SULTANS OF SWAP: BP Collapse Potentially More Devastating than Lehman!

Companies / Credit Crisis 2010 Jul 01, 2010 - 02:51 PM GMTBy: Gordon_T_Long

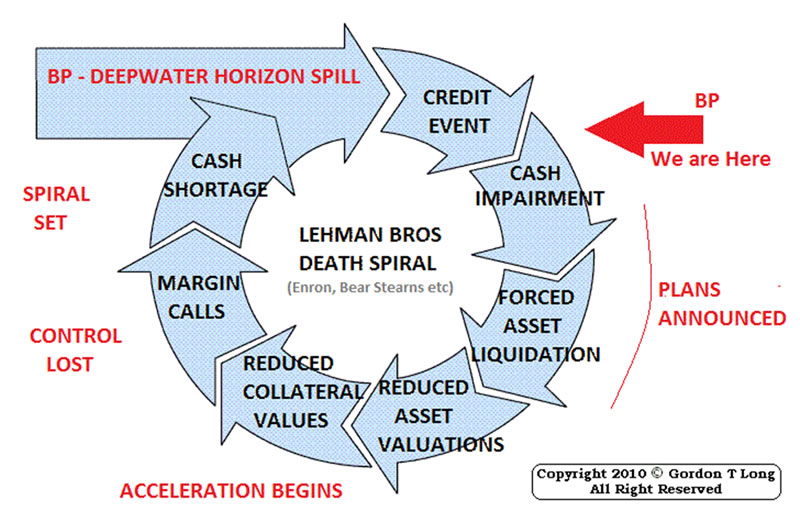

As horrific as the gulf environmental catastrophe is, an even more intractable and cataclysmic disaster may be looming. The yet unknowable costs associated with clean-up, litigation and compensation damages due to arguably the world’s worst environmental tragedy, may be in the process of triggering a credit event by British Petroleum (BP) that will be equally devastating to global over-the-counter (OTC) derivatives. The potential contagion may eventually show that Lehman Bros. and Bear Stearns were simply early warning signals of the devastation lurking and continuing to grow unchecked in the $615T OTC Derivatives market.

As horrific as the gulf environmental catastrophe is, an even more intractable and cataclysmic disaster may be looming. The yet unknowable costs associated with clean-up, litigation and compensation damages due to arguably the world’s worst environmental tragedy, may be in the process of triggering a credit event by British Petroleum (BP) that will be equally devastating to global over-the-counter (OTC) derivatives. The potential contagion may eventually show that Lehman Bros. and Bear Stearns were simply early warning signals of the devastation lurking and continuing to grow unchecked in the $615T OTC Derivatives market.

What is yet unknowable is what the reality is of BP’s off-balance sheet obligations and leverage positions. How many Special Purpose Entities (SPEs) is it operating? Remember, during the Enron debacle Andrew Fastow, the Enron CFO, asserted in testimony nearly 10 years ago that GE had 2500 such entities already in existence. BP has even more physical assets than Enron and GE. Furthermore, no one knows the true size of BP’s OTC derivative contracts such as Interest Rate Swaps and Currency Swaps. Only the major international banks have visibility to what the collateral obligations associated with these instruments are, their credit trigger events and who the counter parties are. They are obviously not talking, but as I will explain, they are aggressively repositioning trillions of dollars in global currency, swap, derivative, options, debt and equity portfolios.

Once again, as we saw with Lehman Bros and Bear Stearns we have no visibility to the murky world of off balance sheet, off shore and unregulated OTC contracts, where BP’s financial risk is presently being determined. At a time when understanding a corporation’s risk position is critically important, investors are in the dark. When markets are uncertain, bad things are certain to follow. The new financial regulations under the Dodd-Frank legislation does absolutely nothing to address this. This was the central issue in truly understanding and corralling TBTF risk. It has not been addressed and the markets will likely make the tax payer pay for this regulatory failure once again.

Massive BP Risk lay in the $615T OTC Market that only the major international banks have any visibility to…. and they are not talking!

