Hot Commodities, The Place To Be Invested

Commodities / Investing 2010 Oct 24, 2010 - 04:48 AM GMTBy: Charles_Maley

As one watches the day to day advice on CNBC, you will notice that we are inundated with stock advice. Bank of America this, Goldman Sachs that, and of course Apple Computer will run the world shortly. But when it comes to commodities, they are rarely explored with the exception of gold, copper and oil.

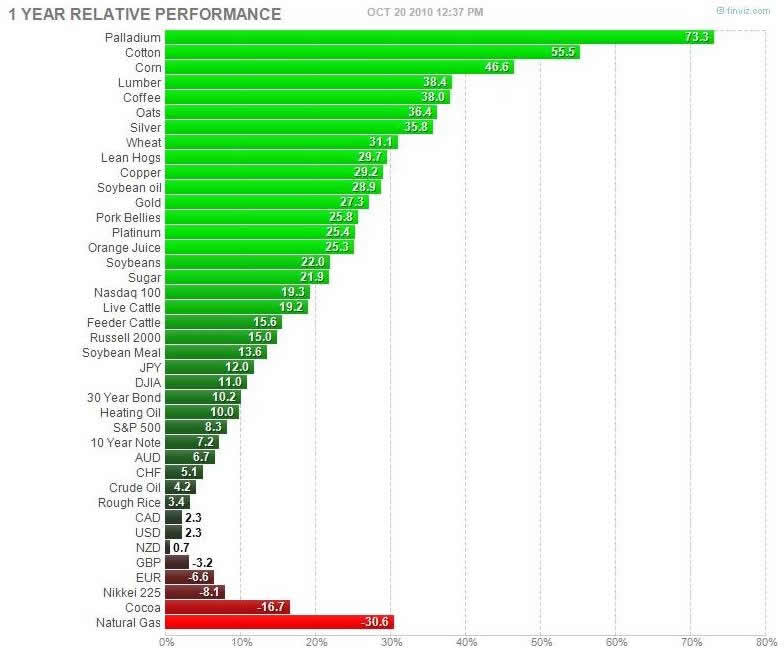

Granted, there have been some great single stock performances over the last 12 months, but as a whole the S&P has grossly underperformed most commodities. The S&P for the 12 month look back is up 8.3%. Also worthwhile mentioning is that this brings us into territory where we are trading at 21.57 times earnings with a dividend yield of 1.87%. Although there is always room for more stock upside, this is not a “cheap” market as we are told daily on CNBC.

Now, let’s look at some commodities for that same period. Palladium is up 73% and Cotton is up 55%. In fact 21 different commodities have outperformed the S&P, and 17 of them are up 0ver 20% for the 12 month period. Natural gas and cocoa are the only commodities that are tracked here that are down over the last 12 months.

I don’t know what fools the Government takes us for, but they want us to believe that there is no inflation. The most recent inflation numbers posted by Robert Schiller reflect inflation running at 1.4%.

I have a question. Can we really expect a new cotton shirt to be up only 1.4% when cotton has gone up 55% in the last year? Will I still pay the same for breakfast when Pork bellies and OJ rose over 25%, and coffee over 38%? Can I expect my grocery bills to go up only 1.4% when wheat and oats went up over 30% and corn is up over 45%, Cattle up over 19% and hogs up over 29%? I doubt it.

I don’t think there is much question that commodities have been the place to be over the last year, and my guess is that they will be the place to be for some time to come. I think that if we are truly in a recovery then commodity prices will reflect the recovery and lead the way out. On the other hand, if this is a false alarm recovery boosted by the government QE1 and potential QE2 aid, then you will want to own “real things” and not paper or fiat currency.

So, wake up and smell the coffee as they say.

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them. Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley www.viewpointsofacommoditytrader.com Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2010 Copyright Charles Maley - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.