Does It Make Economic Sense to Strive for a Balanced Federal Budget?

Economics / Government Spending Jul 19, 2011 - 02:07 AM GMTBy: Paul_L_Kasriel

When business make capital expenditures in order to enhance future profitability, do they typically fund all of these capital expenditures out of current income? No.

When business make capital expenditures in order to enhance future profitability, do they typically fund all of these capital expenditures out of current income? No.

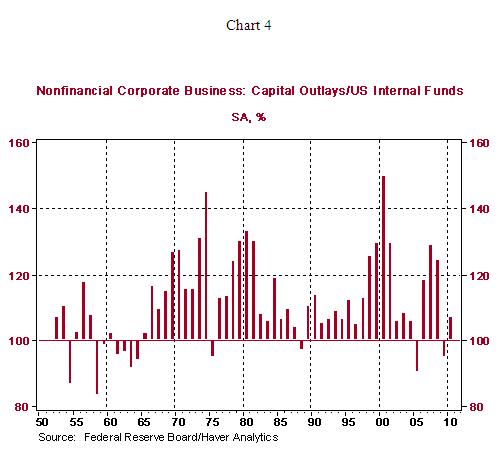

As shown in the chart below, it is far more typical that the dollar amount of corporate capital expenditures exceeds current net income. That is, capital outlays typically are more than 100% of profits after taxes and dividends. By borrowing or issuing equity to fund current capital outlays, corporations are assuming that these capital outlays will increase future profits enough to pay the principal and interest on borrowed funds, leaving enough left over to maintain or increase dividends and perhaps fund some other capital outlays or acquisitions.

If it makes sense for corporations to borrow to fund capital expenditures, why does it not make sense for the federal government to do so as well? By the government making investments in physical capital (infrastructure) and human capital (education), the economy's future growth rate would be expected to be enhanced. This, in turn, would imply higher future tax revenues (even, or especially, without higher tax rates) to pay the interest and principal on the debt issued to fund the government capital expenditures. An argument could be made that military hardware expenditures - nuclear subs and cruise missiles - are government capital expenditures. By deterring military attacks from enemies, we are able to go about our daily business of producing goods and services uninterrupted. So, rather than trying to balance the overall federal government budget, would it not make more sense to bring into balance the operating expenses of the federal budget with current revenues and have the Treasury borrow to fund federal capital expenditures?

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.