Is the Gold And Silver Correction Over?

Commodities / Gold and Silver 2011 Oct 03, 2011 - 01:47 PM GMTBy: Jeb_Handwerger

Stock markets are tumbling from Japan to Wall Street. Already shaky Spanish and Italian financial instruments are quaking in their fancy boots as Greece does not make the cuts needed to be able to receive financial assistance. Vladimir Putin, a prototypical example of a classic Russian Bear says that the American Bull has blunted horns and suffers from impotence. He states, "Americans are living beyond their means and shifting the weight of their problems to the world economy...They are living like parasites off the global economy and their monopoly of the dollar." China joined Putin by calling the brouhaha in the West as "madcap brinksmanship."

The scepter of fear is haunting the fiscal world from West To East. International turbulence is precipitating a search for safe havens. Treasuries (TLT) are hitting new highs, the U.S. dollar (UUP) has bounced versus other currencies, commodities (DBC) are being sold off and gold(GLD) and silver (SLV) bullion's volatility has increased significantly.

These actions are signaling a notice of caution in an economy which is in desperate need of jobs. It is not only the debt crisis, it is the DEBT. The world is worried. No country including the United States can long remain a global factor when dollars are being squirreled away at close to 0% interest in cash and long term treasuries. This capital should be productively used to build factories, mines and mills.

Dormant dollars and treasuries are not exactly the B12 injection that the old bull needs. Do not be surprised as unemployment soars that the Fed at its upcoming meetings does a reprise of the show from the summer of 2010. It may not be a stretch to think that all of these developments may be programming us for Chapter 3 in an ongoing series of quantitative easing to try to stimulate job growth and to stave off a deflationary spiral as Operation Twist was a dud.

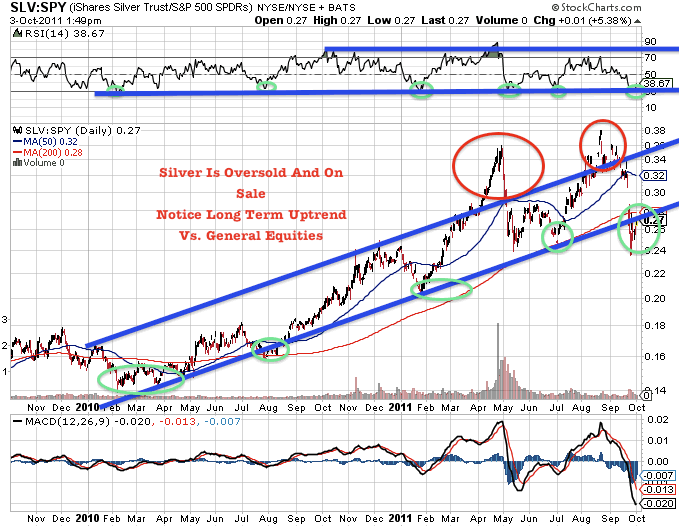

By now our readers should realize that it is specifically those sectors representing wealth in the earth resources such as the gold (GDX) and silver (SIL) miners that will prove to be areas of sizable payouts in times to come. Our sectors represent buys of a lifetime as the global economy is in convulsions.

It must be realized that not all wealth in the earth sectors move synchronously. Gold and silver are unique in that over the centuries they move from peaks to valleys and back again with breathtaking volatility. An examination of historic charts reveal that despite the ongoing roller coaster the precious metal arc rolls upward.

Right now, gold(GLD) has achieved our long awaited pullback to the $1600+ area. Our firm recommended taking partial profits in a percentage of our holdings in gold before this pullback. It appears to be a prudent move as we witnessed a short term decline. Now may be a more propitious time to reenter at oversold conditions and after a healthy correction.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.