Gold and Silver Deeper Correction Due?

Commodities / Gold and Silver 2011 Aug 27, 2011 - 01:47 AM GMT The rise in the gold price has continued and shown a break up above the trend line. This has always been a sign that the gold, silver prices have 'spiked'. This has always been a signal to be ready to take profits and be ready to go back in lower down.

The rise in the gold price has continued and shown a break up above the trend line. This has always been a sign that the gold, silver prices have 'spiked'. This has always been a signal to be ready to take profits and be ready to go back in lower down.

This was a correct approach and we do not argue with the logic; however, a change is happening in precious metal markets. Over the last few weeks gold has run ahead but it has seen brief and shallow corrections until this last week when traders and speculators caused a 'spike' to $1.910, before an equally dramatic fall back to $1,716. This is not the sort of correction we are discussing here. The speed and extent of the correction did not reflect the market fundamentals.

So we must ask, "Are the current buyers also potential sellers?" In developed markets, the concept that an investor will not take a profit once his target price is reached seems ridiculous because it is believed that all buyers will be sellers when they have a good profit. But in the changed gold market of today buyers are not often sellers, as we know it.

Does the Developed World Still Dominate Gold Prices?

The ongoing uncertainty in the developed world, the lack of political leadership over financial matters Angela Merkel telling all that governments should not be told what to do by markets, still--and overwhelming debt in the face of further economic downturns, points to demand for gold coming from the developed world; however, gold demand is lackluster there, at best.

Developed world investors are asking themselves...

Developed world investors are asking themselves...

-

Will the developed world debt and distress factors pushing gold higher be put right?

-

Are these the factors that are pushing gold higher?

-

Are the gold and silver price rises just about the developed world and its problems?

- Has gold seen its top?

By past measures the gold price looks as though it should have a deep correction. The same was said when gold hit $500 after rising from $300 too.

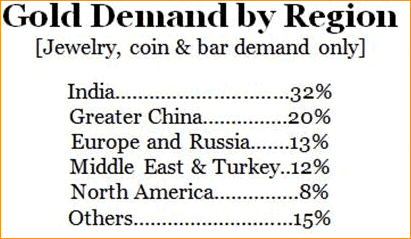

There has never been a more important time to understand both the gold and silver markets. Those who followed our Alert bought gold at $1,555 and are still holding gold. The table to the left is the most definitive piece of evidence describing what is happening in the global gold markets.

Gold Goes Global

Gold went really global around five years ago. In 2009 central banks came in as buyers. These two factors have changed the gold market entirely; they have distorted the factors bearing on technical analysis and changed the way prices move now. In fact, the very nature of investors in gold has changed, and for good!

Of course the market looks as though it needs a major correction, if you look at it through the eyes of six years ago. If you believe the picture painted by the old criteria, you should sell gold and stay out until it drops back, but to where?

If you understand the new investors and how they think, then your conclusions should be different. Look at what has happened since June and note that while the risks in the gold market have risen, current buyers are not price chasers either. This fact alone should make you ask,

Are they likely to be sellers because of a swift rise?

What we have seen is a failure to follow prices up, but to wait until they pull back and for physical gold to be on offer. The new investor wants physical gold itself and is not so concerned with price. If they are right, sooner or later the price will rise to well above what they have paid. The lifespan of their investment is generations long, not days, weeks, or years long.

The conditions that have lifted gold from $275 to $1,900 continue to persist. The gold price is not about gold; it is about the bear market in currencies, the deteriorating confidence in the value of currencies, as well as developed world's government's ability to restore that confidence.

As these factors point to more of the same expect a continuation in the fall of currencies against gold and silver to levels deemed incredible by the developed markets of the world.

Do you expect the value of currencies to rise? Do you expect a resurgence of economic health in the developed world? Do you expect strong government with the force and conviction to produce a reformed strong monetary system across a financially united world?

Asian View of Money

Asia has always had an inherent trust in precious metals; a trust, which has now been validated again and again over the last decade.

Asian investors have never believed that paper money is a solid measure of value. When they see currencies weaken it is in line with the nature of governments. Is there a government whose money has lasted throughout its entire lifetime? When there has been, its money was gold and silver, and such money has lasted throughout most governments in history. Now, has there been a paper money based on a government's obligations that has lasted beyond the life of the government?

It is this perspective of money that is critical to understanding today's gold and silver markets.

There is a point where confidence in paper money has sunk so low that a collapse is triggered. Governments will fight tooth-and-nail to prevent that from happening. When it does happen, it happens as fast as rebels entering Tripoli.

Central bank's investment in gold is an insurance policy against such a collapse. People who have never been lulled into the developed world's sophisticated monetary systems are not likely to be so, now that it looks so wobbly. The rise of gold and silver prices is about the fall of paper money.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.