SULTANS OF SWAP ACT II - The Sting!

Politics / Credit Crisis 2010 Mar 19, 2010 - 10:37 AM GMTBy: Gordon_T_Long

There are 7 stages to executing a successful sting operation. Whether this is the modus operandi behind the Sultans of Swap operating in the $605 Trillion OTC Derivatives market or just simple coincidence, I will leave it to you shrewd reader to determine. The seven stages do however offer us an instructive theater guide to better understanding these murky instruments called Interest Rate Swaps.

There are 7 stages to executing a successful sting operation. Whether this is the modus operandi behind the Sultans of Swap operating in the $605 Trillion OTC Derivatives market or just simple coincidence, I will leave it to you shrewd reader to determine. The seven stages do however offer us an instructive theater guide to better understanding these murky instruments called Interest Rate Swaps.

Act I can be found at SULTANS OF SWAP: Smoking Guns!

Act I can be found at SULTANS OF SWAP: Smoking Guns!

In Act I of our fictional play before we broke for Intermission, we discovered the players, how our Sting has been set-up, the innovative financing arrangements employed and the trading mechanism that allows our Sting to be potentially perpetrated.

There was a very interesting development however that occurred during our play's intermission. We had a fight break out between our DIRECTORS. Our sleepy actors were heard arguing amongst themselves behind the stage curtains as our audience enjoyed a casual libation and pondered the smoking guns unveiled in Act I.

What they overheard was the White House (a DIRECTOR) refusing to support European legislative efforts to stop the apparent deviant behavior of our sinister SPECUALTORS (see Act I for your theater guide). Angela Merkel and Nicolas Sarkozy emphatically demanded changes in European Derivatives trading and sent Greek Prime Minister George Papandreou to the White House as an example of a vulnerable victim (PATSY) to plead the case. He was quickly rebuked, being informed that this "was a Greek problem". The audience once again heard Johnny Depp's famous quip from the mob movie "Donnie Brasco", when Brasco was trapped in similar exposing entanglements responding 'Forget about it!'. Without US legislative action any European actions attempted would be knowingly useless in today's global trading markets. The President is fully cognizant of this, especially when he authorized the $170B of bailouts by the US government on AIG's CDSs (Credit Default Swaps) which had been headquartered and executed out of London. Who is our President possibly listening to, especially since he was elected on a platform of "Change" in the midst of the financial meltdown?

The cartoon of the White House I saw recently on the web is an indication of a strong growing public perception. These actions by the White House simply reinforce this view. Sites are now detailing relationship grids with the White House. I point this out not to cast dispersions on the parties depicted by this particular cartoonist, but rather to highlight the public outrage that is becoming clearly prevalent.

The cartoon of the White House I saw recently on the web is an indication of a strong growing public perception. These actions by the White House simply reinforce this view. Sites are now detailing relationship grids with the White House. I point this out not to cast dispersions on the parties depicted by this particular cartoonist, but rather to highlight the public outrage that is becoming clearly prevalent.

But this is not the full argument between our DIRECTORS that the audience overheard. The day after the President's meeting, Gary Gensler the Chairman of the CFTC (US Commodity Futures Trading Commission) and the chief enforcement DIRECTOR in the US, spoke. In an address to Markit's Outlook for OTC Derivatives Markets Conference and then again two days later at the International Regulators to Discuss Future Industry Issues, he spelled out almost verbatim that which we dear reader laid out in Act I concerning the OTC and CDS trading. I absolutely applaud him and all the professional members within the OTC. I strongly recommend you study carefully his remarks in full (1)(2). Make no doubt about it appalled reader, the vast majority of practicing professionals want this mess cleaned up. There appears however to be a powerful element that has the ear of the Legislative Branch of the US government. Without stringent legislation, the enforcement agencies are toothless tigers. This is a remake of the play starring former CFTC Commissioner Brooksley Born in her well documented efforts by PBS Frontline's "The Waring" which would have potentially avoided the whole 2008 financial crisis (3). The Washington "Blame Game" cannot be placed at the feet of the CFTC, though I am sure the commissioner will be another 'Fall Guy' in future years when the Sting has occurred and a successful Getaway has taken place. Our 7 steps to a successful Sting mandate a 'Fall Guy' which allows for the deflection during the masked getaway. Commissioner Gensler obviously does not knowingly want to be cast as yet another PATSY in our instructional theater.

