Confessions of an Investor, the Problems Modern Portfolio Theory

InvestorEducation / Learning to Invest Apr 05, 2011 - 04:24 AM GMTBy: John_Mauldin

“Tail risk (the risk of large losses) is dramatically underestimated by many investors and the tools we have available to manage such risks are hopelessly inadequate. Financial theory which is taught at business schools and universities all over the world is plainly wrong.” This week we turn to my friend Niels Jensen of Absolute Return Partners in London for our Outside the Box offering, in which he looks at tail risk, Modern Portfolio Theory, and a risk he identifies as Birthday Risk. It is a lively and easy read, which is also designed to make you think about your basic investment principles.

“Tail risk (the risk of large losses) is dramatically underestimated by many investors and the tools we have available to manage such risks are hopelessly inadequate. Financial theory which is taught at business schools and universities all over the world is plainly wrong.” This week we turn to my friend Niels Jensen of Absolute Return Partners in London for our Outside the Box offering, in which he looks at tail risk, Modern Portfolio Theory, and a risk he identifies as Birthday Risk. It is a lively and easy read, which is also designed to make you think about your basic investment principles.

Your loving NYC weather today analyst,

John Mauldin, Editor

Outside the Box

Confessions of an Investor

By Niels Jensen Absolute Return Partners

“When models turn on, brains turn off.” –Til Schulman

I have been thinking a great deal about risk over the past couple of years. The depth of the financial crisis took many of us by surprise. I made mistakes. I am sure you made mistakes. In fact, the whole industry made mistakes, from which we should all learn. Whether we will is another story, but we should try.

Making those mistakes is all the more frustrating because I was aware of the dangers but, like most others, underestimated the magnitude. In fact I wrote about them – see for example the October 2007 Absolute Return Letter ( Wagging the Fat Tail).

Now, let’s distinguish between trivial risk (say, the risk of the stock market going down 5% tomorrow) and real risk - the sort of risk that can wipe you out. The geeks call it tail risk, and James Montier provided an excellent definition of it in his recent paper, The Seven Immutable Laws of Investing, where he had the following to say:

“Risk is the permanent loss of capital, never a number. In essence, and regrettably, the obsession with the quantification of risk (beta, standard deviation, VaR) has replaced a more fundamental, intuitive, and important approach to the subject. Risk clearly isn’t a number. It is a multifaceted concept, and it is foolhardy to try to reduce it to a single figure.”

Following James’ line of thinking, let me provide a timely example of the complex nature of tail risk:

The Japanese disaster

Contrary to common belief, the disaster at the Fukushima Daiichi nuclear power plant was not a direct result of the 9.0 earthquake which hit Northeastern Japan on 11 March. In fact, all 16 reactors in the earthquake zone, including the six at the Fukushima plant, shut down within two minutes of the quake, as they were designed to do. But Fukushima is a relatively old nuclear facility – also known as second generation - which requires continuous power supply to provide cooling (the newer third generation reactors are designed with a self-cooling system which doesn’t require uninterrupted power).

When the quake devastated the area around Fukushima, and the primary power supply was cut off, the diesel generators took over as planned, and the cooling continued. But then came the tsunami. Around the Fukushima plant was a protection wall designed to withstand a 5.2 metre tsunami, as the area is prone to tsunamis. However, this particular one was the mother of all tsunamis. When a 14 metre high wall of water, mud and debris hit the nuclear facility, the diesel generators were wiped out as well. But the story doesn’t end there, because Fukushima had a second line of defence – batteries which could keep the cooling running for another nine hours, supposedly enough to re-establish the power lines to the facility. However, the devastation around the area was so immense that the nine hours proved hopelessly inadequate. The rest is history, as they say.

