Why Early Dec Will Be Financial Markets Last Hurrah! Global Economy to Crash

Stock-Markets / Financial Markets 2011 Nov 29, 2011 - 04:03 AM GMTBy: Capital3X

Part of this article was originally published to C3X clients on 28 Nov 2011 early Asia trading time and discussed in the C3X live trading room, on Nov 18 2011 when the S&P was at 1160 and AUD/USD below 0.9688, EURUSD at 1.3230 and USDCAD at 1.0480. Markets have already moved in the direction of trends and trading calls that we have published since then.

Part of this article was originally published to C3X clients on 28 Nov 2011 early Asia trading time and discussed in the C3X live trading room, on Nov 18 2011 when the S&P was at 1160 and AUD/USD below 0.9688, EURUSD at 1.3230 and USDCAD at 1.0480. Markets have already moved in the direction of trends and trading calls that we have published since then.

TECHNICAL ANALYSIS

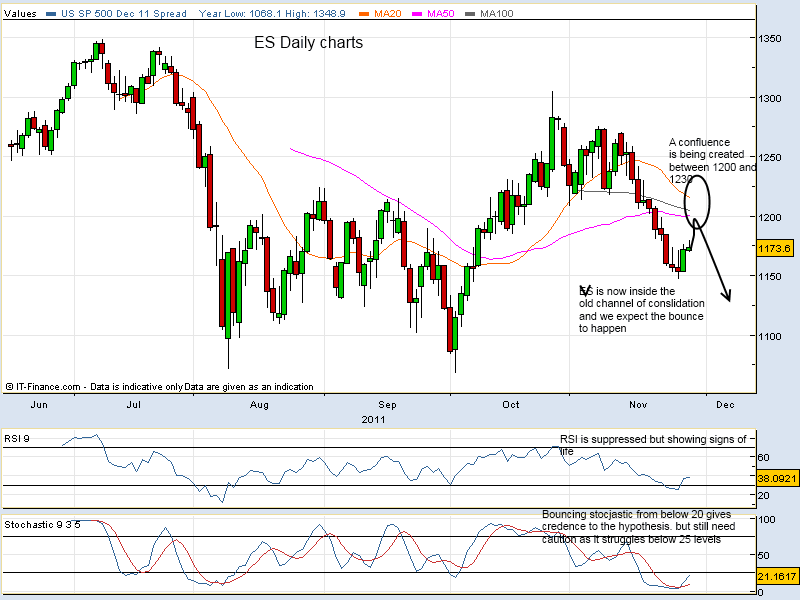

ES Daily charts

Stochastic have rebounded indicating a rebound while the vortex continues to bearish. We expect ES to pull back to 1230 levels which is a developing *confluence* zone.

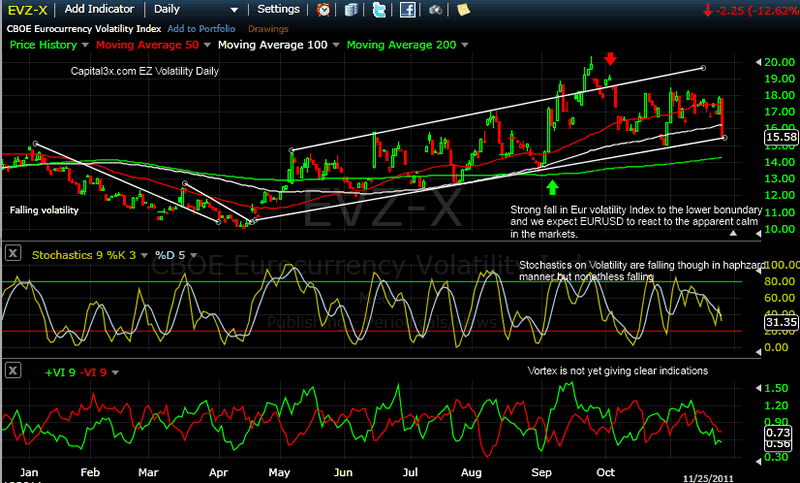

EU volatility charts leading us

The EUR volatility has been falling over the last few days even while EURUSD has been tracking Italian Yields. We expect in between the EU auctions, EURUSD will find enough reasons to rally given the falling stress in inter bank lending. The stochastics on volatility are falling to a relatively calm lending market.

