Job-Killing Labor Costs and the Manufacturing Sector

Economics / Employment Jan 20, 2011 - 10:21 AM GMTBy: MISES

Christopher Westley writes: If there is one issue that pops up again and again in my conversations about economics with interested noneconomists, it is manufacturing.

Christopher Westley writes: If there is one issue that pops up again and again in my conversations about economics with interested noneconomists, it is manufacturing.

There's a genuine concern about the state of manufacturing in the United States, and I am not sure of the reason why. It could be that there is an inchoate sense that manufacturing is dying here, given that so many of our popular-consumption goods seem to be made overseas. Then there is the issue of the trade deficit, which is generally reported on in the mainstream media in a manner that is irresponsible, uninformed, or both.

Personally, I am quite proud of the US manufacturing sector, which still leads the world in manufacturing output. It will surprise some readers to learn that, after an initial decline in manufacturing during the outset of the 2008 recession, manufacturing output in the United States has increased for 17 consecutive months. According to a recent report by the Institute for Supply Management (described by Yahoo Finance),

Personally, I am quite proud of the US manufacturing sector, which still leads the world in manufacturing output. It will surprise some readers to learn that, after an initial decline in manufacturing during the outset of the 2008 recession, manufacturing output in the United States has increased for 17 consecutive months. According to a recent report by the Institute for Supply Management (described by Yahoo Finance),

[ISM's] index of manufacturing activity rose to 57 in December [2010] from 56.6 in the previous month. Any reading over 50 indicates growth. The latest is well above the recession's low of 32.5, hit in December 2008. But it's below the reading of 60.4 in April, the highest level since June 2004.

So the United States has been producing wealth at an increasing rate since the low point of the most recent recession. This has been the norm, not the exception, for decades. In an open letter to protectionist Senator Sharrod Brown of Ohio, economist Donald Boudreax noted, "Just before the current downturn — in 2008 — inflation-adjusted manufacturing output in the U.S. was 13 percent higher than it was in 2000, 52 percent higher than in 1990, 84 percent higher than in 1980, and 133 percent higher than in 1970."

Despite the postwar resurgence in global output and competition, US manufacturing output has remained steady at 21 percent of the world's output. Needless to say, reports of the death of US manufacturing are greatly exaggerated.

But what makes me proud of this sector isn't its aggregate output. Rather, it has to do with its output given the constraints placed on it by the federal government. These constraints have the effect of increasing the cost of capital and labor, which become especially serious when these costs grow relative to those of international competitors. How ironic are the actions of so-called progressives who champion positive interventions in the workforce meant to help the average worker but that actually harm these workers in the long run.

The important question is, why do increases in manufacturing output tend not to lead to increases in manufacturing hiring? When considering this question in class, I like to show students a video clip of the scene in the movie "Back to the Future" when the protagonist, Marty McFly, is transported to the 1950s. There, he drives his car into what was then a typical service station. Several well-dressed men run out to greet him, pump his gas, check his oil, and wash his windshield. To modern generations accustomed to self-service gas stations, such employment seems bizarre.

The message for my students, however, is that such jobs, once a ubiquitous portion of the labor market, were eventually priced out of existence by government interventions. Increases in the minimum-wage, increases in payroll taxes, and other attempts to coerce employers to act in ways others find virtuous often forced employers to cut back elsewhere.

If the cost of labor increases, someone has to pay for it. Laborers may pay in the form of decreased work opportunities, investors may pay in the form of decreased returns on capital, or consumers may pay in the form of higher prices required by increased costs. Society in general pays if simply because we have less wealth and higher costs than would otherwise have been the case.

In the case of the gas stations, we see an effort on the part of service-station owners to organize their operations in ways that make them less labor-intensive than they otherwise would have been. The result is that entry-level workers who might earn income, as well as other valuable workplace skills, must find other uses of their time.

We no longer see certain occupations anymore because of such workplace interventions. For most of us, elevator operators are an amusing curiosity seen mostly in black-and-white movies. Many fast-food restaurants now make customers pour their own drinks in an effort to reduce labor costs. The growth of the temp-worker industry reflects the desire by firms to hire workers without the increased regulatory burden of labor, which is then taken on by the temp agencies themselves.

What impresses me are the heroic efforts of unsung individuals and firms to maintain productivity in spite of such interventions. This is especially shown in the US manufacturing sector. To illustrate this phenomenon, consider the graph below.

