Silver Waits to Begin Breakout

Commodities / Gold and Silver 2011 Oct 25, 2011 - 01:27 AM GMTBy: George_Maniere

To 250 million people in 51 countries in the world the word for money is the same word as the word for silver. Silver literally means money. According to Noble Laureate Milton Friedman the majority of monetary metal throughout history has been silver, not gold. Gold is the money of kings while silver is the money of gentlemen.

To 250 million people in 51 countries in the world the word for money is the same word as the word for silver. Silver literally means money. According to Noble Laureate Milton Friedman the majority of monetary metal throughout history has been silver, not gold. Gold is the money of kings while silver is the money of gentlemen.

Before we make a case for silver being money, let’s take a look at what is money? I believe money is the grease or oil that lubricates the supply lines that bring goods and services to where they are needed. Without money our economy would be reduced to barter. The problem with barter is that you would not only have to find someone that has what you want but he would also have to have what you want in return. Let’s face it, in this modern world of infinite goods and services this would be a complete disaster.

So no matter what we use as a medium of exchange be it gold, silver, paper or sea shells we need an unrestricted supply of money to keep the economy lubricated. Money is a unit of storage or a proxy for value that must be something completely different from what is being exchanged. This is why money must float freely in value to coincide with the law of supply and demand.

What is the true value of silver? I have no idea. Silver like anything else will fluctuate with the laws of supply and demand. I do know this. If you are waiting for industry or the fiat printing of paper to send silver through the roof, you may be waiting a long time. That is because like a beautiful work of art is in the eye of the beholder the value of silver as money is perceived. It doesn’t come with an instruction manual.

So here’s where I come down on this. A dollar used to have stamped on it “Silver Certificate.”

They were produced in response to silver agitation by citizens who were angered by the Fourth Coinage Act. The Coinage Act had effectively placed the United States on the Gold Standard which was fine but with each subsequent act the value of the dollar was debased. So in 1878 Silver Certificates were printed. One silver certificate could be traded for a silver dollar. Well in 1960 silver was trading for $1.29 which meant that a silver dollar was worth more than a silver certificate. In March 1964 Secretary of the Treasury C. Douglas Dillon halted redemption of silver certificates for silver dollars and while you could still trade with Silver Certificates. The new currency was the Federal Reserve note which still exists today.

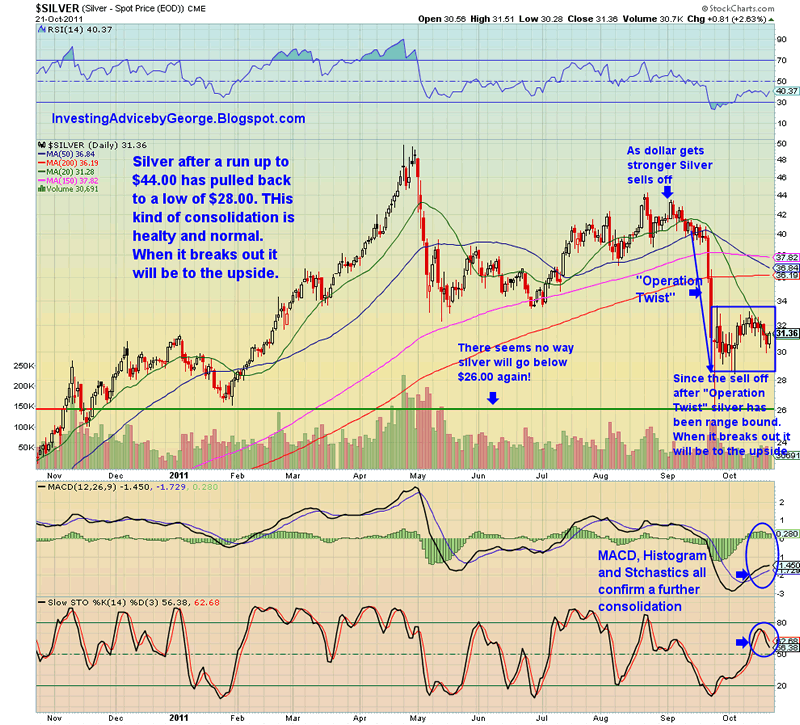

I like to buy on AMPEX so I was on their web site and it would take 37 one dollar Federal Reserve notes to buy one American Eagle One Dollar coin. Last Spring in the last week of April it would have taken over 50 one dollar Federal Reserve notes to buy one American Eagle One Dollar coin. So I ask you, in the long term, which way do you think silver will go? Let’s take a look at a chart of Spot Silver below.

As you can see silver has been in a consolidation period for the last month. For those of you that like the market to move at warp speed let me save you the suspense. It doesn’t.

In conclusion, after the volatility that silver has gone through since January of this year I think it’s healthy for it to consolidate. When Silver breaks out again it will be to the upside.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.