European Debt Crisis, What’s Up With The PIGS? A Picture Is Worth A Thousand Words

Interest-Rates / Global Debt Crisis May 09, 2010 - 07:22 AM GMTBy: Charles_Maley

Once again, the media has many reasons (in hindsight) for the demise in Greece, Portugal and Spain, and of course are now forecasting how the situation will be resolved. Personally, I think this could be the beginning of the end for the Euro. Greece is the first test, but other European countries have problems, and the entire European Union are now called into question. Remember, the original goal was to unite different economies into one powerful trading block, with the Euro currency hopefully replacing the Dollar as the world currency.

Once again, the media has many reasons (in hindsight) for the demise in Greece, Portugal and Spain, and of course are now forecasting how the situation will be resolved. Personally, I think this could be the beginning of the end for the Euro. Greece is the first test, but other European countries have problems, and the entire European Union are now called into question. Remember, the original goal was to unite different economies into one powerful trading block, with the Euro currency hopefully replacing the Dollar as the world currency.

Good luck with that.

What I thought was always in question, and is clear now, is the EU appears to be far less of a union than originally thought. The member nations are always fighting and their inability to come up with a unified response to deal with Greece’s troubles has proven that factions do exist despite the “front” of union solidarity.

We are the United States of America. At the end of the day whether you are a surfer from Los Angeles, a Texas oilman or a street kid from the Bronx, you are American. When the chips are down, no man in a fox hole in Vietnam or Iraq cared what state their brothers were from. After 9-11 almost everyone, no matter what state they were from, flew the American flag from their house or car.

Not true in the European Union. They are truly different from each other and perceive themselves that way, and during bad times this will exacerbate their current situation. After all, you have to stick together in both good and bad times for a union of any sort to work. I wonder if the separate cultures have what it takes.

In any event this is not good for Europe and we are now at the moment of truth.

We shall see how the Greek crisis unfolds, and what impacts it has on other EU members. Some say that Greece will not default for several reasons. According to BIS data, French-based banks have $75 billion of exposure to Greek debt, and German banks have a $45 billion exposure. Greece’s debt stands at $395B, so these two major EU nations are directly exposed to 30% of Greece’s debt. Further, 99% of Greece’s government debt is held abroad.

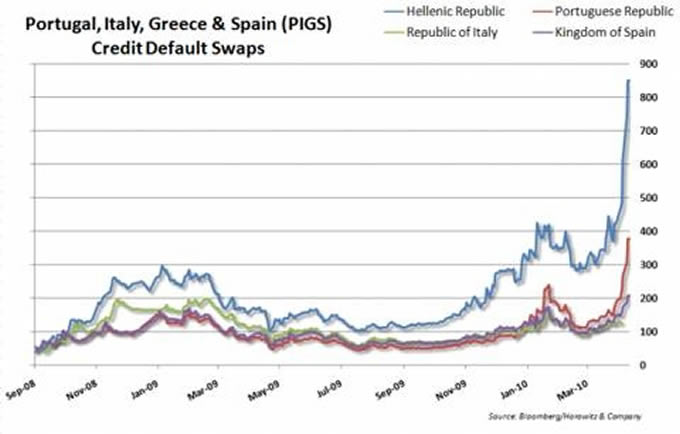

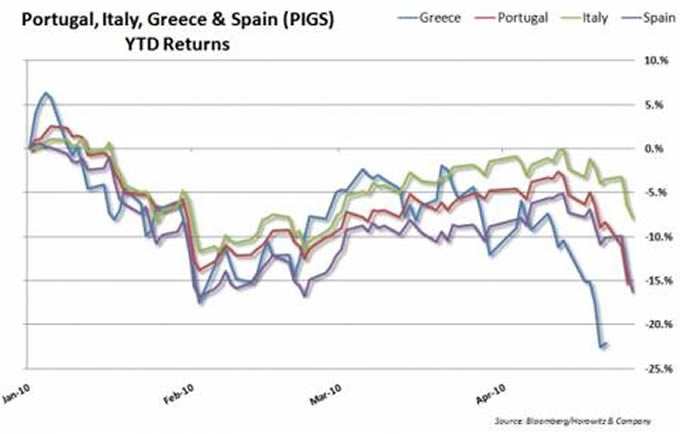

I say that the current situation is fueling a credit spiral for the PIGS (Portugal, Italy, Greece, and Spain) with downgrades starting to pop-up and the Euro feeling the pain, falling 13% in 6 months.

The headlines recently are a variation of “Will Greece spill into Spain, Italy and Portugal.” It looks to me like it already has. More often than not, a picture can really put things in perspective. This is a serious situation and the question becomes how severe will it get, and how it might affect your investment posture. (See charts below. Chart 1 = Credit Default Swaps, Chart 2 = the Equity Markets.)

When one invest in the markets they need to be aware of potential “Black Swans”, as Nassism Taleb would say, and how these events can throw a monkey wrench into what we might think are unrelated markets.

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them. Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley www.viewpointsofacommoditytrader.com Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2010 Copyright Charles Maley - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.