BubbleOmics & Gold Expose America’s Suicide Pact with God’s Workers

Commodities / Gold and Silver 2011 Jan 03, 2011 - 06:28 AM GMTBy: Andrew_Butter

The original reason Professor Nouriel Roubini started to fret about the US economy was when he noticed, in about 2003, that its current account deficit was becoming positively “Argentinean”. Here is a line from paper he put out with Brad Setser in 2004:

The original reason Professor Nouriel Roubini started to fret about the US economy was when he noticed, in about 2003, that its current account deficit was becoming positively “Argentinean”. Here is a line from paper he put out with Brad Setser in 2004:

It should be noted that simply annualizing the financial flows reported in the first half of 2004 fails to provide sufficient financing to cover our estimated current account deficit. Moreover, the pace of foreign official purchases of U.S. Treasuries has slowed from the first half. Something else will have to give.

http://pages.stern.nyu.edu/...

Putting that into plain English, what he was saying was that America was not going to be able to borrow enough money to pay for its imports; (having given up on the idea of paying for them with exports).

What he failed to anticipate was that securitization came to the rescue and over the next four years (2004 thru 2007) “God’s Workers” sold $2.12 trillion of toxic assets to unsuspecting foreigners, which “saved the day”. That’s the reason why the Prophesies of Doom Roubini started making in 2003 didn’t actually materialize until 2008, and explains where the jibe “a stopped clock is right twice a day” came from.

One problem with Roubini is that he makes lots-and-lots of predictions. Personally I’ve never seen one that hasn’t turned out to be completely wrong since I started paying attention in late 2008; although after a few wild miss-hits one starts to lose interest so that might be unfair; but I’m not the only one to be sceptical.

Which is a shame; crying “Wolf “, doesn’t win you friends or respect outside of a media machine addicted to headlines. Yet ironically, Roubini’s biggest miss-hit was his “call” on US Current Account deficits.

He was not pessimistic enough.

In 2003 America faced the urgent option of (a) tightening their belts, or (b) putting their houses up as collateral and on that basis borrowing money to pay for the cost of cheap gasoline, toys from China, and Rambo Wars in places no one had heard of or cared about.

In the event, America voted for higher house prices (not surprising when 70% of population own their own houses), and debt, that’s the joy of “freedom”, suicide is always an option.

“No-worries” said the economists, we can export all our factories to China and Mexico and rely on “innovative financial engineering” instead; and life was good.

What happened in 2008 was the slow realization that a synthetic collateralised debt obligation lovingly crafted by Goldman Sachs and bearing a bulletproof AAA rating from Moody’s, was another word for a “confidence trick”. And what had been booked by many banks as “profits” in the past, so as to work out the bonuses, were actually losses.

That realization affected “confidence” and then “something” did “give”. Which was that no one wanted to buy the garbage created by the American style of corrupt securitization (there is nothing wrong with securitization per-se, the Europeans have been doing “covered bonds” for hundreds of years), and so the “rolling loan that gathered no moss” stopped rolling. That was called the “Credit Crunch”.

Tracking America’s decline to Banana Republic

For more than a year I have been wrestling with the question of “what on earth was driving the price of gold” (as expressed in dollars). After making one bad call after another (I said Gold was a bubble at $950… that’s embarrassing), I finally ended up in the same place Roubini was in 2003, current account deficits.

It was a long winding road to get there; I started off looking at CPI, gold holds value so it should be in synch with CPI…Nope!! Then I looked at oil, there is a 74% correlation year on year between gold and oil since gold got “freed” by Richard Nixon. Which kind of makes sense given that oil is the ultimate source of value in modern life, follow that logic through and today with the “correct” price of oil about $80 if you believe in the Immutable Laws of Parasite Economics, the correct price of gold should be $780.

Turn that on its head and the “correct” price of oil at $1,400 gold is $150.

Something’s got to give.

I got to the “answer” looking at how much of the toxic assets that America “manufactured” from 2000 to 2007 got “exported”. Those didn’t get classified as “exports” for the simple reason that the idea (certainly in the minds of the people who bought them), was the loans would have to be paid back one day. Isn’t it amazing how highly-paid and supposedly smart people don’t read the small-print, as in “Non-Recourse…Baby”!!

