The Self-Defeat of the Keynesian Cross

Economics / Economic Theory Jul 13, 2010 - 10:09 AM GMTBy: MISES

Predrag Rajsic writes: The Austrian business-cycle theory, initiated by Ludwig von Mises and further developed and elaborated by F.A. Hayek, is by many considered the cornerstone of this school of thought. However, in 1998, Paul Krugman plainly dismissed the theory as not "worthy of serious study."

Predrag Rajsic writes: The Austrian business-cycle theory, initiated by Ludwig von Mises and further developed and elaborated by F.A. Hayek, is by many considered the cornerstone of this school of thought. However, in 1998, Paul Krugman plainly dismissed the theory as not "worthy of serious study."

More recently in his New York Times blog, Professor Krugman claimed that the Austrian business-cycle theory fails to fully explain fluctuations in output and employment between recessions and booms. From this he concludes that the theory fails to demonstrate how a business cycle can be caused by government intervention. At the same time, he interprets this as a sign of Austrians' unconscious adherence to Keynesianism in explaining the booms but not the busts. Austrian economists, says Professor Krugman, seem to be "Keynesians during booms without knowing it."

More recently in his New York Times blog, Professor Krugman claimed that the Austrian business-cycle theory fails to fully explain fluctuations in output and employment between recessions and booms. From this he concludes that the theory fails to demonstrate how a business cycle can be caused by government intervention. At the same time, he interprets this as a sign of Austrians' unconscious adherence to Keynesianism in explaining the booms but not the busts. Austrian economists, says Professor Krugman, seem to be "Keynesians during booms without knowing it."

The assertions about the alleged inadequacy of the Austrian business-cycle theory have been addressed by Robert Murphy and will not be the focus of this article. Instead, I will demonstrate that the common interpretation of the theory that Krugman considers more worthy of studying seriously — J.M. Keynes' General Theory of Employment, Interest and Money — has serious logical flaws. Ironically, it turns out that these are the same flaws that Krugman attributes to the Austrian theory, namely the inability to explain continuous unemployment during a recession.

The Basics of J.M. Keynes' Theory

Keynes based his 1936 treatise The General Theory of Employment, Interest and Money on one key assumption, that involuntary unemployment is a possible market-equilibrium outcome. He defines involuntary unemployment in this way:

Men are involuntarily unemployed if, in the event of a small rise in the price of wage-goods relatively to the money-wage, both the aggregate supply of labour willing to work for the current money-wage and the aggregate demand for it at that wage would be greater than the existing volume of employment.[1]

Next, Keynes describes the basic elements of his theory:

This theory can be summed up in the following propositions:

In a given situation of technique, resources and costs, income (both money-income and real income) depends on the volume of employment N.

The relationship between the community's income and what it can be expected to spend on consumption, designated by D1, will depend on the psychological characteristic of the community, which we shall call its propensity to consume. That is to say, consumption will depend on the level of aggregate income and, therefore, on the level of employment N, except when there is some change in the propensity to consume.

The amount of labour N which the entrepreneurs decide to employ depends on the sum (D) of two quantities, namely D1, the amount which the community is expected to spend on consumption, and D2, the amount which it is expected to devote to new investment. D is what we have called above the effective demand.

Since D1 + D2 = D = φ(N), where φ is the aggregate supply function, and since, as we have seen in (2) above, D1 is a function of N, which we may write χ(N), depending on the propensity to consume, it follows that φ(N) − χ(N) = D2.

Hence the volume of employment in equilibrium depends on (i) the aggregate supply function, φ, (ii) the propensity to consume, χ, and (iii) the volume of investment, D2. This is the essence of the General Theory of Employment.[2]

These propositions were later formulated by Paul Samuelson into what is now known as the Keynesian cross model.[3] This model has become one of the standard elements of undergraduate macroeconomics courses.

