Irredeemable Fiat Currencies, The Ever-Changing Means of Mr Doubter…

Currencies / Fiat Currency Aug 10, 2011 - 12:38 PM GMTBy: Aftab_Singh

Mr Doubter, otherwise known as the child who pointed out the Emperor’s lack of clothes, has always played a key role in monetary affairs. However, the tools with which he has done his doubting have evolved over time. Here, I detail the means by which alert speculators have questioned the currency systems of the past, and the means by which they question the irredeemable fiat currency systems of today.

Mr Doubter, otherwise known as the child who pointed out the Emperor’s lack of clothes, has always played a key role in monetary affairs. However, the tools with which he has done his doubting have evolved over time. Here, I detail the means by which alert speculators have questioned the currency systems of the past, and the means by which they question the irredeemable fiat currency systems of today.

The distinction between monies and currencies:

As mentioned in our article on the Pound Sterling’s fall from grace, we make a distinction between monies and currencies. [Feel free to see the article itself for a more complete exposition of this point.]

Money does not have to be ordained into existence by the state, and it wasn’t ‘invented’ (as the propaganda producers at the ECB would have our children believe!). Rather, money is a good – indeed, any good – that people naturally come to choose as the medium of exchange. To overcome the difficulties inherent within a barter economy (for example, consider that the professor of economics who wants a haircut needs to find a hairdresser who wants lessons in economics!), people start to engage in indirect exchange.

And as for currencies:

For the purposes of the following discussion, I will use the term ‘currency’ to denote some kind of system of money (rather than simply money itself). So, for example, a banknote that is redeemable into gold would be a currency, but not necessarily a money (for example, consider whether or not a ‘greshams-law.com note’ would reach the status of a widely used medium of exchange!).

So, in this way, we can say that all currencies are functions of monies, but not all monies need be functions of currencies. For example, gold bullion might easily circulate as money alongside redeemable claims upon gold bullion, and yet the bullion wouldn’t be a ‘currency’.

Redeemable Currencies:

Before the early-1930s, currencies were generally redeemable in one sense or another. Meaning, the deal was that you could take your notes to the issuer for redemption at any time you pleased (into a previously agreed-upon quantity of gold/silver/copper or whatever else). To be sure, this kind of system was a great and much-loved improvement on previous systems. It allowed for great efficiencies to be made with respect to the transportation of wealth. Instead of people having to move vast quantities of gold, they could use notes, and allow the issuing institutions to settle the movement of gold in the background. However, with the transition from monarchy to democracy, the business of coin minting / currency production was somewhat transferred to the state. Or at least the state slowly but surely asserted itself upon the money business. In this way, currency issuers were able to indulge in the temptation that all currency issuers have faced through history; to issue notes beyond reserves. With the state’s progressively greater encroachments upon this business, these indulgences were able to run further and further. In short, for varying reasons, excessive issuances of notes weren’t necessarily checked immediately by competing banks. That is, lots of different laws and cartelization devices were implemented to stop banks from immediately bankrupting each other.

However, despite all the trickery, the kid who pointed out the emperor’s lack of clothes was waiting in the background. His means, back in those days, was to trade notes only at discounts from par and/or to redeem. Meaning, if a specific note was nominally redeemable into one ounce of gold, a form of doubting it – if you will – was to only exchange less than one ounce of gold coin/bullion against it and/or to express the redemption claim.

In 19th Century America, a class of “Money Brokers” emerged (perhaps the 19th century equivalents of gold bugs & certain currency speculators?). They would challenge the legitimacy of nominally redeemable notes issued by state banks. As Murray Rothbard wrote in his fantastic book; A History of Banking in the United States: The Colonial Era to World War II:

From the 1814–1817 experience on, the notes of state banks circulated at varying rates of depreciation, depending on public expectations of how long they would be able to keep redeeming their obligations in specie. These expectations, in turn, were heavily influenced by the amount of notes and deposits issued by the bank as compared with the amount of specie held in its vaults.

In that era of poor communications and high transportation costs, the tendency for a bank note was to depreciate in proportion to its distance from the home office. One effective, if time-consuming, method of enforcing redemption on nominally specie-paying banks was the emergence of a class of professional “money brokers.” These brokers would buy up a mass of depreciated notes of nominally specie-paying banks, and then travel to the home office of the bank to demand redemption in specie. Merchants, money brokers, bankers, and the general public were aided in evaluating the various state bank notes by the development of monthly journals known as “bank note detectors.” These “detectors” were published by money brokers and periodically evaluated the market rate of various bank notes in relation to specie.

