How the ECB Engineered the Euro’s Recovery

Currencies / Euro Jul 15, 2010 - 02:59 AM GMTBy: Gary_Dorsch

Trying to pick a winning trade in the foreign exchange market is similar to judging a “reverse beauty” contest. In other words, one must be able to identify the least ugly currency among its peers, at any given moment in time. All paper currencies are considered to be ugly, when compared to the “king of currencies” – Gold, since the central bankers are apt to print vast quantities of fiat currency, at the behest of government officials who have appointed them to run the printing presses.

Trying to pick a winning trade in the foreign exchange market is similar to judging a “reverse beauty” contest. In other words, one must be able to identify the least ugly currency among its peers, at any given moment in time. All paper currencies are considered to be ugly, when compared to the “king of currencies” – Gold, since the central bankers are apt to print vast quantities of fiat currency, at the behest of government officials who have appointed them to run the printing presses.

“By this means, government may secretly and unobserved, confiscate the wealth of the people, and not one man in a million will detect the theft,” – observed the late John Maynard Keynes, the father of modern macro-economics.

In the arcane world of foreign exchange, the axiom, - “the trend is your friend,” – is a very valuable piece of advice, since trends in currency pairs can extend for many months, or even years, often leading to double-digit returns. The Australian dollar is among the most volatile of currencies, due to its tight linkages to base metals and other commodities, and is now viewed as a global barometer for risk taking.

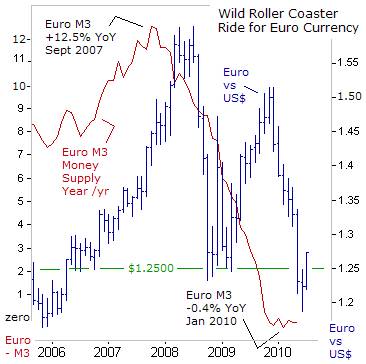

The Euro has also been exceptionally volatile this year, plunging by as much as 20% against the US-dollar to a four-year low of $1.1875, as Europe’s festering debt troubles were sending flashbacks to the Lehman Bros bankruptcy, when paralyzed bank lending had nearly triggered a global depression. Traders are now worried that European banks could face huge losses on some of the $1.3-trillion of loans extended to banks and private institutions in Greece, Spain, and Portugal.

The Euro has also been exceptionally volatile this year, plunging by as much as 20% against the US-dollar to a four-year low of $1.1875, as Europe’s festering debt troubles were sending flashbacks to the Lehman Bros bankruptcy, when paralyzed bank lending had nearly triggered a global depression. Traders are now worried that European banks could face huge losses on some of the $1.3-trillion of loans extended to banks and private institutions in Greece, Spain, and Portugal.

The hysteria over the solvency of the Club-Med countries, - Greece, Portugal and Spain, was whipped into a frenzy, with questions being asked about the long-term viability of the Euro itself. There was speculation that the 11-year-old currency could collapse, if Athens defaults on its debts and opts out of the Euro, in return for setting up its own central bank and regaining the ability to print drachmas.

Concern quickly spread beyond a possible default by Greece on its sovereign bonds. Portuguese and Spanish bond yields also turned sharply higher. Private-sector debt in the Club-Med countries is a big worry, because when governments must pay more for financing, so do corporate and private borrowers. Sharply higher interests can deepen an economic downturn, and lead to more corporate defaults. Already, the Euro M3 money supply has been stagnant for six months, with Euro-zone bank loans to the private sector stalled at +0.3% growth from a year ago.

Analysts estimate that European banks have lent about 2.2-trillion Euros to Greece, Spain, and Portugal, with about 567-billion Euros plowed into government debt, 534-billion Euros to companies in the private sector, and 1-trillion Euros to other banks. While Greece is the weakest debtor, much more was lent to Spain and its private sector, about 1.5-trillion Euros, compared with Greece’s 338-billion.

