What happens when the U.S. Bond Market Loses its Patience?

Interest-Rates / US Bonds Aug 29, 2011 - 05:15 AM GMTBy: Aftab_Singh

The concomitant surges in the dollar prices of gold and the US treasury note seem to have got many market participants scratching their heads. For isn’t gold an ‘inflation asset’ and the treasury note a ‘deflation asset’? Aren’t they supposed to be antagonistic to one another? We square this price action by noting that the means of the currency skeptic are distinctly peculiar in this post-Bretton Woods experiment — it matters that the Federal Reserve note is by and large ‘backed’ by US government securities and gold. That being said, our hunch is that this price action is a relatively temporary phenomenon; for whereas gold remains intact regardless of an increasingly precarious stock of irredeemable claims upon it, US government securities do not. We believe that the current tolerance of the US bond market should be regarded as the last gift from above. Here I outline why a world with an intolerant bond market might not be that pleasant.

The concomitant surges in the dollar prices of gold and the US treasury note seem to have got many market participants scratching their heads. For isn’t gold an ‘inflation asset’ and the treasury note a ‘deflation asset’? Aren’t they supposed to be antagonistic to one another? We square this price action by noting that the means of the currency skeptic are distinctly peculiar in this post-Bretton Woods experiment — it matters that the Federal Reserve note is by and large ‘backed’ by US government securities and gold. That being said, our hunch is that this price action is a relatively temporary phenomenon; for whereas gold remains intact regardless of an increasingly precarious stock of irredeemable claims upon it, US government securities do not. We believe that the current tolerance of the US bond market should be regarded as the last gift from above. Here I outline why a world with an intolerant bond market might not be that pleasant.

The Means of Doubting a Currency:

We addressed the issue of the ever-changing means of Mr Doubter in a recent article, however I’ll quickly review one key point for those who haven’t read it.

The means by which the doubter of currencies does his doubting today is quite different when compared to the analogous doubters of previous monetary ages. In short, rather than the heretical speculator using the usual means of redemption, he uses the tool of exchange — he swaps his irredeemable fiat currency notes for the assets upon which they supposedly make a claim. This is because the there is no physical ‘promise’ involved with modern irredeemable fiat currencies. As mentioned in that previous article, the only consistency involved with modern-day fiat currencies is that they are constantly subject to the supposedly benevolent whims of a committee of statist bureaucrats:

In this way, each Federal Reserve note, Euro note, and Pound Sterling note became an irredeemable claim upon a portfolio of assets. Only, by their very declarations, central bankers (the guys in charge of the portfolios) had no intention of keeping those assets in tact. Thus, the only consistency that was to arise from this arrangement was that their consistency would be decided by the interplay between a committee of (somewhat) democratically elected bureaucrats and the market.

In our time, where the very legitimacy of the fiat currency is being questioned, we find ourselves operating in a seemingly contradictory environment; we are witnessing a huge upward surge in the dollar price of gold at the same time as a huge upward surge in the dollar price of US Treasury bonds and notes.

A Slightly Inappropriate Legacy

An interesting thing to note is that the ‘art’ or ‘science’ of security analysis is very old. Whereas, in contrast, the irredeemable fiat currency system is decidedly young. I am not saying that the long-standing merits of good-old security analysis have vanished, but I am saying that such security analysis scarcely pays great attention to the issue that debt securities can be monetized into an irredeemable fiat currency system.

In particular, let’s consider the silly contention that if the money price of something goes up then it must be an ode to the consensual ‘loveliness’ of that asset (or conversely if the money price of something goes down then it must be an insult to that asset). By this lens of viewing the financial markets, one might conclude that the recent spike in the US treasury note is a blatant refutation of the contentions of all naysayers, and evidence of the greatness of the mighty US government. This is nonsense; anyone with a semblance of clean and good thought must note that there is symmetry in every price of every financial asset. The dollar price of a given US government security is, of course, as much about the dollar as it is about the US government security! So, in this way, a spike in the dollar price of US government securities may well represent revulsion for the dollar rather than adoration for the debt security!

Interesting Times – Contrasting Dynamics across the Waters:

Needless to say, we live in interesting times — the differing outcomes from varying debt monetization policies are all too evident when contrasting the systems that lie across the waters of the Atlantic Ocean and the English Channel. Whereas the US and the UK have opted to transfer a problem involving creditors to the government and the government itself to all holders of their respective central bank notes, the Euro — in spite of all its flaws — has opted to take a higher road where the brunt of the pain is at least debated amongst the original creditors and debtors.

Whereas the collapses in peripheral European sovereign debt have been widely regarded as the consequence of incompetence of the issuing nations, it may also be regarded as a testament to the relative decency of the Euro. For all its woes, we must remember that Jean Claude Trichet has even read Money, Bank Credit, and Economic Cycles by Jesus Huerta de Soto!!!

