Wall Street Wealth Bailout, The Bernank Who Stole Christmas

Politics / Credit Crisis 2010 Dec 20, 2010 - 09:36 AM GMTBy: James_Quinn

Ben Bernanke is a highly educated PhD from Princeton who has never worked a day in the real world since he graduated from college in 1975. His entire life has been spent in the ivory tower of academia surrounded by models and theories that work perfectly in the comfort of his office. After building his reputation as an "expert" on the Great Depression by studying it and reaching the wrong conclusions, he came down from his ivory tower in 2002 to join an organization that has systematically destroyed the value of the US currency, thereby undermining the well being of the once vibrant middle class.

Ben Bernanke is a highly educated PhD from Princeton who has never worked a day in the real world since he graduated from college in 1975. His entire life has been spent in the ivory tower of academia surrounded by models and theories that work perfectly in the comfort of his office. After building his reputation as an "expert" on the Great Depression by studying it and reaching the wrong conclusions, he came down from his ivory tower in 2002 to join an organization that has systematically destroyed the value of the US currency, thereby undermining the well being of the once vibrant middle class.

He became a member of the Federal Reserve and has served his masters (Wall Street Banks, Mega-corporations, Washington politicians) unswervingly since. When he makes his now regular appearances on 60 Minutes, he tries to give the appearance of being someone concerned about the average American. The facts in the real world completely obliterate the lies he nervously mouths while answering softball questions underhanded to him by corporate media mouthpieces. His quivering lip and nervous ticks reveal his true nature. How could Bernanke blatantly take measures that destroy the lives of millions of Americans? Maybe Dr. Seuss had the answer:

It could be his head wasn’t screwed on just right.

It could be, perhaps, that his shoes were too tight.

But I think that the most likely reason of all,

May have been that his heart was two sizes too small.

Whatever the reason, His heart or his shoes,

He stood there on Christmas Eve, hating the Whos,

Staring down from his cave with a sour, Grinchy frown - Dr Seuss

If the Grinch had been pimping for a small pack of Grinchsters who impoverished the honest people of Whoville, then the Dr. Seuss poem would have perfectly described Ben Bernanke, the Federal Reserve and the banksters that run the show here in the USA. The actions taken by Ben Bernanke, Alan Greenspan and their brethren on the Federal Reserve over the last quarter century have destroyed the middle class and left senior citizens impoverished, while enriching its Wall Street masters. Now he is stealing Christmas from the hard working middle class of this country.

Bernanke's latest theoretical venture into manipulating the puppet strings of the economy began with his speech at Jackson Hole in August and concluded with his Op-Ed on November 4. His master plan to buy an additional $600 billion of Long-term Treasuries is being implemented on a daily basis. This QE2 follows his previous QE1, which consisted of buying $1.4 trillion of toxic mortgage securities from his masters, the insolvent Wall Street banks. What follows are Ben Bernanke's own words:

"I believe that additional purchases of longer-term securities, should the FOMC choose to undertake them, would be effective in further easing financial conditions." - Ben Bernanke - August 27, 2010 - Jackson Hole

"Given the Committee's objectives, there would appear--all else being equal--to be a case for further action. For example, a means of providing additional monetary stimulus, if warranted, would be to expand the Federal Reserve's holdings of longer-term securities. Empirical evidence suggests that our previous program of securities purchases was successful in bringing down longer-term interest rates and thereby supporting the economic recovery." - Ben Bernake - October 15, 2010 - Boston Speech

“To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.” - Ben Bernanke Fed Announcement - November 3, 2010

"This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion." - Ben Bernanke - November 4, 2010 - Washington Post Op-Ed

Ben and his friends on the Federal Reserve have a PR machine to help sell their lies. Let's assess whether Ben and his Federal Reserve have helped or hurt the average American.

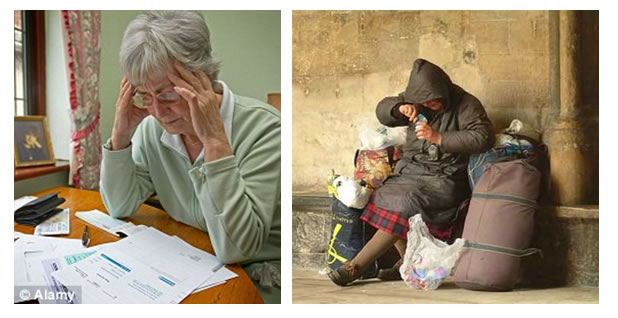

Throwing Senior Citizens Under the Bus

Then he slunk to the ice box. He took the Whos' feast, he took the who pudding, he took the roast beast. He cleaned out that ice box as quick as a flash. Why, the Grinch even took their last can of Who hash. - Dr Seuss

There are approximately 40 million senior citizens living in 25 million households in the US. According to the Census Bureau, more than 12 million of these households survive on less than $30,000 of income per year. The median household income in the US is $49,777. A full 70% of all over 65 households make less than the median income. A recent study found that 58% of those between 60 and 84 will at some point fail to have enough liquid assets to allow them to get through unanticipated expenses or declining income.

