Jaguar A Sign of Gold Stocks Accumulation

Commodities / Gold & Silver Stocks Nov 17, 2011 - 04:51 AM GMTBy: Jeff_Berwick

We were beginning to question our premises... something that almost always signifies a bottom. But, after riding through a tough year for the gold stocks, despite gold holding steadily between $1,500 to $2,000, it only came naturally that we should re-assess everything.

We were beginning to question our premises... something that almost always signifies a bottom. But, after riding through a tough year for the gold stocks, despite gold holding steadily between $1,500 to $2,000, it only came naturally that we should re-assess everything.

Were we wrong? Would the gold shares consistently underperform the metal? Would the rest of the market continue to ignore the precious metals stocks no matter what happened?

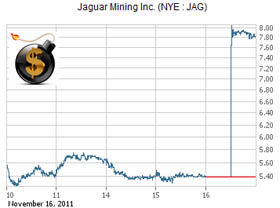

Well, today we got our first direct evidence that at least for one of the stocks in our portfolio, Jaguar Mining (NYSE:JAG), we weren't the only ones screaming that it was undervalued. Today, someone put their money where their mouth was.

SHANGDONG PUTS JAGUAR MINING INTO PLAY

According to media sources, China’s Shandong Gold Group made an all cash offer to buy Jaguar Mining (JAG:NYSE) at $9.30 per share, or an enterprise value of roughly US$1.1 billion. The stock closed at $7.80, up 45%, in New York today for a 16.1% discount reflecting some uncertainty about the deal.

According to media sources, China’s Shandong Gold Group made an all cash offer to buy Jaguar Mining (JAG:NYSE) at $9.30 per share, or an enterprise value of roughly US$1.1 billion. The stock closed at $7.80, up 45%, in New York today for a 16.1% discount reflecting some uncertainty about the deal.

The offer was made public today but remained unconfirmed until management was forced to respond later in the day, acknowledging “that it has received proposals over the past few weeks,” and that it is initiating “a strategic process to explore alternatives to maximize shareholder value.”

Jaguar has been a holding in the TDV portfolio available to Premium Subscribers for the last year. A number of dissapointments and poor management decisions along the way meant that we were down significantly in recent months but TDV Senior Analyst, Ed Bugos, told subscribers to not only stick with it but to buy more in recent months.

Here are Ed's comments on the bid:

Thanks Jeff,

It is interesting that management has been sitting on the proposal for the past few weeks. I had noticed the shares under accumulation. Maybe they were afraid to announce it because obviously shareholders would (or should) want to replace the whole kit and kabootle mickey mouse operation that these guys ran into the ground, allowing Shandong to come in and scoop up the asset for a fraction of its value.

My valuation for Jaguar using a $1,450 long term gold price assumption and a 10% discount rate works out to almost exactly US$1 billion after taking account of its outstanding debts and capex requirements going forward. On this basis it would seem like a good idea to take the money and run. At a T-5 (current spot price minus 5%), however, our NAV comes closer to $19 per share.

Given its growth profile the stock would have already been trading at a premium to NAV were it not for several bad moves by management. We added it to our portfolio before the latest of these took the shares down to a 50% discount to NAV. The current discount to the takeover price reflects the risk that Shandong’s offer disappears.

I have reservations about this management group and I believe Shandong can rally shareholders behind its bid. On the other hand, Kinross Gold (TSX:K) has an interest in Jaguar – both as a vendor and equity owner. It is possible that Kinross comes out of the woodwork and makes a competing offer. Either way, despite my take on management, and given that we are in somewhat of a forgiving gold price environment, my opinion is that management should not take the first offer based on shareholder interests. Our position was deep in the red and maybe we should take advantage of this bid right away; on the other hand, Shandong’s bid may change the market’s psychology whether it succeeds or not.

Jaguar could be at an important fundamental turning point regardless of this unexpected news. It could even catalyze the sector, especially if it turns into a bidding war. At the current share price, JAG is still trading at a slight discount to NAV. If you’re concerned that they might drop the ball like Novagold (TSX:NG) did with Barrick (NYSE:ABX) back in the day this is understandable; and if you can’t sleep with your position then sell it. No investment is worth losing a good night's sleep. It is possible to lock in the current price either by buying puts or writing calls. I don’t particularly like the prices of JAG’s option chain though. You’re giving up almost a whole $1 to buy a put, and the call premium for a 3-month option with an $8 strike is just $1.39 today, which would lock us in at the takeover price on the upside and give us a small buffer on the downside.

If you own the shares and have no leverage it might make sense to write some calls, maybe further out. But I think it makes more sense to wait out its next move. Not that management’s track record inspires any confidence that they’ll pull a rabbit out of their hats. But I think that we’ll get US$9.30 for these shares in the next six months with or without Shandong, and hence it’s worth waiting.

I would not, however, conclude that this will be followed by takeover mania - though who knows - mainly because that theme is over played. However, the Chinese appear to be on the acquisition path. And, more important, the bid confirms our own valuation... the market is demonstrating that it agrees with us. It could be defining a bottom in our midst.

CHINA AND QATAR ACTIVELY ON THE PROWL

China has been actively buying up resource companies worldwide. And, Qatar has recently announced a $10 billion fund exclusively targeted at buying up gold producers.

With big players like this moving in, things could get very interesting very quickly. After all, there are approximately $200 trillion in total global financial assets - many of those paper investments that can and will turn into dust at any moment. Countries like China, Russia and Qatar know this and they are all eyeing the tiny $1.5 trillion in market-available gold. China has reserves of over $3 trillion... in other words, if they could get the rest of the world to sell, they could buy all the gold in the world twice over at current prices.

They know this and now they are starting to reach down into the gold producers as another way to get rid of their paper assets and hold real, producable in-the-ground gold.

Doug Casey has been quoted many times stating that if even a portion of the world's financial assets begin to move into gold and gold stocks it will be like "pushing the contents of Hoover Dam through a garden hose".

To date, we have yet to have anything signifying a gold share mania in this bull market since 2000. The following chart shows the gold producers (HUI) versus the price of gold since 2000.

As can be seen, after a rambunctious start in 2000, rising four-fold versus gold from 2000-2004, the gold shares have consistently underperformed gold ever since and still trade at the same level, vis-a-vis gold, that they did in 2002 when gold was at $300/oz.

So, if you missed the large gold rise from $300 to $1,700/ounce and wish you had an opportunity like that again, you may be looking at it with the precious metals shares.

Gold and silver were the investment of the last decade and while we still expect them to perform very well for the coming years we think this decade may be remembered for the mania in gold and silver mining shares.

China and Qatar seem to think so.

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.