The Independent Asset Vs the Dependent One:

Ironically, the great complaint about gold is its strength. ‘Gosh…’ some say with dogmatic exasperation, ‘how can you own gold when it yields nothing?’ This is precisely why it is a great asset in these times — it is on the balance sheets of the world’s central banks and yet it is not tied to the liabilities of central banks like the US Treasury note. This gives gold a degree of independence — if you will — that is not shared by the Treasury note. Of course, the Treasury note is denominated in the dollar; and however ‘safe’ they may be considered because of the cozy relationship between the Fed and the Treasury, this relationship contains the seeds of its own destruction.

The Worn Thread, the Tipping Point, the Cliff…

The key point here is that government debt securities cannot be monetized forever into oblivion — people don’t tolerate pain endlessly, especially given that it never had to be tolerated in the first place! In a sense, the words of Etienne de la Boetie have some roundabout relevance here:

How does he have any power over you except through you? How would he dare assail you if he had no cooperation from you? What could he do to you if you yourselves did not connive with the thief who plunders you, if you were not accomplices of the murderer who kills you, if you were not traitors to yourselves?

At the point in time when the bond vigilantes awaken from their thirty-year slumber, and realize that the denominator is destined to tend to confetti, the outright revulsion for the Federal Reserve note in relation to the US Treasury note may rudely turn 180 degrees.

This, by itself, is not incredibly dangerous. Despite all the gloomy musings posted here on greshams-law.com, we must remind our readers that if the consensus were to really change, then after a relatively brief period of financial chaos, proper moral, economic and political order could be in place within a few years. However, it is our hunch that people will not change and that the unpalatable circumstances brought about by an intolerant bond market will lead to greater and greater encroachments upon the already scarce strata of productive men. Although this remains a hunch (and it could be contradicted going forward), we find that the souring of thought articulated by Carroll Quigley in Tragedy & Hope: A History of the World in Our Time summarizes the long-term secular trend in the herd’s mindset:

To the nineteenth century mind evil, or sin, was a negative conception. It merely indicated a lack or, at most, a distortion of good. Any idea of sin or evil as a malignant positive force opposed to good, and capable of existing by its own nature, was completely lacking in the typical nineteenth-century mind. To such a mind the only evil was frustration and the only sin, repression.

Just as the negative idea of the nature of evil flowed from the belief that human nature was good, so the idea of liberalism flowed from the belief that society was bad. For, if society was bad, the state, which was the organized coercive power of society, was doubly bad, and if man was good, he should be freed, above all, from the coercive power or the state. Liberalism was the crop which emerged from this soil. In its broadest aspect liberalism believed that men should be freed from coercive power as completely as possible. In its narrowest aspect liberalism believed that the economic activities of man should be freed completely from “state interference.” This latter belief, summed up in the battle-cry “No government in business,” was commonly called “laissez-faire.” Liberalism, which included laissez-faire, was a wider term because it would have freed men from the coercive power of any church, army, or other institution, and would have left to society little power beyond that required to prevent the strong from physically oppressing the weak.

… The average man of 1880 was convinced that he was the culmination of a long process of inevitable progress which had been going on for untold millennia and which would continue indefinitely into the future. This belief in progress was so fixed that it tended to regard progress as both inevitable and automatic. Out of the struggles and conflicts of the universe better things were constantly emerging, and the wishes or plans of the objects themselves had little to do with the process.

… These characteristics of the nineteenth century have been so largely modified in the twentieth century that it might appear, at first glance, as if the latter were nothing more than the opposite of the former. This is not completely accurate, but there can be no doubt that most of these characteristics have been drastically modified in the twentieth century. This change has arisen from a series of shattering experiences which have profoundly disturbed patterns of behavior and of belief, of social organizations and human hopes. Of these shattering experiences the chief were the trauma of the First World War, the long-drawn-out agony of the world depression, and the unprecedented violence of destruction of the Second World War. Of these three, the First World War was undoubtedly the most important. To a people who believed in the innate goodness of man, in inevitable progress, in the community of interests, and in evil as merely the absence of good, the First World War, with its millions of persons dead and its billions of dollars wasted, was a blow so terrible as to be beyond human ability to comprehend. As a matter of fact, no real success was achieved in comprehending it.

… In contrast with the nineteenth-century belief that human nature is innately good and that society is corrupting, the twentieth century came to believe that human nature is, if not innately bad, at least capable of being very evil. Left to himself, it seems today, man falls very easily to the level of the jungle or even lower, and this result can be prevented only by training and the coercive power of society. Thus, man is capable of great evil, but society can prevent this. Along with this change from (good men and bad society to bad men and good society has appeared a reaction from optimism to pessimism and from secularism to religion. At the same time the view that evil is merely the absence of good has been replaced with the idea that evil is a very positive force which must be resisted and overcome. The horrors of Hitler’s concentration camps and of Stalin’s slave-labor units are chiefly responsible for this change.