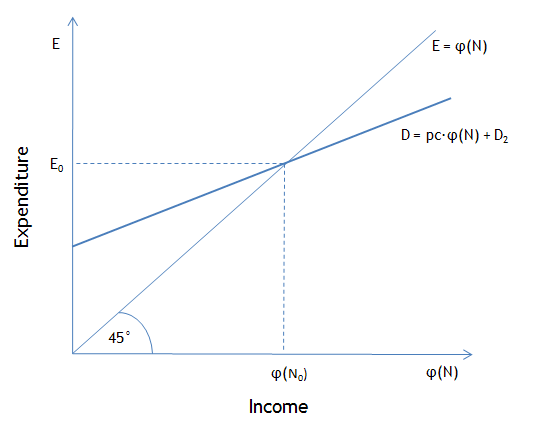

Figure 1 shows a diagrammatic representation of the Keynesian cross, as generally presented in contemporary macroeconomics textbooks. The horizontal axis represents the aggregate output or income, and the vertical axis denotes the aggregate expenditure. The aggregate demand, D, is equal to the sum of the consumption expenditure, pc∙φ(N), and investment, D2. The consumption expenditure at any level of employment, N, is a product of the propensity to consume, pc, and the income, φ(N). While Keynes avoids using any explicit units for the aggregate income, expenditure, consumption and demand, implicitly, they are treated in terms of money outlays.

The 45° line represents the locus of points where the aggregate expenditure equals aggregate output. Consequently, the economy is in equilibrium at the output level φ(N0), and N0 is the equilibrium level of employment. At this point, the aggregate expenditure is E0. If we assume that N0 is the total amount of labour available in the economy, this equilibrium corresponds to full employment. From this, it follows that the consumption expenditure at full employment is pc∙φ(N0).

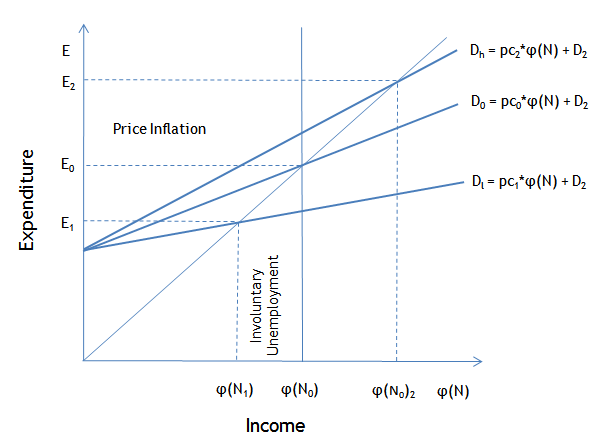

The next step in the application of this model generally involves assuming that propensity to consume, which is an exogenous variable, fluctuates between some minimum and maximum value. Let these values be pc1 and pc2. This is shown in figure 2.

If the propensity to consume fluctuates around the level that ensures full employment, pc0, the model suggests that, in times when the propensity to consume is below pc0 (i.e., pc1), aggregate demand, Dl, is low and there will be a period of reduction in output and employment. In contrast, as the propensity to consume increases above pc0, aggregate demand, Dh, is high, full employment and maximum output is reached and a period of increases in output prices can be observed.

Figure 2. Changes in the aggregate demand due to the changes in propensity to consume

