U.S. Housing Market Adjusted CPI, Gold, and Deflation Theory

Housing-Market / Deflation May 10, 2011 - 06:46 PM GMTBy: Mike_Shedlock

I am a firm believer that housing prices belong in the CPI. I have discussed this at length before, and in light of reported inflation (as measured by prices but certainly not credit), it's time to take another look at a CPI adjusted for housing prices.

I am a firm believer that housing prices belong in the CPI. I have discussed this at length before, and in light of reported inflation (as measured by prices but certainly not credit), it's time to take another look at a CPI adjusted for housing prices.

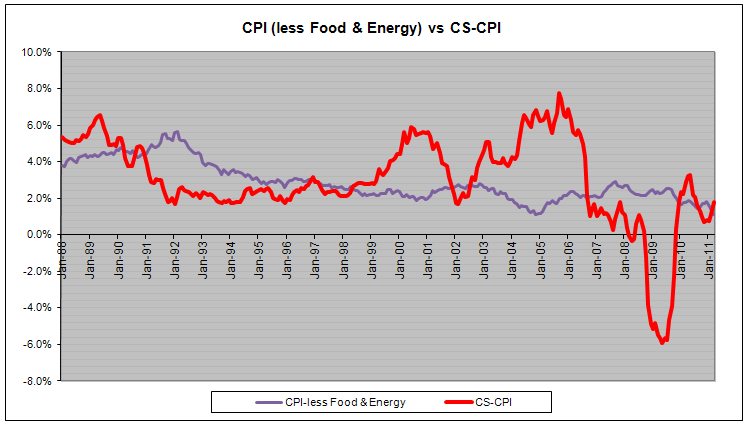

Here are a couple of chart from my friend "TC" that show the relation between the CPI, a Case-Shiller adjusted CPI, and the Fed Funds Rate. For more on the rationale behind the following charts please see What's the Real CPI?

Case-ShillerAdjusted CPI (CS-CPI) vs. CPI Less Food and Energy

That chart is for comparison purposes only. I do not mean to imply as Bernanke does, that one can exclude food and energy prices to make things appear benign when they aren't. Moreover, I certainly do not think the Fed should ignore housing prices as the Fed did from 2002-2006.

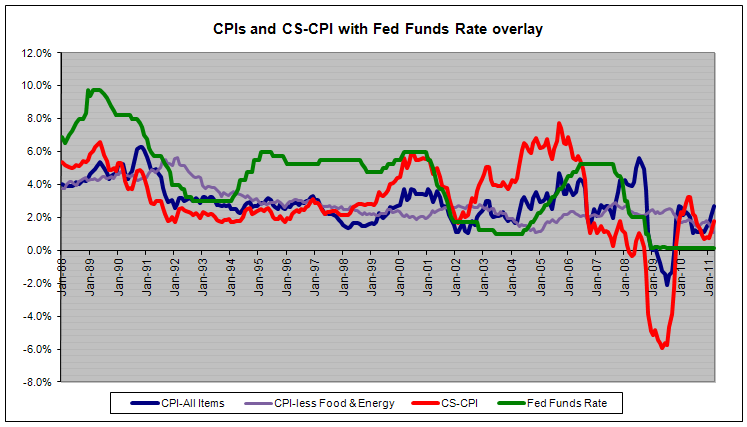

CS-CPI vs. CPI-U vs. Fed Funds Rate

Huge Inflation? When?

Those screaming inflation have a point, provided they are talking about 2002-2006.The lines to pay attention to are the lines in red and green. The Fed Funds Rate was above or identical to CS-CPI until January 2002. At that point housing prices shot up, along this the stock market, commodities, and everything else until late 2007.

As measured by CS-CPI, the Fed Funds rate went negative to the tune of 6% or so at various spots on the curve.

Fed Sponsored Housing Bubble

Normal Fed policy would be for the Fed Funds Rate to be a couple points higher than the CPI. With real interest rates running at -6%, is it any wonder the housing bubble got as big as it did?

Thus, Fed policy sponsored a housing bubble that Greenspan then Bernanke ignored every step of the way. Finally, when the bubble did bust, the Fed cut rates to zero in a series of panic moves hoping to stop the housing crash.

The Fed failed. Factoring in home prices, CS-CPI dipped to -6% in January of 2009.

Deflationists Got It Correct

Not only was there a credit bust, there was nearly 1.5 years of CS-CPI deflation, and near a year of CPI-All Items (CPI-U), deflation.

Whether you define deflation in terms of credit, in terms of purchasing power of the dollar, in terms of the CPI, or in terms of the Case-Shiller CPI, to the complete consternation of screaming hyperinflationists, those predicting deflation got it correct.

Where to From Here?

Should we get another credit crunch, and I think that is likely, I foresee another round of deflation. Thus my prediction has been and remains, the US will go in and out of deflation for a number of years. I see no reason to change that forecast.

Please note that I do not buy into the grand supercycle theory of deflation where the DOW drops to 1000 and the S&P 500 to 200 or lower.

I do not know if the bottom in equities is in or not, but no one else does either. Nonetheless, I see no sense in predicting something for 30 years that has not happened and still seems unlikely today.

Moreover, supercycle deflation calls for gold at $250 seem preposterous although in theory darn near anything can happen.

Why Gold?

As I predicted (unlike what other deflationists were saying), gold soared in response to Central Bank rate-cutting and liquidity moves. Notice I said Central Bank, not just the Fed.

Moreover, the sovereign debt crisis in Europe, the massive housing bubble in China and especially the credit bubble in China offer still more reasons to own gold.

Those calling for deflation and for gold to crash with it, blew the call. Hyperinflationists blew the call as well. I will address the silliness of hyperinflation theories in a subsequent post.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.