US Mint Running Out of Silver (and Excuses)

Commodities / Gold and Silver 2010 Sep 09, 2010 - 04:51 AM GMTBy: Tarek_Saab

In Title 31 of the US Code, the United States Mint is required by law to supply "in quantities sufficient to meet public demand, one dollar silver bullion coins of specified size, weight, and design." (Source) This law is widely referenced, and I have criticized the US Mint in the past when it fails to meet consumer demand because of poor planning, despite the availability of silver.

In Title 31 of the US Code, the United States Mint is required by law to supply "in quantities sufficient to meet public demand, one dollar silver bullion coins of specified size, weight, and design." (Source) This law is widely referenced, and I have criticized the US Mint in the past when it fails to meet consumer demand because of poor planning, despite the availability of silver.

DOMESTIC SILVER SUPPLY

However, there is an incredible amount of confusion about a second law which allegedly states that the US Mint must supply its silver "blanks" from domestic resources. At present, two of these resources are the Sunshine Mint and Stern-Leach. On June 5th, 2008, during the first massive Silver Eagle shortage, the director of the US Mint published the following statement:

"By law, the United States Mint's American Eagle silver bullion coins must meet exacting specifications and must be composed of newly mined silver acquired from domestic sources. The United States Mint will continue to make every effort to increase its acquisition of silver bullion blanks that meet these specifications and requirements to address continuing high demand in the silver bullion coin market." (Source)

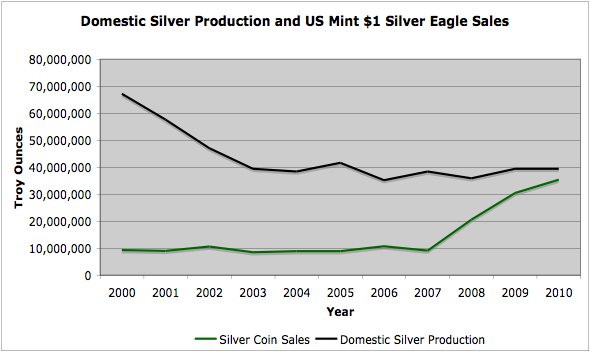

This interpretation of the law is extremely relevant because Silver American Eagle sales are now on the verge of surpassing total domestic silver mine production.

*2010 data assumes flat domestic silver production from 2009 YoY. Silver Eagles sales figures are linear estimates based on 23.6M coins sold through August 2010, with no market assumptions. Sources Silver Production: USGS.gov Silver Eagle Sales: USMINT.gov

WHAT DOES THE LAW ACTUALLY SAY?

However, many contend that the 'domestic supply' law doesn't actually exist for silver, but has been confused with a different law on the books for gold, PUBLIC LAW 99-185—DEC. 17, 1985 99 STAT. 1179.

“(4) The Secretary shall acquire gold for the coins issued under section 5112(i) of this title by purchase of gold mined from natural deposits in the United States, or in a territory or possession of the United States, within one year after the month in which the ore from which it is derived was mined."

There is no mention of silver in this law. In fact, the only mention we found for silver supply chain requirements comes from Title 31 U.S.C. § 5112 : US Code - Section 5112: Denominations, specifications, and design of coins:

"(C) Sources of bullion. - The Secretary shall obtain silver for minting coins under subparagraph (B) from available resources, including stockpiles established under the Strategic and Critical Materials Stock Piling Act."

With respect to the law on the books for gold, the phrase "available resources" is somewhat ambiguous. Are there any qualifiers to an "available resource"?

This ambiguity is so serious that in 2002 Representative Frank Lucas of Oklahoma proposed the Silver Eagle Coin Continuation Act of 2002 (H.R. 4846) to the House of Representatives "to amend title 31, United States Code, to clarify the sources of silver for bullion coins, and for other purposes."

On June 25, 2002, this bill passed the house by a count of 417 Ayes to 1 No (16 Abstain) and moved onto the Senate as S. 2594 [107th]: Support of American Eagle Silver Bullion Program Act.

However, the Senate referred this legislation to the Committee on Banking, Housing, and Urban Affairs, where it has since remained, and has never been signed into law.

So where does that leave the situation? It apparently leaves us with an ambiguous law that is open to interpretation by the only party with the authority to make one - the Treasury Department.

We will discover the ramifications soon enough. If the United States Mint decides not to source in the open market or tap into strategic reserves, the data would indicate that there will be extreme domestic shortages. If they do decide to source from the open market, well, who knows? . . . What happens when the US Mint begins buying physical bullion on the open market?

'Til next time, that's my Saab Story.

By Tarek Saab

Website: trustedbullion.com E-mail: tarek@trustedbullion.com

Tarek Saab is an entrepreneur, speaker, and nationally syndicated author. He is the founder of Saab & Company Inc., which owned the online bullion business, Guardian Commodities, before it was acquired by Trusted Bullion in August 2010. An avid precious metals enthusiast, his column, Saab Stories, is published on this site and syndicated on many others.

Tarek rose to fame as a popular contestant on Season Five of The Apprentice with Donald Trump. He has been prominently featured in such magazines as Us Weekly, TV Guide, People, Enigma, In Touch Weekly, The Dallas Business Journal, The Fort Worth Business Journal, Digital Gold Currency Magazine, The Mensa Bulletin and numerous other print and online publications.

© 2010 Copyright Tarek Saab - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.