ACT II - THE STING

6- THE SHUT-OUT

The whispering has now ended on stage and only the PATSIES remain. They stand nervously clutching their newly minted Swap contracts.

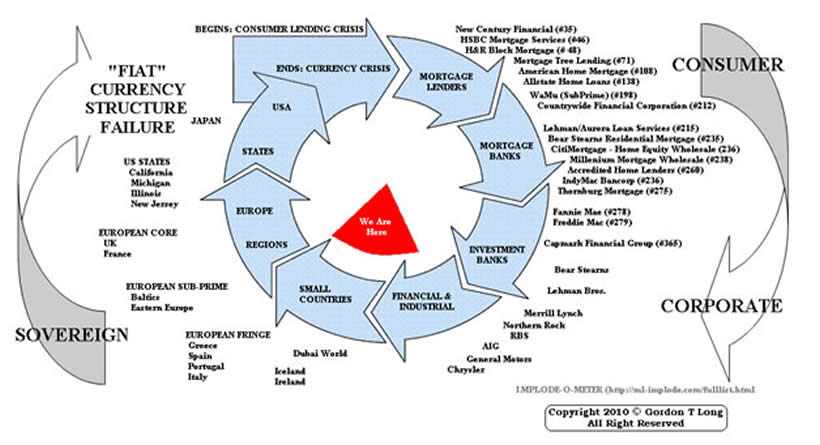

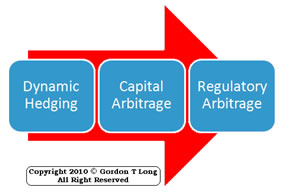

Our chart above shows that the financial crisis that began with the Consumer specific to Sub-Prime lending eventually took down most of the US Housing financial lending industry but then rolled on to engulf Fannie Mae / Freddie Mac / AIG and then to almost end Investment Banking as we have known it in America. What may be misunderstood is how the obligations were all rolled upward. What was consumer debt suddenly became corporate debt (i.e. Fannie Mae) which then became Sovereign Debt problems (i.e. Fannie Mae / AIG). This is not by coincidence. The "assumption" of the obligations and the securing of the 'Guarantee' of debt are part of what we might label as Regulatory Arbitrage.

Regulatory Arbitrage strategies were never clearer than during the following periods:

1- When the US Government was forced to Lend or Guarantee GM and Chrysler Debt when stock prices were crushed along with their bond prices as CDS's activity shot up. Don't forget GMAC in these commitments.

2- When the US government was forced to payout AIG obligations of $182.3B based on contracts that were heresy. The US government felt it had no choice but to immediately pass legislation to spend $700 Trillion for TARP (Troubled Asset Relief Program) to bailout insolvent banks who less than 9 months later declared record profits.

3- When the US government was suddenly forced to accept the obligations of Fannie Mae and Freddie Mac as conservatorships. This was after years of the US government denying it had implicit responsibility for the debt and obligations of these agencies. This public charade came crashing down in September 2008.

It is a chess game between a keen eyed chess champion executing a carefully choreographed strategy with each move versus a hallucinating crack cocaine addict.

Strategy is something that happens to you when you are looking the other way!Anonymous CEO during a bankruptcy proceeding

Let's take a second and 'peel the onion' on just one of many examples. Let's use the Fannie Mae and Freddie Mac example above as an illustration.

