Fitch Warns on China as Housing Market Crashes 26% in One Month

Housing-Market / China Economy Apr 14, 2011 - 02:34 AM GMTBy: PhilStockWorld

The futures are bouncing!

The futures are bouncing!

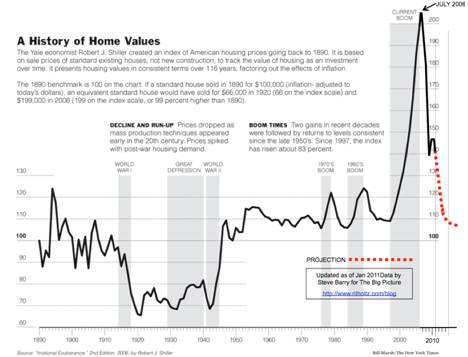

Why are they bouncing? Why not? We went down and people love to buy those dips and that means they are just going to love this chart, courtesy of Barry Ritholtz's team. We don't get our next Case-Shiller data point until the 26th but we did get mortgage applications this week and they are down ANOTHER 6.7%. This is despite the fact that an average 30-year mortgage is still just 4.98%.

I know that we have been trained to ignore supply and demand in commodities as well as to pretend that all prices are inelastic and that American consumers will buy anything at any price because they are generally mindless sheep that you can lead into anything with the right jingle but, if they are not willing to buy a $250,000 home with a 5% mortgage - what's going to happen when that mortgage is 6%?

At 5%, a $250,000 mortgage has a monthly payment of $1,342.05. At 6% that payment jumps up to $1,498.88 - 10.5% higher! At 7% it's $1,663.26, 24% higher - that's the "cost" of housing as rates tick higher but, of course, that will force housing prices even lower to compensate and the Fed will tell us that inflation is low because home prices will be falling faster than food prices are rising - so we have that to look forward to...

I mentioned yesterday that China tightened their rates and home prices in Beijing fell 26.7% in the month of March. I waited all day to read more about it in the WSJ or Bloomberg or to see them discussing this on CNBC but no - it's not the kind of news they want you to hear so - for your own good, it is not mentioned. I had to find this news in Business China but it's also in the China Daily and the People Daily but where it isn't is in any US newspaper I've looked at and neither is there mention of the problem caused by giant-sized, irradiated Asians poking buildings with sticks! (just kidding).

We talk about Chinese censorship and control of information but what is this? If a Nigerian Rebel spits at a pipeline or if a Somali Pirate even glances in the direction of an oil tanker - it's on the front page of the papers (sometimes before it even happens if they get their timing wrong) but when a 26.7% drop in housing prices in a single month in the World's 16th largest city (population 12.7M) isn't even mentioned in the MSM - you HAVE TO start wondering which government is really censoring your information. What else are we not being told?

Fitch Ratings downgraded their outlook on China's long-term local-currency issuer default rating to negative from stable last night. We'll see if this one gets any attention but at least I found it in MarketWatch. "The negative outlook reflects concern over the scale of sovereign contingent liabilities and risk to macro-financial stability arising from the very rapid pace of bank lending in recent years, especially against the backdrop of rising real estate valuations and inflation," said Andrew Colquhoun, head of Fitch's Asia-Pacific Sovereigns group. "Fitch expects some sovereign support for the banking system will be required," he said.

Matt Tiabbi points out that we are not being told about the "other budget" - the one the Republicans love, that is bigger than the budget they are fighting to contain and that's the Federal Reserve's $3.5Tn budget. As Tiabbi states:

After the financial crash of 2008, it grew to monstrous dimensions, as the government attempted to unfreeze the credit markets by handing out trillions to banks and hedge funds. And thanks to a whole galaxy of obscure, acronym-laden bailout programs, it eventually rivaled the "official" budget in size — a huge roaring river of cash flowing out of the Federal Reserve to destinations neither chosen by the president nor reviewed by Congress, but instead handed out by fiat by unelected Fed officials using a seemingly nonsensical and apparently unknowable methodology.

Our friends at Goldman Sachs alone received roughly $800Bn in loans from the Fed but what's more interesting is $220M worth of loans made to Christy Mack (wife of MS Chairman, John Mack) and her partner, who were given low-interest loans by the Fed in a brand new enterprise they set up to take advantage of the FREE MONEY. As Tiabbi points out, the interest spread alone would guarantee them millions in profits in a program he calls "giving already stinking rich people gobs of money for no ***** reason at all." He goes into great detail so I won't here but I will point out that THIS IS YOUR MONEY they are giving away - this is your debt burden that is being increased by the Fed's actions - this is not a victimless crime - WE ARE THE VICTIMS!

