Intuitive Trading: Fact Or Fiction? - Part 1

InvestorEducation / Trader Psychology Nov 04, 2007 - 12:51 AM GMTBy: Dr_Janice_Dorn

Why did you sell silver yesterday? Why did you buy the S&P e-mini (ES) just now? Why did you decide to cover your shorts in the dollar? Why? Why? Why?

Why did you sell silver yesterday? Why did you buy the S&P e-mini (ES) just now? Why did you decide to cover your shorts in the dollar? Why? Why? Why?

If you ask these questions to a group of traders, you will likely get one of two types of answers. The first answer will be something about the indicators:

“Well, the price was above the 65 period moving average and the RSI were above 50, so I kept with the trend and I got into the ES. Or, you may hear something like this: It was back at a Fib retracement of 50% and the Williams percent was on a “buy”, the parabolic SAR was screaming “yes” and the Bollinger bands were in the right position showing me that trade had more to go on the upside. The other 5 indicators I use were pretty much telling me that this was a good time to get in. “

Others will tell you simply: “My mechanical program gave a buy so I got in.”

Well, that all sounds pretty cut and dried. Indicators say to get in, so you get in. The mechanical program says to get in, so you get it. Both of these assumptions are based on the fact that you actually follow your indicators and act when they say to act (that discussion is for another day, since we all know of multiple times when signals say to do something and we ignore them or do something else).

Back to the “Why?” There are a group of traders who do not know why they do things. As strange as that sounds, it is true. Here are some examples of answers I get from my coaching students when I ask them why they did something:

“I sensed it.”

“I felt the odds were in my favor.”

“It seemed like I was thinking it in my subconscious or something like that.”

“Deep down, it was like a danger or something.”

“The last time I got this feeling, it was like lightning struck me like a “bang!”

“I don't really know---hmm—I guess it was like coming from my heart or gut.”

Many traders will describe the sense of getting a “hunch” or having a dream the night before that the ES was going to drop hard the next day. When questioned about these premonitions that come, either while awake or during sleep, they cannot explain or understand them. In other words, there are no explicit factors to explain what is going on within them. If there are, they are unable to verbalize these.

It is through science that we prove, but through intuition that we discover …

Jules Henri Poincare

Is there such a thing as trading on intuition? What is known about trading grounded, in part, on intuition? How can learning to cultivate your intuition make you a better trader or investor? What are the positive and negative aspects of intuition that impact your trading? What is the brain basis for intuition? In this two-part series entitled: Trading Intuition: Fact or Fiction?,” I attempt to answer these questions. The goal is to expand your understanding of your personal trading psychology and the how you might use intuition as part of sharpening your trading edge.

In reality, the processes of sensing, feeling, coming from the heart or the gut, and other ways of describing what is going on are external representations of something very real to the trader. Despite that, the trader may not be in touch with them or sees them as something outside of him or her and over which there is little control. These processes rely on an interesting combination of knowledge, information, and past market experience. When traders talk about the close link between these so-called subconscious thought and bodily feelings, they are generally referring to what is called “trading intuition.”

Despite studies that show the role of intuition in trading, many people don't want to believe this. They prefer to say that their decisions are based on logic, fundamentals, technicals or some combination of these. Intuitive trading gets a really bad rap and very little respect. Traders speak about it in hushed voices, almost like they don't want to be “found out” or accused - of trading with their feelings, rather than with a logical, considered and back-tested analysis.

How are we able to understand and appreciate the role of intuition in trading? Neurological research shows us that when people make decisions in situations where they have a great deal of experience, their explicit reasoning is preceded by a brain process that is not conscious to them. So-called “experts” in many fields (law, politics, medicine, etc) make these decisions every day.

Prince Charles of Great Britain once said, “Buried within each and every one of us there is an instinctive, heart-felt awareness that provides — if we allow it to —the most reliable guide.” There is a lot of truth to this statement. On the other hand, people who claim to rely on intuition may also end up doing things that are not in their best interests or the interests of others. Examples of such behavior are everywhere around you, and I encourage you look for them.

There has been a proliferation of popular books on “intuitive learning,” “intuitive healing,” “intuitive trading,” listening to our “intuitive voices” and flexing our “intuitive muscle.” What is the validity to these claims? Shall we buy into this intuitive movement, or are we better served to heed the wisdom of King Solomon (one of the richest men who ever lived) who said “He that trusteth in his own heart is a fool”?

I sense when it is dangerous. I see things—or maybe I just feel things—that tell me to get out.

I wonder what this is, but I don't think much about it because I just know…. L.R., Forex Trader

These questions are not easily answered, as they go to the core of what neuroscience is attempting to understand about the function of the human brain. Over the past decade, brain research has showed us that much of the information processing we do occurs “under the radar” in the hidden recesses of our brain.The existence and power of the way that these so-called “automatic subconscious processes” pervade our mental and physical lives are not easily accepted by us. Our conscious brain automatically assumes that conscious intentions and choices rule our lives and govern our decisions.