On Christmas Eve 2009 the Obama administration quietly slipped out an announcement entitled "Treasury Issues Update of Support For Housing Programs".(4) The Sub-Titles are labeled 'Program Wind Downs' and 'Amendments to Terms of Preferred Stock Purchase Agreements'. A person would have to have nearly no life to start crawling through such a document with these headings instead of slipping away to do some last minute family shopping. But there buried near the end of the fourth paragraph: "Treasury is now amending the PSPAs to allow the cap on Treasury's funding commitment under these agreements to increase as necessary to accommodate any cumulative reduction in net worth over the next three years". (bold mine) Then at the end of the next paragraph: " The amendments to these agreements announced today should leave no uncertainty about the Treasury's commitment to support these firms as they continue to play a vital role in the housing market during this current crisis.". Immediately the Washington Post who pay people to work these holidays on Christmas Day ran this story: 'U.S. promises unlimited financial assistance to Fannie Mae, Freddie Mac'. I am sure this pulled everyone away from the Christmas family meal to read. Bloomberg also hastily ran the story on Christmas Day: 'U.S. Treasury Ends Cap on Fannie, Freddie Lifeline for 3 Years' which many who have Bloomberg screens in their home office would have been riveted to. By Monday the coverage was way down the reading list below breaking news and the stale 'yesterday's news'. I thought Representative Scott Garrett (R-N.J.), a member of the House Financial Services subcommittee that oversees Fannie Mae and Freddie Mac, said it well in the Washington Post on Christmas Day:

"The Obama administration's decision to write a blank check with taxpayer dollars for the continued bailout of Fannie Mae and Freddie Mac is appalling. Not only is this a continued bailout of failed entities that need to be privatized to protect the taxpayer, the timing of the announcement is clearly designed to try and sneak the bailout by the taxpayers."

Representative Scott Garrett (R-N.J.) U.S. promises unlimited financial assistance to Fannie Mae, Freddie Mac Washington Post

This is used simply as an instructive example of how things work when people are feeding at the public trough and the Holy Grail of Lending when Sovereign Guarantees are involved. What we learned from the housing bubble is when accountability is removed then deviant behavior is prone to occur. When the banks stopped holding the mortgages on houses they initially lent money to, their motivations change. In our example here the ultimate accountability rests with the taxpayer who is almost completely unaware. The taxpayers' elected representatives are not representing. They are absent or 'handcuffed'. I have heard endless politicians like Representative Scott Garrett express their frustrations. Michael Moore's alarming new movie: "Capitalism: A Love Story" is worth reviewing simply to listen to our elected officials using words like "Coup d'état".

We have never witnessed more debt so successfully shifted up the Debt Risk Ladder to Sovereign debt in the history of the MANKIND.

There is an old saying:

OLD SAYING:

“When you owe the bank $100,000 and can’t pay you have a problem.

When you owe the bank 100M ($100,000,000) and can’t pay the bank has a problem”.TODAY’S VERSION:

When the banks owe 100B ($100,000,000,000) and can’t pay the banks have a problem.

When the banks owe 1T ($1,000,000,000,000) and can’t pay, MANKIND has a problem”.

To say governments are being trapped is rather an understatement. Ask the furious electorate what they think. In the US many border on rebellion with 'tea parties' while the lunatic fringe crashed a plane into a government building and another shot military personnel at the pentagon. This is new behavior not seen in the US. The rage was palpable for those that witnessed firsthand the election of Scott Brown in Massachusetts. Ask the rioters in the streets of Greece. It is obvious to all but our DIRECTORS - still in near oblivion to how they are being played like a violin. The public has the street smarts to spot a sting, even when those in power claim to not see it. Like former Fed Chairman Alan Greenspan not seeing the US housing bubble. This may all seem like just political hyperbole from yours truly but it is important as you will see later in Act III to the success of "The Getaway"

The vice is squeezing to set up the actual STING.

7- THE STING

Events have changed and our PATSIES find what was a good idea doesn't appear to be such a good idea any longer. They begin reading the small print in their Swap contract to see how they might alter their commitments (see Sultans of Swap: Fearing the Gearing!).