THE LEVERAGE ASSOCIATED WITH “AAA” ASSETS

I could not have stated it any clearer than Jim Sinclair at jsmineset.com: “People are seriously underestimating how much liquidity in the global financial world is dependent on a solvent BP. BP extends credit – through trading and finance. They extend the amounts, quality and duration of credit a bank could only dream of. You should think about the financial muscle behind a company with 100+ years of proven oil and gas reserves. Think about that in comparison to a bank with few tangible assets. Then think about what happens if BP goes under. This is no bank. With proven reserves and wells in the ground, equity in fields all over the planet, in terms of credit quality and credit provision – nothing can match an oil major. God only knows how many assets around the planet are dependent on credit and finance extended from BP. It is likely to dwarf any banking entity in multiples…. The price tag and resultant knock-on effects of a BP failure could easily be equal to that of a Lehman, if not more. It is surely, at the very least, Enron x10.”

I could not have stated it any clearer than Jim Sinclair at jsmineset.com: “People are seriously underestimating how much liquidity in the global financial world is dependent on a solvent BP. BP extends credit – through trading and finance. They extend the amounts, quality and duration of credit a bank could only dream of. You should think about the financial muscle behind a company with 100+ years of proven oil and gas reserves. Think about that in comparison to a bank with few tangible assets. Then think about what happens if BP goes under. This is no bank. With proven reserves and wells in the ground, equity in fields all over the planet, in terms of credit quality and credit provision – nothing can match an oil major. God only knows how many assets around the planet are dependent on credit and finance extended from BP. It is likely to dwarf any banking entity in multiples…. The price tag and resultant knock-on effects of a BP failure could easily be equal to that of a Lehman, if not more. It is surely, at the very least, Enron x10.”

From a historical context, some may not be aware that the infamous House of Rothschild at the height of their banking power moved into Energy & Oil. Also, John D. Rockefeller quickly realized his globally expanding Standard Oil was more a bank, consolidating his financial empire under a banking structure which resulted in the Chase Manhattan Bank (the basis of Citigroup). As long as an energy giant can manage its cash flows throughout the volatility of price fluctuations, it becomes a money and credit generating machine. It can borrow with AAA yields anywhere on the curve and lend to less credit worthy entities at attractive spreads. These lending differentials help fuel the $430T Interest Rate Swap OTC market. BP has been able to spin off $20B of earnings for the last 5 years and $15B in cash last year. All of this suddenly comes to an end if its credit rating is significantly impaired. But what could possibly cause this to happen? It would take a black swan event. An outlier. A fat tail.

Sound familiar? Heard this discussion before?

The Gulf Oil Disaster may be the fat tail to end all fat tails and shows the exposure behind the entire risk models of the vast majority of derivatives algorithm models. To suggest that BP would need to take impairments north of $20B would have seemed out of the realm of possibilities less than 90 days ago. Now, if it is contained to only $20B, it would be considered a blessing. Fitch dropped BP’s credit rating an unprecedented 6 notches on June 15th from AA to BBB which followed June 3rd's AA+ to AA cut. This is what happens when a fat tail occurs and it has only just begun.

The Gulf Oil Disaster may be the fat tail to end all fat tails and shows the exposure behind the entire risk models of the vast majority of derivatives algorithm models. To suggest that BP would need to take impairments north of $20B would have seemed out of the realm of possibilities less than 90 days ago. Now, if it is contained to only $20B, it would be considered a blessing. Fitch dropped BP’s credit rating an unprecedented 6 notches on June 15th from AA to BBB which followed June 3rd's AA+ to AA cut. This is what happens when a fat tail occurs and it has only just begun.

CONTAGION HAS BEGUN

Though few are talking openly, it doesn’t mean large amounts of money aren’t aggressively repositioning. This repositioning is effectively de-leveraging and is consequentially a liquidity drain. This comes as US M3 has gone negative and M2, M1 are rapidly declining. BP is going to face a massive liquidity crunch which has all the earmarks of triggering an already tenuous and worsening international liquidity situation.