So then the message went out, “Well why don’t y’all mosey on down to Tennessee, and we will cook you some finger-licking-fried-chicken and then we will hand you the keys for your collateral”. And then the trustees of Norwegian pension funds and the like; read the small print…Oops!!!

But the $2.12 trillion that the dumb foreigners handed-over in return for dubious bits of paper bearing dubious promises, was enough to “pay the bills”, and that’s what financed that last spasm of America’s reign as that proud owners of the most powerful fiat currency the world has ever seen.

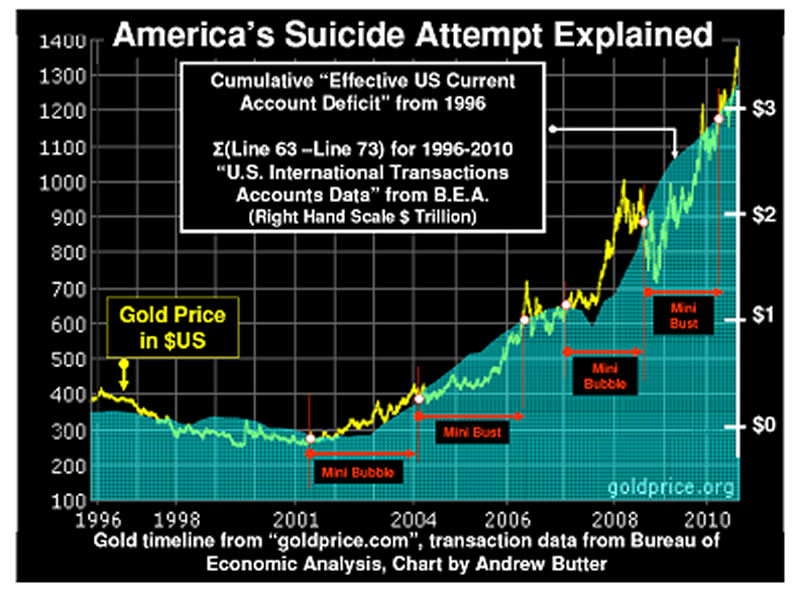

If you take the current account deficit and deduct the amount of toxic assets that got sold that year (i.e. treating them as “exports” that don’t have any manufacturer’s warranty for falling to bits driving down the freeway), you get to what I call the “effective current account deficit”. Cumulate that since 1996 and you can explain 95% of the changes in the price of gold since then up to 2009.

That makes some sort of sense; the “effective” current account deficit is how much the dollar has been trashed relative to things of value that it can buy outside USA; and one of the best markers for that, appears to be gold.

http://www.marketoracle.co.uk/Article24034.html

By way of confirmation, of the “effective current account deficit” as the fundamental driving the price of gold is that the BubbleOmics jives. I.e. the size of the difference from the fundamental in the bubble is about the same as what happened next in the bust, and the time for the mini-bubble is mirrored in the time for the min-bust, which is perfectly aligned with the Seven Immutable Laws of BubbleOmics:

http://www.marketoracle.co.uk/Article12114.html

Perhaps there are other “models” and other explanations, but I don’t know of any that give you a 95% R-Squared, month on month since 1996.

And if that’s right, it’s scary.

Tim can issue as many US Treasuries as he likes and Ben can print as many dollar bills as he likes so as to pay for them, if no one else wants to buy them (like he printed $1.25 trillion to buy a load of toxic garbage no one wanted to buy under TALF).

But unless some dumb-foreigners buy those, that does not generate one single fiat dollar to pay for the difference between imports and exports.

But now all of America’s factories have been re-assembled in China, Mexico, Vietnam; and in fact anywhere where they don’t have (a) unions, (b) Tort, (c) crippling corporate taxation, (d) insane and contradictory regulations to comply with (e) expensive politicians (corruption is no worse in America than in many other countries, just the politicians are greedier), (f) Organized (and disorganised) crime (g) cartels on your supply chains and affecting your costs for example the Medical Cartel which ensures that American pay three times more for a like-for-like medical procedure as anywhere else in the world.