Other tail risk events

I have included this sad tale in order to put the concept of risk into perspective. You cannot quantify a risk factor such as this one because, if you try to do so, the prevailing models will tell you that this should never happen. Take the October 1987 crash on NYSE. It was supposedly a 21.6 standard deviation (SD) event. 21.6 SD events happen once every 44*1099 years according to the mathematicians amongst my friends1(1096 is called sexdecillion, but I am not even sure if there is a name for 1099). The universe is ‘only’ about 13.7*109 years old (that is 13.7 billion years). Put differently, 19 October 1987 should quite simply never have happened. But it did. (My source is Cuno Pümpin, a retired professor of Economics at St. Gallen University.)

So did the Asian currency crisis which resulted in massive losses in October 1997, which statistically should only have happened once every 3 billion years or so. By comparison, our planet is ‘only’ about 2 billion years old. And the LTCM which created mayhem in August 1998 was apparently a once every 10 sextillion years (1021) event. And I could go on and on. The models we use to quantify risk are hopelessly inadequate to deal with tail risk for the simple reason that stock market returns do not follow the pattern assumed by the models (a normal distribution).

Black swans galore

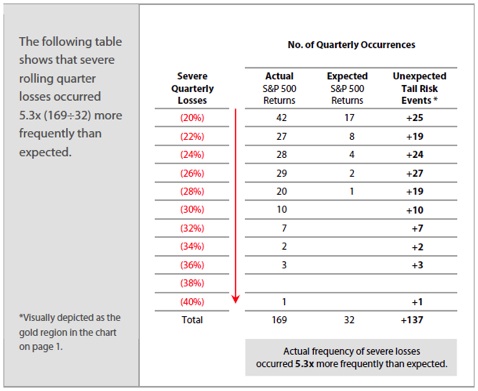

The smart guys at Welton Investment Corporation have studied the phenomenon of tail risk in depth and kindly allowed me to re-produce the table below which sums up the challenge facing investors. In short, severe losses (defined as 20% or more) happen about 5 times more frequently than estimated by the models we (well, most of us) use.

Table 1: Severe Losses Occur More Frequently than Expected

Source: Welton Investment Corporation ( www.welton.com)

Why your birthday matters

It is not only tail risk, though, which brings an element of unpredictability into the equation and effectively undermines Modern Portfolio Theory (MPT), which is the foundation of the majority of applied risk management today (more about MPT later). One of the least understood, and potentially largest, risk factors is what I usually call birthday risk. Effectively, your birthday determines your ability to retire in relative prosperity. Is that fair? No, but it is the reality. Woody Brock, our economic adviser, phrases it the following way:

“I would happily live with vast short‐term market volatility in exchange for certainty about the level of my wealth and future income at that date when I plan to retire. Wouldn’t you? Wouldn’t most people?”

And Woody goes on:

“But if this is true, then why does most contemporary “risk analysis” completely bypass this perspective and focus on shorter term risk?”

