Flash Stock Market Crash, the Dark Side of Stop Loss Orders

InvestorEducation / Learning to Invest Oct 03, 2010 - 06:06 AM GMTBy: Richard_Shaw

We are proponents of persistent percentage trailing stop loss orders to protect against significantly declining markets. If more investors used stop loss orders, fewer investors would have been devastated by the the 2008 stock market crash. Just like seat belts and airbags that save lives in auto crashes, stop loss orders save portfolios in market crashes. However, in a small minority of cases, seat belts or airbags are a partial cause of injury in an auto crash. Similarly, in a small minority of cases, stop loss orders are a partial cause of investment losses.

We are proponents of persistent percentage trailing stop loss orders to protect against significantly declining markets. If more investors used stop loss orders, fewer investors would have been devastated by the the 2008 stock market crash. Just like seat belts and airbags that save lives in auto crashes, stop loss orders save portfolios in market crashes. However, in a small minority of cases, seat belts or airbags are a partial cause of injury in an auto crash. Similarly, in a small minority of cases, stop loss orders are a partial cause of investment losses.

Unfortunately, the frequency of occasions where stop loss orders are part of unintended, loss producing trades may be on the increase. In former times, specialists were charged with maintaining an orderly market by creating supply or demand when needed to smooth price movements. These days electronic trading reigns with some occasional severe price distortions. That's where the dark side of stop loss orders comes into play.

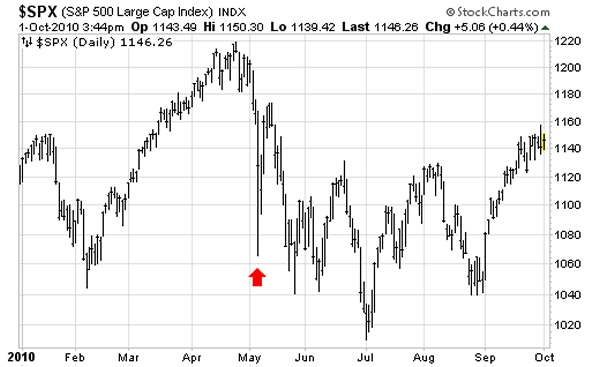

The "flash crash" of May 6th 2010 is an obvious and dramatic example of market chaos that can arise from electronic trading without the smoothing actions of specialists. Some regulations may be changing, but we doubt they will be sufficient anytime soon.

This chart shows the nearly 100 point "instantaneous" drop in the S&P 500 on May 6th. We had millions of dollars in positions in SPY that day and all were stopped out, but fortunately, the price before the stop was already close to the trigger price; and because of the extreme liquidity of SPY, we suffered only a minor loss. Take note that liquidity is key when thinking about stop loss orders. The less the liquidity the greater the danger.

We have a policy of (a) not owning securities with less than 3-month average daily dollar trading volume of $25,000 per minute, and (b) not owning more than 2% of the daily dollar trading volume of a security (preferably less than 1%) -- not a perfect solution, but it helps

This chart is for the Vanguard Total US stock market, a far less liquid security, which also took a deep instantaneous dive on May 6th. We had some, but not much of that ETF at that time. Rather than the lower than 10% dive for SPY, VTI declined nearly 50% in a few seconds.

Many investors with stop losses were partially restored that day by the dealers breaking some of the trades, but not all trades were reversed.

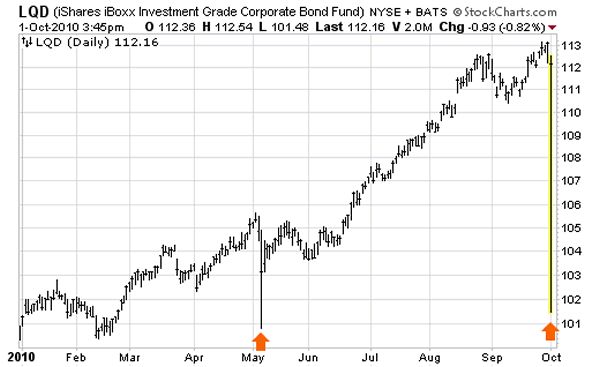

Unfortunately, the problems are not gone, and the non-specialist, electronic trading system can still be a treacherous system. Case in point, LQD today.

