Stock and Commodity Market's Bullish Reaction to QE2

Stock-Markets / Financial Markets 2010 Nov 04, 2010 - 08:17 AM GMTBy: Chris_Ciovacco

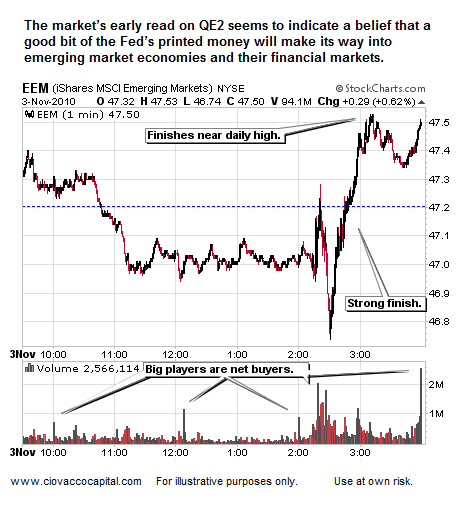

One day does not make a trend, but sometimes early leadership after an event like the November 3rd QE2 announcement holds for the next leg up in asset prices. The early read after the first hour and forty-five minutes in the new QE2 world is bullish. With markets extended and sentiment getting a little on the giddy side, a correction could come at anytime. Given what we know as of the November 3rd close, the odds favor risk assets making higher highs before we turn the page on 2010. If a correction comes, it should represent a buying opportunity. Early leaders include the NASDAQ (QQQQ) and emerging market stocks (EEM).

One day does not make a trend, but sometimes early leadership after an event like the November 3rd QE2 announcement holds for the next leg up in asset prices. The early read after the first hour and forty-five minutes in the new QE2 world is bullish. With markets extended and sentiment getting a little on the giddy side, a correction could come at anytime. Given what we know as of the November 3rd close, the odds favor risk assets making higher highs before we turn the page on 2010. If a correction comes, it should represent a buying opportunity. Early leaders include the NASDAQ (QQQQ) and emerging market stocks (EEM).

The bottom portion of the chart below shows the relative strength of (a) silver (SLV) vs. gold (GLD), (b) consumer discretionary (XLY) vs. consumer staples (XLP), and (c) “junk” bonds (JNK) vs. Treasuries (TLT). Silver has more industrial uses than gold. Gold has more appeal than silver when times are tough. Silver carried the day on November 3rd relative to gold which is bullish for risk and the economic outlook. Under bullish market, monetary, and economic conditions, we would expect to see more interest in consumer discretionary stocks relative to the more defensive consumer staples. The early read with discretionary vs. staples is also bullish. Similarly, "junk" bonds had more interest from buyers than defensive Treasuries after the QE2 details became known – again pointing toward bullish outcomes. Notice the evidence below has nothing to do with a personal bias or an opinion – it is what it is.

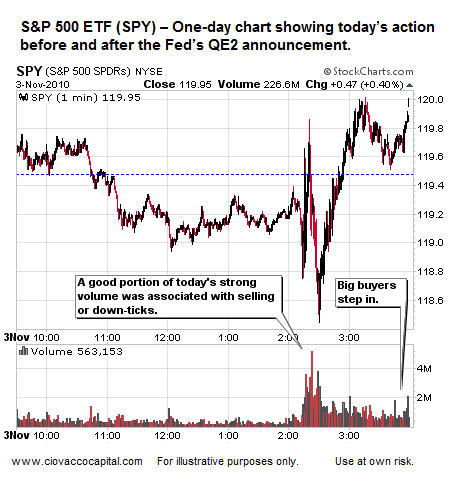

There were some concerns from the November 3rd trading day relative to volume, breadth, resistance, and volatility. Volume was impressive yesterday, but we would like to see better intraday results on November 4th and/or 5th.

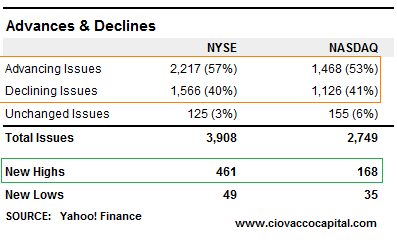

Market breadth on the day of the Fed’s QE2 announcement improved into the close, but we would like to see more conviction in the coming days. A day with roughly 70% of stocks advancing would improve the odds of the S&P 500 moving toward 1,230 or 1,250. Trading activity on November 2nd and 3rd helped clear up some short-term concerns about the market, including those related to market breadth. We still need to see more improvement on a few fronts, but the last two days have us moving in the right direction.

