How to Trade Gold Options Using Calendar Spreads

Commodities / Gold and Silver 2010 Nov 10, 2010 - 03:30 AM GMTBy: J_W_Jones

Most market participants are aware that precious metals have been on fire rocketing higher only to consolidate briefly, gap higher, and leave slowly reacting traders in the dust. The parabolic moves in gold and silver have many potential connotations, but great traders respect price action as the final arbiter and adapt. Since the financial crisis began, many traders have evolved into reactionary lemmings.

Most market participants are aware that precious metals have been on fire rocketing higher only to consolidate briefly, gap higher, and leave slowly reacting traders in the dust. The parabolic moves in gold and silver have many potential connotations, but great traders respect price action as the final arbiter and adapt. Since the financial crisis began, many traders have evolved into reactionary lemmings.

For nearly two years we have been conditioned by the Federal Reserve, the SEC, the U.S. Treasury, and the federal government itself that no matter the situation government entities will bail everyone out. Never before in American history have free markets been tampered with to such a degree. As a result of these manipulated market perturbations, traders need to reflect and think seriously about market conditions with the intent to see all sides without any directional leaning.

With that in mind, imagine what would happen to the price of gold, silver, and oil if the dollar strengthened on the heals of a sovereign default issue in Europe. The simple truth is that the short dollar, long risk asset trade that so many traders and money managers are involved in could blow up in their face should the U.S. Dollar put in a strong bounce higher. The real question is whether this is just another short term bounce or whether this is the beginning of an entirely different sequence of events.

Equity traders acknowledge that while the stock market indices are significantly higher the rise in the equity and commodity market was accompanied with a significant selloff in the U.S. Dollar index (.DXY). The chart below illustrates the extreme selling pressure and the ascending trendline drawn on the weekly chart indicates a critical support level that must hold if the dollar is to put in any sort of a bounce.

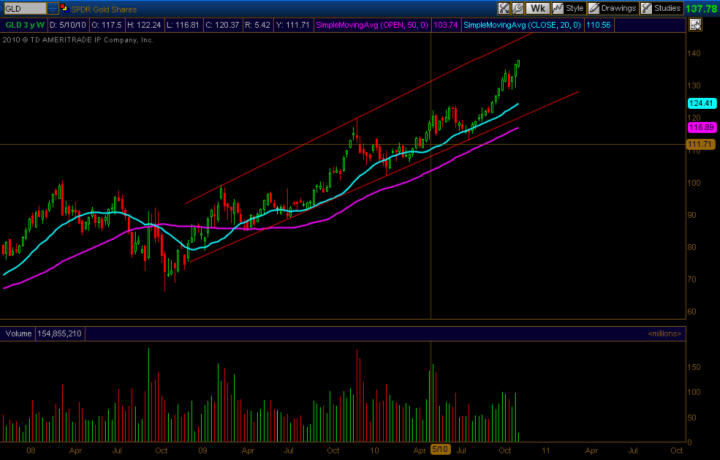

Based on the chart above, a trade setup with crisply defined risk around the 75 area comes into view. Should the 75 area breakdown, more sellers would emerge leading to significant downward pressure on the dollar causing precious metals, specifically gold and silver to rally fast and hard. If the 75 level holds and the dollar bounces, it would likely place downward pressure on equities and precious metals. When we look at a gold chart, it is relatively obvious that gold is trending higher. Gold is at all time highs, which causes it to be scary to play either direction simply because we do not have any long term support/resistance areas that are nearby at this point as seen below:

With the gold chart being extended, it makes sense to key trading decisions off the dollar. Traders could get short gold with contingent stops on the other side of 75ish on the dollar index. Should the 75 level break with confirming volume, traders could get long gold. At this point, anything is possible it would seem based on the recent price action. Two potential trade setups could be taken depending on a trader's directional bias. A trader with a long bias could either enter on any slight pullback on a short term gold chart (10 Min, 15 Min, etc.) and use the 75 area on the dollar index to place a stop order.

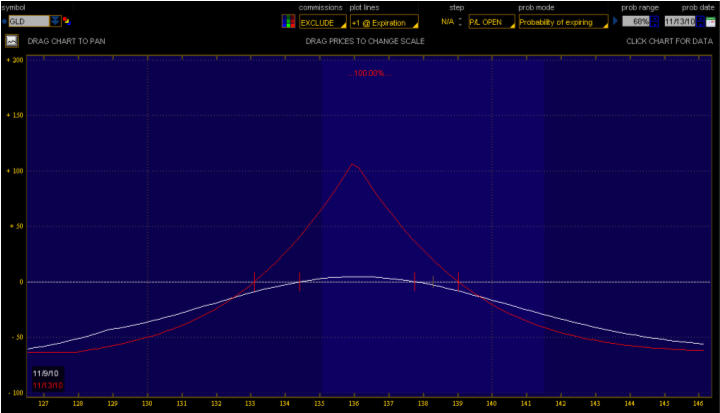

With most traders being extremely bullish with regard to gold and silver, I thought I would be different and post a short trade. Keep in mind, this trade is based on a period of time that will end with the November 19th option expiration. The trade construction is a put calendar spread. In the example being used, the primary profit engine is time (Theta) decay. However, because we used puts that were slightly out of the money, this trade does have a very slight short bias if gold were to decline. As is usual with trades that I post, the passage of time is our friend. Additionally, for the sake of analysis I used the Monday evening closing prices on the GLD option chains to illustrate this example.

The trade is constructed as follows:

Short(Sell to Open) 1 November Week 2 (Exp. 11/12) 136 GLD PUT

Long (Buy to Open) 1 November Monthly (Exp. 11/19) 136 GLD PUT

This type of trade is referred to as a calendar spread. The characteristic profitability curve is listed below:

The trade will be profitable this Friday at market close if price stays within a range of 132.80/share to around 139.30 per share. The maximum gain would take place if price on GLD closed this Friday precisely at 136/share and would produce a maximum gain of around $115 per leg. The maximum loss on this trade is $64 per leg. Keep in mind that if price stayed within the confines of the range, the option trader would have the ability to take profits this Friday or build another position utilizing the November monthly put which would expire on 11/19. These estimates assume implied volatility remains constant and that Vega is positive. It should be considered reasonable to assume the relative constancy of implied volatility over this truncated period of time and anticipated price movement represented in the above example.

While this strategy may seem quite basic, it can produce some insane risk/reward opportunities with a crisply defined risk level. The trade offers opportunities for trade management should market conditions change and the trade allows for a significant margin of error. Through the utilization of contingent stops based either on the GLD price or on the dollar index chart, an option trader utilizing this strategy can get short with a defined amount of risk and with very little emotional capital being exposed. While this is a speculative play regarding the short side in gold, it is an outstanding example of the power that options offer to traders who understand their price behavior.

For those of you wanting to get long gold via GLD for a longer term trade, be sure to watch for my next article later this week as I am going to focus on a strategy that utilizes options for a longer holding period (2-3 Years) and has the potential to produce massive long term gains should the gold price continue higher over the intermediate to longer term.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.