Yesterday, September 30, LQD closed as $113.09. At the open today, in the first minute, the low was $101.25 -- over a 10% decline. At the end of the second minute of trading, the low was $111.75 and the high was $112.54.

In the complete absence of major negative news, a diversified portfolio of investment grade corporate bonds has absolutely no fundamental or technical reason to decline by 10% on an overnight basis -- and if it did have reason, then there is no reason to recover the 10% loss in the next one minute. This is a pure and simple example of the failure of the currently constructed electronic trading systems to create and maintain a reasonably orderly market -- and a good example of why so many investors are frightened away. There is an urgent need for some kind of stabilizing, circuit-breaker algorithms per security to be built into the electronic system in the absence of human specialists

To our shock and dismay today, we had LQD positions in several accounts with stop loss trigger prices of approximately $109. Those positions were stopped at 9:31 AM at prices between $101.74 and $101.81. Those were huge losses equal to about 2.5 years of interest and substantially more than the losses that would have occurred with a sudden unexpected 2% interest rate increase.

To our extraordinary relief, Schwab (the broker we use), adjusted those trades. They couldn't reverse them -- we are still stopped, but they were able to establish a "bad print" and adjusted our execution price to levels we found quite satisfactory in the vicinity of the prices that prevailed in the minute after our stop.

So much for our tale of horror, and relief. The issue for you is to be aware of these electronic trading risks and pick the alternative that best suits you.

With some (perhaps many) brokers you have these choices;

- do nothing -- buy and hold -- avoid whipsaws, but suffer the damage of the next "2008"

- closely monitor price and use mental stops -- immune from electronic distortions, but exposed to emotional instead of rational exit decisions, and need for constant observation (no time off)

- use technical stops -- removes emotional decisions, but you've got to be watching all the time (forget two week vacations)

- use multiple criteria conditions for stops (e.g. Bid and Ask pierce trigger price) -- but those orders expire and new trailing stops cannot restore old set points

- (at Schwab) use non-expiring "bracket" orders when opening a position -- automatic until you cancel order, but only based on Bid which sometimes collapses (as it did for LQD today)

Our problem today, was the we chose #5 for non-expiring protection, but were hit by collapsing Bids. You can bet we raised heck with Schwab suggesting that they should make the multiple conditions options available on bracket orders that they make available on approach #4 -- or, they should make the multiple conditions approach of #4 non-expiring, at least as an option. If you use both the Bid and the Ask as conditions, it is less likely that a instantaneously collapsing Bid would be accompanied by an instantaneously collapsing Ask.

If you have a short-term position (less than 60 day horizon at Schwab or a 120 day horizon at Fidelity to match their expiration times), we strongly recommend method #4. If you have a long-term position, we recommend using very liquid securities and approach #5 (unless you are an accomplished technical trader with option #3).

Keep in mind that stop-loss orders (which are market orders when executed) are not available for mutual funds, options, or individual bonds, but are available for stocks, ETFs, ETNs, CEFs, MLPs, and public royalty trusts. To deal with that problem, we have developed an in-house "stop alert" system that makes an end-of-day evaluation of securities it tracks and emails QVM, as well as the client if they wish, to suggest it is time to exit a position. That is the only practical solution we have for stop loss option #4 after the order expires.

Until Schwab or others implement a multiple conditions option for non-expiring, investors are left with choosing their form of protection from alternatives each with positive and negative attributes.

We hope this article helps brokers more seriously consider the needs of investors for multiple conditions, non-expiring stop loss orders; and helps investors think more comprehensively about the pluses and minuses of different stop loss order approached..

Holdings Disclosure: As of October 1, 2010, we hold SPY and LQD in some managed accounts.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.