What the End of QE2 Means for Gold

Commodities / Gold and Silver 2011 Mar 14, 2011 - 02:23 AM GMTBy: Q1_Publishing

In the last six weeks gold has erased all the losses from the short-lived correction. Gold is back setting new all-time highs and silver is up more than 30% in the past six weeks.

In the last six weeks gold has erased all the losses from the short-lived correction. Gold is back setting new all-time highs and silver is up more than 30% in the past six weeks.

But as precious metals are adding to their gains, there are a lot of perceived headwinds coming for gold in the months ahead.

Summer’s not far away. Gold has historically lags over the over the summer months. Between 2002 and 2010 gold prices have increased an average of 0.3% in June, July, and August. Meanwhile, gold prices have risen an average of 19.7% during the other nine months.

Also, QE2 will be over in a few months. The Fed’s money printing program has kept interest rates artificially low and given a jolt to the prices of all asset classes, especially precious metals.

The combination of the summer and the end of QE2 have commodity traders’ thinking the old advice “sell in May and go away” will be the good advice once again this year.

The way things are shaping up though, gold could be poised to buck the historical trend, blow through all the selling pressure from uncertainty created by QE2’s winding down and have a very strong summer. Here’s why.

Bond Buyers Wanted

Bill Gross, founder and co-CIO of PIMCO, has helped bring a critical impact from the end of Q2 to the forefront of many investors’ minds.

In his most recent monthly commentary Gross asked, “Who will buy Treasuries when the Fed doesn’t?”

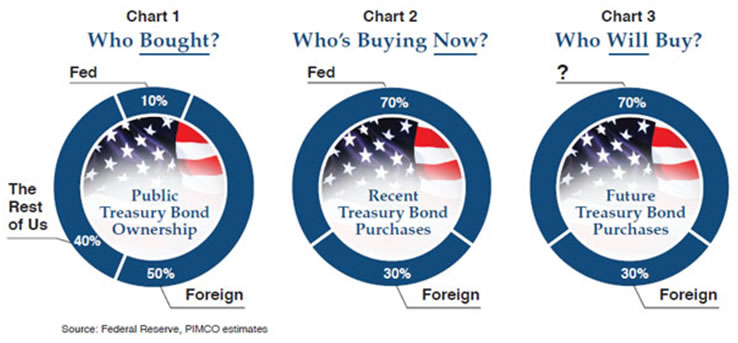

Gross posed the timely question along with an image that lays out the situation perfectly:

The image displays how the U.S. debt is fairly diversified between foreign buyers, private investors (retail investors, pension funds, institutions, etc.), and the Fed.

During QE1 and QE2 the Fed had become the overwhelmingly dominant purchaser of Treasury Bonds. It’s buying accounted for 70% of all new U.S. Treasury debt issued during that time.

But with just a few months of QE2 left and a couple billion dollars of Treasury bond purchases left to make, the uncertainty of what happens when the largest buyer of Treasury bonds stops buying will have an increasingly larger impact on all markets – gold, oil, housing, stocks, bonds, etc. - as QE2 comes to an end.

Treasury Bonds: Supply Up, Demand Down

The most likely result of the end of QE2 will be higher interest rates.

The market has proven there just aren’t many buyers interested in Treasury bonds given their artificially low current yields (keeping rates low was one of the main goals of QE2).

On top of that, the Fed’s bond buying spree couldn’t be coming at a worse possible time. Individual investors have reversed their aggressive bond-buying trend and started pulling money out of bonds. Last month they ended their 22-month streak of adding money to bond funds. The $643 billion they put into funds is now starting to be withdrawn.

Now that buying demand for bonds is drying up and the most significant purchaser of Treasury bonds is pulling out, Treasury prices must go down and yields must go up to attract new buyers.

That’s just the demand side of the equation. On the supply side the U.S. government’s deficit is expected to hit another record this year.

When demand falls, supply increases, prices go down. And when bond prices go down, interest rates go up.

Rising interest rates is generally bad for stocks, housing, and economic growth. But historically it has been good for gold.

Let History Be Your Guide

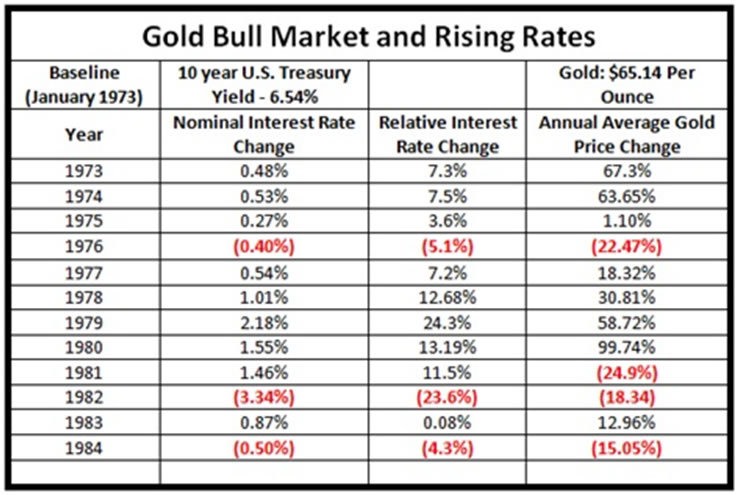

The yield on the benchmark Treasury bonds must go up to attract sufficient new buyers. The rising rate trend is critically important to gold prices.

Our past research on gold and interest rates has found a very strong correlation between gold and interest rates historically:

In 13 of the 14 years tracked both interest rates and average gold prices rose. The only exception was 1981, which came after a year when average gold prices nearly doubled.

Bucking the Trend

Of course, rising rates on Treasury bonds is going to have other impacts that, on the surface, would appear to be headwinds for gold prices.

For example, money tends to flow where it’s treated best. And currencies which offer higher interest yields tend to attract more buying.

The value of the U.S. dollar relative to other currencies would likely increase along with interest rates.

Also, an end of quantitative easing would signal some level of monetary sanity from the Federal Reserve which would also add strength to the dollar.

The current bull run in gold, however, has repeatedly bucked the trend of a rising dollar and has often gone up along with the dollar.

Finally, we’re looking at a relatively short time period. The start of the post-QE2 era and the weeks leading up to its end will likely be filled with a lot of uncertainty across the markets. No one really knows for sure how the end of the program will turn out and how high interest rates will go.

But despite it all, the fundamentals are lining up to be a net positive for gold. The end of the artificially suppressed long-term interest rates will likely show how strong the market believes inflation has already become. And a significant rise in non-artificially-suppressed interest rates will show that inflation is much higher than the official numbers report.

As a result, we continue to recommend moving into high-quality gold stocks with big resources and significant growth potential to ride the gold bull regardless of the short-run and likely volatile effects of the end of QE2 on gold prices.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2011 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.