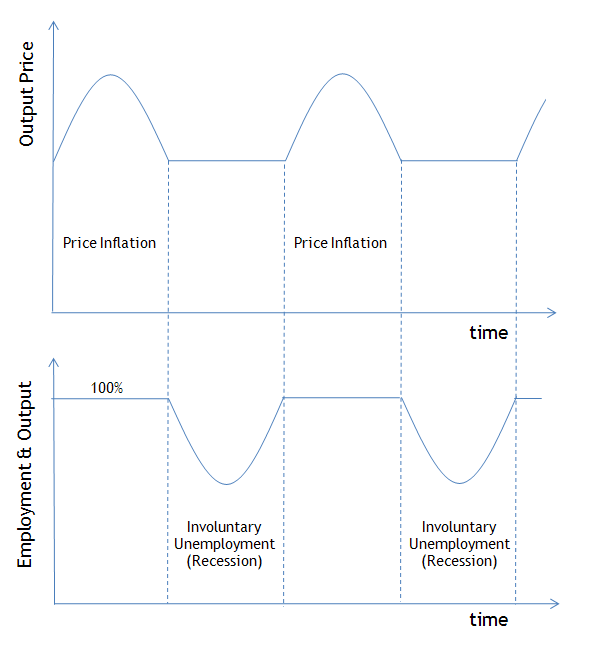

This idea is graphically illustrated in figure 3. It shows cycles of price increases, output and employment loss, as the propensity to consume fluctuates over time. The periods of higher prices and output, according to this model, coincide with full employment while the periods of lower prices are accompanied by unemployment and a decrease in output.

The typical interpretation of the model is that the observed cycles in output, prices, and employment are consequences of intertemporal fluctuations in the aggregate demand, caused by the changes in the population's propensity to consume in a market not stabilized by government intervention.

Figure 3. Fluctuations in output price, employment, and output over time, as commonly interpreted using the Keynesian cross model

The suggested remedy for these fluctuations, according to the Keynesian theory, involves either fiscal or monetary policy. The fiscal policy remedy would be to increase taxes during the inflationary periods and run budget deficit during the recessionary period. The monetary-policy intervention would involve a reduction in the money supply during the inflationary periods and an expansion of the money supply during the recessionary periods.

The intended effect of these policies would be to reduce the aggregate demand when it is too high and increase it when it is too low. This would make the government the primary body that balances the economic activity in order to bring about full employment. This interpretation, on the surface, sounds plausible. However, when the internal logic of the model is examined, a serious error can be found. The next section elaborates on this.

The Internal Contradiction

N0 in figure 2 is the quantity of labor that produces the output/income φ(N0). The demand equation implies that, in equilibrium, some share of the total output, pc0, is consumed by the income earners — the employed laborers (N0) and the employers. Consequently, pc0∙φ(N0) is the aggregate (accounting) value[4] of the consumption goods and services exchanged on the market.

Following this logic, the same relationship needs to hold in any other equilibrium. Thus, if there is some other equilibrium at the level of employment, N1, and another propensity to consume, pc1, the consumption, C1 = pc1∙φ(N1), is the aggregate accounting value of the consumption goods and services exchanged on the market. These are the goods and services produced by laborers, N1, and consumed by all those who earn income.

However, if pc1 is less than the propensity to consume that corresponds to full employment, there will be some unemployed labor, equal to the difference between N0 and N1. In order for this labor to be available at another point in time, when the (exogenous) propensity to consume returns back to the level needed for full employment, these unemployed laborers need to have some nonzero level of consumption while being unemployed. Let CU = e∙N1 be this minimum consumption, where e is the physical quantity of output needed to sustain the life of an unemployed person.

But consumption of the unemployed is not met by an equivalent expenditure because unemployed labor does not earn income. This physical output must be given to the unemployed without monetary compensation. However, nowhere in this model is it specified that there is some surplus production of physical output that will be given away to the unemployed without monetary compensation. Thus, it seems that the model assumes zero consumption for the unemployed, which directly implies that the unemployed will not be able to sustain their physical existence in a prolonged recession.

If, on the other hand, one assumes nonzero consumption for the unemployed that is not included in the consumption expenditure of the employed, the actual physical output available for purchase at the level of employment, N1, is less than the quantity that results in the expenditure E1. In order to arrive at the actual value of goods exchanged on the market, say φ'(N1), the amount equal to the unpaid consumption of the unemployed must be subtracted from the existing supply: φ'(N1) = φ(N1) − P∙CU, where P is the price of output.

But this lowers the aggregate quantity of the goods and services available for exchange in the market below the quantity that corresponds to φ(N1). This means that the actual supply available for exchange no longer meets the effective demand of the income earners at pc1. Thus, assuming nonzero consumption of the unemployed that is not included in the expenditure of the employed is not an equilibrium situation in the model presented above.

