It's Not the Debt, It's the Government Spending

Economics / Government Spending Mar 29, 2010 - 06:30 PM GMTBy: Paul_L_Kasriel

Last Friday afternoon I listened to a senator get all worked up about the avalanche of federal debt that is about to roll over America. He is correct that there is an avalanche of debt on the way. But his concerns are misplaced. More precisely, his concerns were misplaced. To reiterate a popular rant of mine, it is not the deficit or debt that is the real economic cost of government, but rather it is the spending of the government. The government always gets its funds by taxing, by borrowing and/or by printing (if the central bank is willing). All three means of government funding are pernicious with respect to economic performance. So, it is not the government debt that we should be concerned with, but rather the government spending.

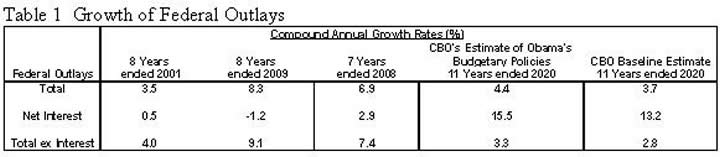

The table below contains the compound annual rate of growth in various categories of federal government spending over various time periods. The first three columns of growth rates are actual or historical data. The last two columns are Congressional Budget Office (CBO) projections of government spending growth rates. The fourth column contains CBO projected government spending growth rates based on the budget that the Obama administration proposed for fiscal 2011. The last column contains CBO projected government spending growth rates based on the laws in effect as of 2009. In other words, the last column of government spending growth rates does not incorporate budgetary changes proposed by the Obama administration in its 2011 budget. For example, the last column does not incorporate spending associated with the expansion of health insurance coverage whereas the fourth column does.

I wonder if the senator I listened to on Friday afternoon was as worked up about our federal fiscal situation in the 8 years ended 2009 (or even the seven years ended 2008) as he is now. He should have been. As you can see, there was a sharp acceleration in the growth of federal spending in the 8 years ended 2009 vs. the 8 years ended 2001. Okay, some of that increase in federal spending was due to the TARP expenditures in 2009. This is why I have calculated the compound annual growth rate of federal spending for the 7 years ended 2008. But even excluding the TARP year, there was an acceleration federal spending growth.

Look at the CBO projections of compound annual growth rates for federal spending over the next 11 years. Even with the Obama administration's expanded health insurance coverage included, annualized growth in total federal spending slows significantly from the 8 years ended 2009 and the 7 years ended 2008.But look what category of federal spending takes off with double-digit compound annual growth rates - interest on the debt. Does the senator know why this is the case? Because he and some of his colleagues were voting for the sharp increase in the growth of federal spending in the 7 years ended 2009 - spending that was being funded by federal government borrowing.

One of the programs funded by borrowing the senator voted for was Medicare Part D, which, of course, lives on and contributes to the federal spending and debt totals in the 11 years ended 2010. Compound interest, the eighth wonder of the world, is now having a much larger impact on the federal budget. The CBO projects that the compound annual rate of growth in federal spending excluding net interest payments over the next 11 years, incorporating the Obama administration's proposed budgetary changes, will be about one-third the rate of growth in federal expenditures excluding net interest in the 7 years ended 2009. As I have said before, Senator, there is no zealot like a convert. I will be watching to see just what federal spending programs you propose cutting.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel and Asha Bangalore

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.