Weekend Market Take, Those Terrible Unions, Greed is not Good and This is Theft

Stock-Markets / Financial Markets 2010 Jun 27, 2010 - 05:21 PM GMTBy: PhilStockWorld

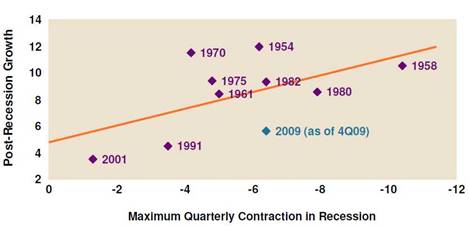

I very much liked Liz Ann Sonders’ take on the markets, she not only has a nice video presentation but there’s a slide show to go with it so kudos to Schwab for providing some very serious value to their clients. Liz has coincident indicators (#6) going up nicely and makes an excellent point about where we are in the norms of recessions past (#8 which is based on recessions between 1950-2010 and annualized Q/Q % change for real GDP. Post-recession growth represents maximum growth one year following recession end):

I very much liked Liz Ann Sonders’ take on the markets, she not only has a nice video presentation but there’s a slide show to go with it so kudos to Schwab for providing some very serious value to their clients. Liz has coincident indicators (#6) going up nicely and makes an excellent point about where we are in the norms of recessions past (#8 which is based on recessions between 1950-2010 and annualized Q/Q % change for real GDP. Post-recession growth represents maximum growth one year following recession end):

She points out that the yield spread makes it VERY unlikely we’ll be double-dipping (9), that payrolls were over-cut and are now a "coiled spring" (12) based on CEO optimism (10) but my concern is that CEOs are generally in the top 10%, where unemployment for that group is just 3% so it’s possible that they are as out of touch with reality as many people I speak to in the investing world and that may explain how CEO confidence can be over 60 (out of 100), while consumer confidence is at 35 (out of 200). If you look at that chart (10), you’ll notice CEOs do seem better at calling a bottom than consumers, who tend to be at their gloomiest just when a recession is ending.

Forget Spain and Greece by the way, they have a grand total of $209Bn in debt but Italy owes $208Bn TO FRANCE! They also owe $210Bn to other countries but WHAT THE HELL WAS FRANCE THINKING? Italians are striking this week to protest Berlusconi’s $34Bn of austerity cuts, which include pay freezes or salary cuts for all government workers and reductions in funds for health care and local governments.

The government has warned Italians to get ready to make "heavy sacrifices" to avoid a Greek-style financial crisis. My favorite report on this comes from our friends at Fox News who ask us to conclude from this "Italian Unions Too Strong For It’s Own Good." They say that, when all you have is a hammer, every problem looks like a nail and, for Fox News, that nail is Unions! The 5.5M member CIGL union called for an orderly 4-hour work stoppage with a very small percentage of the workers (2% struck) to protest, not so much the austerity measures placed on workers as the fact that there were no matching tax increases placed on the top 10% and corporations, which could have raised $70Bn a year and put Italy back into compliance with the EU in 2011 and on their way to paying down their debts. Oh those terrible unions!

Of course, that is dangerous Commie Talk. Imagine if it occurred to the working people of America that corporations earn $6Tn year AFTER TAXES and the top 10% of this country earn another $2Tn so raising taxes by about 15% on just corporations and top income earners would generate enough money to cover our entire deficit - even with our insane $1Tn a year defense budget (now 55% of the World’s total as others begin to cut back).

