Gold Rises as the Euro Vaporizes

Currencies / Euro May 14, 2010 - 11:07 AM GMTBy: Andy_Sutton

This wasn’t supposed to happen. When it was introduced 11 years ago, the Euro was to be the world’s newest, biggest, and best yet currency. There were strict guidelines for getting into Club Euro and you’d better follow them if you didn’t want to be voted off the island. What became immediately clear is that there were stronger members and weaker members. That fact is becoming increasingly apparent as the real state of the Eurozone now comes into clear focus. Over the years, rules were bent, concessions made, and explanations given, all for the purposes of justifying short-term benefits such as the availability of Italian milk to the Club. Yes, Italian milk.

This wasn’t supposed to happen. When it was introduced 11 years ago, the Euro was to be the world’s newest, biggest, and best yet currency. There were strict guidelines for getting into Club Euro and you’d better follow them if you didn’t want to be voted off the island. What became immediately clear is that there were stronger members and weaker members. That fact is becoming increasingly apparent as the real state of the Eurozone now comes into clear focus. Over the years, rules were bent, concessions made, and explanations given, all for the purposes of justifying short-term benefits such as the availability of Italian milk to the Club. Yes, Italian milk.

In yet another example of the failure of globalization, or regionalization as it were, the Euro is poised on the precipice of disintegration. Ironically, it will not be the overprinting and resultant hyperinflationary spiral that kills the Euro, but dead weight in the form of various Eurozone welfare states. Germany and some of the other quasi-responsible members simply cannot carry their own burdens and those of Greece, Spain et al. The $1 Trillion rescue fund created in haste this past weekend was intended to inspire confidence in the dying behemoth. Instead, the sheer magnitude of the bailout has done the exact opposite.

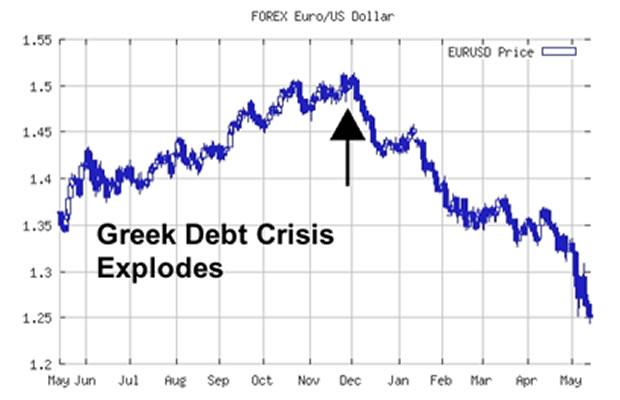

The Euro-Dollar pair has now sunk below pre-bailout levels and there is a good deal of doubt as to whether rescue recipients will be willing or able to hold up their end of the bargain. I pointed this out in last week’s piece. The temporary euphoria created by a trillion dollars of palliative paper is already gone. This is something that was alluded to in these pages years ago; the law of diminishing returns applies to stimulus and bailouts. As the periods of crisis occur in a more frequent fashion, the effectiveness of Keynesian monetary policy falls commensurately.

That aside, there are several other points that must be addressed as we examine the latest Tower of Babel in the global macroeconomic arena.

National Sovereignty Ceded

While anyone looking at the debt picture could tell that Greece (like so many others) was in trouble almost since its acceptance into the Eurozone, its problems burst into the international media in early 2010. One of the first things that many people noted was the major difference between the Greek government and that of America. Greece was hamstrung in that it did not have its own national bank; it relied on the ECB. While I am not a fan of national or central banks absent a strict Gold standard, this total absence of flexibility accelerated the Greek crisis in months, rather than years. Greece had given up its national identity to join the Club. And for a time it worked. The people of Greece enjoyed lavish social benefits and a carefree lifestyle. As an IMF official recently said, however, and I am paraphrasing: “The party is over”.

Other dominoes are set to fall as well since every other country in the Club has essentially the same problem: they cannot pay their bills, and have no way to wiggle out of it. While in the strictest of terms, this is not a bad thing; it outlines the categorical failure of international trading and currency blocs in the long run. There are always members of any cohort who will try to ride the coattails of someone else. It is human nature and it will not change. From that standpoint, the breakup of the Club was ordained from the day of its inception.