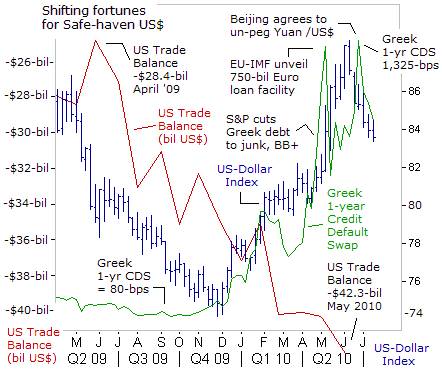

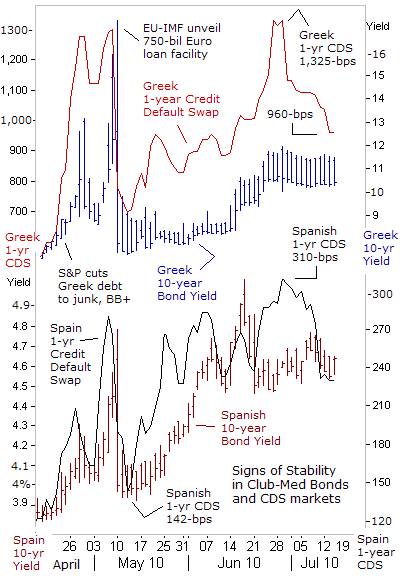

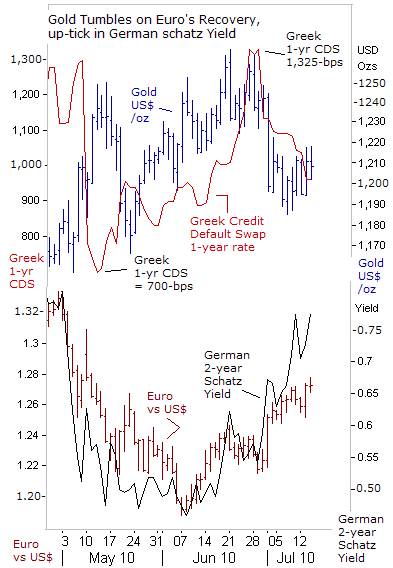

The ECB estimates that the Euro-zone’s largest banks will write-off 123-billion Euros ($150-billion) for bad loans this year, and an additional 105-billion Euros in 2011. According to the credit default swap markets, Greece is the most likely candidate to default, after 1-year CDS rates catapulted upwards to a record 1,325-basis points, (bps) in April and June, after hovering around 80-bps last year.

The ECB estimates that the Euro-zone’s largest banks will write-off 123-billion Euros ($150-billion) for bad loans this year, and an additional 105-billion Euros in 2011. According to the credit default swap markets, Greece is the most likely candidate to default, after 1-year CDS rates catapulted upwards to a record 1,325-basis points, (bps) in April and June, after hovering around 80-bps last year.

In the foreign exchange market, the US-dollar index turned higher against the Euro, British pound, Swiss franc and other currencies, (with the exception of the Japanese yen), tracking the upward spike in Greek CDS rates. The US-dollar, a heavily inflated and debt ridden currency, was utilized as a temporary “safe haven,” currency, - a depository for scared money fleeing the uglier looking Euro. A violent shakeout in industrial commodities, triggered by the sharp slide in Shanghai red-chips, and other stock markets, also swept the Aussie and Canadian petro-dollar lower.

The US-dollar index continued to surge higher towards the 88-level, tracking the Greek CDS market, which reached a record high of 1,325-bps in June. At the same time, the US-dollar’s surge made American goods less competitively priced in world markets. The US trade deficit widened to $42.3-billion in May, the highest level in 18-months. The deficit with Europe rose to $6.2-billion as imports rose by 3.2%, outpacing a 1.9% rise in US-exports to that region.

Still, the biggest culprit behind the widening US-trade deficit is China. The US-Sino deficit jumped +15.4% in May to $22.3-billion, and now equals 53% of the total US-shortfall. Thus, the US-dollar’s most glaring overvaluation is against the Chinese yuan, perhaps by as much as 40-percent. On a trade weighted basis, the US-dollar index looks increasingly vulnerable to a sustained decline. However, the primary driver behind the US-dollar index is capital flows into and out of global bonds and stocks, while trade flows generally have little influence.

European and IMF officials took quick steps to guarantee Club-Med’s debts, unveiling a €750-billion lending facility for weaker nations to raise capital, at affordable interest rates. Teetering on the edge of default, Europe’s banking Oligarchs averted catastrophe with repeated short-term fixes. The latest bailout is a wealth transfer from taxpayers and flowing directly to German, French and other foreign banks, which are creditors of Greek, Portuguese, and Spanish debt. Among the biggest winners are Banco Santander, BBVA, Société Générale, BNP Paribas, and Unicredit.