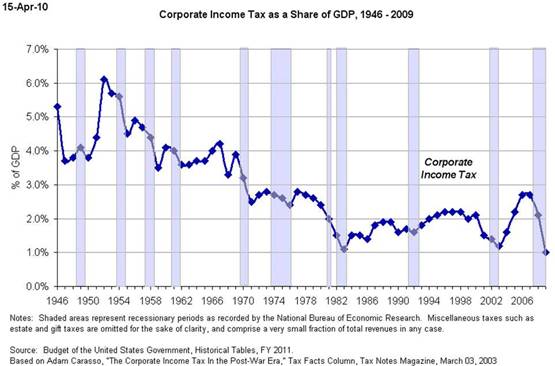

Why, if we allow workers to organize, some wise guy might say that if corporations simply paid 10% of their $25Tn in revenues (VAT) as taxes instead of the average 0.3% of net profits they now pay ($200Bn), then ALL of our budget problems would be solved and WE CAN’T HAVE THAT IN AMERICA!

The reason CEOs get more confident in a recession while workers get less confident is because the cost of labor gets lower and lower as more people lose their jobs. The Federal Reserve of the United States has what is called a "dual mandate" to maintain price stability and to promote full employment. As the price of gold and oil indicates, inflation is out of control and 10% of our workforce is unemployed, even using the government’s nonsense statistics while the Fed has spent $2.5Tn of taxpayer money buying bad assets from the banks at face value in the single largest transfer of wealth from the poor to the rich in the history of the human race. So the Fed is a total and utter failure at both parts of it’s dual mandate and they have added $2.5Tn worth of debt on the back of US taxpayers - what a joke - but, not a bigger joke than the way corporations in general have been raping this country:

Gee, Phil, I wonder what is wrong with our country? This chart offers no clues at all (end extreme sarcasm font). In 2001, the first year of the Bush tax cut (the one that followed the Reagan tax cut, which followed the Nixon tax cut), US corporate sales were about the same as the prior year ($20Tn) despite 9/11 and costs were in-line with 2000 but their deductions jumped significantly to the point where they were able to shave $38Bn off the prior year’s $204Bn in taxes paid, down to just $166.7Bn paid on $20,272,952,624,000 in revenues (0.8%).

That was only the beginning of the assault on our nation’s income. In 2000, the marginal tax rate on corporations was 41%, about the same as it had been since 1982 but way down from 60% in 1980, when Ronnie rode into town. 2001 was just a phase-in of tax relief for corporations and by 2003, the marginal rate had dropped to 32% with the firm-level rate down to 27% from 32% in 2001. Effectively, under the Bush tax cuts, corporations got a 25% tax break yet there were so many new deductions that 75% of all corporations pay no taxes at all now.

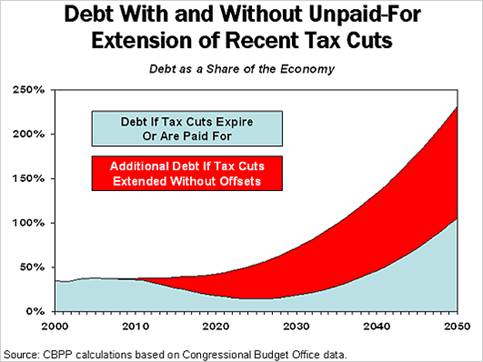

I won’t get into the insane Bush tax cuts or the way the middle class got screwed or how there was no justification to cut taxes when they led to massive deficits because then everyone will say I’m Bush bashing but what I’m really trying to do is simply impress upon you that the situation we are now in is VERY easy to fix because ALL WE HAVE TO DO is roll things back to where they were before we became fiscally irresponsible.

This all matters A LOT because we have an election coming up and we are either going to trim spending and raise taxes or we are going to trim spending and allow the redline scenario on the above chart to play out. Not too much difference in the next ten years but, after that, we will have doomed this country to third-world status and there’s not going to be too much anyone can do about it. I’m very sad because the time to act is now but all I see is corporate interests and the top 10% maneuvering their judges and politicians and media outlets to make sure that nothing changes. Rich 45-70 year-old men don’t give a crap about what happens to this country in 2025. They will all be retired or dead by then and most of their kids are already on their own and not innocent children they feel may need protecting so "every man for himself" is the new Battle Hymn of the Republic.