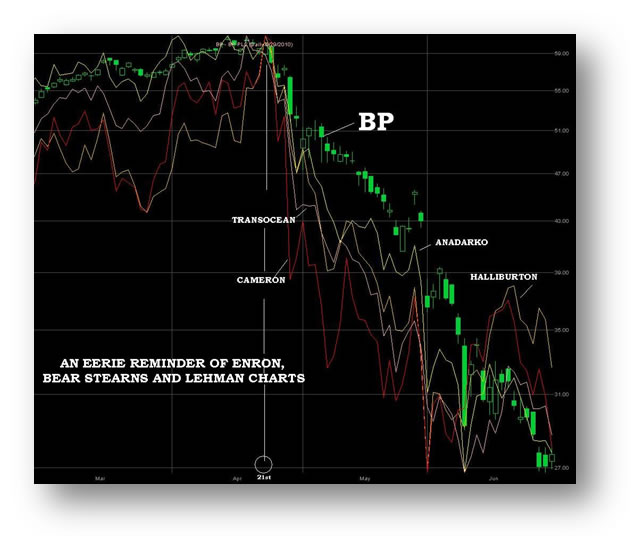

I found the charts (right) published by Credit Derivatives Research to be very telling of the abrupt shift that has occurred. Their charts show that the April 21st Macondo well explosion has triggered a significant inflection in the risk, counterparty and high yield areas. A comparison with Government and High Grade Debt has a different profile (see end of this report for the charts) which reflects the European banking concerns associated with the southern European economies (PIIGS). It is important to differentiate these as separate drivers. Both come as the percentage of corporate bonds considered in distress is at the highest in six months - a sign investors expect the economy to slow and defaults to rise. This spells deleveraging.

WHAT WE KNOW ABOUT BP DERIVATIVES:

1 - CSO (Credit Synthetic Obligations)

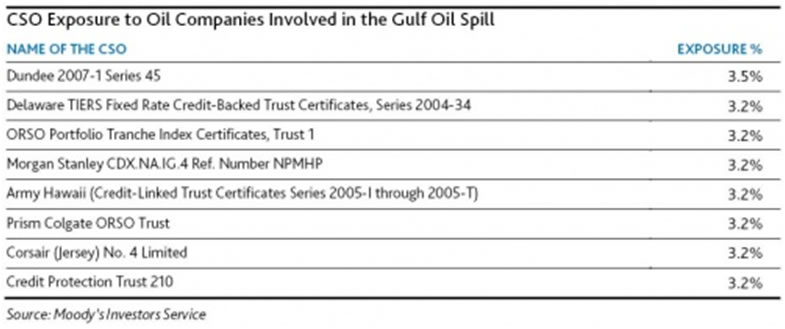

A study by Moody’s outlines that a BP bankruptcy would impair 117 Collateralized Synthetic Obligations (CSOs), which would lead to pervasive losses by a broad range of holders. The 117 effected is a startling 18% of the total CSOs outstanding, which is an indication of the scope and impact of BP financing globally. For those that remember the 2008 financial debacle, you will recall its epicenter was the collapse of Collateralized Debt Obligations (CDO) associated with mortgages and Credit Default Swaps (CDS) of financial companies impacted. CSOs are even more leveraged and toxic.

The exhibit above lists CSOs (excluding CSOs backed by CSOs) with over 3% exposure

to the five companies involved in the Gulf of Mexico incident.

To quote Moody’s:

In the event of BP’s restructuring or bankruptcy, CSO transactions referencing BP or its affected subsidiaries may experience what is called a “credit event.” If the credit event occurs, the CSO transactions will have to meet their payment obligations to the protection buyers, which will result in the loss of subordination to the rated CSO tranches. In cases where the subordination is no longer available, CSO investors will incur the loss.

….

