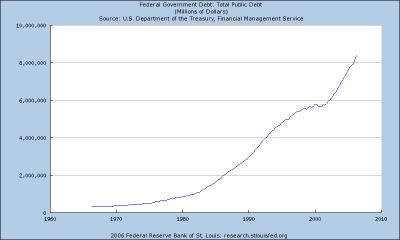

Let take a look at some data from the Fed:

As you will notice, we have a normal progressive growth of public debt from the 1970s to about 2000. Then we see something odd happening. We see the angle trajectory of the chart suddenly shift. Somehow I doubt the majority of folks were paying off debt. If anything, they were consolidating credit card debt, only to reuse the damn things again! Kind of defeats the purpose of debt reduction if you are moving your money from different pockets in your pants and thinking you are richer.

So you may say, what does the Fed have to do with this? They don't lend the money to the consumers. Au contraire my friend. Just because something isn't directly related doesn't mean no change is occurring. If anything, you need to ask yourself where do banks bank? They have standards set by the Federal Reserve and the key interest rate is vital for so many reasons. If they lower rates as they did to the 1 percent range, it makes no sense to purchase US Treasuries long-term since inflation will kill your investment. In addition, since the rate was lowered to a historical low, it actually encouraged people to spend. Plus with Big Ben pumping money into the market like a sewer repair man, apparently people still think this credit bubble can go on forever.

Many reports have been issued showing that Americans actually have less equity as a percentage in their home than in the past. Begs the question of all this $5 trillion housing wealth we've been wallowing in. Well somehow it became our patriotic duty to spend (remember the Bush speech) and folks true to form, went out and spent like a drunken hyena. We save so little, we are actually in a negative savings rate. Think about that for a second. We spend more than we earn! You can only do this if excess credit is in the market. With the advent of MEW and inflated housing prices, folks decided to appoint themselves CEO of the Bank of Home.

What Will Happen when Home Bank Forecloses?Since the dollar is worth a lot less because of inflation and irresponsible monetary policy, you are now able to purchase less with your current income. Think about the nature of inflation. When you print too much money, you devalue the worth of the current money supply. This is basic economics. What makes something valuable? The amount and scarcity of an item in relation to the demand. Money for a few years was so cheap, it made no sense to save and the public followed. The leaders of this consumption used every advertising medium available. If you drive a two year old car you simply were an old school idiot with no taste for the finer things in life. Have you noticed those credit card commercials where the person paying with a check or cash is seen as a leper? Everyone is having a merry time paying with their Visa and Mastercard but god forbid you show cash you dirty rotten animal. How dare you stop the flow of credit to the rightful owners of consumption!

But you can only spend so much and grow an economy on pseudo-wealth. Eventually someone will have to pay for it. And at a certain point, there will be no more money left. Take a look at the below chart:

You'll notice that suddenly as we hit the housing peak in 2005/2006, MEW dropped off the map. Why did this happen? For one, housing is correcting and coming back down to Earth. Another reason is the Fed was forced to tighten credit standards, otherwise we were on our way toward paying for orange juice with wheel barrows of dollars at Ralphs.

So the perma bull arguments are absolutely false. Housing was artificially inflated by investors looking for higher returns, a Fed that dropped rates faster than muscle growth in the MLB, and finally a society that is based on 70 percent consumption . If you read your history books, you'll find many great empires collapsing because of massive deficits. However, this is a worldwide glut in credit so this will impact the entire planet. Have any doubt about the bubble? Take a look at these 10 homes and then come back and let us know your thoughts.

Subscribe to Dr. Housing Bubble's Blog to get more housing content and your full dose of Real Homes of Genius.

Subscribe to Dr. Housing Bubble's Blog to get more housing content and your full dose of Real Homes of Genius. By Dr. Housing Bubble

Author of Real Homes of Genius and How I Learned to Love Southern California and Forget the Housing Bubble

http://drhousingbubble.blogspot.com

Dr. Housing Bubble Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.