The Third Uranium Boom

Commodities / Uranium Oct 06, 2010 - 06:13 AM GMTBy: Madison_Avenue_R

Mark Steen knows uranium, besides receiving formal education at the Mackey School of Mines, he is the son of Charlie Steen whom is credited with making the first big uranium discovery in 1951 on the Colorado Plateau. He has had a long time interest in the geology of uranium ore deposits and the history of uranium exploration. As a result of his father’s discovery the Four Corners (Utah, Colorado, New Mexico, Arizona) area opened up and prospectors and geologists started looking for sandstone hosted uranium deposits throughout the Colorado Plateau.

Mark Steen knows uranium, besides receiving formal education at the Mackey School of Mines, he is the son of Charlie Steen whom is credited with making the first big uranium discovery in 1951 on the Colorado Plateau. He has had a long time interest in the geology of uranium ore deposits and the history of uranium exploration. As a result of his father’s discovery the Four Corners (Utah, Colorado, New Mexico, Arizona) area opened up and prospectors and geologists started looking for sandstone hosted uranium deposits throughout the Colorado Plateau.

The first uranium boom was the post WWII nuclear boom, second was the 60s & 70s utilities boom with plans to build more than 100 new reactors in the USA alone -- this ended with Three Mile Island.

Mr. Steen believes the third Uranium boom is in its infancy and about to usher in a wave of higher prices for the commodity as governments, utilities, and a growing chorus of green pundits around the world recognize nuclear power is the only hope for clean, reliable, and efficient energy.

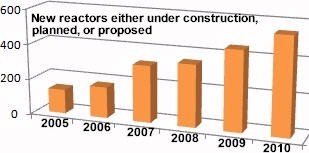

Long Term Price Support for U3O8 will come from international competition for the commodity as a result of escalating nuclear programs in nations such as India and China. There are currently only 441 operational nuclear reactors worldwide and that number is expected to grow significantly within the next decade. According to the World Nuclear Association there are official plans in the works worldwide for 547 new reactors (either under construction, planned, or proposed), 182 of those new reactors are in China alone, 64 in India, 54 in Russia, 32 in the USA, and these numbers are expected to grow.

Rapid growth in number of reactors - price to follow

Figure A. Global commitment for new reactors either under construction, planned, or proposed. Click here for complete list broken down by country as of Q3 2010. |

Mark Steen believes prices are destined to go over $100/lb for U3O8 within the near future; “Uranium prices should eventually stabilize around $110 – 120 per pound to meet the needs of all these new reactors.” Uranium Miner notes there is evidence of an acceleration in commitments internationally, the aforementioned 547 new reactors (either under construction, planned, or proposed) was only 137 reactors in mid-2005 (U308 was US$47.25/lb), 175 reactors in mid-2006 (U308 was US$47.25/lb), 320 reactors in mid-2007 (U308 was US$120/lb), 350 reactors in mid-2008 (U308 was US$64.50/lb), 450 in mid-2009 (U308 was US$47/lb). Mark Steen also sees the upcoming midterm elections in the USA as providing impetus for higher prices "The upcoming elections will likely help drive up the price of uranium; Congress needs to have a rational pro nuclear energy policy. It is already happening in Europe and Asia. This will encourage the utilities to step up the construction of new reactors and the USA will be on the road to energy independence in terms of clean electricity.” Click here for historic market price of U3O8. See complete breakdown by country for reactors and uranium required here.

Focusing on the western extension of the Grants Uranium Mineral Belt for the next big uranium discovery

As a result of Mark Steen’s father’s discovery, geologists started looking for uranium elsewhere on the Colorado Plateau and exploration soon lead to the discovery of the Grants Uranium Mineral Belt in New Mexico . The Grants Uranium Mineral Belt produced more uranium between 1951 and 1980 than any other uranium district in the world. It produced more than 336M pounds of Uranium from 134 properties. The Grants Uranium Belt extends for 93 miles in length. The maximum width of the belt is 24 miles, but most of the uranium ore deposits are located within a 5 – 15 mile wide zone within the belt. The Department of Energy (DOE) estimated that there's still ~239M pounds of U3O8 for the taking from the belt and potential for substantially more. The uranium deposits are found at increasing depth from west to east. Early exploitation on the Grants Uranium Mineral Belt was the relatively shallow deposits in the western portion; however major uranium discoveries were made in the deeper regions to the east during the 1970s. During this same time, exploration in the deeper portions of the San Juan Basin discovered several significant uranium deposits.