The conscious brain does not like the idea that there might be other factors that play a large part in the decisions we make. We may feel threatened by this concept. We don't want to think that there is something underneath the conscious because it removes from us a feeling or locus of control. In essence, it is an insult to the conscious brain. It removes the conscious brain from a place of privilege by even suggesting that there are other parts of the brain that are powerful and over which we have no control. T his situation is further muddied by the findings that our “hidden” brain not only feeds into our insight and creativity, but also has enormous influence on implicit prejudices and irrational fears. Few people want to hear this, let alone believe it.

Let's go further into this concept of intuition by looking at what we now know about the science of thinking (cognitive science). In order to do this, we go back to the work of one of the greatest living psychologists, Daniel Kahneman. In his 2002 Nobel Prize lecture, Dr. Kahneman (and his late collaborator Amos Tversky) noted that there are two separate systems of thinking—emotional and analytical. System 1 is emotional, reflexive and intuitive. System 2 is analytical, reflective and rational. Table 1 shows the basic correlates of these two systems of thinking.

Table l. Properties of the Two Systems of Thinking*

| System 1 | System 2 |

| Holistic | Analytic |

| Affective - what feels good | Logical |

| Associative - judgments based on similarity and temporal contiguity | Deductive |

| Rapid parallel processing | Slow, serial processing |

| Concrete images | Abstract images |

| Slower to change | Changes with speed of thought |

| Crudely differentiated - broad generalization | More highly differentiated |

| Crudely integrated - context specific | More highly integrated - cross-context processing |

| Experienced passively and preconsciously | Experienced actively and consciouly |

| Automatic and effortless | Controlled and effortful |

| Self-evidently valid "Experiencing is believing," or perhaps wishing is believing |

Requires justification via logic and evidence |

* Modified from Epstein (1991) |

|

As you can see from the above, System 1 is the “behind-the-scenes intuitive” brain. It is fast, effortless, automatic, associative and implicit (not available to introspection, i.e., we really can't think about it or analyze it). System 2 is familiar, conscious, deliberate, explicit (open to introspection, i.e., we can think about and analyze it).

System 1 is the emotional part of the brain. That part of the brain is becoming more and more familiar to readers of this Newsletter as the old, primitive, rat brain. [ See ] The rat brain pre-screens information and processes automatically and effortlessly. If it feels good, it does it. Because of the way it processes information, System 1 is the default mechanism for thinking. In other words, in the presence of information or emotional overload, System 1 fires into action. This means that, in conditions of stress such as those during the trading day when there is information and data coming at you from all directions, your thinking process will “default” into the System 1 rat brain. As a result you are more prone to make decisions over which you have no conscious control. For computer geeks, this is the same a rapid parallel processing. The rat brain doesn't have to “believe” anything or have anything proved to it. It just has to “want” that something is there. It grabs for all the gusto it can get.

The rat brain wants it all and it wants it all now.

It is important for everyone reading this to stop and go back and think about what I have just said. Specifically, during the stress of the trading day, your rat brain will sneak up on you and cause you to do things that have no basis in fact, reason or analysis. Rather, it will do things because they “feel” right or good. Panicking in and panicking out of trades is an automatic function of your System 1 rat brain. Getting in when a position looks absolutely awesome and will do nothing but keep going up (Why not? It's been going up for weeks now and nothing can stop it. It just looks so good!) is nothing more than your rat brain on overdrive. There is no real thinking going on. You just have to do it because---well—you have to!

System 2 is the new, higher cortex centers of the brain. To use this system requires deliberate, considered and conscious effort. It is not automatic; rather it is analytic and deductive. Because it is slower to process (analogous to a computer serial processing unit) it can follow only one step at a time. It must be convinced before it acts.

Table 2 shows the major brain areas that are currently believed to underlie Systems 1 and 2. For simplicity, I did not include every brain structure, rather I want you to see approximately where these two systems are located in the brain in order to lay the foundation for - this ongoing discussion of intuitive trading.

Table 2. Brain Structures That May Correlate With Systems 1 and 2*

| System 1 | System 2 |

| Amygdala | Anterior cingulate cortex |

| Nucleus accumbens | Prefrontal cortex |

| Media temporal lobe | Lateral temporal lobe (?) |

* Modified from DrKW Research |

|

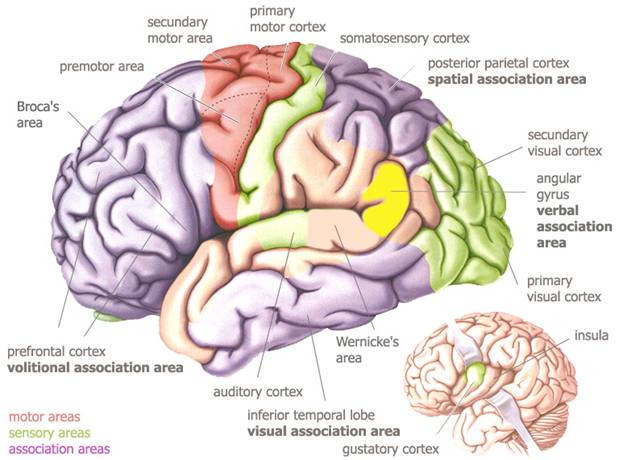

Figures 1 and 2 show the brain areas that may subserve Systems 1 and 2. Those who have been reading my writings for a while have seen these drawings of the brain before. Now, I am taking you one step further into the understanding of these areas of the brain and how they play a critical role in the types of trading decisions you make.