One of the problems with lowering the top tax rates is that you create a greater incentive to earn more. Think about that. You have heard conservatives say for years that if we raise taxes then corporations and individual Masters of the Universe will go on strike and refuse to be productive if they can’t keep all they earn and then they won’t be able to piss on trickle profits down to their workers and that will hurt the whole economy. Well, if that’s true than obviously, lowering the top tax rates motivates them to make as much money as possible. Unfortunately, that means they now have much more incentive to reduce quality, cut corners on safety, screw over the workers and outsource jobs because that’s THEIR money those bastards are trying to get a piece of.

If you fail to see the logic of that, you may as well stop reading because I will have nothing to tell you that you want to hear.

Greed is NOT good. Greed is greed. It is one of the 7 deadly sins for a reason. Greed means you are taking too much for yourself to the detriment of others. Greed means that you are attempting to die with the most toys while children in this world starve and die who have no toys at all. Greed is having rooms in your house you never use while people live on the streets with no rooms at all. Greed is driving a car that consumes as much fuel as 3 other cars and it’s the lifestyle of this country, which consumes 20% of the world’s oil (20Mbd) with just 2% of the population, double the rate of other developed countries. Greed is US homes and restaurants throwing out more food in a day than Africans consume…

Just because oil is not going to run out in your lifetime doesn’t mean you shouldn’t preserve it today. I was saying this to some Japanese friends as we were whale hunting with our rainforest-wood harpoons - things do run out and counting on future generations to solve our problems is pretty much how we got into this mess. We are the generation that was supposed to solve the problems our parents swept under the rug and now we have government policies that do nothing more than sweep things under the rug for our children but that rug is getting so disgusting that we don’t even look in that room anymore.

Two weeks ago, we looked at the options of "Default or Hyperinflation" but, as I said above and as the G20 is trying to convince our President this week - maybe we SHOULD give this austerity idea a fair shake. The whole concept of austerity, of cutting back and making sacrifices is so antithetical to American thought that it doesn’t even seem like an option but when you think about how we used to live compared to how we live now and when you look at how little the top 10% and corporations are paying in taxes - then you begin to realize that the message that’s being hammered home to us every day by the MSM, the message that’s being pounded into our heads in the newspapers, the magazines, the TV shows and even the websites is nothing more than greedy corporate BS - the people who are causing the problems don’t want to stop and they don’t care who else gets hurt in the process.

This shouldn’t be news to you. Gordon Gekko said to Bud Fox over 20 years ago: "The richest one percent of this country owns half our country’s wealth, five trillion dollars. One third of that comes from hard work, two thirds comes from inheritance, interest on interest accumulating to widows and idiot sons and what I do, stock and real estate speculation. It’s bullshit. You got ninety percent of the American public out there with little or no net worth. I create nothing. I own. We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naive enough to think we’re living in a democracy, are you buddy? It’s the free market. And you’re a part of it."

This shouldn’t be news to you. Gordon Gekko said to Bud Fox over 20 years ago: "The richest one percent of this country owns half our country’s wealth, five trillion dollars. One third of that comes from hard work, two thirds comes from inheritance, interest on interest accumulating to widows and idiot sons and what I do, stock and real estate speculation. It’s bullshit. You got ninety percent of the American public out there with little or no net worth. I create nothing. I own. We make the rules, pal. The news, war, peace, famine, upheaval, the price per paper clip. We pick that rabbit out of the hat while everybody sits out there wondering how the hell we did it. Now you’re not naive enough to think we’re living in a democracy, are you buddy? It’s the free market. And you’re a part of it."

Yet when you see this picture of "Gordon Gekko", is it admiration or revulsion that you feel? Heck "The Gecko" is now a cute little lizard in commercials, isn’t he? It sure is some coincidence that the cutesy makeover of Gekko is the product of the insurance company owned by the World’s 3rd richest man, isn’t it? As Gekko says: "It’s not a question of enough, pal. It’s a zero sum game, somebody wins, somebody loses. Money itself isn’t lost or made, it’s simply transferred from one person to another." The trick is simply to convince the losers that the winners DESERVE to win and it will be "better luck next time" in the game of life.