In order for this situation to move towards equilibrium, the propensity to consume of the employed and the employers needs to be reduced below pc1 to meet the consumption needs of the unemployed. However, propensity to consume is an exogenous variable and is not a subject of individual choice in this model.

Even if propensity to consume was subject to individual choice, a further reduction in the propensity to consume would only lead to more unemployment and disequilibrium — since the reduction in the propensity to consume, according to the model, caused the recession in the first place. The only stable equilibrium in this situation is zero output for the whole economy, which amounts to a complete annihilation of the economy. Therefore, we cannot assume that the consumption of the unemployed is not included in the expenditure of the employed.

Alternatively, if the consumption of the unemployed were to be included in the expenditure of the employed (i.e., the employed used a portion of their income as charity for the unemployed), we would end up with a paradox: that, as the propensity to consume reduces, the employed are more able to feed more unemployed by spending ever smaller portions of their income. Thus, it must be concluded that, in this model, the consumption of the unemployed is not included in the consumption expenditure of the employed.

But the model at the same time implies that the consumption of the unemployed cannot be outside of the expenditure of the employed if the model is expected to produce a nonzero equilibrium output. This leaves the only remaining option — the consumption of the unemployed must be zero.

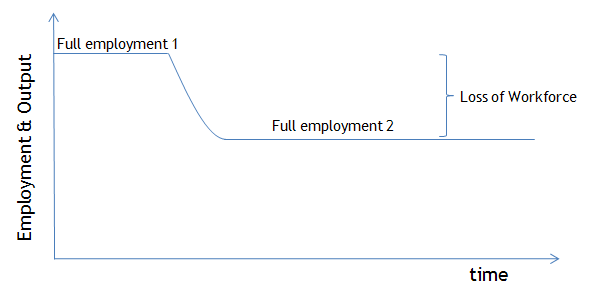

Thus, according to this model, in any continuous economy free of external intervention, if the initial reduction in the propensity to consume below the level that ensures full employment persists for long enough, the economy returns to equilibrium at a lower, newly established level of full employment, N1. This is shown in figure 4.

Figure 4. A true restoration of equilibrium in the Keynesian cross model

But, unlike the restoration of equilibrium where the unemployed find the yet undiscovered opportunities for employment, the true logic of the Keynesian model implies that the equilibrium is restored by the cessation of the physical existence of the unemployed (i.e., death). Any other outcome contains unresolved internal contradictions.

Conclusion

Contrary to the commonly used interpretation of the "Keynesian cross," continued fluctuations in output and employment cannot be produced by this model if its strict logic is coupled with the logic of human existence. In this case, the Keynesian model implies that prolonged business cycles could not persist in the absence of an intervention external to the market processes. However, for Keynes, government intervention was the cure, not the cause, of the business cycle. It then turns out that the Keynesians are Austrians during recessions "without even knowing it."

Rhetoric aside, given the inadequacies of the Keynesian paradigm, anyone interested in explaining the origins of the business cycle would benefit from seriously studying other economic theories. This is why I cannot agree with Professor Krugman's statement that the Austrian business-cycle theory is not "worthy of serious study."

Notes

[1] Keynes, J. M. 2006. The General Theory of Employment, Interest and Money. Atlantic Publishers & Distributors: New Delhi, pp. 14.

I have shown earlier that this odd idea ignores the existence of undiscovered opportunities for cooperation in an economy consisting of thousands or millions of individuals.

[2] Keynes, pp. 23.

[3] Samuelson, P.A. 1948. Economics: An Introductory Analysis. New York: McGraw-Hill.

[4] The concept of accounting value should not be confused with the concept of economic value. The aggregate accounting value is a number constructed using the market data — quantities of goods and services exchanged and the corresponding exchange ratios. The economic, subjective value is the importance that that an individual attributes to his or her means and ends when making a choice.

Predrag Rajsic is a PhD candidate in the Department of Food, Agricultural, and Resource Economics at the University of Guelph in Ontario, Canada. Send him mail. See Predrag Rajsic's article archives.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.