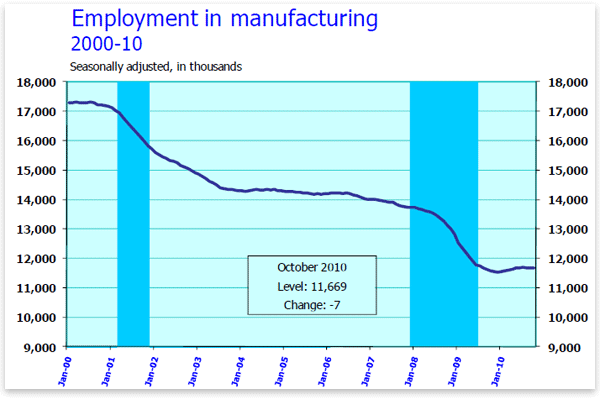

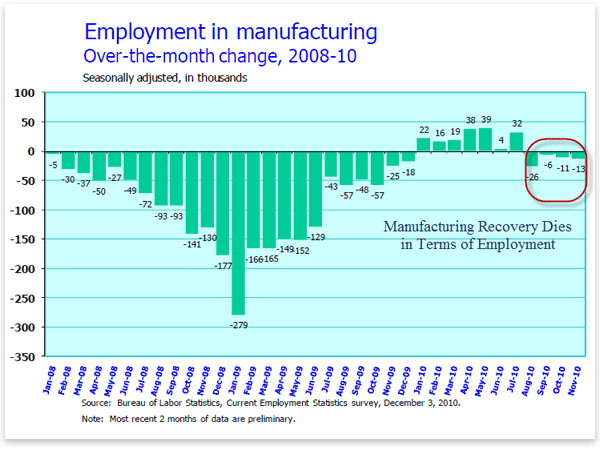

This chart shows that while manufacturing employment fell significantly during the most recent recession — which is to be expected as firms correct from the years of malinvestment that characterized the unsustainable boom — the recent "official" recovery has been characterized by at best tepid growth in manufacturing employment.

What is more, recent gains in manufacturing output have occurred amid months of falling manufacturing employment.

It is significant that meager increases in manufacturing employment that occurred near the beginning of 2010 disappeared once states began implementing federal health-care "reform," which created added employer costs and uncertainty. Until issues associated with these costs get sorted out, manufacturing employment seems to have been paying for it.

But employment decline in manufacturing is no recent phenomenon, and many economists, including Boudreaux, argue that because US manufacturing output leads the world (albeit with reduced labor inputs) this is not an issue that should be of great concern. I beg to differ, if only on the basis of allocative efficiency. It is one thing if electronic manufacturing moves to Asia because Asians have comparative advantages in their production, but quite another if it moves to Asia because of artificial costs placed on domestic producers.

Similar logic applies to the growth of the service sector in the United States. It is one thing if this sector has grown because of some genuine comparative advantages of US workers in providing service output, but it is quite another if this sector's growth has occurred because workers are forced into it in numbers higher than they otherwise would have been due to artificial costs placed on manufacturing labor.

Does this explain much of the growth of the service sector in the United States? If so, we are witnessing a malinvestment of labor inputs, favoring service over manufacturing, that has been forced on resource markets — and an inevitable change in the character, if not the quality, of national output.

While we laud US manufacturing dominance, the state of manufacturing employment is an issue that should be of great concern to those of us who study the effects of economic interventionism. It is obvious that current levels of manufacturing output could be achieved with higher levels of labor input than we see today.

Unemployed workers in the United States should be up in arms over any legislation that increases the cost of labor. (Employed workers should be up in arms as well, to the extent that they face less job security and lower wages due to such legislation.) Despite the laudable efforts of manufacturing firms to maintain levels of output with increased cost, labor has paid the price with higher levels of unemployment.

Congress conceded as much, if only implicitly, when it allowed for a reduction of payroll taxes in the tax-overhaul bill it passed this past December. Such actions must be expanded and made permanent for the United States to retain its manufacturing competitiveness in the 21st century.

In the end, the depletion of manufacturing employment merely reflects the law of demand in that, by increasing the cost of manufacturing labor, employers have demanded less of it while whole manufacturing sectors have moved overseas. Meanwhile, unemployed manufacturing workers collect unemployment compensation while their former managers work overtime to replace their manufacturing output with higher levels of capital.

These outcomes would hardly surprise Ludwig von Mises, who wrote, "State interference in economic life, which calls itself 'economic policy,' has done nothing but destroy economic life. Prohibitions and regulations have by their general obstructive tendency fostered the growth of the spirit of wastefulness."[1]

I would only add that a serious discussion about some of the costs of intervention in the manufacturing sector, as well as the overall economy, is long overdue. Bring it on.

Christopher Westley is an adjunct scholar at the Ludwig von Mises Institute. He teaches in the College of Commerce and Business Administration at Jacksonville State University. Send him mail. See Christopher Westley's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.