What we have witnessed since 2002 is a race by consumer borrowers to capture what they perceived to be low rates and by consumer lenders (i.e. pensioners on fixed income) to chase yield. Like addicts needing a fix they both wanted it now - immediately. In the case of Professional borrowers and lenders; jobs, careers and advancement were on the line. Success was felt to be determined by getting another 15 points or possibly 100 basis points. All are clearly short term preoccupations. They are looking the other way!

What we have witnessed since 2002 is a race by consumer borrowers to capture what they perceived to be low rates and by consumer lenders (i.e. pensioners on fixed income) to chase yield. Like addicts needing a fix they both wanted it now - immediately. In the case of Professional borrowers and lenders; jobs, careers and advancement were on the line. Success was felt to be determined by getting another 15 points or possibly 100 basis points. All are clearly short term preoccupations. They are looking the other way!

We see States and Municipalities locking themselves into contracts unwittingly for 30 years versus 10 years, as the New York Times points out (5). They are locking themselves into balloon payments that they can't possibly ever pay as we witnessed with Kitlos PLC and the Greek government debt. Debt that will be financed in the future with higher principle amounts (see the growing list at SULTANS). We will discuss in a moment the interest rates these rollovers may potentially command.

How for example will the US ever realistically pay for its $62 Trillion (Niall Ferguson estimates it to be $104T (6)) in unfunded liabilities associated with Medicare / Medicaid and Social Security? Add to this another $20T in fiscal spending imbalances by the end of the decade. Since we don't have a clue, is it too hard to imagine that those who eventually will be orchestrating the lending just might?

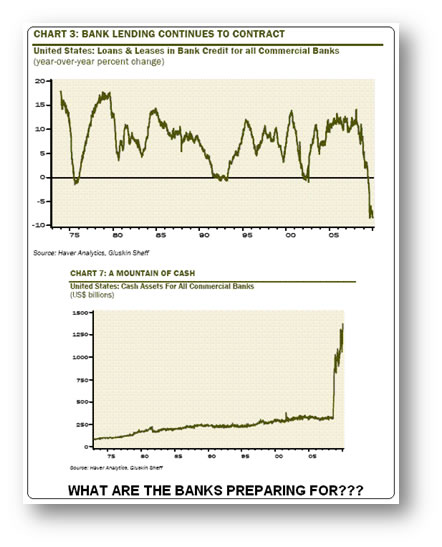

Unknowable you say? Maybe not? The BANKSTERS seem to know something if you study the chart to the right. What they know might be debatable. That they know something is coming, that is not!

"The number of companies globally that were rated B- or lower rose to 523, or 9.3 percent of the total, at the end of last year as speculative-grade issuers were downgraded, Standard & Poor's analysts led by Diane Vazza said in a March 5 report. That compares with 8.4 percent in 2008 and 5.8 percent in 2007, S&P said." (8)

"S&P said, in December, 260 companies had defaulted in the year to date, the highest count since its series began in 1981. The trailing 12-month speculative default rate has continued to climb since the crisis though S&P has lowered its default rate forecast for 2010, because of the improvement in capital markets. But the more positive default rate expectation is being driven by increased forbearance by lenders "in a monetary environment propped up by policy-induced liquidity". The S&P analysts said in a report: "Without a revival in top-line earnings and growth, many surviving leveraged issuers originated during 2003-2007 could face renewed default risk unless they significantly reduce their debt burdens". (9)

"At the annual conference for the Loan Syndications and Trading Association, investors and observers said the market's focus should be farther into the future. "2011 will be the exciting year," said James Ferguson, chief investment officer at Octagon. Problems could arise again because much of the debt raised to finance the buy-out boom a few years ago will begin to mature from 2011. The demand that helped to fuel that boom, mainly from structured vehicles called collateralized loan obligations (CLOs), has fallen. The financial market also will not have the support of government stimulus, which will be winding down by then. Roughly $1,000bn of leveraged loans and bonds are coming due over the next five years, according to Michael Zupon of Sound Harbor Partners, while $500bn of CLOs are coming to the end of their investment periods. New issuance of CLOs has dried up in the downturn. "It sets the stage for what could be a dramatic period in 2012, 2013 and 2014," said Mr Zupon. "If it comes at the same time as an economic downturn, it could create a pretty serious situation." (10)