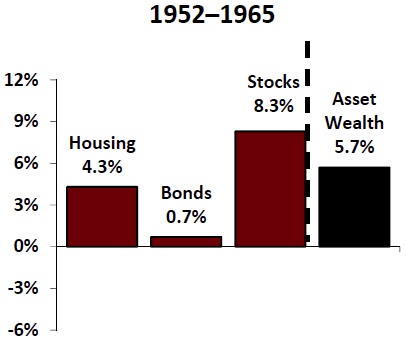

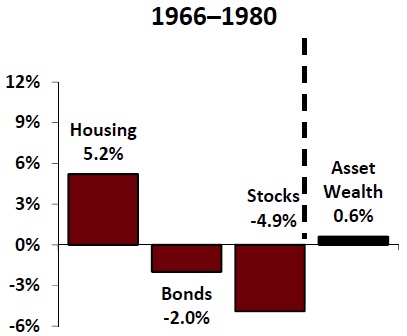

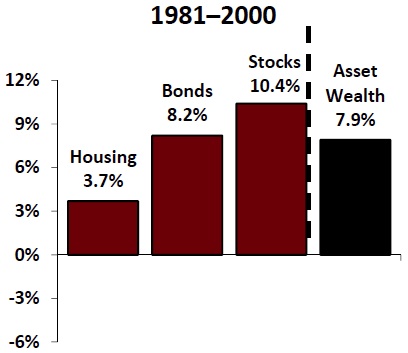

To illustrate the point, let me share with you some charts produced by Woody and his team at Strategic Economic Decisions. Most people have the vast majority of their assets tied up in property, stocks or bonds, or a combination of the three. It is also a fact that most people do most of their savings over a 15-20 year period – from their mid to late 40s until their early to mid 60s, the reason being that most of us are net spenders through our education and until the point in time when our children move away from home. It is therefore extremely important how those 3 asset classes perform over that 15-20 year period. Now, look at the charts below (all numbers are annual returns, and the asset wealth column represents a weighted average of the other 3 columns):

Chart 1a: Growth in US Asset Wealth, 1952-1965

Chart 1b: Growth in US Asset Wealth, 1966-1980

Chart 1c: Growth in US Asset Wealth, 1981-2000

Source: Strategic Economic Decisions ( www.sedinc.com)

When you look at those charts, wouldn’t you just love to have retired in 2000? A solid 7.9% per year for the preceding 19 years turned $1 million in 1981 into $4.2 million in 2000, whereas those poor souls who retired in 1980 managed to turn $1 million into no more than $1.1 million during the previous 14 year period. And those who are retiring today aren’t much better off following an extremely volatile decade. This is effectively a birthday lottery but, as we shall see later, there are things you can do to address the problem.

The problems with MPT

However, before we go there, I would like to spend a moment on MPT, as I believe it is important to understand the shortcomings of the prevailing approach to investment and risk management. (Much of the following is inspired by Woody Brock.) Let’s take a closer look at three of the most important assumptions behind MPT (there are many more assumptions behind Modern Portfolio Theory. Wikipedia is a good place to start should you wish to read more about it):

1. Risk-free investments exist and every rational investor invests at least some of his savings in such assets, which pay a risk-free rate of return.

2. Returns are independently and identically-distributed random variables (returns are trendless and follow a normal distribution, in plain English).

3. Investors can establish objective and accurate forecasts of future returns by observing historical return patterns. (Strictly speaking, this assumption was relaxed by Fischer Black in 1972 when he demonstrated that MPT doesn’t require the presence of a risk-free asset; an asset with a beta of zero to the market would suffice.)

Well, if these assumptions are meant to stand the test of time, then good old Markowitz (the father of MPT) is in trouble. Truth be told, none of the three stand up to closer scrutiny. The concept of risk-free investing no longer exists, post 2008. Banks are giant hedge funds which cannot be trusted and even government bonds look dicey in today’s world. Secondly, returns are clearly not random. If you have any doubts, just look at how the trend-following managed futures funds make their money. Thirdly, from 26 years of investment experience, I can testify to the fact that historical returns provide little or no guidance as to the direction of future returns.

A new approach is required.

So what does all of this mean? First of all it means that universities and business schools all over the world should clear up their acts. Two generations of so-called financial experts have been indoctrinated to believe that MPT is how you should approach the management of investments and risk whereas, in reality, nothing could be further from the truth. It also means that investors should kick some old habits and re-think how they do their portfolio construction. Specifically, it means that (and I paraphrase Woody Brock):

i. the notion of the “market portfolio” being an appropriate performance benchmark should be discarded;

ii. there is in reality no meaningful distinction between strategic and tactical asset allocation - the difference is illusory;

iii. investors should once and for all reject the notion that there is an optimal portfolio for each investor from which he or she should only deviate “tactically” in the shorter‐run;

iv. market‐timing deserves more credit than it is given;

v. MPT is a straitjacket preventing investors from rotating between different classes of risky assets (with vastly different risk/return profiles) as market conditions change.