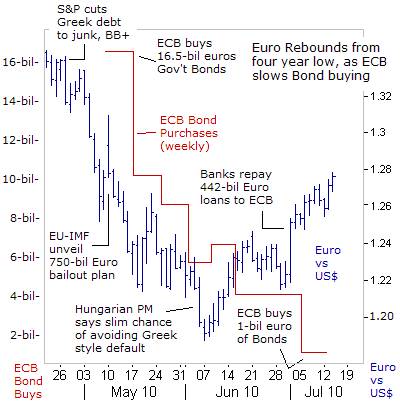

Euro-zone central banks started to buy government bonds on May 10th, in a reversal of the ECB’s long-held resistance to full-scale asset purchases as it fights to contain Greece’s debt crisis. ECB chief Jean “Tricky” Trichet gave no indication of how much the ECB’s agents were prepared to buy. Boosting its firepower further, the ECB restarted a US-dollar swap program with the Federal Reserve, in order to inject emergency US-dollar liquidity in the global money markets.

The ECB’s efforts to contain the wildfire in the Greek and Spanish bond markets, are starting to show signs of sustained success, and in turn, aiding the recovery of the Euro currency to $1.2750 this week. On May 10th, the ECB’s agents, - Bank of Italy, Bank of France, the Bank of Finland, the Slovenian central bank and the Bundesbank began buying Greek bonds. The “shock-and-awe” effect of the rescue operation, initially drove yields on Greece’s 10-year bond sharply lower, from a record high of 17.35%, to as low as 7.43% in a single day!

Since then, Greek bond yields have drifted upwards, but are now contained within a narrow range between 10.50% and 11.50-percent. Greek CDS rates are still dangerously high, but have tapered off dramatically from a record 1,325-bps on June 30th, to as low as 960-bps today, indicating much less fear of a Greek default or restructuring. Likewise, Spain’s 10-year bond yield has been capped at 5%, and Spanish CDS rates have also tumbled 80-bps in recent weeks.

Spain is the biggest ticking time bomb in the Euro-zone. On the surface, Spain’s debt load appears manageable. Its debt relative to gross domestic product is 54%, compared with 120% for Greece and 80% for Portugal. However, Spain’s private sector debt is 178% of GDP, and is heavily dependent upon fickle foreign investors for financing. Spain has 225-billion Euros in debt coming due this year, an amount that is about the size of Greece’s economy.

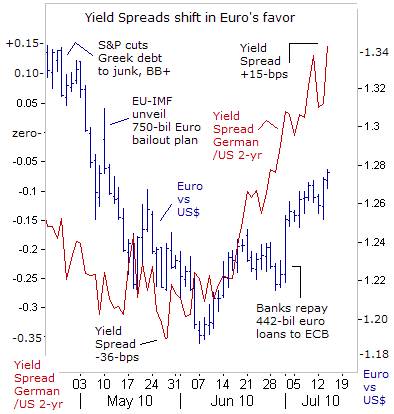

Following S&P’s decision to slash Greece’s debt rating to BB+, or junk status, the Euro began to cascade lower, losing 10% of its value in an orderly fashion, within five weeks time. The impetus for the Euro’s devaluation, were heightened expectations that the ECB would unleash its nuclear option – “Quantitative Easing,” (QE), or printing vast quantities of Euros on its electronic printing press, in order to monetize the debt of the Euro-zone biggest borrowers and delinquents.

Following S&P’s decision to slash Greece’s debt rating to BB+, or junk status, the Euro began to cascade lower, losing 10% of its value in an orderly fashion, within five weeks time. The impetus for the Euro’s devaluation, were heightened expectations that the ECB would unleash its nuclear option – “Quantitative Easing,” (QE), or printing vast quantities of Euros on its electronic printing press, in order to monetize the debt of the Euro-zone biggest borrowers and delinquents.

The climax of the Euro’s selling spree was reached on June 4th, when it skidded below $1.200, after a spokesman for Hungarian Prime Minister Viktor Orban told reporters that Hungary’s public finances were in a much worse shape than previously thought, and said there was a slim chance that Budapest could avoid a Greek-style scenario. However, as fate would have it, the deep seeded pessimism engulfing the beleaguered Euro would soon dissipate, as the ECB took remedial action.

