Dollar Gold, Rand Gold, DOW, JSE Gold and HUI

Commodities / Gold and Silver 2010 Oct 11, 2010 - 09:41 AM GMTBy: Hubert_Moolman

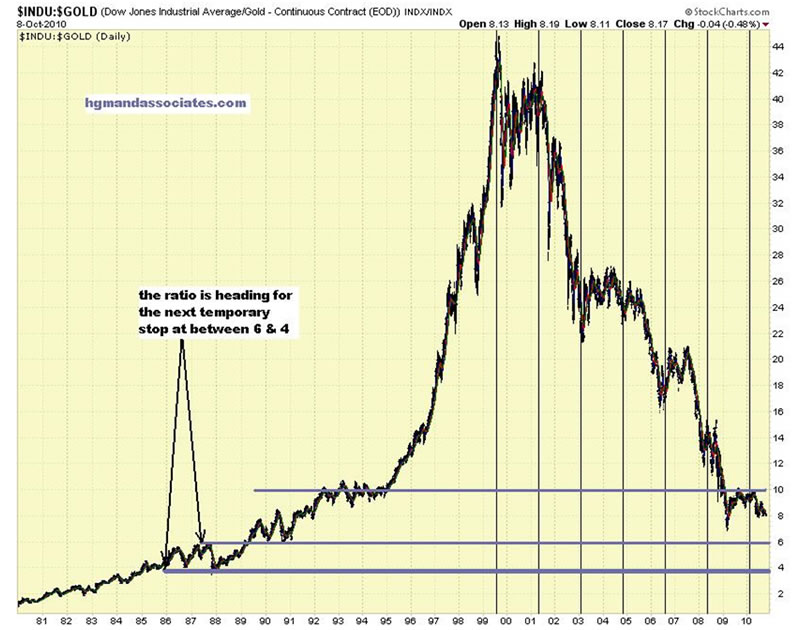

Let’s start with a big picture view. Below is a long term Dow/gold ratio chart. As you can see on the chart, it has just been one-way traffic the last ten years, with the ratio moving down from almost 45 to about 8.16. It seems that the next temporary stop might be between the 4 and 6 level. I have previously written how the 10 Dow/gold ratio level has been a pivot point back all the way to 1930.

Let’s start with a big picture view. Below is a long term Dow/gold ratio chart. As you can see on the chart, it has just been one-way traffic the last ten years, with the ratio moving down from almost 45 to about 8.16. It seems that the next temporary stop might be between the 4 and 6 level. I have previously written how the 10 Dow/gold ratio level has been a pivot point back all the way to 1930.

This number has acted like a “golden ratio” in that things really start to happen before or after the Dow/gold ratio breaches 10, in either direction. In the past it was the level from where either the gold price or the Dow increased spectacularly while the other went nowhere to down.

Chart generated on the stockcharts.com website

As you can see on the chart, in 2009 the ratio went through the 10 level (going down), touching 7, from where it went back to test the 10 level. Since April 2010, it has resumed the downward move and appears ready to accelerate its fall.

So, in my opinion conditions will continue to favour gold, relative to the Dow.

What will be the effect of conditions on gold, going forward?

Higher—much higher—prices. That will be the major effect on the gold price, going forward. From a shorter term perspective, things are much like they were in 2007. This can be seen from the following chart:

chart generated on the fxstreet.com website

More information and analysis of this chart is available to subscribers to my premium service.

From a longer term perspective (see my Long Term Gold Fractal Analysis), conditions are much more like the 70s, when gold was continuously making all time highs. The similarities to the 70s are likely to continue throughout this decade, with conditions propelling gold higher on a parabolic path, whereas the world economy and the Dow in particular will be going nowhere. The world’s great debt bubble will continue deflating, and until it has appropriately deflated there can be no recovery. Along with gold and silver, much higher prices should eventually be expected for commodities, whereas paper and all things inflated by the great debt bubble of the last century should lose significant value relative to gold, silver and commodities.

What will be the effect of conditions on the Dow, going forward?

As I have said, I expect the world economy to go nowhere over the next decade. It can only recover when we are at the end of this huge debt crisis, which could take another 10 years or more. A peak in the gold price will likely be a good signal that the end of the world debt crisis is only a few years away. I believe we are still far from a peak in the gold price, however, which means we’re even further from having conditions suitable for a growing world economy and a Dow worth investing in.

I wrote previously: “Debt levels have become a huge burden and will strangle the world economy for at least the next 10 years. The debt will have to be settled eventually, either voluntarily (unlikely) or by force (death of all fiat denominated debt). All future production will be severely reduced by the debt obligation and the effects will be a world economy in chaos and possibly with life threatening phenomena like starvation being the order of the day.

That is just how it works when you have huge debt – you will have less of your future income/production available due to the debt obligation that has to be met every month.”

From a shorter term perspective, the 11000 level could prove to be a barrier to the Dow, and it could fall to the 9000 level or below.

The Rand Gold Price

Below is a chart of the South African rand gold price.

chart generated on the goldprice.org website

I have indicated a possible symmetrical triangle. In textbook fashion, the price broke out of the triangle, advanced for a few weeks, and has returned to a support at nearly the same level where it broke out. It is now at a point where it could spike significantly higher. This is a great signal for the SA gold miners, as well as possible evidence that the HUI breakout will have “legs”. For more analysis on JSE gold miners and the HUI index, please visit my website (premium service).

Conclusion

I believe gold and silver are the assets to own throughout the next several years. They might be the most functional assets with which to protect one’s wealth during the coming storm. I encourage you to look after yourself and your loved ones, and please obtain the most functional assets to protect your wealth.

Warm regards and God bless

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

Please visit my blog and website for more of my work and premium service. http://hgmandassociates.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2010 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.