Stocks or Gold, What's Real?

Commodities / Gold and Silver 2010 Aug 10, 2010 - 02:30 PM GMTBy: Steve_Betts

"It is my opinion that the use of this barbarous weapon at Hiroshima and Nagasaki was of no material assistance in our war against Japan. " - "The lethal possibilities of atomic warfare in the future are frightening. My own feeling was that in being the first to use it, we had adopted an ethical standard common to the barbarians of the Dark Ages." --- William Leahy, Chief of Staff to Presidents Franklin Roosevelt and Harry Truman - I Was There, pg. 441.

"It is my opinion that the use of this barbarous weapon at Hiroshima and Nagasaki was of no material assistance in our war against Japan. " - "The lethal possibilities of atomic warfare in the future are frightening. My own feeling was that in being the first to use it, we had adopted an ethical standard common to the barbarians of the Dark Ages." --- William Leahy, Chief of Staff to Presidents Franklin Roosevelt and Harry Truman - I Was There, pg. 441.

We’re going to go at it from a different angle today, stepping back away from the everyday chatter, to take a look at a series of historical charts. There is a lot of misinformation about what makes money and what doesn’t, and about what constitutes risk and what doesn’t. I think if we focus our attention on months and years, instead of minutes and hours, we may actually learn something. One of the so called market truths I want to look at is this idea that stocks go up over a long period of time, so you simply buy them and put them away in order to make money. They point to how the Dow has risen over the decades as proof that stocks are a good long term investment. Simply put, that is a big lie! What follows is a list of the current Dow 30 stocks:

Notice the emphasis on the word current. I do that because these weren’t the Dow 30 stocks ten years ago. Below I have a list of the Dow stocks that were weeded out over the last decade:

Anyone who bought the list back in 2000 suffered significant losses with General Motors and Citibank as they became penny stocks. Now I’ll go so far as to assume that you have “second sight” and you bought the current list back in 2000. You still would have lost money because the Dow opened the decade at 11,400 and is currently trading at 10,610 as of 12:30 pm EST. I suppose you could claim that dividends would have made up for some of the loss but the average dividend yield is a 2.5% and I could have purchased a ten-year treasury back in 2000 that paid 5% or more and my capital would have been “guaranteed”. So stocks came up short in both price and yield.

If that’s the case maybe bonds were the solution. It's true that bonds did rally from 99.00 back in 2000 to their current level of 129.00, for a gain of 23.23%, plus interest paid out every year. Assuming 5%/year and you’re looking at 62.88% interest earned for the decade. On the surface it sounds like a good deal, and it certainly is better than stocks.

There is always the alternative of cash; as they used to say back in the 30’s and 40’s, cash is king. Obviously if you would have left your money in a savings account back in 2000, earning a miserable 2% per year, your capital would have been safe. Right? Wrong! Take a look at the monthly chart for the US Dollar Index below:

This Index stood at 105.00 in early 2000 and is now at 81.00 meaning that the US dollar has lost 29.2% of its real value over the last decade, and that was probably more than the interest earned. Now stop and think about the stocks and bonds denominated in US dollars. What was a small loss in stocks in now 29.2% bigger in real terms and the gains in bonds were more than cut in half by the decline in the value of the greenback. So stocks ended up the big loser, cash lost a little, and bonds probably gained 30% for the decade; not exactly the stuff fortunes are made out of.

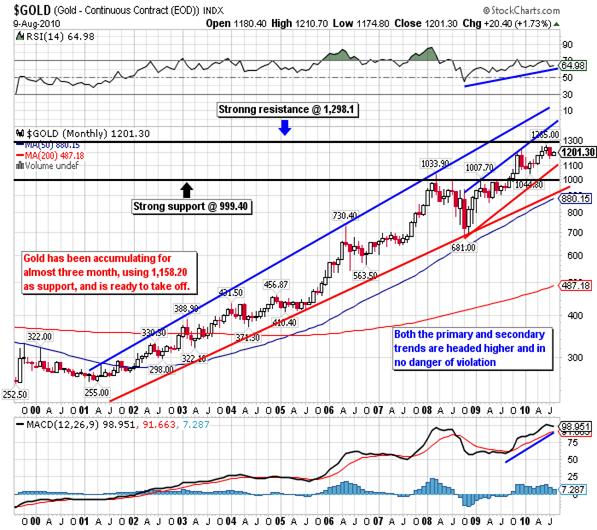

So if paper assets didn’t exactly set the world on fire over the last decade, what did? The answer is not blowing in the wind my friend, instead it’s found in a “high risk” and “barbarous relic” known s gold! It’s been in use for thousands of years, and that’s thousands of years more than fiat currency, bonds, or stocks. Over the last ten years it has moved from a 1999 low of 252.50 to the current price of 1,199.00 and it’s on a ten year winning streak. Almost no one talks about the yellow metal and those that do usually give you ten reasons not to own it. Renowned guru Robert Prechter of Elliot Wave fame has been calling or gold’s demise for five years, he’s been dead wrong for five years, and yet everyone hangs on his every word. Go figure! Too make matters worse, even less people own it than talk about it.

For those of you who think that gold rode the back of commodities, you would do well to think again. Take a look at the following monthly chart of the CRB Index:

Commodities topped in June 2008 and have been struggling every since while the price of gold moved from 800.00 to 1,200.00 over that same period. That’s a 50% gain for those of you who are a bit rust with your math. This serves to highlight what I going on with gold, and is being missed by just about everyone. Gold is rallying in spite of weakness in commodities and paper assets, it is rallying in every major currency, it rallies whether the dollar rises or falls, and it is the only real store of value that is making real money in real terms over a decade. That’s a little known fact that no one seems to talk about on TV. In conclusion I find it truly amazing that I could the pull the name of some NASDAQ stock out of a hat, valued at 60 times earnings, and have clients lined up to buy it based on a balance sheet that reads like bad fiction. Those same folks rode Enron all the way down! Yet something like gold, that’s stood the test of time, won’t even get a second look. That’s why my best advice is to buy gold (and silver)!

[You can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).]

By Steve BettsE-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.