The vast majority of their income is from Social Security payments. Most senior citizens are rightly risk adverse and dependent upon income from certificates of deposit. During the 1990's and as recently as 2007, a senior citizen could get a 5% return on a CD. Many of these people depended on this interest income to pay their everyday expenses. Below is a chart that plots the average interest rate for 6 month CDs since 1964. Today the average rate on a 6 month CD is .30%.

Ben Bernanke is to thank for this poverty enhancing rate. He reduced the discount rate to 0% while paying interest on deposits at the Fed. The affect of this policy has been to transfer hundreds of billions to the Wall Street criminal banks from the pockets of senior citizens and other Americans dependent upon interest income to sustain their meager lives. A brainless CNBC anchor can look at this chart and realize that the Federal Reserve caused the housing crisis by driving down rates from 2002 through 2005. Ben Bernanke, who never saw the housing collapse coming and personally had an exploding adjustable rate mortgage, has learned nothing from the prior disaster. He has driven rates down to 0% in order to force people into speculative investments. The Federal Reserve is a perennial bubble blower. This will likely be the final bubble of Bennie's career.

These recent actions by the Federal Reserve are just the tip of the iceberg. Alan Greenspan, the Federal Reserve and the US Government have systematically screwed senior citizens for decades by purposely understating CPI. The result has been that the cost of living adjustments to Social Security has seriously lagged real inflation. For the 2nd consecutive year senior citizens will get no cost of living increase on their Social Security. The average monthly Social Security payment is $1,074. While seniors struggle to make ends meet, Wall Street banks are handed billions in free money by Ben Bernanke. The chart below details the COLA increases since 1975. Alan Greenspan and his commission began manipulating the CPI in the early 1980s.

Since 2000, seniors have seen their monthly payment increase by 27%, or less than 2.5% per year. I challenge anyone to convince me that inflation has been 0% for the last two years. I have calculated my real inflation and it is four times the government reported figure. I suppose government bureaucrats and Federal Reserve Chairmen don't fill up their gas tanks or go food shopping. John Williams at www.Shadowstats.com calculates the CPI as it was calculated prior to the Greenspan fraud. Based on this true assessment of inflation, prices have increased by 100% since 2000, or 8% per year.

Only an Ivy League academic could examine the following yearly price data and conclude, as Bernanke has, that inflation is well contained:

- Unleaded gas up 24%

- Heating Oil up 28%

- Corn up 50%

- Wheat up 48%

- Coffee up 56%

- Sugar up 27%

- Soybeans up 30%

- Beef up 26%

- Pork up 22%

- Cotton up 101%

- Copper up 33%

- Silver up 72%

I wonder what a can of Who Hash will cost in 2011?

The truth is that senior citizens spend a much higher percentage of their limited income on the basics of housing, transportation, food, and insurance. So, these increases have a much greater impact on seniors than rich bankers and Princeton scholars. The figures for key items over the last decade prove the point that seniors have fallen further due to the inflationary policies of the Federal Reserve.

Helping Housing?

And the one speck of food That he left in the house,

Was a crumb that was even too small for a mouse.

Then He did the same thing To the other Whos’ houses

Leaving crumbs Much too small For the other Whos’ mouses! - Dr. Seuss

Not only was Ben Bernanke complicit in aiding Greenspan in creating the housing bubble by keeping interest rates too low for too long, completely missing a two standard deviation (PhDs love this stuff) price bubble right in front of his eyes, telling Americans that we had a strong housing market, telling Americans that housing price declines would not affect the economy, not regulating or policing the rampant mortgage fraud that was happening under his nose, and aiding and abetting the very criminal banks that created the bubble, but now he has blatantly lied by saying his QE2 $600 billion monetization of our debt is to support the housing market. If you believe this, I have some prime real estate with great views in the mountains of Afghanistan to sell you.

In his October 15 speech, Bernanke assured the world that QE2 would reduce long term interest rates. On November 4, he stated:

"Lower mortgage rates will make housing more affordable and allow more homeowners to refinance."