Speaking of reincarnation, did you know that two Indians are now the 4th and 5th richest people in the world and, in fact, US Billionaires only occupy 7 out of the top 20 spots on the Forbes list? The top 20 Billionaires "won" over $500Bn in 2010, over $100Bn more than the top 20 had a decade ago when 10 of the top 20 were from the US and we had the top 4. So, what have we done? We have exported our culture of greed and consumerism even as we have expanded our own and we have created an unsustainable upper class, which really becomes shocking as you go further down the list and compare Y2K Billionaires 26-50 ($187Bn) with 2010 ($342.5Bn). Are you getting the picture? Where did this money come from? Everyone else!

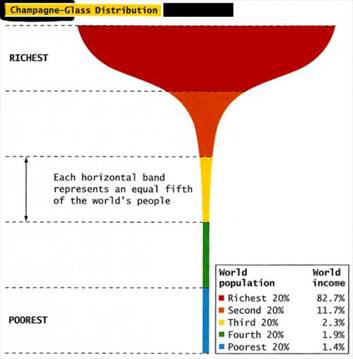

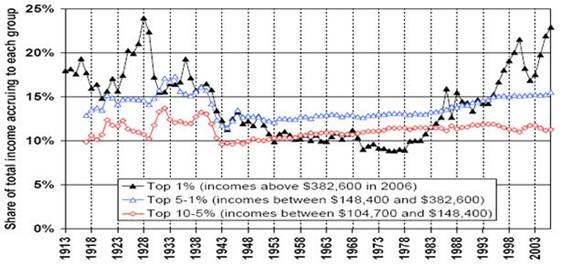

The rich, the top 1% of this world, have grown their fortunes by over $20Tn in the past decade while, coincidentally, the World’s governments have gone over $20Tn into debt. Money cannot be printed fast enough to feed this beast and, while there has been some "trickle down" (the top 20% now make 82.7% of the World’s income, leaving 12.3% for the other 5Bn people to fight over), the bottom 60% of the people on this planet are tapped out, earning just 5.6% of the World’s income. That is called the breaking point - the point at which those we have stepped on on the way up, now far out number us and are beginning to think it may be time to take us down.

The top 1% have now become so wealthy and the bottom 80% have now become so poor that there is nowhere to grow wealth than by now taking it from the bottom of the top 20%. In 2009, while the Forbes 400 added an average of $500M EACH to their net worth, the United States lost 500,000 Millionaires. Globally, there was a 20% reduction in the number of Millionaires as the rich got richer but the definition of rich was just moved up a peg or two.

So when I tell you the rich are too rich now, I don’t mean you. You only think you are rich with your $10M net worth and your $1M income but you don’t even make the top 2%. Yes, we could all cut back a bit and we could all learn to live like better global citizens and we should all be willing to take 10% of our incomes and pay off our nation’s debts but it’s not your 10% that’s going to make a big difference. It’s the 10% that has been siphoned off by the top 1% that needs to come back and that includes individuals and corporations who benefit from the thousands of loopholes and deductions and end up paying less taxes than you and everybody else at the Tea Party rallies they sponsor.