Please note that this does not imply that asset allocation is irrelevant. Far from it. However, it does mean that a bespoke approach to asset allocation, where individual circumstances drive portfolio construction, is likely to be superior to a more generic approach based on a strategic core and a tactical overlay.

This is nevertheless serious stuff. Effectively, Woody Brock is advocating a regime change. Throw away the generally accepted approach of two generations of investment ‘experts’ and start again, is Woody’s recommendation. As a practitioner, I certainly recognise the limitations of MPT and I agree that, in the wrong hands, it can be a dangerous tool, but there is also a discipline embedded in MPT which carries a great deal of value. And, in fairness to Woody, he does in fact agree that you can take the best from MPT and mix it with a good dose of ‘common sense’ and actually end up with a pretty robust investment methodology.

A solution to the problem

Here is what I would do in terms of applying his thinking into a modern day investment approach:

1. Do what you do best. Some investors are made for short-term trading. Others are much more suited for long-term investing (like me). Don’t be shy to utilize whatever edge you may have. MPT suggests that markets are efficient. Nothing could be further from the truth. If you have spent your entire career in the medical device industry, the chances are that you understand this industry better than most. Use it when managing your own assets. Insider trading is illegal; utilizing a life time of experience is not.

2. Take advantage of mean reversion. Mean reversion is one of the most powerful mechanisms in the world of investments. At the highest of levels, wealth has a long term ‘equilibrium’ value of about 3.5 times GDP. As recently as 2007, wealth was well above the long term equilibrium value and signalled overvaluation in many asset classes. But be careful with the timing aspect of mean reversion. The fact that an asset class is over- or undervalued relative to its long term average tells you nothing in terms of when the trend will reverse. A good rule of thumb is to buy into asset classes when they are at least a couple of standard deviations below their mean value.

3. Be cognizant of herding. We are all guilty of keeping at least one eye on other investors, and we are certainly guilty of letting it influence our own investment decisions. This is how investment trends become investment bubbles and fortunes are wiped out. Herding is relatively easy to spot despite the fact that former Fed chairman Alan Greenspan argued otherwise – probably because it was a convenient argument at the time. But herding is also subject to the greater fool theory. You can make a lot of money investing in fundamentally unsound assets, as long as you can find a greater fool to whom you can sell it at a higher price. It works fine but only to a point.

4. Think outside-the-box. All those millions of baby boomers all over the western world who will retire in the next 10-15 years have been told by the MPT-trained financial advisers that they need to lighten up on equities and fill their portfolios with bonds, because they need the income to live on in old age. STOP! Who says that bonds can’t be riskier investments than equities? When circumstances change, you should change your investment approach accordingly and not rely on historical norms. Given the state of fiscal affairs in Europe and North America, it does not seem unreasonable to suggest that circumstances have indeed changed.

5. Bring non-correlated asset classes into the frame. One should consider having a core allocation to non-correlated assets. Traditionally, many non-correlated asset classes have not met the liquidity terms required by the majority of investors (see below on liquid versus illiquid investments), but there are exceptions, the most obvious one being managed futures. The asset class proved its worth in 2008 with managed futures funds typically up in the range of 20-30% that year.

6. Take advantage of investor constraints and biases. The classic, but by no means only, example is the outsized impact a downgrade to below investment grade (i.e. a credit rating below BBB) may have on corporate bonds, as some institutional investors are not permitted to own high yield bonds and are thus forced to sell regardless of price when the downgrade takes place.

My favourite example right now is illiquid as opposed to liquid investments. I strongly believe that less liquid investments will outperform more liquid ones over the next few years for the simple reason that the less liquid ones are struggling to catch the attention of investors who, still smarting from the deep wounds inflicted in 200809, stay clear of anything that is not instantly liquid. This has had the effect of pushing the illiquidity premium (i.e. the extra return you can expect to earn by investing in an illiquid as opposed to a liquid instrument) to levels we haven’t seen for years.

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.