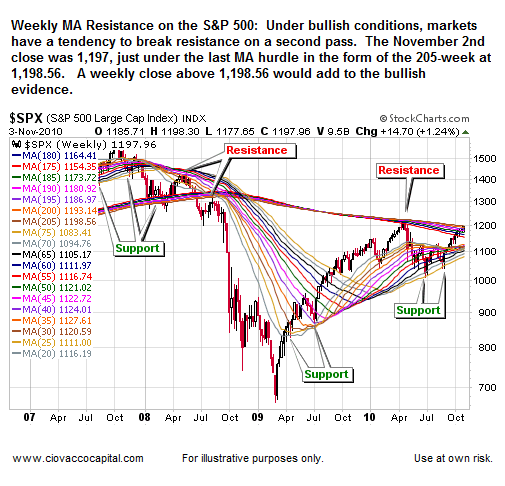

As we noted on October 13th in Possible QE Upside Targets, a barrier of resistance stands directly in front of the S&P 500. We believe the market will break through, but the question is pre-correction or post-correction. Longer-term (next few weeks) higher highs are probably in the cards for most risk assets, but we will continue to monitor conditions with an open mind.

Another concern which may be moving us closer to a correction is volatility. The currency markets, which have been big drivers of weak-dollar assets such as copper, gold, silver, and emerging market stocks, have seen a significant pick-up in volatility, indicating indecision among market players. While things look good at the moment, just when investors begin to get more confident is typically when we need to be on "correction alert".

As we described in Quantitative Easing: How Does The Money Get Into The Real Economy?, the global reach of the Fed’s eighteen primary QE dealers will assist the freshly printed U.S. dollars in finding their way into a wide variety of countries and global markets.

One way to monitor the health of a market rally is to monitor the rally’s leadership. As long as the current leaders remain healthy, the market in general is probably healthy as well. The move in tech stocks after the Fed’s Quantitative Easing announcement (QE2) gives an early bullish read on Chairman Bernanke's plans to print more money.

The most notable reaction to QE2 may have been in TBT, which allows holders to "go short" U.S. Treasuries, meaning TBT makes money when the price of the Treasury EFT (TLT) falls.

Gold has yet to make a new high, but the short duration of the recent correction was impressive from a bullish perspective. The fact gold is lagging silver tells us the economy may be better off than most believe – not strong, but not headed for a double-dip. As we repeatedly stated over the summer, an objective review of the economic data never placed high odds on a GDP double-dip – that could change, but currently the double-dip scenario remains the lower probability outcome.

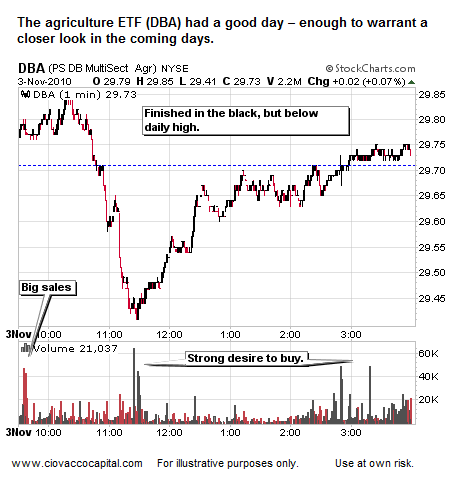

One advantage to owning agricultural commodities, like corn, is their aggregate gains over the last year have been a little more subdued relative to copper and silver.

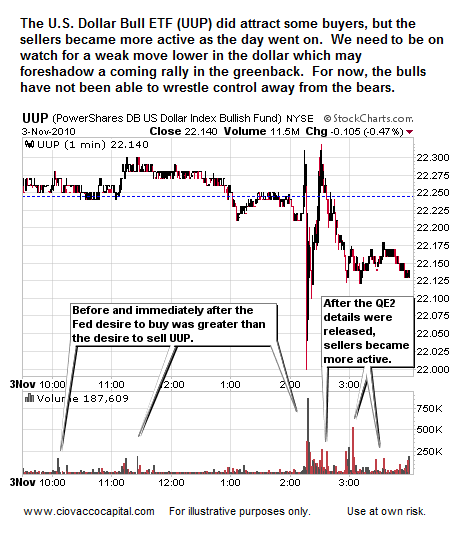

Like gold and silver, the U.S. dollar gave us a head-fake looking like it may rally. Dealing in probabilities takes into account you could be wrong. It also allows you to focus on the task at hand (trying to make money) rather than defending a forecast. Flexibility remains key as we head into unchartered QE2 waters.

The dollar should play a role in the next market correction, which may be due to arrive sometime in the next few weeks. Keep an eye on market sentiment, which is currently extended and concerning.

The video below is part six in a six part series on quantitative easing and its possible impact on the markets and your purchasing power. Part six gives an overview of QE investment strategies. The video was recorded a few weeks ago, but the basic concepts still apply. You can access all six parts in the QE series on this quantitative easing page.

The CCM 80-20 Correction Index has firmed in the last two days which indicates the threat of an imminent correction has been reduced (not passed entirely, but reduced). The CCM Bull Market Sustainability Index (BMSI) also remains firmly in bullish territory relative to the longer-term outlook (next few months). We will continue to post frequent updates on Short Takes. We still believe the next correction may be a buying opportunity, but we will have to see how things unfold.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.