Associated with these changes are a number of others. The belief that human abilities are innate and should be left free from social duress in order to display themselves has been replaced by the idea that human abilities are the result of social training and must be directed to socially acceptable ends. Thus liberalism and laissez-faire are to be replaced, apparently, by social discipline and planning. The community of interests which would appear if men were merely left to pursue their own desires has been replaced by the idea of the welfare community, which must be created by conscious organizing action. The belief in progress has been replaced by the fear of social retrogression or even human annihilation. The old march of democracy now yields to the insidious advance of authoritarianism, and the individual capitalism of the profit motive seems about to be replaced by the state capitalism of the welfare economy. Science, on all sides, is challenged by mysticisms, some of which march under the banner of science itself; urbanism has passed its peak and is replaced by suburbanism or even “flight to the country”; and nationalism finds its patriotic appeal challenged by appeals to much wider groups of class, ideological, or continental scope.

The Discounting of Irredeemable Fiat Currencies in the Absence of a Tolerant Bond Market:

One may reasonably ask: why is this a problem? Well, to be sure, it’s not a problem per se, but rather a trigger to some decidedly unlovely happenings. Without a tolerant bond market, the bulk of the degree to which the market discounts monetary debasement will have to be felt in central banking assets that are not bonds; which is essentially gold:

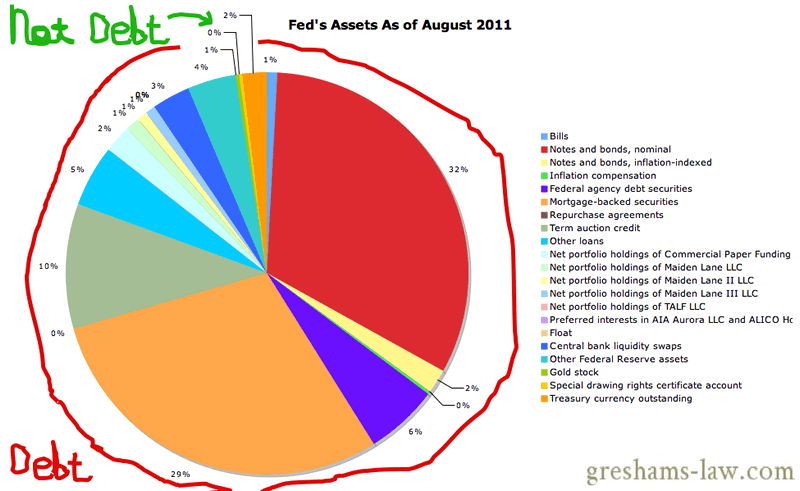

Bearing in mind that the Fed has some funky accounting principles - the above shows the Fed's assets on a proportional basis in August 2011. It's all debt! - Click to enlarge. Source: Federal Reserve

Till yet the gold bull market has been fantastic. After all, despite the onslaught of continuing monetary debasement, the gold price has risen well beyond consumer prices (and other financial assets for that matter). This would be an environment where the money prices of gold would have to rise with such a vengeance that commodity prices would be forced higher to maintain any semblance of reasonable ratios between these assets. This, we would contend would be deemed as incredibly unpalatable by the majority of the voting public. And as people seek solutions from the very creator of the problems, government, we can only suspect that the reality-denying mindset of the people will bring forth some rather debauched policies.

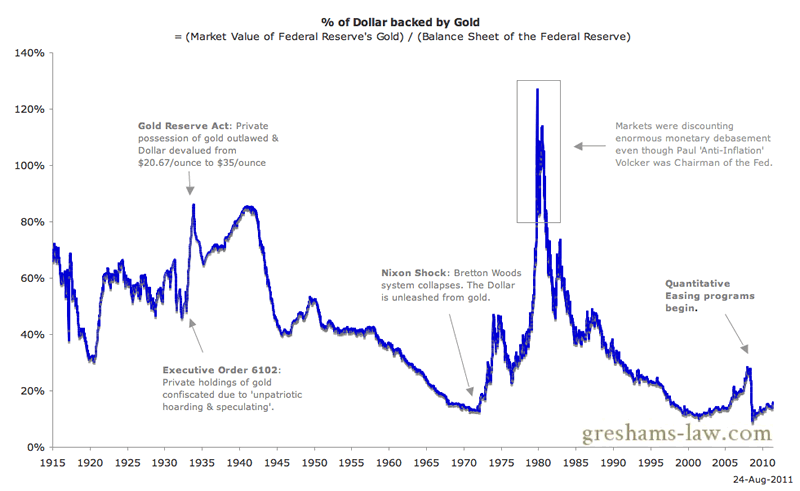

We are incredibly far away from a scenario similar to that seen in 1980-1981. At that time, the market had essentially written off the entire stock of debt securities on the Fed's balance sheet... and then some! If the bond bull market were to come to a close over the coming years, we might have to see enormous increases in commodity prices and all the debauched policies that come along with it. Click to enlarge. Source: St Louis Fed & World Gold Council. This chart is updated every week on the 'Long-Term Charts' Page.

In the past (here and here), we mentioned that the precondition to a hyperinflation is some kind of lodged conviction that somehow more money printing is a prudent response to the consequences of previous rounds of money printing. For those who were wondering what kind of scenario could lead to such a hyperinflationary premise: the environment where the bond market isn’t quite so tolerant could be a proper platform for this! An intolerant bond market could produce circumstances where — for example — declines in the external value of currencies could be deemed to be a good reason to print more money (and thus do further damage to the external value of the currency and so on)….

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.