Do Stock Market Investors Really Want The Fed to Lower US Interest Rates?

Stock-Markets / US Stock Markets Sep 06, 2007 - 02:02 PM GMTBy: Hans_Wagner

Investors trying to beat the market are closely following the trends in interest rates, especially the Federal Funds Rates. With many of the market traders and talking heads calling for a cut in the Fed Funds rate, do investors follow their advice or make their own assessment. Let's look at what the theory says about the link of interest rates and the market. Next we will look at the impact of inflation will have on rates and finally a chart that compares Fed Funds rates, the 3 month Treasury Rate and the S&P 500.

Investors trying to beat the market are closely following the trends in interest rates, especially the Federal Funds Rates. With many of the market traders and talking heads calling for a cut in the Fed Funds rate, do investors follow their advice or make their own assessment. Let's look at what the theory says about the link of interest rates and the market. Next we will look at the impact of inflation will have on rates and finally a chart that compares Fed Funds rates, the 3 month Treasury Rate and the S&P 500.

The Theory

In theory changes in interest rates and movements in the stock market move in opposite directions. Assuming investors are rational people, when interest rates decrease should encourage them to move money from the bond market to the stock market, as bonds will be returning less as rates are lower. Also, businesses will be able to borrow at lower rates to finance growth and expansion, which should lead to future growth and as a result higher stock prices.

The other effect a cut in interest rates is psychological. Investors and consumers see lower interest rates a sign that they can borrow more cheaply, meaning they can spend more. This in turn should contribute to higher corporate profits, expansion of the economy and therefore higher stock prices.

The discounted cash flow model is one method used to value securities. This approach takes the sum of all expected future cash flows from a company and discounts them at a capital value rate to derive the current value. To obtain the stock price one takes the sum of future discounted cash flows and divides this value by the number of shares available.

Using this method and investor can compare the return on two investments; let's say a treasury bond and a stock. If the money they get from bonds is less than the money they get from the stock they should buy the stock. On the other hand if the money they get from bonds is greater than the bond then they should buy the bonds.

Basically the higher the interest rate, the lower will be the value and therefore the price of a payment in the future. A rise in the interest rate causes stock prices to fall. And a fall in interest rates causes the price of a stock to rise.

The complete theory is more complex and detailed.

The RealityAccording the latest release from the Bureau of Economic Analysis (July 31, 2007) Personal Consumption Expenditures (PCE), supposed to be the Federal Reserve's favorite inflation indicator, was 2.1% for the year. This is just above the rumored Federal Reserve's target inflation range of 1 – 2%. For reference the table below shows the PCE rate for the last eight months. It has been decreasing since May 2007, though it has remained in a 2.1 – 2.6 range. So inflation is not yet within the Fed's desired range, though it is close.

Price Index for Personal consumption Expenditures: Percent Change from Month One Year Ago

| Month | Dec 06 | Jan 07 | Feb 07 | Mar 07 | Apr 07 | May 07 | Jun 07 | Jul 07 |

| PCE | 2.3 | 2.1 | 2.3 | 2.6 | 2.3 | 2.4 | 2.3 | 2.1 |

Source: Bureau of Economic Analysis Press release (July 31, 2007)

The August 17, 2007 Point of Interest discussed how the Fed faces a series of difficult months ahead on the inflation front. This seems to imply that the Fed is not yet ready to lower the Fed Funds rate, even if the market says it must have a lower rate.