We reviewed our entire universe of outstanding CSOs and determined that exposure to BP and its rated subsidiaries appears in 117 (excluding CSOs backed by CSOs) transactions, which represents approximately 18% of global Moody’s-rated CSOs. Exposure ranged from 0.26% to 2% of the respective reference portfolios. The transaction with the largest exposure to BP and its subsidiaries is Arosa Funding Limited – Series 2005-5.

Restructuring or Bankruptcy of Other Oil Companies Involved in the Spill Also Affects CSOs. In addition, we assessed Moody’s-rated CSO exposure to the other four companies and their subsidiaries that were involved in the Gulf of Mexico incident, which are Halliburton, Anadarko Petroleum, Transocean Inc., and Cameron International. Halliburton appears in 43 CSOs, Anadarko Petroleum appears in 28 CSOs, Transocean Inc. appears in 79 CSOs, and Cameron International appears in 6 CSOs. We recently changed the credit outlooks for Transocean and Anadarko Petroleum, as well as their rated subsidiaries, to negative from stable because of uncertainties related to the companies’ involvement in the Gulf of Mexico incident and potential financial liabilities associated with it. The CSOs referencing one or more of these issuers would face credit event consequences in a scenario where any of them restructures or enters bankruptcy.

We need to recall that Transocean was the owner /operator of Deepwater Horizon with 131 of the actual 137 employed by Transocean (RIG) and that Anadarko (APC) was BP’s 25% partnership holder in the well. Cameron International (CAM) was the builder of the faulty blowout preventer and Halliburton (HAL) the contractor for the well cementing operation in sealing the 13,350 foot Macondo drill site. These players will no doubt be heavily involved in the litigation and compensation settlements, but additionally will have collateral damage on other oil industry participants as they are forced to raise cash for litigation and claims.

2 - CDS (Credit Default Swaps)

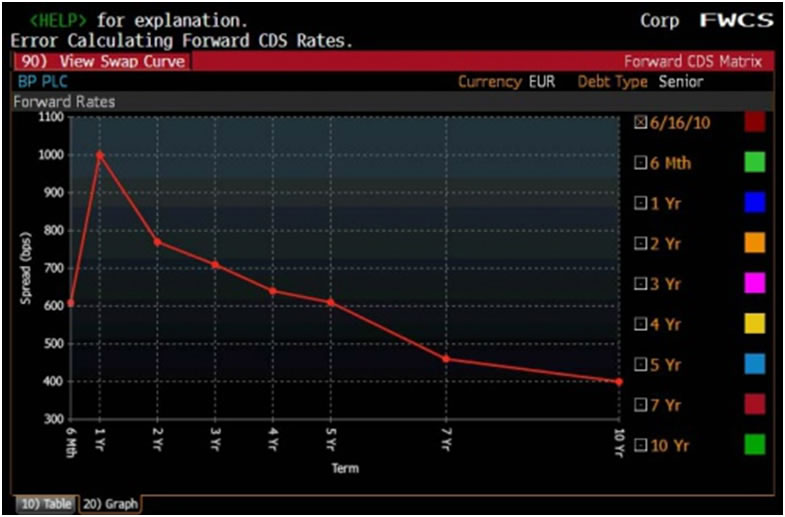

On June 25th BP’s Credit Default Swaps shot up 44 to 580 on the 5 years CDS. This meant it costs $580,000 per year to ensure $10 million in BP bonds over a 5 year contract period. Anything approaching 300 is considered serious risk. For counterparties willing to pay this amount means their dynamic hedging models are working over time and a near panic scramble is taking place.

On June 16th Zero Hedge Reported:

The BP Curve has really flipped (out). The 1 year point on the curve is now over 1,000 bps, a 400 bps move in one day. The point is also offerless (bidless in traditional cash jargon). Granted the DV01 so close to 0 is rather low, but this kind of ridiculous curve inversion is simply wreaking havoc on correlation desks. The 6 month point is now 0.5 pts upfront. Pretty soon BP will need to apply for the same ECB bailout that rescued all those banks who were risking a wipe out when Greek spreads were trading at comparable levels. The question now becomes: who sold the bulk of the BP protection? BofA's announcement yesterday (06-15-10) that it is limiting counterparty risk exposure with BP to all contracts over 1 year could be a rather material clue as to the identity of at least one such entity.