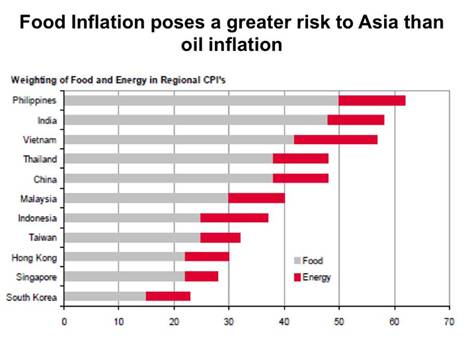

That's OK, though, there are plenty of other victims, like the 3Bn people in Asia who are being ripped to shreds by inflation despite the fact that China, India, Malaysia and Thailand all subsidize fuel costs (adding more Government Deficits over there). The threat of further oil-price increases has become a “key downside risk” for global growth, the International Monetary Fund said on April 11. Oil at $120 per barrel would shave 0.5 to 1.2 percentage points off gross domestic product growth this year in most of Asia’s biggest economies, Oversea- Chinese Banking Corp. said in a March 10 report.

“These governments feel very susceptible to populations that are under pressure, especially from food price increases, so they will basically do everything they can to try and head off trouble,” said Jim Walker, managing director at Hong Kong- based Asianomics Ltd. and former chief economist at CLSA Asia- Pacific Markets, in a phone interview. “That means subsidies and sometimes inappropriate spending from the public purse.” Federal and state debt levels in India, which meets about three-quarters of its annual energy needs from imports, are among Asia’s highest at 73 percent of gross domestic product, according to data compiled by Bloomberg.

Inflation has indeed become the United State's chief export as the deflating Dollar is the World's Reserve currency at 62% of all the money in the World and growing fast as Ben buys 'em as fast as Timmy can print them and then loans them out to the Banksters, who promptly lever that money 10:1 to buy commodities. Oh, I'm sorry, did I say buy? I meant speculate - buying commodities is what poor people do...

Rules are also only for poor people as Deutsche Bank (DB) follows Barclays' (BCS) example and, rather than put up $20Bn to cover $373Bn worth of exposure, the IBank is simply moving the potential losses off their books so they can "comply" with the Dodd-Frank Act. Is DB any less exposed than they were yesterday? No, not at all. Does this accounting move allow them to completely circumvent the law - sure it does. Laws are written to make sure that small banks get screwed and big banks have all the liquid capital, silly!

JPM just goosed the Financial Sector this morning with a 67% increase in record profits of $5.56Bn in Q1. Interestingly, $5.5Bn is just about the amount by which JPM reduced their provisions for credit losses - from $6.88Bn to $1.17Bn - making that the entirety of JPM's "profits" but, please, let's not spoil this rally by actually looking at the numbers. Q1 Revenues actually fell 8% and Retail Banking posted a $208M loss which Dimon called "good underlying performance” that was “more than offset by the extraordinarily high losses we still are bearing on mortgage-related issues. Unfortunately, these losses will continue for a while.” I'm going to go out on a limb here and predict that Cramer will tell you to BUYBUYBUY.

[click here to enlarge]

European Banksters are thrilled with JPM's profits AND DB's cleverness and they are leading EU markets up 1.25% this morning (9am) and our pre-markets are up about 0.75%, all reversing most of yesterday's losses. This will be an excellent chance to buy the QQQ April $57 puts for about .40 at the open as the Qs should open up around 56.78 and, last I checked - they didn't have all that many banks in the index so what the Hell are they so excited about?

The Dollar has been bashed back to 75 overnight and that's got gold back to $1,461 but silver came roaring back to $40.50 while copper is still looking bad at $4.38. Could it be that copper is a demand commodity that can't be hoarded like silver (and the big puts are getting layered now) and gold? Well oil is still down at $107 - also a demand commodity but a bit easier to manipulate than copper. Natural gas is $4.13 and gasoline is $3.21, only down a bit from the $3.27 wholesale high (and if you want to know who is raking in the cash - it's the gas retailers with their .53 spreads - up 47% from last year!). Retail gas prices are up 33% from last year - what inflation?

We expected a run to $108.50 into the 10:30 oil inventories and we'll be taking that opportunity to short oil again unless the net build is over 2Mb, which I doubt at $4 per gallon. According to AAA’s daily fuel-gauge report, the national average price for a gallon of regular gasoline is about $3.79, up about 33% from $2.86 a year earlier and projected to be up 40% over the Summer. The average U.S. household’s vehicle fueling costs will rise about $825 from last year’s level, hitting $3,360 in 2011, the EIA said.

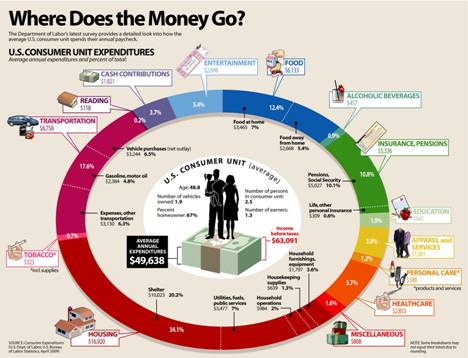

So let's see, a guy makes $63,000 and pays about $18,000 in taxes and has $40,000 to spend and gasoline alone takes away 5% of his possible spending. Sure - that's going to be fine...

This is not a bounce we'll be chasing - thank you!

Try out Phil's Stock World here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.