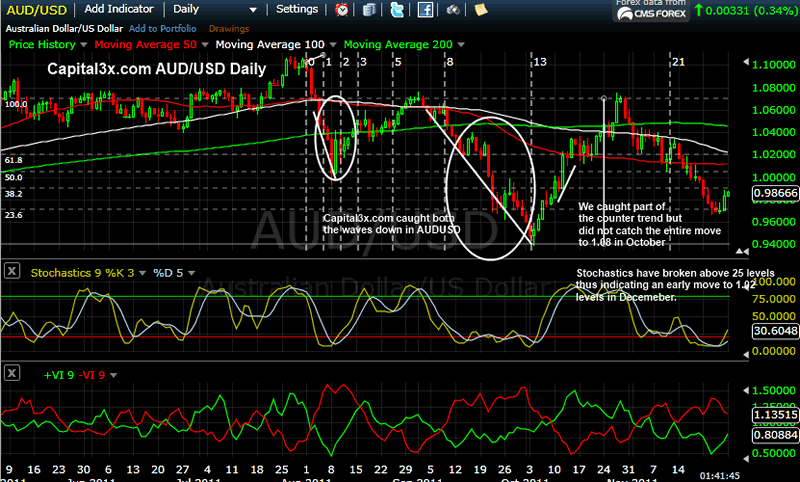

AUDUSD Daily charts

AUDUSD is a key barometer for risk. We expect AUDUSD to bounce of key FIB levels .9650 to 1.02 levels in December tracking risk trades.

USD/CAD Daily charts

USD/CAD is leverage play on crude but even then USD/CAD supersede crude over a longer duration. We expect USD/CAD to play ball with risk as USDCAD falls back to 50 MA at 1.0220 levels before Dec is done.

FUNDAMENTAL ANALYSIS

On fundamental side, we believe that the world is about to crash to a crisis that we may not have seen in our life times. Two of the world largest importers of world trade, China and India are now nearly 200 bps of their peak growth rates with both countries slowing sinking into a political quagmire.

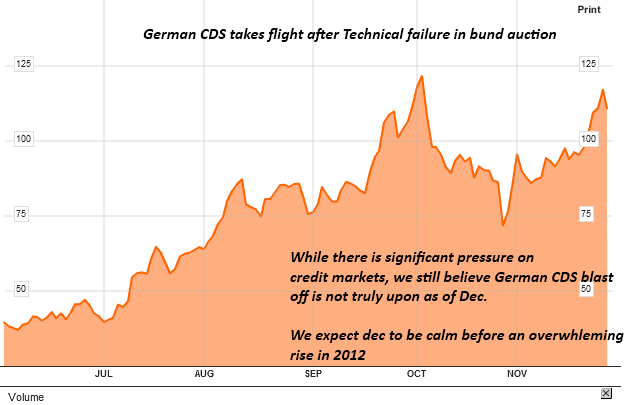

In the euro zone, to everyone utter surprise, Germany is becoming the crux of the problem. Macro economic slowdown and credit markets starting to question the very ability of Germany to be the corner stone of EU bailout. The CDS flew of the handle to 120 from under 100 levels though since then have calmed. But it was a stark reminder to Berlin that “Do not take the bond markets for granted”.

As the crisis has spread over the last six months into the larger peripherals, the need for fiscal consolidation from large euro area member states has increased. Austerity in these larger member states such, as Italy and France, clearly weighs more on euro area economic prospects than does the austerity in smaller countries. Six months ago, we were already predicting a significant tightening of the euro area fiscal stance in 2012.

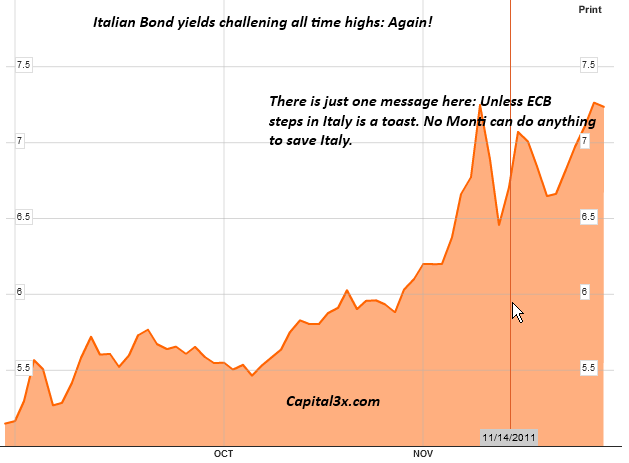

The failure of the EU authorities to find a solution to the sovereign debt crisis means the downside risks are materializing. The ECB will step in as a temporary buyer of Italian and Spanish bonds but treaty changes and fiscal union are coming our way in 2012. But without the compensating moves on the political front, markets will fear this as politically unsustainable.

The trouble is, we fear the impact of fiscal tightening on broader economic activity is itself increasing, that is, the fiscal multiplier is growing. We think this for two reasons. First, the crisis is having a materially greater impact on the bank credit channel. Second, the austerity has been insufficient to inject confidence back into markets, with the danger that it loops back into the economy with no tangible benefits seen in which case a greater level of austerity will be demanded which will then shrink growth even further.