So the “happy-talk” of suddenly replacing the $500 billion a year of toxic assets that were sold at the peak as a way to pay the bills, with manufactured good (or services), is just an illustration of how far the US administration is removed from reality. If you thought invading Iraq so as to destroy WMD was dumb, well trashing America’s manufacturing base was suicidal, and the “happy-happy-talk” of magically reversing that trend without making and radical changes, is simply delusional.

By the way, it’s not wages that drives anyone with an idea or a process out of America, if they can possibly locate the money-making part of the business elsewhere. Wages are irrelevant in manufacturing, look at Japan and Germany; all high-wages do is change the optimisation point between automation and manual processes; the simple truth is that America is a lousy place to do manufacturing or service orientated “value-added”.

And all the talk about the Rembini is just another example of American politicians trying to blame their incompetence on a “Big-Bad-Wolf”, the truth is that China is two countries, (1) a corrupt inefficient hinterland, supported by (2) Special Economic Zones, where 80% of exports are made, where the loans for the new machinery were made in dollars, to American corporations. If “access” to the hinterland is opened up, the first people to benefit will be American corporations with direct or indirect investments in China’s Special Economic Zones.

But what’s really-really scary is the potential of the price of oil to go up.

http://www.marketoracle.co.uk/Article24849.html

If oil stays in the range $90 to $100 America’s “bill” for crude plus petroleum products will be $450 billion plus or minus, up from $250 billion in 2009. If it goes to $150 the bill will be $675 billion.

That may not sound much compared against the $3 trillion that some analysts say the search for Osama and WMD will have cost by the time everyone realises that was pointless, or even the trifling cost of TARP, TALP and the “Stimulus”, (trifling as in compared to the cost of paying what Eisenhower called the “Military Industrial Complex”, to play Rambo). But that’s money which will have to be found from exports or persuading foreigners to buy US debt (in the short-term; although the realisation appears to have sunk in that the problem with taking on debt is that you have to pay it back if you want to get any more).

Predictions

This analysis says that gold is worth about $1,100 right now. So, I hate to say this…(again), having been so wrong on gold so many times, but in my very humble opinion (and I’m saying this as quietly as I possibly can), that looks 27% over-valued, which is a mild bubble.

Although that’s nothing to get alarmed about (if you own gold), a bubble (defined as a departure in price from the fundamental), isn’t “serious” until it’s 40% over, and now that the dumb foreigners who were buying all that non-recourse toxic garbage have lost their appetite and with the current account deficit heading upwards in the direction of $800 billion particularly if oil edges up to $150 (in 2009 the current account deficit was $380 billion).

So the current price of gold of $1,400 is simply “front-running” expectations, and that expectation says that any-time soon the correct price of oil will indeed go to $150 as soon as the Saudis figure out that there is no profit to be had from artificially keeping the price low, or (more likely) we might find out they were lying about their ability to pump much more than they are currently pumping.

Oil prices are tricky, and that’s the wild card. Historically the “correct” price of oil was dictated by what the buyers could afford to pay for it, without suffering unduly, that’s called “Parasite Economics”, with the oil producers cast as the parasites, sucking just enough blood so that their host is not injured, permanently. The logic there is that in nature, any parasite that sucks its host dry; will die with its host.

That dynamic is hard to read as the picture was clouded by bubbles and busts, but with the help of the Seven Immutable Laws that’s not hard to unravel.

http://www.marketoracle.co.uk/Article24849.html

What’s really scary (for America), is that now that there is a distinct possibility that oil as we know it might run out, so the game might change. If that’s “real” then the correct price will start to be dictated by the replacement cost, and if the “host” dies of shock, at $150 or $200 oil, well that will just be “tough”…on “Daisy”.

And it won’t be the first time in history that a Great Power bit the dust after it borrowed money to pay for luxuries to keep the “chosen” proletariat at home happy, whilst excluding a good part of the population from the party (40% of the population of the Roman Empire were slaves). And then used up the rest to embarked on endless, pointless wars either directly or by proxy, neglecting the “knitting” back home…

Or in the words of the ex-Vietnam helicopter pilot, Kris Khristofferson:

Freedom’s just another word for nothing left to loose…Nothing ain’t worth Nothing, but it’s Free.

http://www.youtube.com/watch?v=TYt1xvjQ35U&feature=related

What ever happened to those ideas?

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.