"Edward Altman, the Max L Heine professor of finance at the Stern School of Business at New York University, said that the surge in so-called distressed exchanges over the last two years also could add another layer of defaults. Companies ranging from casino operator Harrah's to commercial lender CIT, have tried, both successfully and not, to convince investors to exchange existing debt for other securities or cash to avoid bankruptcy. Such exchanges, which usually only happen a few times a year, exploded to 14 in 2008 and 39 this year. "Fifty per cent of all distressed exchanges wind up in bankruptcy one to three years after," Mr. Altman said. "Of the 2009 crop of distressed exchanges, half will go bankruptcy in 2011, 2012 and 2013." Mr. Altman, a noted default forecaster, also warned that optimistic 2010 default forecasts were vulnerable to a downturn in the economy. (10)

The growth area in Investment banking is presently bankruptcy, restructuring and workouts as they gear up for the eventuality. Massive defaults are coming and everyone knows it except the PATSIES, DIRECTORS and unfortunately the taxpayer. (see SULTANS OF SWAP: Fearing the Gearing!) Ratings will continue to be downgraded which will drive out borrowing costs and possibly more importantly will drive collateral calls associated with Interest Rate Swaps.

We mentioned previously that a key part of a sting is that the assumptions upon which decisions were taken change. We pointed out in "SULTANS OF SWAP: Smoking Guns!" that "the five largest U.S. derivatives dealers, including JPMorgan Chase & Co., Goldman Sachs Group Inc. and Bank of America Corp., were on pace through the third quarter to record as much as $35 billion in revenue last year from trading unregulated derivatives contracts, according to company reports collected by the Federal Reserve and people familiar with banks' income sources." (11)

But it gets worse. In a March 15th, 2010 Business Week article entitled: Goldman Sachs Demands Derivatives Collateral It Won't Dish Out the "vig"of $35B pales in comparison to "demanding unequal arrangements with hedge-fund firms, forcing them to post more cash collateral to offset risks on trades while putting up less on their own wagers. At the end of December this imbalance furnished Goldman Sachs with $110 billion, according to a filing. That's money it can reinvest in higher-yielding assets. "If you're seen as a major player and you have a product that people can't get elsewhere, you have the negotiating power," said Richard Lindsey, a former director of market regulation at the U.S. Securities and Exchange Commission who ran the prime brokerage unit at Bear Stearns Cos. from 1999 to 2006. "Goldman and a handful of other banks are the places where people can get over-the-counter products today."(12) It isn't just new deals, it includes deals that not only corporate but more and more sovereign PATSIES must restructure.

"Over the last three years the BANKSTERS are extracting ever larger amounts from the $605 Trillion over-the-counter derivatives market according to filings with the SEC and reported by Business Week & Bloomberg. The firm led by Chief Executive Officer Lloyd C. Blankfein collected cash collateral that represented 57 percent of outstanding over-the-counter derivatives assets as of December 2009, while it posted just 16 percent on liabilities, the firm said in a filing this month. That gap has widened from rates of 45 percent versus 18 percent in 2008 and 32 percent versus 19 percent in 2007, company filings show. "That's classic collateral arbitrage," said Brad Hintz, an analyst at Sanford C. Bernstein & Co. in New York who previously worked as treasurer at Morgan Stanley and chief financial officer at Lehman Brothers Holdings Inc. "You always want to enter into something where you're getting more collateral in than what you're putting out." (12)

"Banks have an advantage in dealing with asset managers because they can require collateral when initiating a trade, sometimes amounting to as much as 20 percent of the notional value, said Craig Stein, a partner at law firm Schulte Roth & Zabel LLP in New York who represents hedge-fund clients." (12)

"We will make them an offer they can't refuse!"

