U.S. Monetary Policy, A Case of Self-Induced Paralysis?

Interest-Rates / US Interest Rates Jun 23, 2011 - 01:03 PM GMTBy: Paul_L_Kasriel

This is a paraphrased title of an essay written in 2000 for the Peterson Institute for International Economics by then Princeton economics professor, Ben Bernanke. In Professor Bernanke's essay, "Japanese Monetary Policy" appeared in the title, not "U.S. Monetary Policy." In the essay, Professor Bernanke makes the case that the Japanese economy's weak real and nominal growth in the 1990s was the result of weak aggregate demand for goods and services, not aggregate supply constraints.

This is a paraphrased title of an essay written in 2000 for the Peterson Institute for International Economics by then Princeton economics professor, Ben Bernanke. In Professor Bernanke's essay, "Japanese Monetary Policy" appeared in the title, not "U.S. Monetary Policy." In the essay, Professor Bernanke makes the case that the Japanese economy's weak real and nominal growth in the 1990s was the result of weak aggregate demand for goods and services, not aggregate supply constraints.

Professor Bernanke reminds readers that low levels of nominal interest rates do not necessarily reflect accommodative central bank monetary policies. Professor Bernanke then argues that variations on what is now called quantitative easing could address the weak aggregate demand condition being experienced in the Japanese economy. Professor Bernanke argues that the only thing preventing the Bank of Japan from acting to remedy the situation of weak aggregate demand is intellectual paralysis on the part of the Bank of Japan itself and/or on the part of the Japanese government.

Professor Lawrence Summers and others recently have argued that the U.S. economy currently is experiencing weak aggregate demand, though not as weak as the Japanese economy's in the 1990s. If weak aggregate demand is the problem for the U.S. economy now, the then 2000 Professor Bernanke had the solution. But the now 2011 Federal Reserve Chairman Bernanke seems to have contracted a case of the same monetary policy paralysis he diagnosed Bank of Japan officials of being afflicted with in the 1990s. At least, this would be the logical conclusion to the FOMC's decision today to terminate its policy of quantitative easing.

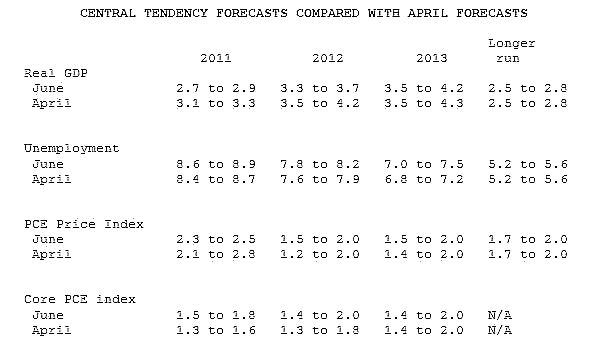

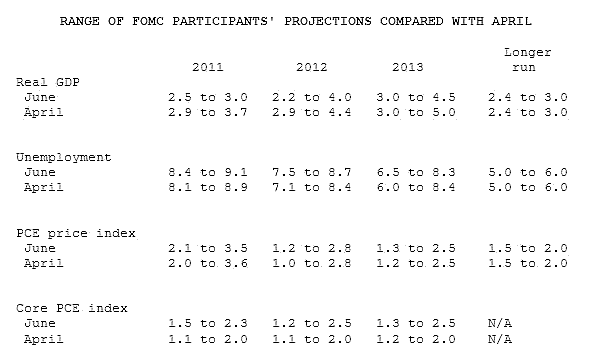

In fairness to now Federal Reserve Chairman Bernanke, when reminded in today's press conference by a Japanese reporter about this 2000 essay, Chairman Bernanke did say that the US economy currently does not face the pernicious deflation risk that the Japanese economy was experiencing in the 1990s. Nevertheless, the FOMC has reduced its real GDP growth forecasts and raised its unemployment rate forecasts, not only for 2011, but for 2012 as well (see table below). This indicates some doubts about the strength of aggregate demand going forward in the face of or because of the termination of a policy that unambiguously boosts aggregate demand.

Part of the decreased real GDP growth / increased unemployment rate central-tendency forecasts for June vs. April can be attributed to supply interruptions from Japan and higher energy prices. But given the FOMC's assumption that the supply interruptions are dissipating and that energy prices are declining, this explanation does not apply to the reduced real GDP growth and increased unemployment rate central-tendency forecasts for 2012. I think the central-tendency forecasts for real GDP growth and the unemployment rate are optimistic for 2011 and 2012 in the absence of continued quantitative easing.

Assuming that special temporary factors such as the Japanese supply interruptions held back real GDP growth in the first half of 2011, real GDP growth would have been even weaker in the absence of quantitative easing. Is it then reasonable to expect a meaningful acceleration in real GDP growth in the second half of 2011 and through 2012 in the absence of quantitative easing? Not unless one believes that the retarding effects of special factors dominated by a wide margin the stimulative effects of quantitative easing. I expect that the FOMC will have revised down its real GDP growth forecast and revised up its unemployment rate forecast for both 2011 and 2012 at Chairman Bernanke's November press conference even more significantly than it did today.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.