3 - BOND INVERSION

With Credit Default Swap concerns we would expect this to be reflected in BP’s Yield Curve Spread. What is interesting here is that the curve is inverted as is BP’s CDS curve (shown above). Usually short term yields are less than longer term yields because of inherent risk over a longer period of time. For instance, one heavily traded bond, which matures in March 2012, traded with 9.48% yield recently. Meanwhile, further down the curve a bond that matures in March 2019 is trading at a yield of 7.74%, less than the shorter-term bond. This suggests that the market is pricing in a credit event. A credit event would have a profound impact on OTC contracts, which we have no visibility to.

What we do know however is that BP has between $2 and $2.5 Billion in one year commercial paper to rollover that is required for trading operations and working capital. This is going to make it both more expensive and harder to secure and will be a liquidity drain for BP.

4 – LIQUIDTY REQUIREMENTS

To the above Commercial paper roll-over ($2-$2.5B in one year), ongoing new and rollover debt issuance, we need to add the $20B it has agreed with the White House to put in place, though we know of no detailed agreement actually being signed.

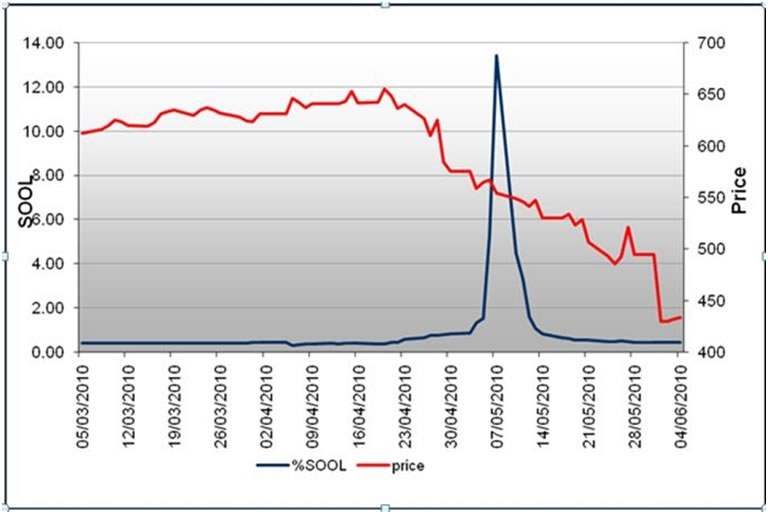

5 - SHORT INTEREST

The Financial Times Alphaville via Data Explorers reported the short interest through June 4th. As you can see from the graph below by stripping out the spike related to the last dividend payment, the underlying level of stock outstanding on loan (SOOL) has barely budged since the spill. So, short sellers can’t be blamed for the plunge; the selling must be coming from somewhere else, such as long-only funds. Rumors circulated 06/10/10 that Norges Bank was looking to offload 330m shares. Brokers said the total Transatlantic volume of stock traded in BP 06-09-10 had a value of $8bn. To put that figure into some perspective, the total volume traded on the entire EuroStoxx index on the same day amounted to $15bn. Moreover, since the Deepwater Horizon rig exploded on April 21st, 70 per cent of BP’s market cap has turned over, most of it in the US. Trading volumes in BP American Depository Receipts (ADRs) are usually 10 per cent lower than the ordinary shares in London. Since the spill, that position has been reversed and the ADRs have traded 3.5 times the ordinaries, all of which suggests BP’s largest US investor base have been dumping stock.

How long before equity shorting begins? It must be noted here that this is BP equity. Shorting activity of BP debt is all together another matter especially concerning dynamic hedging, with again much less visibility.

6 - OPTIONS ACTIVITY

Wall Street Pit on 06/10/10 wrote that “Options volume on beleaguered oil company, BP PLC, is fast approaching 750,000 contracts, fueling a more than 79.7% upward shift in the stock’s overall reading of options implied volatility to a 5-year high of 120.96%. Options activity on the stock can easily be described as frenzied as volume continues to grow in both call and put options across multiple expiries.”