In Figure 1, the large colored illustration shows the exterior of the human brain and its four main lobes or cortical areas. For all intents and purposes, and for absolute simplicity, this is the new brain and the anatomical basis for System 2. For now, just pay attention to the motor and sensory areas and ignore the association areas. This makes it as simple as possible. Remember- we are all about the K.I.S.S. principle and even more so when it comes to something like the human brain. This is not rocket science, even though many would like you to believe that! The most important structures for our purposes here are the prefrontal cortex and the area of the lateral temporal lobe shown here as the auditory cortex and inferior temporal lobe.

Figure 1. New Brain (Analytical System 2)

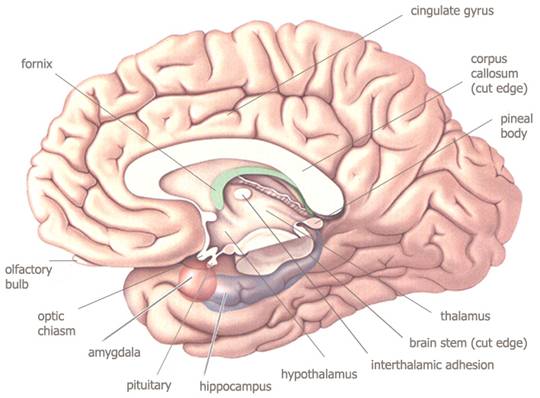

For Figure 2, we look at the small brain on the right side of Figure 1. You can see the retractor instruments that are separating out a part of the brain called the insula. Underneath the insula are the structures of the limbic rat brain.

Figure 2. Limbic Rat Brain (Emotional System 1).

The most important structures for this discussion of intuition are the amygdala and its connections with other structures shown here in the medial temporal cortex.

I have likely gone on long enough about this today. This is quite a bit to digest and think about.

Next time, I will continue with Part 2 of “Intuitive Trading: Fact or Fiction?”. Using this introduction as a template, I will discuss in more detail the way the two systems (emotional and analytical) may act with each other to produce intuitive trading decisions. I will also tell you ways that they oppose each other to produce conflict and “bone-headed” mistakes in trading. I will also show you how the concept of Whole Brain Trading relates to the role of intuition in trading.

Included in Part 2 of “Intuitive Trading: Fact or Fiction?” will be a description of the power and peril of intuitive trading, including automatic biases, and the four factors that influence our perceptions of risk.

I hope you have learned a little today that enriches you and leads to want to know more about the intuitive aspects of your trading. To that end, I have included a free 10 -question test to gauge the extent of your trading intuition and beliefs.

There are two types of mind... the mathematical, and what might be called the intuitive. The former arrives at its views slowly, but they are firm and rigid; the latter is endowed with greater flexibility and applies itself simultaneously to the diverse lovable parts of that which it loves …Blaise Pascal

By Dr. Janice Dorn, MD, PhD

Prescriptions for Profits

www.thetradingdoctor.com

Signup for your risk-free subscription to the Trading Doctor Newsletter. If you are not completely satisfied that our newsletter is for you just let us know, via email, within 7 days of your subscription date and we'll immediatly refund your money.

© Copyright 2006-07 -- Janice Dorn, M.D., Ph.D. -- Ocean Ivory LLC

Dr. Janice Dorn is a graduate of the Albert Einstein College of Medicine, where she received her Ph.D. in Neuroanatomy. She did her postdoctoral work in Neurophysiology at the New York Medical College. She received her M.D. from La Universidad Autonoma de Ciudad Juarez, did one year of clinical clerkships in Phoenix, Arizona. and then completed a Neurology Internship at The University of New Mexico in Albuquerque. For the past twelve years, Dr. Dorn has focused her attention on trading, mentoring and commentary in the financial markets, with emphasis on Behavioral NeuroFinance, Mass NeuroPsychology, Trading NeuroPsychology, Futurism and Life Extension. A graduate of Coach University, she is a full time futures trader and trading coach. Dr. Dorn is the author of over 300 publications, relating to Trading and Investing Neurouropsychology, Market Mass Neuropsychology, Behavioral Neurofinance, and Holistic Wellness and Longevity.

Dr. Janice Dorn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.