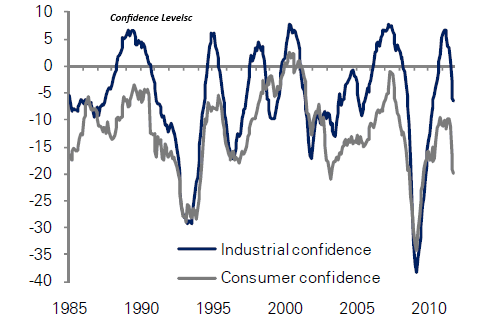

Consumer and Industrial Confidence

The consumer and Industrial confidence in Germany are being dragged down by EU debt crisis. It is a matter of time before the Debt crisis will fully engulf the German economy, something the EUR founders need to happen if their dream for EU fiscal union needs to be realized.

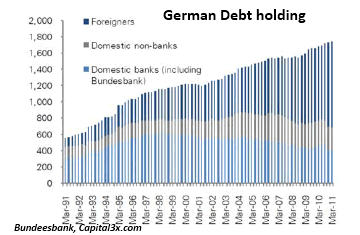

German Debt holding

Significant portion of German debt is held by foreigners and hence making the Germany economy extremely susceptible to volatility.

EU Debt redemption in 2012

In other part of the world, both India and China are struggling with rising Yield and FX issues over and above a slowing consumer growth .

Expected auctions by Italy and Spain are upwards of 500 bn euros. With bond markets nearly calling a strike on Italy and Spain, we expect to be catastrophic defaults across EU zone with crisis dragging right to the German doorsteps. We expect the auctions will drag EUR/USD to parity in 2012.

Spreads are pointing to imminent Inversion

Spreads between 2y and 30 y are falling below key levels which are indicating to severe liquidity crunch which will now boil into the larger economy.

German CDS springing

Italian Yields refusing to calm

Italy, the third largest bond market in the world, is now defining the EURUSD moves. It is no more Germany which leads EURUSD moves, but in a strange sense, Italy defines the EU zone destiny.

On the other side of the coin, US economy has maintained a certain sense of calm but we believe this is temporary.

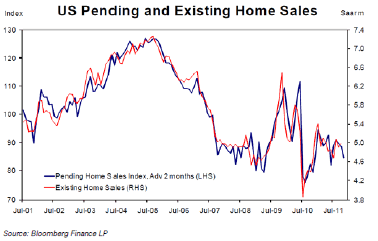

US home sales

The US home sales while have held up till now are now weakening again. The case shiller index has been stable after a 35% correction but is now ready to begin the decline as financial markets pay scale takes a drop and speculation starts to ebb away given the rising 2Y yields on US treasury (key schemes through which banks and speculators borrowed for speculation).

Emerging Markets

India

The Indian economy today has more depth and breadth than a decade ago but it is also more vulnerable to global cycles and high expectations from investors and its own population. A year ago, India boasted the best performing stock market in Asia, surging foreign investment flows, and confidence among observers and policymakers about growth exceeding 9 percent for years to come. In a striking turnaround, a year of persistently high inflation, an anaemic investment cycle, repeated governance scandals, and little movement in market friendly reforms have soured the underlying economic dynamic and market sentiments. Coupled with

substantial headwind from the debt crisis in industrialized economies, much of the exuberance associated with India has dissipated, and India’s perennial Achilles’ Heel, a pernicious combination of trade and fiscal deficits, has come back under scrutiny. We believe that India is on a structural slowdown for the next half a decade thus affecting world growth as a whole of till the time a second reform revolution brings about change.

China

China’s October trade surplus amounted to USD17bn and inward FDI amounted to USD8bn, the size of outflow of capital (which includes authorized outward FDI, portfolio outflow, private sector purchase of forex, as well as hot money outflows, among others) was substantial. It obviously reflected the expectation of RMB depreciation by some market participants. The negative net forex purchase by the PBOC leads to a contraction of RMB liquidity in the banking system, initially by the amount PBOC forex sales, and over a period of time this contractionary effect will be multiplied by the money multiplier (3.7x time). This exacerbates the downward pressure on the deposit base in the banking system and makes it more difficult

for banks to fund their lending activities. This will have severe consequences for Chinese credit markets as we already see wild volatile movement in China CDS spreads. China may no longer be the net importer of world trade and hence pushing the ball back into US and EU courts.

We believe, far from solving any crisis, the world has sunk deeper into a crisis whose depth and breadth will surprise everyone. Bond markets are ready to come calling as they take no prisoners once they decide to call the bluff. But we also believe that 2012 will see EU fiscal union being enacted post which we expect EURUSD to spring back to 1.5 and then continue the rise given the coming holocaust of US Municipal Bond run starting Oct 2012.

The immediate short term, we expect markets to well bid in Dec till the summit on 9th . We expect EURUSD to recover smartly and risk assets to post gains. The sante rally, however suppressed it maybe, is now upon us. Santa may just be a bit pale this time around.

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.