COST OF CAPITAL IS SKYROCKETING FOR BP WHICH AS FUNDAMENTALLY AN ENERGY FINANCING CORPORATION CAN BE TERMINAL!

SIZE & SCOPE OF LITIGATION

Are the final gulf oil spill costs going to be $20B or $60B? Does anyone know? I personally believe it is closer to the latter than the former. If we just use the reported oil spillage numbers for comparison we might get a better understanding of the complete failure to grasp the scope of the disaster. According to the Financial Times, the oil spillage was reported as follows:

SPILLAGE COST INCREASE

(bls./day) TO DATE

April 20 1000

May 4 5000

May 7 5000 350M

May 14 5000 625M

May 28 15,500 950M

June 3 19,000 990M

June 8 15,500 1,250M

June 10 15,500 1,430M

June 17 15,500 1,600M

June 23 25,800 2,600M Spillage increased by 25 X in 60 days

As time passes the numbers are rising exponentially. Engineers are warning that the capture will be complicated and scientists monitoring the situation are predicting the spill will prove larger than the current estimates are reflecting. An expert in the field, Matt Simmons of Simmons International has stated that the flows are over 100,000 barrels per day. Most independent experts agree.

Assuming $4,000/barrel damages costs, 100,000 barrels per day flow rates, a 90 day flow duration (minimal), we arrive at clean-up, litigation and damage compensation of approximately $32B. This is nearly twice the US escrow account agreement and within our expectations of between $20 and 60B. There are a range of issues regarding further leaks, shifting seafloor, methane levels, hurricanes, disbursement effects and many more that are surfacing daily that will have significant negative impact on current analysis and assumptions.

Assuming $4,000/barrel damages costs, 100,000 barrels per day flow rates, a 90 day flow duration (minimal), we arrive at clean-up, litigation and damage compensation of approximately $32B. This is nearly twice the US escrow account agreement and within our expectations of between $20 and 60B. There are a range of issues regarding further leaks, shifting seafloor, methane levels, hurricanes, disbursement effects and many more that are surfacing daily that will have significant negative impact on current analysis and assumptions.

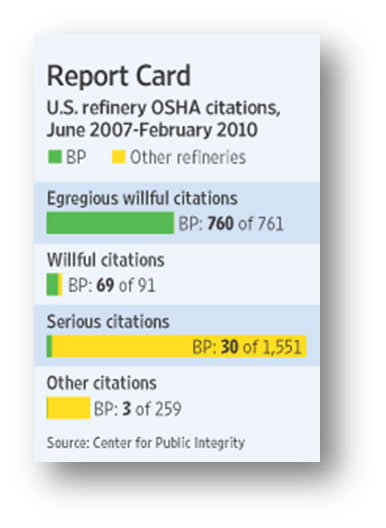

An element of future litigation that is very concerning is the amount of punitive damages that may be awarded. After the White House sent Attorney General Eric Holder to New Orleans to threaten BP with criminal prosecution, BP responded that it believes a case of negligence can’t be proven. However, the Deepwater Horizon travesty comes at a particularly bad time for BP. According to Caroline Baum at Bloomberg: “BP is already the most reviled company in America. Two of its refineries accounted for 97 percent of the violations (a total of 862, of which 760 were “egregious willful”) in the refining industry over the last three years, according to the Center for Public Integrity. It holds the record for the largest fine ($87 million) ever levied by the Occupational Safety and Health Administration.” Additionally, the US Chemical Safety & Hazard Investigation Board has immediately jumped into the oil spill investigation as they did previously at the 2005 fire and explosion of BP’s Texas City refinery that killed 15 and injured many others.

