Gold and Silver Waiting for August

Commodities / Gold and Silver 2011 Jun 14, 2011 - 02:27 AM GMTBy: Jason_Hamlin

Precious metals investors are getting a little antsy as many newer investors and weak hands have been scared away after witnessing the first major correction since the financial crisis of 2008. While gold has only corrected 3% from its April high of $1,565, silver is down nearly 30% in the same time period. This article will focus on how I think things will play out over the next few months and into the close of 2011, with a focus on the price action in silver.

Precious metals investors are getting a little antsy as many newer investors and weak hands have been scared away after witnessing the first major correction since the financial crisis of 2008. While gold has only corrected 3% from its April high of $1,565, silver is down nearly 30% in the same time period. This article will focus on how I think things will play out over the next few months and into the close of 2011, with a focus on the price action in silver.

While the long-term fundamentals remain robust and I continue to expect silver to push towards $100/ounce at some point in 2012, the short-term situation is not so clear. The dollar may be the last fiat currency standing, as the sovereign debt situation in Europe deteriorates. In turn, the Euro weakness will likely provide strength for the dollar in the short term, along with the end of QE2 and continued silence from “The Bernank” regarding QE3. Throw in weak seasonality during the Summer months and we might have a recipe for lower silver and gold prices over the next month or two.

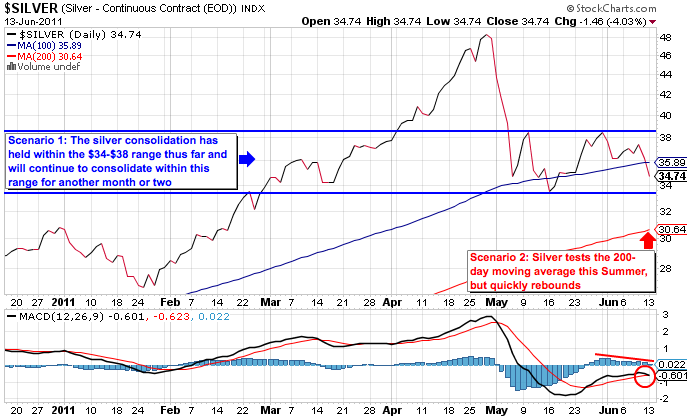

The technical chart for silver is not looking very bullish in my estimation and points to one of two scenarios. Either silver continues to be range-bound and consolidate within the $34 – $38 channel for another few months or the fundamental conditions mentioned in the previous paragraph create downward pressure and silver tests support at its 200-day moving average around $30.

I am inclined to believe that silver will test the 200-day moving average, as has occurred during every correction over the past decade. Even silver’s long consolidation of September 2009 to September 2010 eventually hit the 200-day moving average before blasting higher. I think there are plenty of buyers waiting for such an opportunity, so any dip to the $30 area is likely to be short-lived.

Getting a gauge on short-term price movements is useful, especially to traders, but it really has little impact on the longer-term view of the silver price. Whether silver stays within the consolidation range or dips to its 200-day moving average, I believe the outcome for later this year and into 2012 remains the same.

Silver is destined for much higher prices and all of the jawboning about the last move towards $50 being the top is utter nonsense. The inflation-adjusted high for silver is somewhere between $150 and $300, using conservative estimates of inflation. Furthermore, the fundamental conditions that created the previous high in 1980 are significantly worse today. The percentage move, while impressive, is also significantly less that the gain achieved during the last bull market.

So, I remain confident the silver bears that have called a top will be proven wrong (again). They will likely make the same top call when silver hits $100, $150 and $200. Eventually they will be right, just like a broken clock tells the correct time now and again, but we are a few years and a few hundred percentage points away from that moment. For those of you that have given credence to these “analysts” calling precious metals a bubble, why are you paying any attention to the people that have got it wrong so consistently? That is akin to trusting Jim Cramer or Ben Bernanke for advice on when the housing market has bottomed.

Waiting for August

So, I am currently in a holding pattern with a reasonable percentage of my portfolio in cash and short positions against overvalued stocks and ETFs. It can be boring at times and overactive investors are often frustrated by the lack of action. But I firmly believe that it is sometimes best to exercise patience and watch from the sidelines. The next opportunity will emerge soon enough, while our short positions advance and our core precious metals holdings catch any unexpected upside move.

I still hold a few junior miners which I am convinced are significantly undervalued and will play an explosive game of catch-up into the close of the year. And I am looking forward to utilizing the cash I have placed on the sidelines to pick up bargains on key mining stocks that are already oversold and will likely fall further as investors throw out the proverbial baby with the bathwater. It always happens during liquidations and the slow Summer months, but precious metals are always quick to bounce back.

Gold and silver are increasingly being viewed as money, not just an investment vehicle. This realization is huge in the face of the declining dollar and growing concern about the government’s ability to repay the mounting debt. The situation is reaching a boiling point, as they have already raided public pensions and many suspect that IRAs and 401k funds could be next. This is all under the guise of protecting us, of course.

In the meantime, I am patiently waiting until August, when the pressure will build for the next round of quantitative easing and the government will have to choose to either default on their debt obligations or push the nation one step closer to hyperinflation. Either way, I expect gold and silver to make new highs by year end and absent an all-out stock market collapse, we should see some truly incredible gains in select mining stocks that are currently trading as if gold was at $1,000 and silver at $20. The situation is out of whack and when equilibrium is restored, I believe those holding shares of quality miners are going be rewarded handsomely.

If you would like to see which mining stocks I am holding and which I am targeting to buy during the dip, sign up for the Gold Stock Bull Premium Membership. You will get the highly-rated monthly contrarian newsletter, real-time access to the model portfolio and email alerts whenever I am buying or selling. I also make myself available to premium members for questions via email.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2011 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.