Credit Crisis Deepens - ATM Withdrawl Limits Next?

Stock-Markets / Financial Markets Jan 05, 2008 - 03:05 AM GMT

Citibank is now limiting ATM withdrawals in New York City , blaming it on “isolated fraudulent activity.” If the fraudulent activity is isolated, why punish all your clients in a given region? This is certainly causing distress among New Yorkers because of the high cost of living in that city. Why not simply increase security on the ATMs? It looks an awful lot like Citibank is experimenting with rationing their cash outflows.

Citibank is now limiting ATM withdrawals in New York City , blaming it on “isolated fraudulent activity.” If the fraudulent activity is isolated, why punish all your clients in a given region? This is certainly causing distress among New Yorkers because of the high cost of living in that city. Why not simply increase security on the ATMs? It looks an awful lot like Citibank is experimenting with rationing their cash outflows.

By the way, the people interviewed in the linked article made the statement, “Its our money. We should be able to take out any amount we want, when we want.” This statement tells me how ignorant the general public is regarding their accounts at a bank. Depositors are really lending their money to a bank. The deposit (loan) to the bank then becomes an asset of the bank, a unique power granted to banks alone. These “assets” are then used as the basis for loans through credit cards, auto loans, commercial loans and mortgages.

Where it gets dicey is that banks are on a fractional reserve system where they may lend up to ten times the amount they have on deposit. So, in reality, the money may not be there. George Bailey, played by Jimmy Stewart in “ It's a Wonderful Life ” had this to say, “ [ during the run on the bank] You're thinking of this place all wrong. As if I had the money back in a safe. The money's not here. Your money's in Joe's house...right next to yours. And in the Kennedy house, and Mrs. Macklin's house, and a hundred others. Why, you're lending them the money to build, and then, they're going to pay it back to you as best they can. Now what are you going to do? Foreclose on them?”

Today's version is a bit more complicated than that. The old-time banks knew who their debtors were. The loan officer made a moral and financial decision every time he granted a loan or a mortgage. In today's securitized economy, there is no telling where the loans went. In addition, securitized mortgage portfolios may not have the proper executed assignments that grant the power to the lenders to foreclose. Very dicey, indeed.

Jobless rate 5%, more trouble for the economy.

The much weaker than expected new jobs numbers and rising unemploy-ment have given the market a vote of “no confidence.” Without the CES Birth/Death Model , the number of new hires in December (+18,000 new jobs) would be –46,000, instead. Add another 31,000 government jobs and you can see why our economy isn't being as productive as it once was. ( See Mish's comments .)

The much weaker than expected new jobs numbers and rising unemploy-ment have given the market a vote of “no confidence.” Without the CES Birth/Death Model , the number of new hires in December (+18,000 new jobs) would be –46,000, instead. Add another 31,000 government jobs and you can see why our economy isn't being as productive as it once was. ( See Mish's comments .)

In addition, analysts have already downgraded the earnings expectations for the financial institutions but not for the other sectors of the economy. This may be where the real surprises are as the fourth quarter earnings reports come in.

Treasuries rally, but will it last?

Treasury bonds rallied as the market declined this week. However, the rally may have stalled at a critical juncture, called a “pivot point.” The news today is that treasuries are gaining based on the weak payrolls data. We shall see. Under normal circumstances, there would be a “flight to quality” out of stocks and into bonds. What makes this situation unique is that bonds have already been rallying since June. Will this rally go the same way as stocks? We'll soon find out.

Treasury bonds rallied as the market declined this week. However, the rally may have stalled at a critical juncture, called a “pivot point.” The news today is that treasuries are gaining based on the weak payrolls data. We shall see. Under normal circumstances, there would be a “flight to quality” out of stocks and into bonds. What makes this situation unique is that bonds have already been rallying since June. Will this rally go the same way as stocks? We'll soon find out.

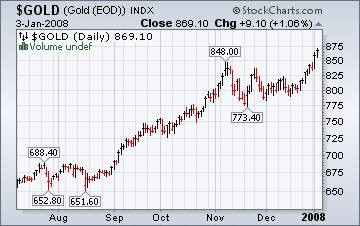

Gold at $900?

Not anytime soon. This morning's stock market debacle has bled over into gold , as well. That hasn't stopped the bullish commentary.

Not anytime soon. This morning's stock market debacle has bled over into gold , as well. That hasn't stopped the bullish commentary.

"Given the recent price surge, gold is vulnerable to a profit-taking correction," said James Moore, an analyst at TheBullionDesk.com. Still, the outlook remains bullish for the precious metal, he said.

"With no improvement in the volatile geopolitical backdrop and the likelihood of further dollar weakness, we remain bullish toward gold and expect a push towards $900 an ounce in the coming sessions," Moore said in a research note.

The Nikkei dives into the New Year.

The Nikkei 225 Index had its worst New Years start , slumping 4% to 14691 (not shown in the chart) in its first day of trading in 2008. The chief concern for the New Year is that the United States will no longer be a growth market for their manufactured goods. “ Toyota slid the most in more than four months and Nissan Motor Co. had its biggest tumble in six years after they both reported a drop in U.S. auto sales. Sony Corp. plunged 6.6 percent, the most since August.”

