Stock Market Report Hyperinflation!

Stock-Markets / HyperInflation Nov 29, 2011 - 01:03 PM GMTBy: UnpuncturedCycle

I read article after article warning us that excessive printing in the western world is going to produce hyperinflation, and I’ve heard good analysts calling for hyperinflation for almost five years now. Lately the call seems to have morphed into a plea. The Federal Reserve Chairman has pledged to do his part, dropping money out of helicopters if need be, so how could we have deflation given such declarations? We all know that the Fed has created almost US $4 trillion out of thin air over the last three years, so why are the prices of everything from commodities, stocks, real estate and housing on the decline, and why is the US dollar on the rise. It’s a valid question and I want to try to come up with an answer in this report.

I read article after article warning us that excessive printing in the western world is going to produce hyperinflation, and I’ve heard good analysts calling for hyperinflation for almost five years now. Lately the call seems to have morphed into a plea. The Federal Reserve Chairman has pledged to do his part, dropping money out of helicopters if need be, so how could we have deflation given such declarations? We all know that the Fed has created almost US $4 trillion out of thin air over the last three years, so why are the prices of everything from commodities, stocks, real estate and housing on the decline, and why is the US dollar on the rise. It’s a valid question and I want to try to come up with an answer in this report.

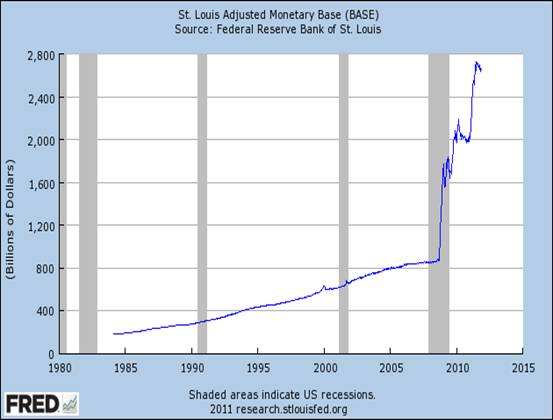

Most people including a lot of analysts are convinced that the one and only requirement for high inflation is an expanding money supply, but that’s a dangerous oversimplification. We know that the Fed has been expanding the money supply, but it will surprise many to know that it recently turned down from record highs. Take a look at this chart:

While it’s true that percentage change for M-1 recently made a new high, it’s also true that the broad M-3 measure is a long way from where it was in late 2007 and that may pull the entire base lower.

The last time we experienced a decline occurred when QE1 wore off and the Fed then needed to rush in with QE2. I believe the recent decline is a signal that QE3 is needed but there doesn’t seem to be much political will to crawl out on that limb right now. The Fed and Congress seem to be playing a game of chicken and the economy is at stake. The Fed does not want to take responsibility for initiating QE3 and Congress doesn’t want to ask for more easing with elections in the wings.

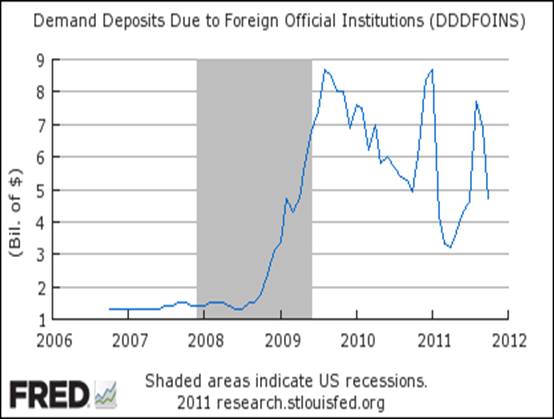

As far as Europe is concerned we can see that the ongoing crisis is having a drastic affect on its money supply:

Europe is also facing elections in the coming months and, combined with growing social unrest, there it little support for another round of quantitative easing although rumors abound. Early yesterday morning it was published that Italy would receive US $600 billion from the IMF and a package was in the works for Spain. The IMF later denied all of that so the problems continue to mount.

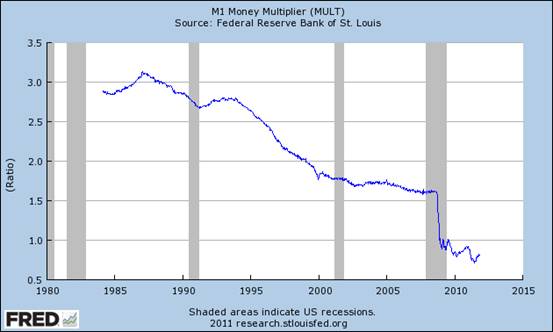

So we’ve experienced sharp increases in the money supply it now appears that in both the US as well as Europe supply is on the decline. You’ll never hear this on Bloomberg but there are more important determinants to inflation than money supply. If I want to know whether or not we have inflation in the pipeline I look at first at the money multiplier:

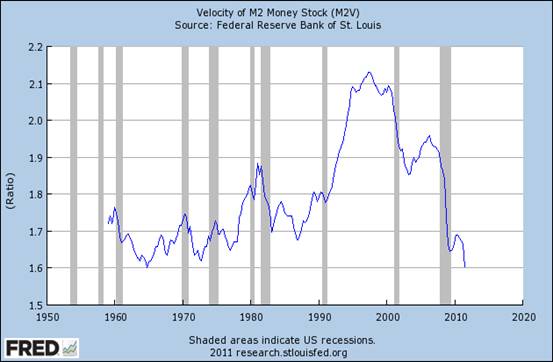

and then at the velocity of money:

With these two charts in mind it is extremely important that you try to understand the following: in no possible world can you have inflation/hyperinflation with these two charts declining as they have been over time. You can print until hell freezes over and you will still be condemned to deflation.

How can the Fed and the ECB print as much as they did and not produce inflation? In very simple terms all that money was not meant for public consumption and it did not produce one bit of growth. It went to a select few and the bill was passed to the many. Debt ballooned as the economy and the tax base shrunk and that is an untenable situation. More printing, and there will be more, will only serve to crowd the private sector out of the debt markets more than they are today. Today’s banks are like pigs at a trough and they are insatiable. They have over US $700 trillion in derivatives to deal with and it will eventual destroy the system as it stands today. The only real solution id to write debt off, but again we have no political will for that. The market will not stand still for ever and it will eventually do the job for the greedy politicians who run today’s show.

Giuseppe L. Borrelli

www.unpuncturedcycle.com

theunpuncturedcycle@gmail.com

Copyright © 2011 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.