silver speculation

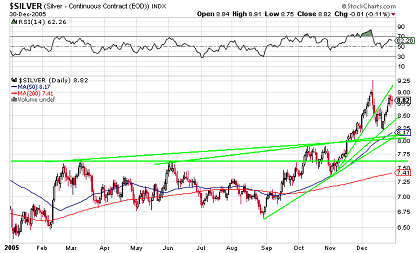

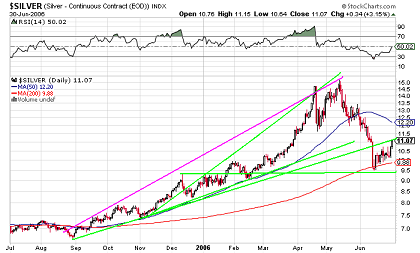

Hassen, I had planned for the comment at the following link to be my last on the financial sites: http://www.marketoracle.co.uk/Article31717.html#comment129057 Since I do not want people to idolize speculation unrealistically, I will make one final comment. I do have a current expectation about silver. But I want to caution readers that no speculator is correct 90% of the time. Over the long-run, the best short-term market timers are apparently correct roughly about 55-60% of the time. If I am not mistaken, Nadeem had stated this rough percentage in one of his past comments. If speculation is longer-term, the probability of success can increase, if the speculator's research is impeccable, e.g. Jim Chanos's successful Enron and China short bets. The fundamental paradigm that caused me to make that silver speculation was noting that we were in a reflation (actually an acceleration of debasement) from the 2008 lows that was likely to run out-of-steam and require another deflationary scare in order for the politics allow another increase in the rate of "socializing defaults", i.e. printing money and other forms of re-distributive debasement. Then I looked at the patterns of the prior cycle of reflation from the dotcom market correction lows, to the top and crash of silver around May 2006. I also saw in various charts that the cycles between reflation and busts were accelerating, as the volatility in the financial system is accelerating. My theory is this is because the free market wants to deleverage quickly, but the politics are against deleveraging, so there is this accelerating see-saw between pumping more air in the balloon and the free market making ever bigger holes in the balloon (the bond vigilantes, etc). I think this pattern will continue to accelerate, so I see silver bouncing back faster than it did from the end of 2008 low, i.e. Europe can't delay printing money (stealing from those who have money to sustain the masses), or the free market will quickly implode it into widespread poverty for the european masses. That is why I am currently expecting $65+ silver before January 2013. However, as can be seen on the following chart from the 2008 bottom forward, silver lags gold coming out of reflations, thus my expectation for silver might be too soon: http://www.munknee.com/2011/11/update-of-alf-fields-elliott-wave-theory-based-analysis-of-the-future-price-of-gold/ It might be wiser to buy gold first, but the more short-term timing one tries to do, the less probability of success. I would recommend some diversification into gold. It is usually wise to have some alternative speculations in play, so one can take profits at different times and profit on different scenarios. Also the Middle East is a powder keg, with the next action possibly to be against Syria, which might cause tension with Russia and China. Looking out several years, I expect with great confidence (80+%) that silver will reach more than $65+ sometime during that period, probably significantly higher than that. But silver will remain incredibly volatile, and this may cause many people to get dejected and ejected from their investment in silver. Silver is volatile because the PHYSICAL market is incredibly tiny, so a small amount of capital buying or selling can move it significantly. And Martin Armstrong claims personal knowledge that the bank paper and futures market for silver is a favorite area of manipulation: http://goldwetrust.up-with.com/t44p75-what-is-money#4601 I expect the ratio of gold to silver price will fall from 50 to below 30 over next years, probably as low as 15. So if you intend to hold gold long-term, silver can potentially give you double or triple the return, assuming you can hold through the volatility and sell when the ratio is low. Sprott is reportedly planning to buy another $1.5 billion of physical silver, which he did right before that that recent runup to $48. Or you can try to sell silver when ever it gets highly overbought. The psychological problem is that 'silverbugs' tend to get over confident and expect higher prices, when silver is moving up too fast, and thus they don't sell (or at least trade for gold). Or they get dejected and sell when the price is low or ratio to gold is high. That is the time to buy silver. A smart trade when silver hit $48 in late April, was for gold at $1500. Then seeing gold get overbought at $1900 and the mainstream TV analyst calls for $2500 before end of the 2011(e.g. JP Morgan commodities guru), sold and repurchased both at the lows in early October. Sites such as this one provide updates on overbought and oversold conditions. Realize that the more uncomfortable an analyst is with very high beta investments such as silver, the more likely they will buy less close to the low and sell less close to the top. For a silverbug like myself who sees a long-term bull market for silver (probably at least to 2018), I am willing to hold if I miss a turn in the market, so I don't mind holding for the next extreme if I miss one. Off topic: I still see in recent comments on this site (and else where, e.g. protesters) that many (most?) people think regulation is a solution, and lack thereof was the cause of the current debt crisis. Or that free market capitalism somehow was tried and failed. As I explained in my most recent article, for as long as humans want to borrow money in droves, no amount of regulation will be able to escape the political capture, that comes from a fractional reserve system. And the widespread use of debt financing, mathematically requires fractional reserve banking. But one thing I have learned recently is that it is a violation of the free will of others to rebuke them constantly, when they make such comments. They have to learn from experience of repeated slavery, that regulation is not the problem nor the solution. Hey isn't it great that we have the internet and can research and share knowledge so efficiently? Let's focus on the positive future ahead that comes from technological advance. Think of this, even the poor today have a better standard-of-living than Kings of Yore. Technological advancement is the reason. Okay time for me to STFU (joke) and do my core skill (programming). So I will let this be the last. Disclaimer: The above expressed opinions and citations are my own and not necessarily endorsed by this site. My opinions and citations are shared as alternative perspective for your entertainment only. I cannot prevent you from deeming that my writings are educational. I am not a professional advisor, thus I claim safe harbor and I am not responsible for any outcomes, mental state, decisions or actions you experience or make after reading this essay or cited sources.

|