Why Quantitative Easing Is Similar to Monopoly

Interest-Rates / Quantitative Easing Nov 03, 2010 - 04:44 AM GMTBy: Jared_Levy

The second iteration of quantitative easing (QE2) is supposed to make "money easier" -- make it flow from the banks to consumers to businesses, etc. The first round of quantitative easing pumped billions of U.S. dollars into the system, but not much of it made it into my hands, and I'm guessing yours either...

The second iteration of quantitative easing (QE2) is supposed to make "money easier" -- make it flow from the banks to consumers to businesses, etc. The first round of quantitative easing pumped billions of U.S. dollars into the system, but not much of it made it into my hands, and I'm guessing yours either...

If you have ever played Monopoly and have been "the bank," you get to control all the money that is divided out to each player.

Remember that the "extra" money is not part of the money circulating in the game yet.

Did you ever cheat and add a little of that "bank" money to your own reserves? I know some of you may have at least thought about it. I mean, how cool was it to just print or add money as you saw fit, so you could buy more stuff?

That is essentially what the Federal Reserve is doing. The Federal Reserve, which is the central banking system of the U.S., is printing extra U.S. dollars to buy "stuff." That stuff they are buying is not Boardwalk or Park Place on the Monopoly game board but rather government bonds, corporate bonds, mortgage-backed securities, and other securities from banks and other financial institutions around the country.

It's considered a good thing for banks to sell (to the Federal Reserve) the risky and not-so-risky stuff (assets) that is sitting in their inventories. They can exchange that stuff for cash so they can go and lend new cash in the form of loans and such to Americans who are in need of it.

This extra cash is also required by most banks as reserves. Think of reserves as "just in case" money. The Fed has also lowered these reserve requirements to encourage banks to lend and not hoard their cash.

So you'd think with all this Monopoly money flying around and the banks being required to keep less of it to protect their loans, "We the People" should be able to get money just as easy, right? Wrong.

The Real Issues

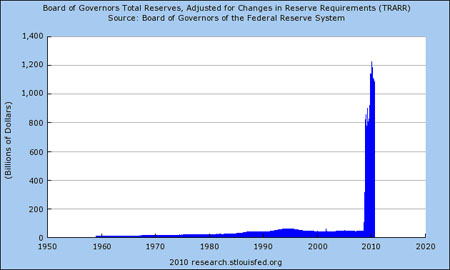

Without getting overly complex, banks are being stingy with their reserves. Over the past year, yields (interest rates) on corporate bonds have fallen, while rates on smaller commercial and industrial loans have risen. That's not good. That means that big companies can borrow money cheaper, but it's still pretty darn tough for the "little guy" to get a loan or a mortgage in many cases. Banks have more cash on hand now than they have ever had and not by some small amount if you look at the chart below.

Free Money, No Risk

If you could borrow money for 0.75% per year, and lend it to a risk-free buyer at 1%, you would have what is called an arbitrage (aka riskless profit). This was a large part of the "lending" that banks have been doing since the economic crisis began. They could borrow from the Fed and turn around and buy a Treasury note, capturing free interest. The Fed has adjusted its discount rate to discourage that action, but yet banks are still not coughing up the cash to consumers.

But get this: Much of the banks' current cash on hand is NOT even borrowed from the Federal Reserve, meaning they are not paying interest on it, giving them even less of a reason to lend it to us!

(Investing doesn't have to be complicated. Sign up for Smart Investing Daily and let me and my fellow editor Sara Nunnally simplify the market with our easy-to-understand articles.)

Won't It Cause Inflation?

With the billions of U.S. dollars already having being printed and 500 billion to 1 trillion expected in QE2, that puts severe downward pressure on the U.S. dollar. In Monopoly, this can be equated to every player owning property with hotels on it and just going around the board once may end up costing you $5,000 or more. No more $4 rent on Baltic Ave.

In that case (or severe inflation), the dollar bills you have are basically worthless and you MUST have real estate to survive the game. This is the simplest form of inflation; dollars become worth less and less, which equates to everything costing more and your "nest egg" of $100,000 cash may only get you around "life's Monopoly board" for a short time before you're broke from expenses.

Obviously, this is a dramatic scenario and some experts believe that there is a positive to this... I just wish it would trickle down to us. Although I do know how you can profit from it!

What Should You Do?

Making the U.S. dollar less expensive does have its merits (if you're an optimist). A weaker U.S. dollar will continue to drive gold, silver and most U.S. dollar-denominated commodities higher, so make sure you have exposure there.

Real estate and hard assets like land and even numismatics will have a benefit from any inflationary pressures that might come down the pike. Even most of the stock market loves a weak U.S. dollar.

So while Helicopter Ben continues to shower the banks with more money, even though they are not passing it along to us like we would expect, at least you can put what money you have in investments that will be driven by the effects of QE2.

P.S. My colleague and currency expert Michael Sankowski has declared that "World War III" has already begun. The truth is, the currency wars that are igniting around the globe could have a devastating effect on your personal wealth. Mike's done countless hours of research and thinking about this situation. And he has several ways to not only protect yourself from these currency wars... but to profit from them handsomely. Get all the details here...

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/tpg/...

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2010, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.