On October 7, one week before Bernanke gave the green light to QE2, the 10 Year US Treasury rate was 2.38%. Today it stands at 3.3%, almost 100 basis points higher. I'm guessing this guy isn't very good picking his weekly football pool. Interest rates have done the exact opposite of what he proclaimed they would do. These rates have surged in the face of an already weakening economy, as unemployment continues to rise and home prices continue to fall. A 100 basis point rise in Treasury bonds piles approximately $120 billion more interest expense per year onto the backs of future generations.

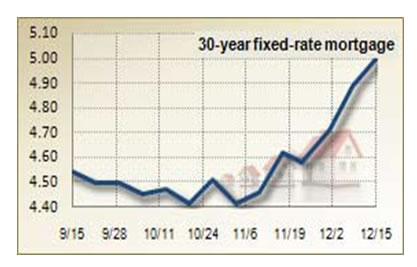

The rate on 30 year fixed mortgages has surged to 5.07% from 4.4% in mid-October. That should do wonders for refinancing and home purchases. Bernanke's actions have priced millions of people out of the market. He has inflicted more damage on an already teetering housing market and has insured that home prices will plunge by another 20% in the next year.

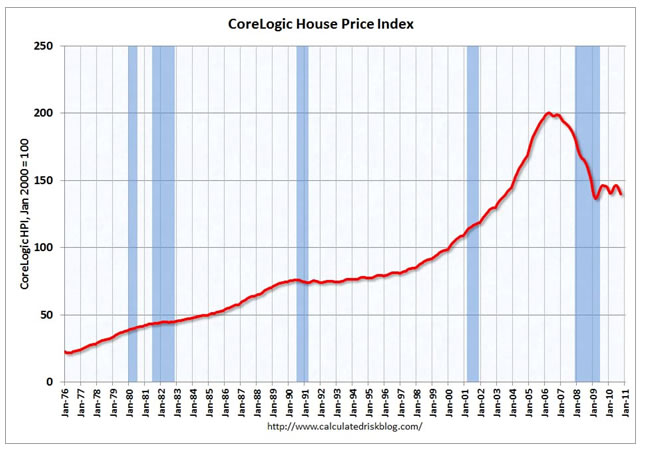

Despite the trillions of dollars thrown at the housing market by Bernanke and Obama through home buyer tax credits, mortgage modification programs, purchasing toxic mortgages from the criminal banks at 100 cents on the dollar, artificially reducing mortgage rates, and forcing those government run disasters Fannie Mae, Freddie Mac and the FHA to backstop more bad loans, home prices are resuming their downward trajectory to fair value. That value is at least 20% lower. With 22.5% of all properties (10.8 million properties) with a mortgage having negative equity, the housing market was already in dire straits. With the surge in mortgage rates caused by Ben Bernanke's actions, a rapid plunge in prices can be expected in 2011, resulting in more foreclosures and negative equity swamping millions.

Despite the trillions of dollars thrown at the housing market by Bernanke and Obama through home buyer tax credits, mortgage modification programs, purchasing toxic mortgages from the criminal banks at 100 cents on the dollar, artificially reducing mortgage rates, and forcing those government run disasters Fannie Mae, Freddie Mac and the FHA to backstop more bad loans, home prices are resuming their downward trajectory to fair value. That value is at least 20% lower. With 22.5% of all properties (10.8 million properties) with a mortgage having negative equity, the housing market was already in dire straits. With the surge in mortgage rates caused by Ben Bernanke's actions, a rapid plunge in prices can be expected in 2011, resulting in more foreclosures and negative equity swamping millions.

The truth is that Ben Bernanke could care less about the average American homeowner making $48,000 per year. The real purpose of QE2 was to further enrich his masters on Wall Street and the ruling elite who control the wealth in this country.

Wall Street Wealth Bailout

"When the Fed uses QEII to subsidize the largest players on Wall Street, it is disadvantaging the smaller, better run banks, and it is also playing with politics. Priyank Gandhi and Hanno Lustig, in a National Bureau of Economic Research working paper issued in November (No. 16553), suggest that the implicit collective guarantee extended to large U.S. financial institutions reflects an annual subsidy to the largest commercial banks of $4.71 billion per bank, measured in 2005 dollars. But, even more important, the paper notes that subsidies for the “too big to fail” banks shows the Fed’s willingness to support the equity markets, an extraordinary and ultimately political act that requires further hearings by the Congress." - Chris Whalen

Chris Whalen and a few other brilliant analysts realize the true purpose of Ben Bernanke's actions. Bernanke even revealed his true intentions in his November 4 Op-Ed:

"Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending."