Marlon Brando on consummating a financial deal in the "Godfather'

All MBA students have studied decision trees and probability paths. Our PRODUCERS and BANKSTERS with little doubt have the finest army of young MBA and PhD's (Quants) graduates in the world working for them. Smart strategists know that one of the secrets to successful strategy optimization is in understanding the probability chains. The primary probability chain presently suggests an unfolding sequence that will start with Credit Rating downgrades. This pattern as I mentioned above is now underway but still is not as visible as it soon will be.

Interest Rates will soon begin to rise for many. A global shortage of savings to fund what is simply monumental levels of debt can lead to no other result. The question is only when? Smart money doesn't let the daily noise, pre-occupying the amateurs, distract them.

The next shoe will be collateral calls. In the financial crisis we had margin calls on falling equity prices. This time the probabilities suggest it will be Collateral Calls because of lowered ratings and increased risk metrics. We outlined this inherent trigger with Interest Rate Swaps in Sultans of Swap - Explaining $605 Trillion in Derivatives and Sultans of Swap: Fearing the Gearing! The 03-15-10 Business Week / Bloomberg article: "Goldman Sachs Demands Derivatives Collateral It Won't Dish Outgives" gives a pretty clear sense of the activity presently going on in this area.

The next shoe will be collateral calls. In the financial crisis we had margin calls on falling equity prices. This time the probabilities suggest it will be Collateral Calls because of lowered ratings and increased risk metrics. We outlined this inherent trigger with Interest Rate Swaps in Sultans of Swap - Explaining $605 Trillion in Derivatives and Sultans of Swap: Fearing the Gearing! The 03-15-10 Business Week / Bloomberg article: "Goldman Sachs Demands Derivatives Collateral It Won't Dish Outgives" gives a pretty clear sense of the activity presently going on in this area.

The most probable outcome by 2012 will be an extremely serious problem within the global "fiat" currency markets. It will be centered on "fiat" currencies" because they are not anchored or based on any specific standards such as a gold standard. They are based on "confidence". Presently the vast number of currencies are 'fiat'. Confidence today is becoming a commodity in short supply.

Fiat currencies are also open to debasement. Competitive devaluations and beggar-thy-neighbor policies are highly likely as trade is fiercely fought over in PIMCO's "New Normal" . The world's largest Bond Fund has some fairly clear views on this and you would suspect is acting accordingly - now.

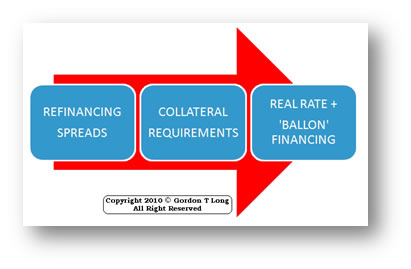

What will this mean to those with a strategy, who have set-up the pins and have been patient? It means initially (as we are seeing now) huge OTC Spreads by panicky PATSIES forced to get out or renegotiate contracts. It will soon mean years of built in balloon payments come due just as interest are rising and the PATSIES have even lower credit ratings than they had when they assumed the underlying contracts.

What will this mean to those with a strategy, who have set-up the pins and have been patient? It means initially (as we are seeing now) huge OTC Spreads by panicky PATSIES forced to get out or renegotiate contracts. It will soon mean years of built in balloon payments come due just as interest are rising and the PATSIES have even lower credit ratings than they had when they assumed the underlying contracts.

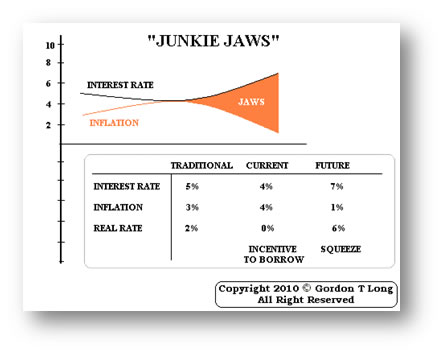

The real crunch potentially comes when interest rates are rising but inflation is falling, as we have heightened concerns with a deflationary depression. However, we don't need this to occur to have low inflation rates. This will potentially crush our debt junkies in its jaws.

