Arab Spring: Counting Costs and Oil Profits In MENA

Politics / Crude Oil Oct 16, 2011 - 01:29 PM GMTBy: EconMatters

To follow up on our last article about the Arab Spring shockwaves, we thought it'd be of interest to see what the cost impact is for countries affected by the uprising. A timely new study by the risk advisory firm Geopolicity provides some insight into that subject.

To follow up on our last article about the Arab Spring shockwaves, we thought it'd be of interest to see what the cost impact is for countries affected by the uprising. A timely new study by the risk advisory firm Geopolicity provides some insight into that subject.

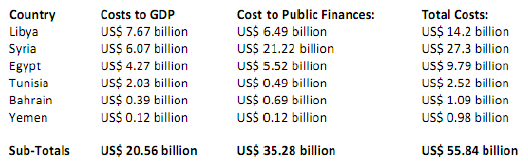

The report estimates that the Arab Spring has already cost countries across the MENA region (Middle East and North Africa) close to $56 billion so far just on the loss of GDP and productivity along, not including infrastructure damage, losses from foregone business and foreign direct investment, and casualties. (See Table Below).

|

| Chart Source: Geopolicity.com |

The study concludes that so far, oil exporters such as Saudi Arabia, Kuwait, and UAE were winners and oil importers losers of Arab Spring, while Libya, though an oil exporter during normal times, has come out as one of the biggest losers. So in aggregate, the Arab Spring has actually provided a positive economic boost across the region worth almost $39 billion:

."....Libya, Egypt and Syria have so far paid the highest price—both human and economic....In terms of public spending, the uprising has led to a 77% reduction in revenues in Yemen and an 84% reduction in revenues in Libya, the impact of which will have been significant on basic and essential services.

.... oil exporting countries such as the UAE, Saudi Arabia and Kuwait the impact on GDP has been positive with GDP growth in the UAE totaling US$62.8 billion, Saudi Arabia totaling US$5 billion and Kuwait US$1 billion. As a result, the overall impact of the Arab Spring across the Arab Realm has been mixed, but positive in aggregate terms (+US$38.9 billion).

The report further criticizes the lack of international support in the region:

"Given the scale of the challenge at hand international support has fallen way short of expectations. The support promised by G8 at the May 2011 Deauville summit has to a large extent not materialized."

Actually, the same criticism could also be said about the richer and more stable countries (who actually benefited from Arab Spring according to Geopolicity's study) right in the heart of the region. Energy Intelligence quoted Saudi Arabia's Prince Turki al-Faisal at a recent industry conference in London that since the start of 2011,

By EconMatters"The kingdom has announced aid packages of over $4 billion to Egypt and over $1 billion to Jordan as well as being the main funder of aid packages to Bahrain and Oman, where we will give $10 billion over 10 years to each country in the hopes of helping those nations transition smoothly out of their current status of turmoil.”

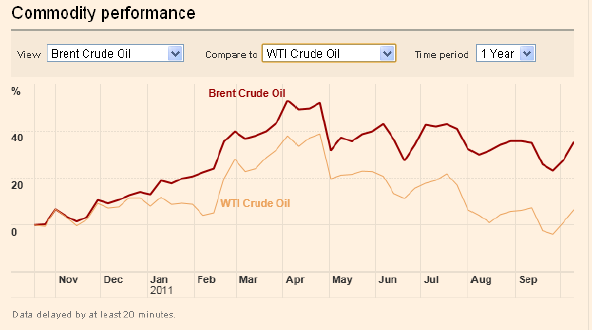

To be fair, the resource of the developed nations, which make up the majority of G8 and G20, is a little stretched with their own debt and social economic crises, and the high oil price driven partly by the Arab Revolutions certainly has not helped either.

A proposal of injecting another $350 billion into the IMF (The U.S. share based on the IMF members' quota of 17% would've been roughly $60 billion) into EU debt bailout was immediately rejected by the U.S. and others, while the G20 sent an unusually direct message to the Euro Zone to basically to fix its own crisis in eight days.

Most people have come to accept that global economic and political power paradigm is shifting from developed countries towards the developing economies, which is part of the normal economic and business cycle on a global scale. Nevertheless, by the same token, the world also has to come to grip with the fact the days are numbered, when the developed economies are relied upon as the ultimate resource to fund or help with turmoils around the globe.

New status and power come with new responsibilities. "New Money" around the globe will need to step up to the plate as well.

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.