Where to look for major discovery potential: Encouraged by deeper exploration in the Grants Mineral Belt, the DOE drilled 15 holes north of the main belt. Following this drilling program, the DOE estimated the resource potential of this area to be 380,000 tons of uranium (that’s 760M pounds). Mark Steen was responsible for staking unpatented mining claims in this area. The most prospective are now controlled by Everett Resources. In 1980, the DOE estimated the potential resources of the Westwater Canyon Member of the Morrison formation had the potential to produce 864,000 tons of Uranium, that’s 1.728M pounds of U3O8. According to Mark Steen “Everett’s claims are in elephant country, if you are going on safari for big uranium deposits, this is where you go. No other area in North America has the potential that the deeper portions of the San Juan basin have for major discoveries. No doubt there is a tremendous potential here, and we know from our follow-up research there is uranium below our [Everett Resources'] claim groups.”

ISR technology overcomes issue of recovery at depth: Large uranium deposits in the deeper portions of the San Juan Basin are not hindered by depth since the advent of in-situ recovery (ISR) technology. The in-situ process uses injection and extraction wells to circulate water through the ore body (Bonus: your discovery holes often become your production wells), removing the uranium, but leaving the rock undisturbed. The native groundwater has a sodium bicarbonate solution similar to club soda added to it. Gaseous oxygen is also added to mobilize the uranium, which is then "washed" from the sand grains by the carbonate. Once the solution is brought to the surface ISR uses the same technique as that of a home-based water softener, except on a much larger scale, to remove the mineral from solution to make yellow cake and the water is then recirculated.

ISR has been successfully used in the USA for over 20 years now. In west Texas, Uranium Resources Inc. (URI) has produced over 7 million pounds of U3O8 and also is active with ISR in New Mexico, where the State Engineer approved the company’s application and granted sufficient water rights for the life of the Crownpoint ISR project. URI has been approved for ISR in the same host rock and approximately the same depth as where Everett Resources Ltd. would be looking for uranium.

Where Mark Steen Sees Opportunity

JV partner sought to secure major uranium discovery potential

Mark Steen is involved with Everett Resources Ltd. (TSX-V: EAR) (US Listing: EVRTF) which holds his best ground situated in the deeper portion of the San Juan Basin.

Everett's land package contains several radioactive anomalies in the same strata where uranium was discovered in the past. “Gama ray logs indicate the uranium is there, the belt of mineralization runs from the NW to the SE. So EAR.V needs to drill on strike and along the trend to delineate the deposit. EAR.V can then use the same discovery drill holes for production; they could be the injection holes. These would be circled with recovery holes. ISR only works if you have the right conditions; EAR.V has the right conditions in terms of the sandstone host rocks, the porosity, and thickness for a huge discovery and successful production. EAR.V has some very good ground. These can be extremely rich deposits, they can run for miles in strike length and there is no reason we can’t anticipate ore grades similar to that which was produced in the past. What we are looking for is a JV partner that likes the concept and wants to get in on the ground floor of a major uranium play just before the price of uranium takes off again.”

In looking at the potential it helps to recognize that the biggest elephant that anyone has ever discovered in the Grants Mineral Belt occurred in 1968 with the discovery of ore grade uranium at the Mt. Taylor deposit at a depth of 2700 feet. The Mt. Taylor deposit extends for 5 miles along strike and contains more than 100M pounds of Uranium with an average grade of.20% U3O8. Significantly, more than 40M pounds of uranium are contained in ore that grades .50% U3O8. This is extremely high grade ore for a sandstone hosted uranium deposits.

Click http://www.uraniumminer.net/ear.htm for full (extended) copy and to see where Mark Steen sees opportunity.

Content Provided by

Joseph Williams, Editor

Madison Avenue Research Group and Uranium Miner Journal

info@madisonavenueresearch.com

© 2010 Copyright Madison Avenue Research Group- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.