“Wildcat” banks were so named because in that age of poor transportation, banks hoping to inflate and not worry about redemption attempted to locate in “wildcat” country where money brokers would find it difficult to travel. It should be noted that if it were not for periodic suspension, there would have been no room for wildcat banks or for varying degrees of lack of confidence in the genuineness of specie redemption at any given time.

Rothbard then goes on to explain why these guys weren’t very popular:

It can be imagined that the advent of the money broker was not precisely welcomed in the town of an errant bank, and it was easy for the townspeople to blame the resulting collapse of bank credit on the sinister stranger rather than on the friendly neighborhood banker. During the panic of 1819, when banks collapsed after an inflationary boom lasting until 1817, obstacles and intimidation were often the lot of those who attempted to press the banks to fulfill their contractual obligation to pay in specie.

Thus, Maryland and Pennsylvania, during the panic of 1819, engaged in almost bizarre inconsistency in this area. Maryland, on February 15, 1819, enacted a law “to compel . . . banks to pay specie for their notes, or forfeit their charters.” Yet two days after this seemingly tough action, it passed another law relieving banks of any obligation to redeem notes held by money brokers, “the major force ensuring the people of this state from the evil arising from the demands made on the banks of this state for gold and silver by brokers.” Pennsylvania followed suit a month later. In this way, these states could claim to maintain the virtue of enforcing contract and property rights while moving to prevent the most effective method of ensuring such enforcement.

Irredeemable Fiat Currencies:

So, now that Federal Reserve Notes, Euro notes, Pound Notes etc. are not ‘promises to pay’ as such, what is the primary tool of the skeptic? Well, to answer this, we have to at least attempt to grapple with the perilous and heretofore mysterious question of; what the hell is an irredeemable fiat currency?

As was said above, the deal used to be that you could take your notes for redemption into a specific quantity of gold (or silver/copper) at any time you pleased. Occasionally, the issuers would ‘debase’ those notes by reducing that specific quantity. As debauched as such acts used to be, at least they were embarrassing to the issuer. The redeemable currencies of the world stepped over into the realm of the irredeemable fiat currency when said reduction was absolute. That is, when it was declared that, instead of those notes being redeemable into a definite quantity of gold, or even a smaller quantity of gold, they were to be redeemable into nothing at all. As soon as this happened, those currencies became claims that were merely ‘good for’ the assets that were there to back them. In this way, each Federal Reserve note, Euro note, and Pound Sterling note became an irredeemable claim upon a portfolio of assets. Only, by their very declarations, central bankers (the guys in charge of the portfolios) had no intention of keeping those assets in tact. Thus, the only consistency that was to arise from this arrangement was that their consistency would be decided by the interplay between a committee of (somewhat) democratically elected bureaucrats and the market.

Recall, the ‘doubters’ of former redeemable currency systems had the options of trading currencies at discounts from the nominal redemption amount (‘par’) and/or to actually redeem. When the currencies of the world turned irredeemable, the redemption option vanished, so the trading of currencies at varying ‘discounts from par’ is all that potentially remains. As self-proclaimed alert speculators then, we should be wary and curious as to how the former discounts translate to modern-day currency systems. If it remains the expression doubt, then it should be high on our list of priorities.

Well, since at any given point, a central bank has a portfolio of assets ‘backing up’ its liabilities (which are Federal Reserve notes, Euro notes etc. with their respective reserve balances), then we can regard ‘par’ (for a given note) as the tiny slice of the portfolio of assets that ‘backs it’. The means of doubting whether or not that note will remain solid in its consistency is to trade those notes at suitable discounts to par. That is, to only buy the irredeemable fiat currencies at levels where the market is over-discounting the degree of monetary debauchery to come, and to sell them (against the assets backing them) at levels where the market is under-discounting the degree of monetary debauchery to come. In short, the primary means of the modern-day doubter is to participate as a speculator in the currency and central banking asset markets (the bond market, the gold market, etc.).