The Nikkei 225 Index had its worst New Years start , slumping 4% to 14691 (not shown in the chart) in its first day of trading in 2008. The chief concern for the New Year is that the United States will no longer be a growth market for their manufactured goods. “ Toyota slid the most in more than four months and Nissan Motor Co. had its biggest tumble in six years after they both reported a drop in U.S. auto sales. Sony Corp. plunged 6.6 percent, the most since August.”

Is the Shanghai Index running out of steam?

“ SHANGHAI , China — Chinese stocks rose Friday as investors bought gold miners, real estate developers and nonferrous metal makers.

The benchmark Shanghai Composite Index gained 0.8 percent to finish at 5,361.57 points.”

It appears that the Chinese aren't as worried about their exports as the Japanese are. Of course, their market is closed while the U.S. economic numbers come in. Meanwhile, the World Bank reports that the Chinese economy is actually 40% smaller than originally estimated. That may take some of the air out of the Chinese market and investors may find out why the Chinese refer to the Shanghai Composite as the “stir fry” market. Don't get burned!

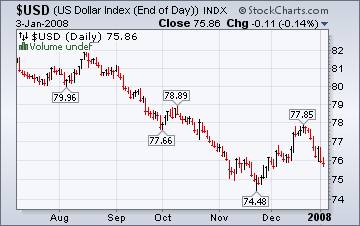

The Dollar hits a one-month low. Will it continue?

Jan. 4 ( Bloomberg ) -- The dollar fell against the yen and euro, touching one-month lows, as U.S. employers added the fewest jobs in four years in December, suggesting the housing slump is spreading through the economy.

Jan. 4 ( Bloomberg ) -- The dollar fell against the yen and euro, touching one-month lows, as U.S. employers added the fewest jobs in four years in December, suggesting the housing slump is spreading through the economy.

Analysts see the jobs news as negative for the U.S. Dollar. Further analysis will show that statistics for Japan and Europe are much worse than ours. The question is, whose currency will be considered the safest haven in troubled times?

Hope springs eternal…oh, nevermind.

Carolyn Baum has an interesting commentary on the housing market. “The word ``housing'' warranted 20 mentions in the minutes of the Federal Reserve's Dec. 11 meeting released yesterday, and none of the references were positive. Policy makers acknowledged the ``intensification of the housing correction,'' said it was ``likely to be both deeper and more prolonged'' than they anticipated, admitted to ``some spillover'' to consumer and business spending, and warned that stresses in mortgage finance could further weaken the housing market.”

Carolyn Baum has an interesting commentary on the housing market. “The word ``housing'' warranted 20 mentions in the minutes of the Federal Reserve's Dec. 11 meeting released yesterday, and none of the references were positive. Policy makers acknowledged the ``intensification of the housing correction,'' said it was ``likely to be both deeper and more prolonged'' than they anticipated, admitted to ``some spillover'' to consumer and business spending, and warned that stresses in mortgage finance could further weaken the housing market.”

How far will gasoline prices go?

The Energy Information's Weekly Report says that the average price per gallon of gasoline jumped 7 cents this last week, nearly 72 cents above the average price of a year ago. The largest increase in the price at the pump was 11.4 cents in the Midwest . It makes working out of your home a very attractive alternative for those who can do it. The chart suggests that the rise in prices may be over very soon.

The Energy Information's Weekly Report says that the average price per gallon of gasoline jumped 7 cents this last week, nearly 72 cents above the average price of a year ago. The largest increase in the price at the pump was 11.4 cents in the Midwest . It makes working out of your home a very attractive alternative for those who can do it. The chart suggests that the rise in prices may be over very soon.

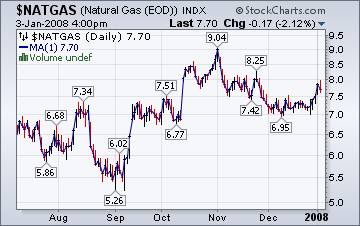

Prices for natural gas remain flat.

The Natural Gas Weekly Update is released later today and I may not have the time to set up a link. The Houston Chronicle reports that natural gas in storage fell slightly last week, but is still 8.2% above the five-year average. Future prices of natural gas will depend upon the severity of the drawdown in storage this winter.

The Natural Gas Weekly Update is released later today and I may not have the time to set up a link. The Houston Chronicle reports that natural gas in storage fell slightly last week, but is still 8.2% above the five-year average. Future prices of natural gas will depend upon the severity of the drawdown in storage this winter.

The President brings in the Plunge Protection Team.

The question is, will it work this time?

( CNBC ) “ Bush will meet Friday with Federal Reserve Chairman Ben Bernanke, Treasury Secretary Henry Paulson and top financial regulators as he prepares for Monday remarks on the health of the economy, the White House said.

The meeting with the Treasury-led President's Working Group on Financial Markets comes amid weakening economic data and growing concerns about a housing-led recession that have led some lawmakers to discuss possible fiscal stimulus moves.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are resuming our normal running commentary on the markets. You will be able to access the interview by clicking here .

Happy New Year!

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.