Greek Bond Market Crash, Greece Budget Deficit Worse Than Feared

Interest-Rates / Global Debt Crisis Apr 23, 2010 - 07:30 AM GMTBy: Mike_Shedlock

With Thursday's admission that Greece's budget gap is worse than expected, CDS rates on Greek debt rose to new highs, and Greek bond crashed.

With Thursday's admission that Greece's budget gap is worse than expected, CDS rates on Greek debt rose to new highs, and Greek bond crashed.

Charts follow a discussion of articles in the news.

Yahoo Finance is reporting Greek deficit spiked to 13.6 percent of national income in 2009, more than previous estimate

Financially-stricken Greece had an even bigger budget deficit for 2009 than previously thought, official figures showed Thursday -- tough news at a time when the country is considering whether to tap a bailout facility from its 15 partners in the eurozone and the International Monetary Fund.

The European Union's statistics office Eurostat said that Greece's budget deficit in 2009, as a percentage of economic output, was 13.6 percent. That's up from the previous estimate of 12.9 percent and nearly double the 7.7 percent recorded in 2008.

Greece's total government debt as a proportion of GDP stands at a massive 115.1 percent, a burden so large that some analysts think it will have trouble paying it over coming years even if a bailout saves Athens from default this year.

Eurostat also warned that the Greek figures may actually be even worse, citing "uncertainties" over the figures related to social security funds and the recording of complex financial swap arrangements.

"Following completion of the investigations that Eurostat is undertaking on these issues in cooperation with the Greek statistical authorities, this could lead to a revision for the year 2009 of the order of 0.3 to 0.5 percentage points of GDP for the deficit and 5 to 7 percentage points of GDP for the debt," Eurostat said.Greece Debt Downgraded, Yields Spike

Please consider Greece downgraded, deficit worse than feared

Greece's budget gap last year was worse than feared, the European Union's statistics office revealed on Thursday, as Moody's Investors Service downgraded its rating of Greek government debt.

The news triggered a fresh slide of asset prices in Greece and other debt-choked European countries, and increased pressure on Athens to seek billions of euros of emergency loans from the EU and the International Monetary Fund.

Greece's two-year government bond yield soared four percentage points to 12.26 percent as investors bet the country would need a bailout to avoid restructuring its debt or defaulting. Athens will have to refinance 8.5 billion euros ($11.3 billion) of bonds maturing on May 19.

In a brief statement, the Greek Finance Ministry insisted the new numbers would not change its intention to shrink the deficit by four percentage points this year. It said measures already taken would be enough to cut the deficit by six points.

But both Athens and EU officials appeared to be backing away from a previously announced target for Greece to slash the deficit to 8.7 percent of GDP this year.

"The target for 2010 is a four percentage point reduction of the deficit. We did not refer to the starting point or the arrival figure, only the reduction effort," European Commission spokesman Amadeu Altafaj said in Brussels. "Greece is on track to meet the target for 2010; that is what counts."No Target?

Greece does not even have a formal target for debt reduction, just a percentage off the high, and that budget gap hit a fresh high on Thursday. Excuse me but didn't the EU sign off on Greece's budget gap? Didn't the EU sign off on Greece's austerity plan?

I have still more questions. Will Greece's budget gap rise again next month? In June? August? When will we know the top is in?

By the way, European Commission spokesman Amadeu Altafaj statement is a purposeful lie at worst and puts a bow tie on a muddy pig at best. When the EU signed off on Greece's plan, it was presented by the EU as if the nature of the problem was understood, not growing.

Italian Prime Minister Blames EU For Greek Bond Price Debacle

One might think that the magnitude of the Greek budget crisis, exposed lies about how big the crisis is, and an admission that the problem may get worse yet is ample explanation for the Greek bond crash.

But No! Prodi Says Lack of EU Support Hurt Greek Bond Prices.

Greek bonds are falling because European Union nations failed to take decisive action to restore confidence in Greece’s finances, former European Commission President and Italian Prime Minister Romano Prodi said.

Criticizing “the weakness of European solidarity” amid the most serious challenge yet for the 11-year-old euro, Prodi said weeks of conflicting signals from the EU and Germany have plunged Greece into a deeper financial hole.Investors Desert Greek Bond Market

The Wall Street Journal is reporting Investors Desert Greek Bond Market

Markets participants say trading in Greek debt on a local electronic trading platform has dropped to around €200 million ($268 million) a day from as much as €2 billion a day in recent months. And according to Tradeweb, average daily trading volume in Greek debt is running 11% lower over the last seven days than in the first quarter.

The sliding activity has magnified the deterioration in Greek bonds and left traders wondering about how to interpret the sharp moves.

Typically, rising yields would reflect growing alarm over Greece's deteriorating debt position, and suggest that investors are bailing out of the debt. (Yields rise as prices fall.) But with only a handful of bonds changing hands, the meaning of the bond move isn't so clear. Other markets such as the euro also have shown little sign of growing worries in the past few days.

"Liquidity is very poor," says Laura Sarlo, a senior sovereign debt analyst at Loomis Sayles & Co.

Based on reports of the ever increasing yields on Greek bonds, I wanted to see the performance of this over time.

I asked my friend Chris Puplava at Financial Sense for some snapshots off a Bloomberg terminal. I wanted to see a comparison between government bond yields between the US, Germany, United Kingdom, and the PIGS (Portugal, Italy, Greece, Spain).

The following charts are all courtesy of Chris Puplava.