After Moody’s cut Anadarko’s rating to junk late on June 18th, the US oil company (a 25 per cent non-operating investor in the Macondo well) broke its eight-week silence with this broadside from CEO Jim Hackett:

“The mounting evidence clearly demonstrates that this tragedy was preventable and the direct result of BP’s reckless decisions and actions. Frankly, we are shocked by the publicly available information that has been disclosed in recent investigations and during this week’s testimony that, among other things, indicates BP operated unsafely and failed to monitor and react to several critical warning signs during the drilling of the Macondo well. BP’s behavior and actions likely represent gross negligence or willful misconduct and thus affect the obligations of the parties under the operating agreement.”

We can safely surmise that the stab in the dark by the White House of $20B is about as accurate as its forecasts of GDP growth, unemployment improvement and the Recovery and Reinvestment Act of 2009. Slim to none. A more realistic number is likely substantially larger and will likely surface soon. However, anything larger than $20B is likely to be the immediate nail in the coffin for BP as evidenced by how quickly the newly elected British Prime Minister was dispatched to the White House to stop the mounting implosion of both BP and the seriously impacted British Pension system.

BP RESPONSE

BP has stated it has immediate cash available of $15B and will raise additional cash via:

- Asset Sales

- Capital Expenditure Cuts

- Dividend Cut for the Next 3 Quarters

LEHMAN BROS / BEAR STREARNS DEATH SPIRAL

To again quote Jim Sinclair at jsmineset.com: “BP is the primary player on the long-end of the energy curve. How exposed are Goldman sub J. Aron, Morgan Stanley and JPM? Probably hugely. Now credit has been cut to BP. Counter-parties will not accept their name beyond one year in duration. This is unheard of. A giant is on the ropes. If he falls, the very earth may shake as he hits the ground. As we are beginning to see, the Western pension structure, financial trading and global credit are all inter-twined. BP is central to this, as a massive supplier of what many believe(d) to be AAA credit. So while we see banks roll over and die, and sovereign entities begin to falter… we now have a major oil company on the verge of going under. Another leg of the global economic "chair" is being viciously kicked out from under us.”

The whole BP travesty is quickly compounded via the OTC Derivatives market and the risk inherent within it.

The whole BP travesty is quickly compounded via the OTC Derivatives market and the risk inherent within it.

- As it was in Lehman, opacity is once again experienced when transparency is most critically required.

- Finance has always been about risk determination but never before with so much leverage associated with risk assessments and held in such complex, dependent structured instruments.

- Investors are still unprotected. The Frank-Dodd Bill is now nothing more than watered down window dressing before it finally reaches legislative approval and even before it begins the regulatory supervision machinations.

- Investors hate uncertainty and we have nothing but uncertainty here:

- Political

- Legal

- Financial

- Business

CONCLUSIONS

The most likely scenario is that the US operations of BP will voluntarily attempt Chapter 11 bankruptcy proceedings. This is the worst possible scenario for claimants. The problem here is that this triggers a credit event which has daunting repercussions to the highly leveraged global financial markets. Like AIG before, the government does not want to tamper with the ramifications and fall out of a CDS event. Lehman was one too many.

If a US voluntary bankruptcy is stopped by the US and there is a BP corporate bankruptcy, then there is a strong possibility that the British Government will be forced to step in and bailout BP. In the end, the tax payer will pay as the ongoing game of Regulatory Arbitrage is played masterfully once again.

Deleveraging associated with BP may be the event that triggers the $5T Quantitative Easing spike we have been warning about for some time now. It will be needed to complete the final process of manufacturing of a Minsky Melt-up to avoid the looming pension, entitlement and US state financial crisis.

The ability of the government to achieve this is anything but certain. However, we need to expect the unexpected and watch out for fat tails to trip over.

The Dodd-Frank Legislation leaves investors & taxpayers once again exposed to another Lehman

The Regulatory Arbitrage Game Continues.

.

UNFOLDING BP FINANCIAL EVENTS ARE TRACKED DAILY ON THE Tipping Points WEB PAGE

Sign Up for the next release in the SULTANS OF SWAP series: Commentary

The last Sultans of Swap article: SULTANS OF SWAP: The Get Away!

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.