Food Prices Aren't Rising, Fiat Currencies Are Collapsing, Massive Monetary Inflation

Currencies / Fiat Currency Feb 04, 2011 - 03:55 AM GMTBy: Jeff_Berwick

It has been a most interesting month of January. A likely presage to an interesting year to come.

It has been a most interesting month of January. A likely presage to an interesting year to come.

In these pages we have spoken often about what will be the first real domino to fall in causing a chain reaction ending up in massive global political and financial change. Often we follow our predictions with a statement something along the lines of, “but, in actuality, the defining primary event will likely come from somewhere that no one expects”.

I think it’s safe to say that no one expected TEOTMSAWKI (The End Of The Monetary System As We Know It) would begin in Tunisia!

It appears that people, including Americans and westerners, are willing to put up with all manners of oppression, taxation and economic stagnation until it reaches the point where they are so impoverished that they cannot even afford to eat.

It is, at that point, that they finally fight back against their oppressors as was the case in Tunisia – and which set off a chain reaction of protests and uprisings in Yemen and Egypt along with other related uprisings in Algeria, Lebanon and Jordan.

It is, at that point, that they finally fight back against their oppressors as was the case in Tunisia – and which set off a chain reaction of protests and uprisings in Yemen and Egypt along with other related uprisings in Algeria, Lebanon and Jordan.

It is still far too early to begin to make any conclusions about these new developments caused partially by rising food prices in the Arab world but there are three very possible outcomes that all threaten the tenuous US dollar based financial system:

1. The worst case scenario: Many of the current governments in the Arab world are overthrown, giving way to the democratically elected devils they didn’t know, who delve the entire Middle East into war. This has any number of potential outcomes including nuclear war. It could also drag the US military into hostilities which would further increase the pace of US dollar monetary inflation (needed to pay for further war) which would further hasten the dollar hyperinflation.

2. The wave of Arab uprisings moves into Saudi Arabia and the other Middle East/Arab major oil producers causing an overthrow of American friendly governments resulting in an end to the “oil for Treasury bonds” agreement. This could result in the oil region not reinvesting its profits into Treasury bonds causing further weakness in bonds, and prompting the Federal Reserve to contemplate QE3 in order to prevent rates from rising too dramatically, or to the 11.1% mark where the US government may become technically insolvent as interest rates overtake all tax income (minus social security payments).

3. Rising food prices and potential for government collapse in other key US Treasury bond holding states such as China, Japan and other Asian countries result in those countries selling Treasury Bonds and dollars in order to increase the value of their currency in order to reduce the prices of imported food items to keep their populations at bay inducing the same results as in (2) above.

The world appears to be going through a purging. A detox, if you will. At no time in world history have people been more regulated, documented, taxed, governed and oppressed. The detoxification may be starting with the planet’s poorest who are driven to fight for their rights and freedoms by a system that has impoverished them through inflation, taxation and outright theft to the point where they cannot even afford to eat.

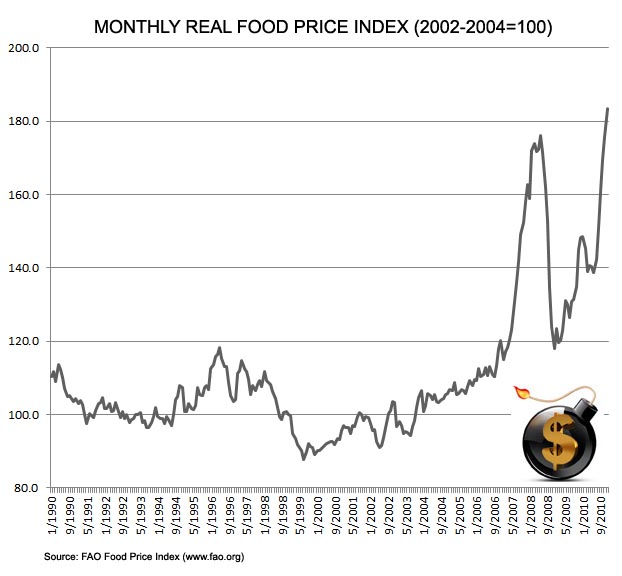

The rising price of food may be the spark that starts things but rising food prices aren’t the cause of much of the world’s problems, it is only a symptom.

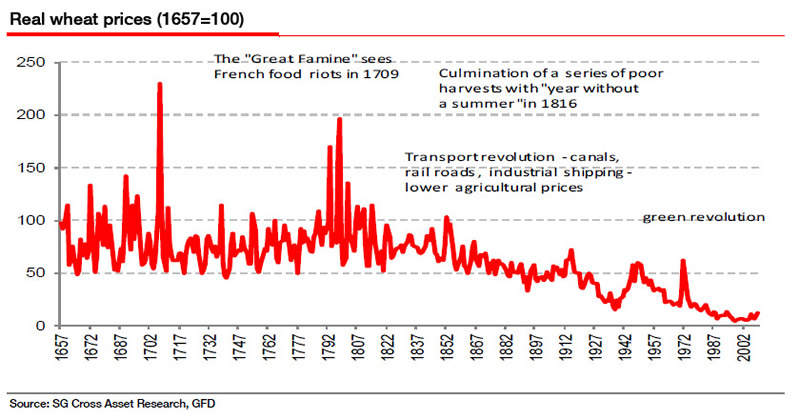

Most mainstream media accounts of rising food prices usually state that the “growing world population” is responsible for the rise in food prices but there is no statistical evidence that growing population correlates to rising food prices.

In fact, food prices have gone down in price, when adjusted for inflation as per the chart above, over the long term even as populations increased as technological advances enable producers to produce more food at less expense.

The reason food prices are now rising all around the world is because central banks have been inflating the money supply in every country in the world at very high levels.

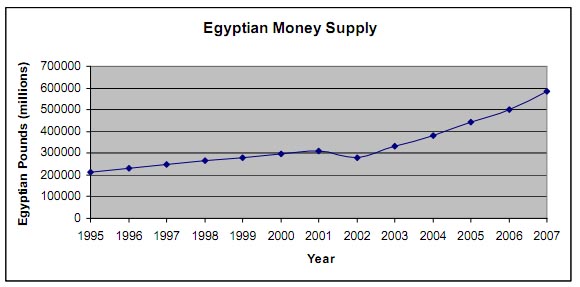

It is difficult to get Egyptian money supply figures, especially since internet access has been cut off by the Egyptian Government making access to the Central Bank of Egypt’s website (http://www.cbe.org.eg) impossible but we found this report from Lindsay Vacek from the University of Reno (see report here) who had done a country study of the Egyptian money supply up to 2007.

Ms. Vacek’s report shows that the Egyptian money supply grew from 200 billion pounds to 600 billion pounds from 1995 to 2007 – a threefold increase in just over a decade. A recent news article (http://www.tradearabia.com/news/eco_191183.html) also stated that the Central Bank of Egypt reported total money supply was at 961 billion pounds in 2010. An increase of over 50% since 2007.

This is massive monetary inflation and is, undoubtedly, the main reason why many Egyptians are having trouble even being able to pay for food. Inflation hurts the poorest people the most because poor people generally don’t have assets and in an inflationary environment those who own real assets (gold, stocks, real estate) see the rise of the price of their assets offset the rise in prices.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.