Only a minor move could, as illustrated to the right, leave PRODUCERS and BANKSTERS with a 'take' of monumental proportions.

The never ending argument of whether we are going to see Inflation or Deflation never ceases to amaze me. No one ever asks the question, when? This is important because the element of time allows for the possibility of both. A probability path could entail a brief period of stagflation with slow growth and increasing rates, then as the government continues to print more money, velocity of money finally kicks in and we have a near "Minsky Melt-up'. This short lived period of Inflation just as quickly ends in a currency crisis and subsequent global deflation. The probability path of this produces profits on a $605T derivatives market that would restructure the global balances of economic and financial power.

All the probability paths models lead to profits of varying degrees for key members of the Sultans of Swap. Unlike the PATSIES or taxpayer the SULTANS HAVE A STRATEGY. The probability paths suggest an ugly future for the PATSIES and those that either work for them or are the taxpayers responsible for the commitments our elected officials have guaranteed. It is hard to win against someone who has a strategy and you are unaware of the game, the rules, the goals and even worse, don't even know it is being played.

The above is not how the process will likely unfold. That is precisely why you have a strategy - to know what to alter to meet your goals. You need to be organized to do this. If there is one thing the Sultans have demonstrated in developing a $605 Trillion derivatives market as fast as they have, is that they are organized.

The above is not how the process will likely unfold. That is precisely why you have a strategy - to know what to alter to meet your goals. You need to be organized to do this. If there is one thing the Sultans have demonstrated in developing a $605 Trillion derivatives market as fast as they have, is that they are organized.

INTERMISSION

We will return shortly with Act III

Sign Up for the next release in the Sultans of Swap series: Sultans

ACT III - THE GET AWAY

The third act is the unraveling of the plot. The characters involved in the heist will be turned against one another or one of the characters will have made arrangements with some outside party, who will interfere. Normally, most of or all the characters involved in the heist will end up dead, captured by the law, or without any of the loot; however, it is becoming increasingly common for the conspirators to be successful, particularly if the target is portrayed as being of low moral standing, such as casinos, corrupt organisations or individuals, or fellow criminals.

SOURCES

(1) 03-09-10 Keynote Address of Chairman Gary Gensler, OTC Derivatives Reform,, Markit’s Outlook for OTC Derivatives Markets Conference

(2) 03-11-10 Remarks of Chairman Gary Gensler, OTC Derivatives Reform , FIA's Annual International Futures Industry Conference

(3) ”The Warning” PBS FRONTLINE - Video

(4) 12-24-09 TREASURY ISSUES UPDATE ON STATUS OF SUPPORT FOR HOUSING PROGRAMS

(5) 03-05-10 The Swaps that Swallowed Your Town the New York Times

(6) 12-14-09 An Empire at Risk Newsweek Magazine

(7) CSPAN - Rep Paul Kanjorski Reviews the Bailout Situation

(8) 03-05-10 Nearly 10% Of Global Corporate Issuers Were Rated 'B-' Or Lower At The End Of 2009 Standard & Poors

(9) 12-22-09 S&P’s ‘weakest links’ list falls sharply Financial Times

(10) 10-29-09 Warning on 2011 corporate default risk Financial Times

(11) 03-01-10 Frank, Peterson Vow to Eliminate Provision Keeping Swaps Opaque Bloomberg

(12) 03-15-10 Goldman Sachs Demands Derivatives Collateral It Won’t Dish Out Business Week / Bloomberg

Sign Up for the next release in the Sultans of Swap series: Sultans

FREE Additional Research Reports at Web Site: Tipping Points

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.