Whereas the currency markets were bracing for the ECB to open-up the floodgates of Euro liquidity, with massive purchases of bonds, similar to the actions of the Fed, Bank of England, and Bank of Japan, just the opposite began to happen. “These purchases of bonds will be very limited. Their only goal is to restore the efficient functioning of bond markets and the monetary policy transmission mechanism. The liquidity which would be introduced, would again be sterilized,” said Bundesbank chief Axel Weber, on May 10th, yet few traders trusted Weber’s vow at the time.

The ECB’s bond buying spree, which began with a flurry of 16.5-billion Euros in the first week of operations, has been whittled down to only 1-billion Euros in the week ended July 7th. Some top ECB policymakers are already hinting at an early end to the QE-scheme amid signs that Greek and Spanish bond markets are stabilizing. The ECB has bought a total of 60-billion Euros worth of sovereign bonds so far, but has also drained 60-billion of Euros from the banking system, by offering to pay 0.56%, on one-week deposits held at the central bank.

Amid signals that the ECB is winding down its QE-scheme on an earlier than expected date, short-term German schatz yields have begun to shoot higher, climbing from a record low of 43-basis points on June 8th, to 77-basis points today. Schatz traders were pricing in the likelihood of a half-point ECB rate cut to 0.50% by year’s end, but now, that speculation looks far fetched. In a separate operation, the ECB drained 200-billion Euros out of the banking system on July 13th, lifting short term interest rates higher, and giving an extra boost to the Euro currency.

Amid signals that the ECB is winding down its QE-scheme on an earlier than expected date, short-term German schatz yields have begun to shoot higher, climbing from a record low of 43-basis points on June 8th, to 77-basis points today. Schatz traders were pricing in the likelihood of a half-point ECB rate cut to 0.50% by year’s end, but now, that speculation looks far fetched. In a separate operation, the ECB drained 200-billion Euros out of the banking system on July 13th, lifting short term interest rates higher, and giving an extra boost to the Euro currency.

Since the Euro hit bottom at $1.1875 on June 7th, the interest rate spreads between Germany’s benchmark 2-year schatz and the US Treasury’s 2-year note, have widened significantly in the Euro’s favor. Germany’s 2-year schatz now yields �basis points more than comparable US Treasury notes, far higher than -35-basis points a few weeks ago. The 50-basis point swing in favor of German schatz yields has uplifted the Euro by roughly 9-US-cents, to a high of $1.2775 today.

While the ECB appears to be winding down its mini-QE campaign, and sterilizing its bond buying program, the Federal Reserve is now starting to send the opposite signals to the marketplace. At the June 22-23rd meeting of the Fed’s policy board, the consensus opinion agreed that further policy stimulus (QE) might become appropriate, if the economic outlook were to worsen appreciably.

Long-term holders of Gold, - the king of currencies, - have suspected for quite some time, that the Fed would eventually re-activate its nuclear QE-weapon, in order to monetize Washington’s debts, and those of state governments, which are going broke. On July 13th Boston Fed chief Eric Rosengren warned the Fed had not run out of ammunition just because official interest rates are now at zero. “There are several policy options if we think the economy is weaker than we would like," he said.

Rosengren added that he was nervous about the prospect of a deflationary spiral, “The risk of deflation has gone up and is more of a risk than I would like to see at this point,” he said. The prospect of more money printing by the Fed continues to buoy the Gold market, for the longer-term view. But in the short-term, - a rebounding Euro, an up-tick in German schatz yields, and a sizeable slide in Greek CDS rate, have all conspired to knock Gold off its all-time highs.

Rosengren added that he was nervous about the prospect of a deflationary spiral, “The risk of deflation has gone up and is more of a risk than I would like to see at this point,” he said. The prospect of more money printing by the Fed continues to buoy the Gold market, for the longer-term view. But in the short-term, - a rebounding Euro, an up-tick in German schatz yields, and a sizeable slide in Greek CDS rate, have all conspired to knock Gold off its all-time highs.

Euro-zone politicians are trying to refurbish the Euro’s stature, by adopting fiscal austerity measures to reduce their bloated budget deficits. At the same time, the ECB has begun to tweak its monetary policy, by jigging-up German schatz rates, and sterilizing its debt purchases. Looking ahead, the Euro could look less ugly compared to the US-dollar, if the Fed cranks-up its money printing operations.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.