The mere existence of these multinational blocs also fosters a temporary sense of false security, as member nations don’t mind their own fiscal indiscretions because they have the perception that they’ll be picked up by the rest. And they usually are initially, so why change? This is precisely why the Greek people (and now the Spaniards too) are resorting to riots and national strikes. Old habits die hard.

At the bottom of the mess, however, is the loss of national identity. While we look at them as Greeks and Germans, they have in a way come to view themselves as Europeans - citizens of Europe. As Ben Franklin so eloquently put it, new nations come into the world like illegitimate children; half compromised, half improvised. In the case of the EU, we’ve already seen the compromise. Now the improvisation has begun in earnest.

Destruction from Within

Much in the same way the EU is being destroyed by the profligate spending and lackadaisical approach to fiscal matters of a few members, the United States is in a similar position of being devoured from within. This is where it gets very dicey, and I am bound to step on a lot of toes here, but it needs to be said. We know that roughly half of Americans pay nothing in the way of Federal income tax. While I don’t have exact numbers for the 50 states, I cannot imagine that the situation is much different there. This means that, like the EU, America has roughly half of its population riding the coattails of the other half. I am sure that in many cases there are good and noble reasons why this is the case, but I’m trying to address this from a structural macroeconomic standpoint rather than drilling down to specific reasons why people aren’t paying.

Frankly, for the purposes of this discussion, it doesn’t even matter. In this way, America is a microcosm of the Eurozone. And we’re not alone. Great Britain is in the same boat. The bills cannot be paid. There is no way to squeeze enough money from the paying 50% to take care of their benefits let alone those of the other 50%.

Much like the EU, America has a central bank, which advocates Keynesian policies such as deficit spending and unfettered monetary creation. Save for one brief stint of interest rate austerity in the early 80’s, America has never wavered. And before we sing the praises of Mr. Volcker, we must consider that his actions most likely were taken to perpetuate the broken system as a whole as opposed to representing some blanket metamorphosis of economic thinking.

The single biggest difference here is that the members of the Club still have the ability to vote others off the island, and/or leave themselves. There is a point certain where the people of Germany, for example will no longer tolerate the abrogation of their economic and financial sovereignty and will either compel Ms. Merkel to take appropriate action or will replace her with someone who will. Hence all the talk of the breakup of the Eurozone. The die was cast on January 1, 1999 when the Euro officially became an international unit of account.

Race to Gold – the Endgame of Paper

All the gloom and doom aside, there is an out for those countries and individuals who fear the breakup of the Eurozone, dollar standard default, national bankruptcy, and the types of cataclysmic financial events that our behavior causes us to flirt with. It is shining right now, making new all-time highs as I pen this commentary. It is soaring even as the dollar races higher thanks almost entirely to the fall of the Euro. The mini liquidation last week in global markets was unable to shake it, so unlike the Lehman days in 2008. People around the globe are racing to Gold as the ultimate safe haven. Where the US Dollar is a proxy on the flaws of the Euro, so is Gold the ultimate proxy on the fallacy of stable paper currencies in a Keynesian world. Where paper currencies represent control, Gold represents freedom and a standard weight and measure.

This is probably one area where many here in America fail to understand the connection between our wallets and the first round of the Eurozone bailout. Thanks to our contributions to fund the IMF, and the resumption of various Fed emergency swap programs, the American taxpayer is on the hook for more of the European rescue fund than anyone who seeks to maintain their position in politics or finance is willing to admit. The burdens of lesser paper currencies are shifting to the already compromised US Dollar and the American taxpayer. There is nowhere else to turn except honest money. Truly, the buck will stop there.

One of the biggest ways our premium newsletter has benefitted its subscribers over the past few years is comprehensive analysis of the macroeconomic, monetary, and precious metals environments. In May’s issue, which will be released on 5/15, we cover the conventional wisdom surrounding sovereign debt loads, propose some alternate metrics, and look at the latest jobs figures. For more information, click here.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.