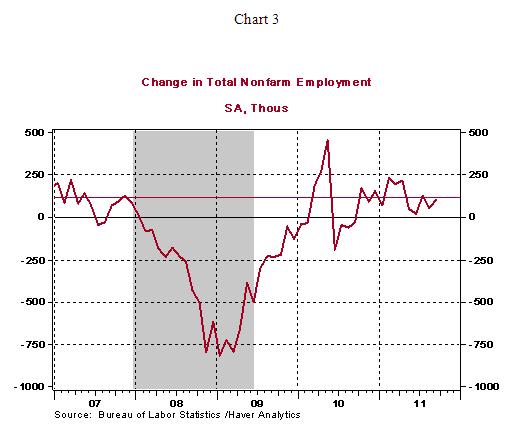

U.S. Unemployment Rate 9.1% in September, unchanged from August

Economics / Unemployment Oct 08, 2011 - 04:53 AM GMTBy: Asha_Bangalore

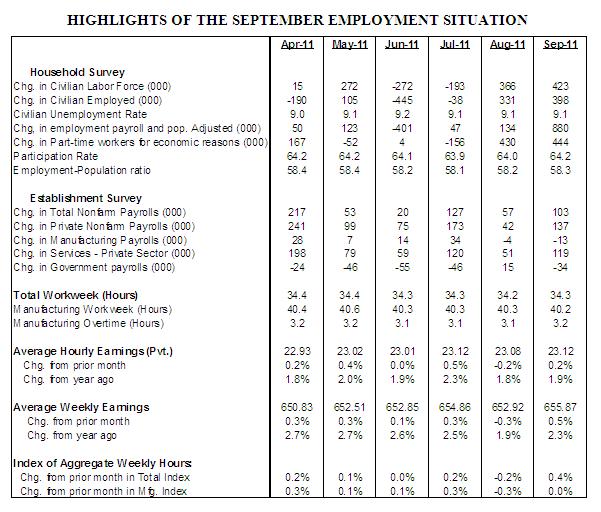

Civilian Unemployment Rate: 9.1% in September, unchanged from August. Cycle high jobless rate for recession is 10.1% in October 2009.

Civilian Unemployment Rate: 9.1% in September, unchanged from August. Cycle high jobless rate for recession is 10.1% in October 2009.

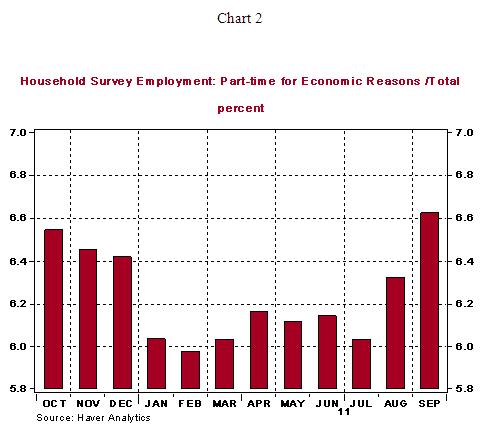

Payroll Employment: +103,000 jobs in September vs. +57,000 in August. Private sector jobs increased 137,000 after a gain of 42,000 in August. Addition of 99,000 jobs after revisions to payroll estimates of July and August.

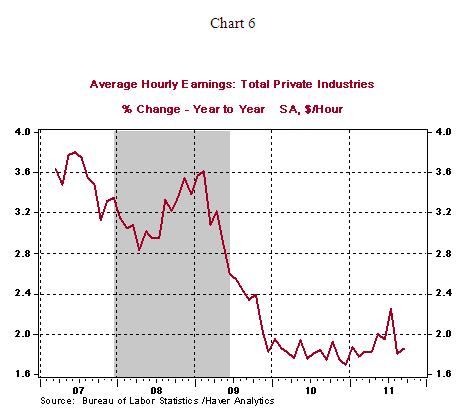

Private Sector Hourly Earnings: $23.12 in September vs. $23.08 in August; 1.9% y-o-y increase in September vs. 1.8% y-o-y gain in August.

Household Survey – The unemployment rate held steady at 9.1% in September. The jobless rate has not improved in the first-half of the year (see Chart 1).

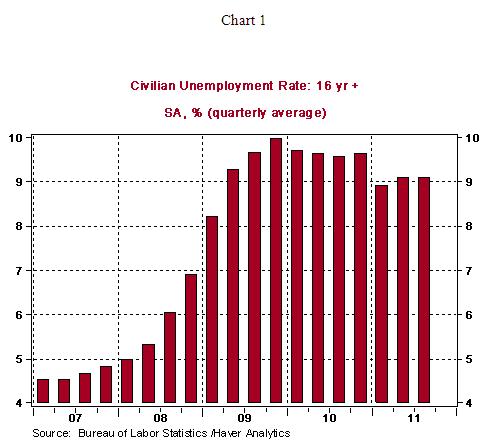

The most worrisome aspect of data from the household survey is that a noticeable percentage of the improvement in employment in August-September period is part-time employment (see Chart 2). Therefore, it is entirely conceivable that part-time employment status can change to unemployed if economic conditions weaken.