Of course, this has been neatly articulated by many people when it comes to the gold market. That is, people have correctly attributed the renewed trend towards embracing gold as a ‘rejection of irredeemable fiat currencies’. This is true, but we think that there’s more to be understood about this when we consider the insights above. Since the world’s irredeemable fiat currencies are primarily backed by bonds (indeed, mostly US government bonds), it is no surprise to us that the bond market is spiking in this environment. Rather than this spike being an ode to the US government, it should be thought of as an insult to the Federal Reserve! Federal Reserve notes are – by and large – claims upon Treasury bonds, so the bidding up of those bonds against Federal Reserve notes is an active way of discounting further monetary debasement (in this environment). This is just another example of how the up=good / down=bad fallacy can invoke bewilderment. In fact, it would seem that the market is framing the Federal Reserve as more profligate than the US government. To be sure, it’s a close match, but we believe that this will change. With this understanding, the paradox of the strong correlation between the supposedly antagonistic assets of gold and government bonds fizzles away…

[Incidentally, we'll be writing about the implications of an intolerant bond market soon. After all, this scenario may be on the way in the ensuing months and years. If you think that the last few weeks haven't been pretty, then you probably won't like it when the bond vigilantes wake from their generational slumber!]

Being the Doubter is Hard! Gains weren’t guaranteed back then, and they still aren’t! Entry Point Matters!

The above shouldn’t be regarded as free ticket to gains. Being a doubter is hard! After all, it is no use saying that a fully-clothed Emperor is naked!

In former redeemable currency systems, the task of buying, selling and redeeming notes was a difficult one. If you decided to buy — say — a large chunk of banknotes on the market at a specific discount, and then found that the bank didn’t have the gold to cover your outlay, you would obviously find yourself with losses. Alternatively, if you speculated that a certain banknote would trade at a greater or lower discount to spot, you might have easily found yourself with losses if your assessment proved incorrect. Likewise, we’re faced with similar problems in the practicalities of modern day-to-day currency, gold and bond trading.

Perhaps on a very very long-term time horizon, gold is a ‘one way bet’. But as we hone down to the practicalities of month-by-month and year-by-year investing, things become a little more difficult. It is conceivable, that one day the market will discount a degree of monetary debasement that will be outrageously far off the reality of the situation. At this time, the whole world will be looking at gold day and night, and the catchphrases associated with gold will be on everyone’s lips. At that time, and only at that time, will it be prudent to short gold. In fact, it seemed that this is precisely what happened during the early-1980s price spike in gold:

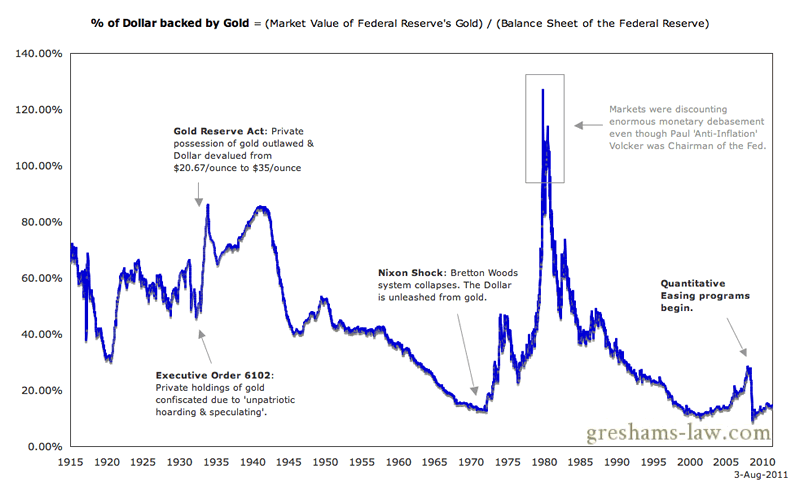

As can be seen here, the market was discounting huge monetary debasement at precisely the wrong time. It was as if they had completely written off the entire stock of bonds on the Fed's balance sheet. Right now, people still respect US Treasury notes and bonds; we would at least have to see that respect turn to revulsion before considering selling/shorting gold. - Click to enlarge. This chart is updated every week on the 'Long-Term Charts' Page

This property has given rise to our relatively bullish stance on the dollar over the past few weeks. Because of the near-term spikes in bonds and gold, the market is discounting a degree of imminent monetary debasement that has been unparalleled for years. In this way, continued weakness in the dollar is highly dependent on the Federal Reserve accommodating the market’s perception of what it will do (which is severe monetary debasement with an imminent QE3 et al). And yet, there are many scenarios where this wouldn’t happen. Indeed, the Federal Reserve has consistently displayed intellectual conceits that suggest that it won’t happen. This is our bullish case for the dollar over the next month or two (or three or four): the market has become so convinced about a certain path of monetary policy (as evidenced from the degree to which Federal Reserve notes have been bid down against central banking assets), that any disruption to that view could cause a drastic realignment of market perceptions (and subsequently the degree to which Federal Reserve notes trade at discounts to par). [The opposite recently occurred in Europe, so that's why we have been relatively bullish on the dollar lately].

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.