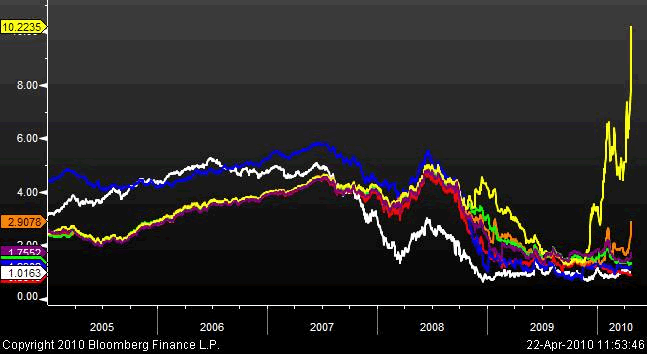

2-Year Treasury Yields

US – White

Germany – Red

UK – Blue

Portugal – Orange

Italy – Green

Greece – Yellow

Spain - Purple

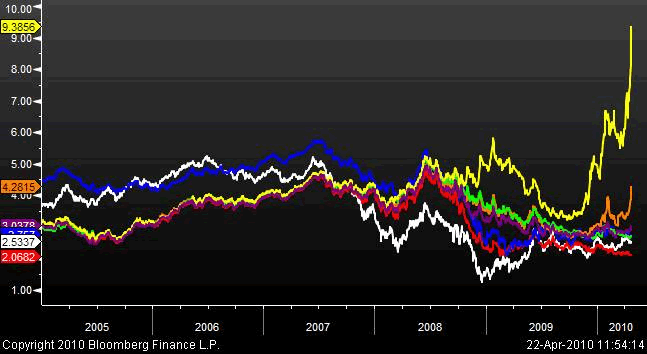

5-Year Treasury Yields

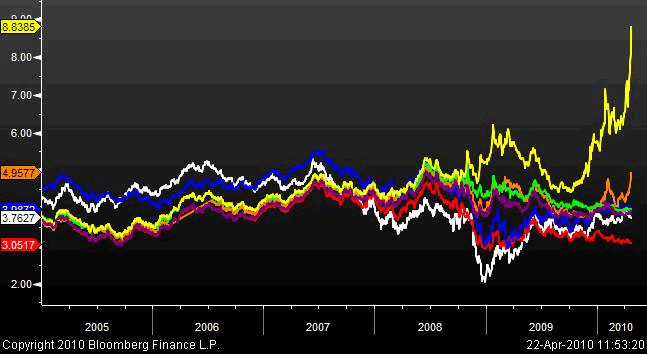

10-Year Treasury Yields

Note that the Greek yield curve is inverted: The 10-year treasury yields less than the 5-year which in turn yields less than the 2-year. This signals a recession, which is no surprise given the upcoming austerity measures. That a recession is coming with yields so high dramatically compounds the problem for Greece.

Also note the spike starting in Portugal. It may be next on the list. For now, the market appears unconcerned about Spain, but for how long?

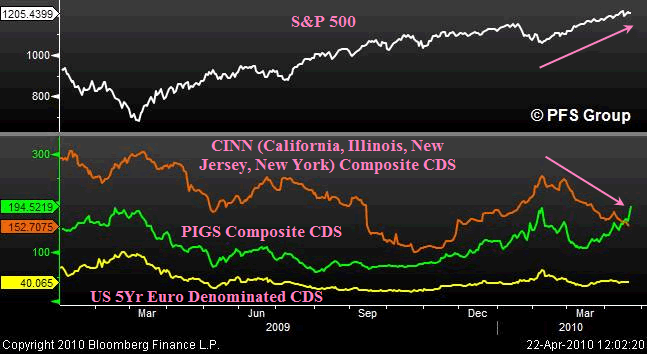

The US has its own set of "PIGS". Chris Puplava labels it the CINN group (California, Illinois, New Jersey, New York).

CINN CDS vs. S&P 500

Note the striking inverse correlation of the CINN composite CDS to the S&P 500.

Thanks Chris!

Greek Bonds Approach Pakistan Levels

Bloomberg is reporting Greek Bonds Approach Pakistan Levels as Default Concern Mounts

Greece’s deficit crisis is pushing its bond yields closer to those of Pakistan, a junk-rated nation that is battling the Taliban.

Two-year Greek note yields soared to more than 11 percent after Moody’s Investors Service cut the nation’s credit rating yesterday and the European Union said the country’s budget deficit was worse than previously forecast. Similar-maturity securities from Pakistan, which turned to the International Monetary Fund for a bailout in 2008, yield 12.2 percent.

The debt of Pakistan, South Asia’s second-biggest economy, is rated B3 by Moody’s, six levels below investment grade. Greece’s ranking was lowered one step to A3 yesterday by the company, four levels above junk. Moody’s put a negative outlook on the bonds, indicating it’s more likely to cut the classification again than raise it or leave it unchanged.

“The market is evaluating Greece as a single B credit,” said David Rolley, who helps oversee $106 billion as co-head of global fixed-income in Boston for Loomis Sayles & Co. “There is a very large policy uncertainty that will have to be sorted out before normal liquidity conditions resume.” Rolley declined to comment on his holdings.

“The market is telling you that there’s a solvency issue that’s likely to peak in the next two years,” said Zane Brown, a fixed-income strategist with Lord Abbett & Co. in Jersey City, New Jersey. The EU-IMF rescue package is a “weak band-aid and too small,” he said.

The cost of insuring against a Greek default jumped to a record yesterday. Credit-default swaps insuring Greek government debt for five years rose 151 basis points to a 639, according to CMA DataVision prices on Bloomberg. Swaps on Pakistan climbed almost 16 basis points to about 665 basis points.

The comparison to Pakistan helps put the above charts into proper perspective.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.