Establishment Survey – Payroll employment rose 103,000 in September after an upwardly revised gain of 57,000 in August (previously reported as no change). The upward revisions of July and August resulted in 99,000 more new jobs. These headline numbers paint a more positive picture of the economy than other recent data pertaining to overall consumer spending and home sales. But, details cast a partial shadow on the September employment report. The increase in employment during September includes the return of 45,000 telecommunications workers in September after a strike in August. To account for this event, the average of August-September payroll employment is a better indicator of hiring, which works out to be only 80,000 jobs vs. a year-to-date average of 119,000 jobs.

Highlights of changes in payrolls during September 2011:

Construction: +26,000 vs. -7,000 in August

Manufacturing: -13,000 vs. -4,000 in August

Private sector service employment: +119,000 vs. +51,000 in August

Retail employment: +14,000 vs. -1,000 in August

Professional and business services: +48,000 vs. +38,000 in August

Temporary help: +19,400 vs. +20,300 in August

Financial activities: -8,000 vs. +5,000 in August

Health care: +43,800 vs. +32,500 in August

Government: -34,000 vs. -15,000 in August

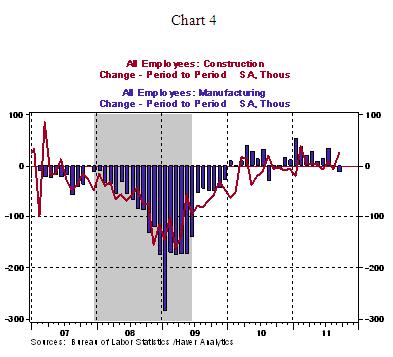

Manufacturing employment has failed to advance in the August September months, while construction employment grew sharply in September (see Chart 4). Health care employment (+43,800) continues to lift payroll employment, temporary help added nearly 20,000 to the headline number, and government employment fell.

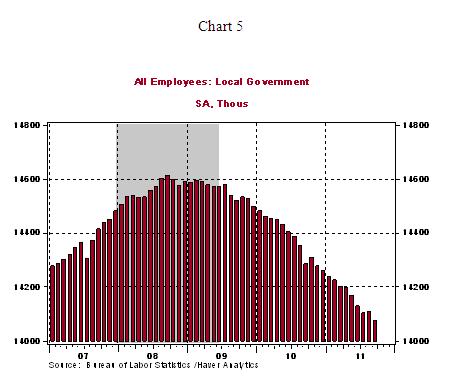

A loss of 5,000 postal service jobs and 35,000 local government jobs accounted for the weakness in hiring in the public sector. Local government employment has dropped 535,500 from the peak in September 2008 (see Chart 5).

The pickup in hourly earnings ($23.12 vs. $23.08 in August) is noteworthy because the decline in August had raised the odds of further weakening of the economy. The year-to-year increase (1.9%) remains contained and offers little support for the hawks on the FOMC.

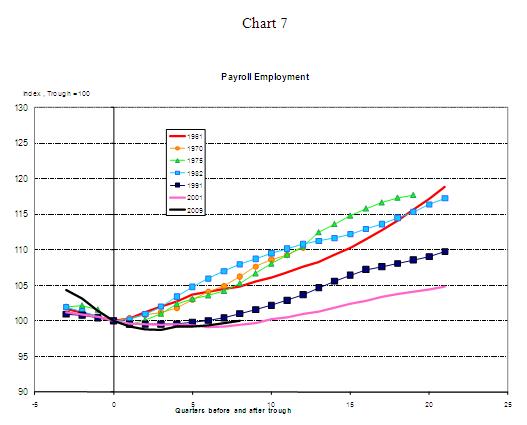

Conclusion – As the title of today’s comment suggests, the headlines were a mild surprise given the string of disappointing recent economic reports. The positives – increase in payroll employment and upward revision of July and August estimates, total workweek was longer than in August, and hourly earnings moved up after a drop in August – are noteworthy. The biggest negative is that job gains remain significantly tepid. Part-time employment helped to keep the jobless rate steady and average gains in payrolls in the last two months fall short of the year-to-date average. Moreover, payroll employment in the current economic recovery ranks at the bottom when compared with prior post-war business cycles, excluding the pace of hiring seen after the 2001 recession (See Chart , which is an indexed chart where the level employment in the trough of each business cycle is set equal to 100 to enable easy comparisons. A reading of 104 denotes a 4.0% increase in hiring from the trough, while 98 would mean a 2.0% drop in employment from the trough). The Fed has bought time with Operation Twist but it may have to consider additional unconventional monetary policy support if the economy continues to advance below trend and as a result the unemployment rate starts moving up instead of declining.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.