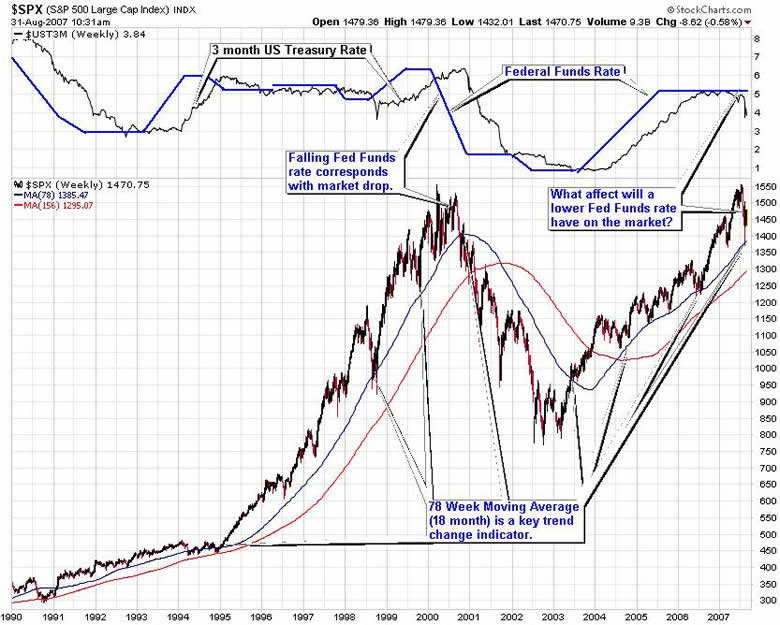

Now let's look at what has happened in the past to the market when the Fed has changed the Fed Funds rate. The chart below is a weekly chart of the S&P 500 beginning in 1990 to the present. The top part of the chart shows the US Treasury 30 month bill rate and the Fed Funds rate. The data on the Treasury Bill rate only went back to 1990, so that is where I started the chart. Take a few moments to look over the chart.

A couple of observations. From 1990 to 1993 the theory that when interest rates go down the market goes up worked. In 1994 rates went up, with the Fed Funds rate leading the way and the market was basically flat. The theory worked again. Starting in 1995 rates went sideways to slightly down and the market move up in a very nice bull market. Starting with the middle of 1998 the Federal Funds rate started to climb and the market experience a strong pull back from just below 1200 to the 950 area. Then the market moved up to finish 1999 much higher. Meanwhile Fed Funds rates and the short term 3 month treasury rate climbed. As everyone knows the market peaked in early 2000. Up until then the theory that when rates moved up the market went down held. The rise in rates in 1999 did not result in a corresponding fall in the market until the first half of 2000.

Starting in 2000 interest rates were lowered dramatically to help deal with the economic slow down. The market fell as well, with the 3 month Treasury Bill rate following behind. As shown Federal Fund rates eventually reached the one percent level, where they remained for about a year. In July 2003 the Fed began to raise the Fed Funds rate over the next two years, reaching the current level of 5.25 percent. The market also began its most recent bull market run in early 2003. So in this case the theory did not follow as rates rose and so did the market. But then rates were considered to be to low by many which helped the economy expand, causing the market to rise. In this case the theory did not work.

This leaves us with the question, if the Fed lowers interest rates, will the market go up? According to the theory, the answer is yes. However, what if the reason the Fed lowers rates is because the U.S. economy is perceived to be going into a recession, rather than just slowing down. I suspect if investors realize this is the case, then the market will fall rather than rise. As happened in 2000, when the economy's growth rate was negative the market also fell. Yes, it was at an extremely high level, but an economy that is experiencing negative growth is not conducive to a stock market that is expanding.

If the Federal Reserve does not lower rates on September 18, 2007, investors need to understand why rather than just throw in the towel and give up. They may be seeing cont9inued economic growth and they are still worried about inflation. The economic news so far is mixed with Gross Domestic Product in the second quarter up a revised 4% and retail sales are stronger than expected. The latest Federal Reserve Beige report did not provide sufficient economic data to support a rate cut, causing the market to fall after it was released. However, the housing sector is still falling as credit problems continue and sales of new and existing homes continue to drop.

On Friday, September 7, 2007, the Labor Department reports on jobs and salaries, a key insight into consumer spending, which makes up 70 percent of the U.S. economy. This will be an important indicator, especially if it surprises either to the up side or down side. It will also be important to monitor what the Federal Reserve members say in various speeches before they meet in September.For more information on the linkage of interest rates and the market check out Economic Growth ![]() by David Weil. An easy to read book that presents the key factors to understand global economies. It is expensive and is used as a text book for college students, but it is worth the money.

by David Weil. An easy to read book that presents the key factors to understand global economies. It is expensive and is used as a text book for college students, but it is worth the money.

Investors need to be careful as they might get what they wish, a lower Fed Funds rate. While many believe it is good for the stock market, it is also a sign that the economy is weaker than expected, possibly indicating a recession is near. As long as the Fed believes the economy is not slowing too much, then I expect the Fed funds rate to remain at 5.25% until there are clear signs that inflation is under control. Beside the market is already factoring in an interest rate cut. If they get one, it is unlikely to move the markets very much, unless the Fed changes its focus. For now investors need to be very careful as there is more down side risk in the market.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.