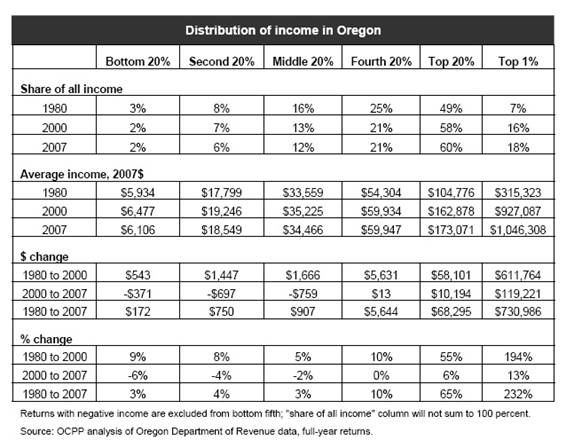

Is this really the democracy you signed up for? Is this the brand of capitalism you support? Here’s a chart of 27 years of the bottom 20% getting a grand total raise (in the middle 20%, their "top" bracket") of $907 out of $34,466, about $33 a year (0.01% a year) while the next 20% gained $5,643 over 27 years (0.3% per year) and the top 20% gained $68,295, is more money gained than the entire salary of anybody below them on the chain and works out to 2.4% per year but even that group is skewed by the top 1%, who more than tripled their earnings over the same period, earning $730,985 MORE than they earned in 1980, which is an annual increase of 8.5%. $27,000 a year MORE.

And where did that money come from? Not from inflation, these are constant dollars. That $27,000 per year, it’s the ENTIRE salary of the average worker in the bottom 80%. How, then, do 1M Americans in the top 1% get and additional $27,000 a year for 27 years? By cutting 1M $27,000 jobs a year, of course! While they are getting that done, they are also paying less and less taxes, shifting the burden down to the bottom 80% (and the suckers in the top 20% who think they are part of the club and fight for the "rights" of their uber-rich buddies) so they can keep more of that extra $27,000 a year. Then they lobby to repeal the inheritance tax to make sure that money NEVER goes back to the general public.

This is not Capitalism folks, this is theft! This is greed on such a grand scale that we fail to recognize it because it’s not about those of us in the top 10%, who make $175,000 a year and wonder how we’re going to be able to pay for our kids college and save to retire. It’s about the people who are making $175,000 a month and the people above them who are making $175,000 a day ("only" $64M a year counting all 365 days) who define greed in our system as they clearly make more money than they or any rational person could ever want and it’s destructive to the entire system, as I warned in 2007 in "The Dooh Nibor Economy".

This is not Capitalism folks, this is theft! This is greed on such a grand scale that we fail to recognize it because it’s not about those of us in the top 10%, who make $175,000 a year and wonder how we’re going to be able to pay for our kids college and save to retire. It’s about the people who are making $175,000 a month and the people above them who are making $175,000 a day ("only" $64M a year counting all 365 days) who define greed in our system as they clearly make more money than they or any rational person could ever want and it’s destructive to the entire system, as I warned in 2007 in "The Dooh Nibor Economy".

That is our deficit people - it’s a moral deficit as well as fiscal and the only people that have the power to change it is the people near the top and that’s YOU! Stop looking up at what you wish you had and start looking down and around you at what’s really going on in the world. We need to make a change and time is running out. Sorry to be dire but 20% of the Millionaires in the top 2.5% lost their places last year and another 20% of America’s Millionaires will lose it again this year to feed the beast that is the top 0.1%. Can we really allow politics as usual to go on anymore?

THEY CAME FIRST for the poor,

and I didn’t speak up because I wasn’t poor.

THEN THEY CAME for the workers,

and I didn’t speak up because I wasn’t a worker.

THEN THEY CAME for the middle class,

and I didn’t speak up because I wasn’t middle class.

THEN THEY CAME for me

and by that time no one was left to speak up.

[Note: I’ll do a nice, 2-week wrap up next weekend as we have the holiday. Monday, the 5th will be our last day off until Sept 6th so we’ll see if we’re in for Summer doldrums or a repeat of last summer, where the S&P ran from 879 on July 10th, to 1,068 on Sept 15th for a nice 21.5% gain in 2 months. Now we’re right back to test the top of last Summer’s rally and find out how real it really was - very exciting.]

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

VP

30 Jun 10, 17:25 |

Thanks

Thank the Almighty!! There are sane people left in the US |