On August 26, the day before Bernanke's Jackson Hole speech, the S&P 500 was at 1,047. Today, it stands at 1,247, a 19% increase in the face of weakening economic conditions for the middle class worker. The more speculative NASDAQ stood at 2,119 on August 26, and today sits at 2,649, a phenomenal 25% increase as more middle class Americans have lost their jobs. Over this same time frame, according to the BLS, there are 500,000 less Americans employed.

The truth is that Ben Bernanke's sole reason for implementing QE2 is to enrich the few at the expense of the many. The chart below paints the picture clearer than the lies and misinformation you will get from CNBC and Fox. The top 1% wealthiest Americans own 60.6% of all the stocks in America, with the next 9% wealthiest owning 37.9% of the stocks in America. That leaves a full 1.5% of stocks in the hands of the remaining 90% of Americans. Who is benefitting from QE2?

Part 2 of the table clarifies who Bennie is working for. The 90% of Americans have 42.3% of the liquid deposits, 61.5% of residential investment and 73.4% of the debt in the country. Ben Bernanke's actions have resulted in liquid deposits paying 0% interest (19 largest banks out of 7,700 banks control 50% of all deposits), residential real estate prices declining, and the cost of carrying debt to rise. Meanwhile, the top 1% convinced the public they needed a tax cut so they could continue to buy gifts like Clive Christian’s $247,000 Imperial Majesty perfume, packaged in a diamond-encrusted Baccarat crystal bottle.

Part 2 of the table clarifies who Bennie is working for. The 90% of Americans have 42.3% of the liquid deposits, 61.5% of residential investment and 73.4% of the debt in the country. Ben Bernanke's actions have resulted in liquid deposits paying 0% interest (19 largest banks out of 7,700 banks control 50% of all deposits), residential real estate prices declining, and the cost of carrying debt to rise. Meanwhile, the top 1% convinced the public they needed a tax cut so they could continue to buy gifts like Clive Christian’s $247,000 Imperial Majesty perfume, packaged in a diamond-encrusted Baccarat crystal bottle.

Of course, we all know the rich create all the jobs. Too bad they were created in India and China. No more conclusive evidence of the Federal Reserve destroying the American middle class can be found on the US Census Bureau site. The median household income in the US reached its all-time peak in 1999 at $52,388, in today's dollars (key data point). Ten years later the median household income is $49,777. The standard of living for the median household in the US has fallen by 5% in the last decade, even using the government manipulated CPI.

The mainstream media will not report this fact. They will report the non-inflation adjusted figures that show a 22% increase in the median household income. They do this because they know that the average American has no clue what the term "inflation adjusted" means. Ben Bernanke, the Federal Reserve, and the ruling oligarchy can only retain their power through the use of inflation, while slowly destroying the currency, impoverishing the masses and enriching them. The website www.mybudget360.com has suggested the proper mission statement for Bennie and the Feds should be:

"To aggregate as much wealth into the banking system while eliminating the American middle class by a slow systematic dilution of their currency and financial well being and standard of living."

While real average weekly earnings for the average American are lower today than they were in the early 1970s, you will be happy to know that Wall Street bonuses have recovered nicely from the dip in 2008. Compensation at Goldman Sachs, Morgan Stanley, JPMorgan Chase, Bank of America, and Citicorp increased by 31% in 2009. Average compensation rose by 27% to more than $340,000. Bonuses jumped above the $20 billion mark in 2009, but sadly trail the record of $35.5 billion in 2006 just before Wall Street destroyed the financial system of the entire world. According to the NYT, 2010 will be a banner year:

"Wall Street’s five biggest firms have put aside nearly $90 billion for bonuses. Whether it’s for jewelry, high-end clothing or apartments, bonus spending has long fed a post-holiday boom in January and February, especially in Manhattan and expensive suburbs like Greenwich."

I'm sure this information warms the cockles of your heart.

At the end of Dr. Seuss' poem, the Grinch repents and brings a happy ending to Whoville:

That the Grinch’s small heart Grew three sizes that day!

And the minute his heart didn’t feel quite so tight,

He whizzed with his load through the bright morning light,

And he brought back the toys! And the food for the feast!

And he, HE HIMSELF! The Grinch carved the roast beast! - Dr. Seuss

Even if Ben Bernanke's heart was to grow three sizes, he would be discarded by the other Grinchsters (banksters) like piece of Whoville tinsel. The truth of our current situation is better captured by Mick Jagger in his song Sympathy for the Devil:

I'm a man of wealth and taste

I've been around for a long, long year

Stole many a man's soul and faith

But what's confusing you

Is just the nature of my game

The people running the show in this country will not be bringing joy to Whoville. You need to understand the nature of their game.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.